Infinite Banking has been happening for more than a century, but the term itself was popularized by Nelson Nash in his influential book “Becoming Your Own Banker®.” The short book (around 90 pages) was published in 2000 after Nelson Nash had been practicing the concept for around 20 years.

In this article, we have attempted to create an wiki for Infinite Banking to help categorize and educate our visitors on the various aspects of this important concept. There are many links in this article that will take you to various other topics pertaining to infinite banking, so please click on any that look interesting.

Table of Contents

- What is Infinite Banking?

- History and Origins

- How Infinite Banking Works

- Risk and Stability

- Tax Benefits

- Costs and Commissions

- Performance and Challenges

- Notable Books

- Debates and Controversies

What is Infinite Banking?

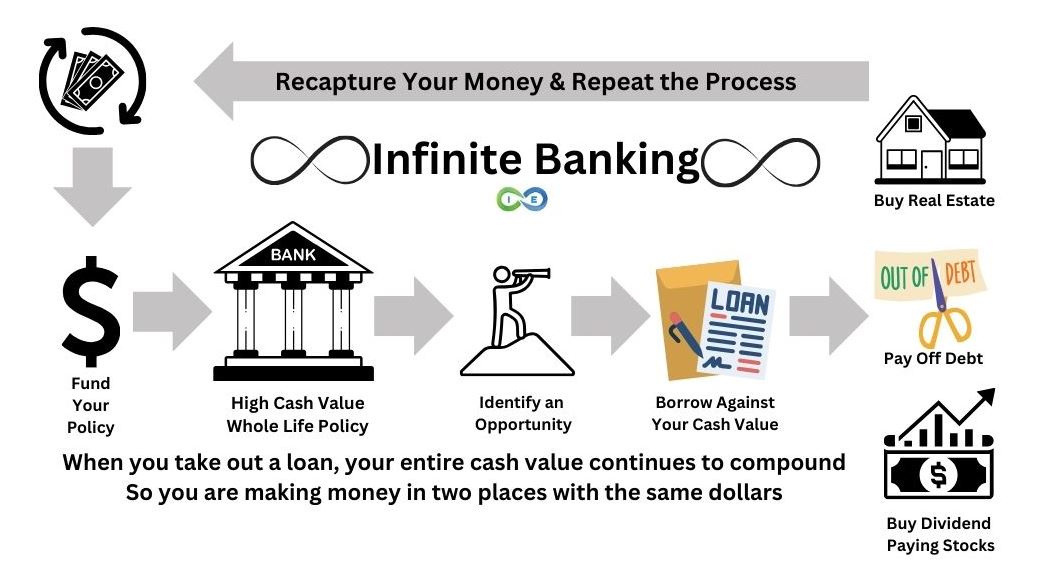

Infinite Banking Concept: The term Infinite means “limitless or endless in space, extent, or size.” And the term has been used with Banking to give the impression that an individual can use this process to bank endlessly.

Since the process of banking creates wealth, the Infinite Banking goal is to duplicate the process as much as possible to build the value of your own bank. The duplication process happens by lending and repayment of money that is typically held in the cash value of a permanent life insurance policy.

The speed at which an individual is able to lend and repay is commonly called the velocity of money, and is a key component of the growth rate of the bank. Money movement is at the heart of all banking, not just Infinite Banking.

Infinite Banking lets you act as your own bank by borrowing and repaying funds from the cash value of a life insurance policy.

History and Origins

As mentioned above the term Infinite Banking was popularized by Nelson Nash in his book Becoming Your Own Banker. Nash had been a Life Insurance Agent for a few decades at the time he wrote the book and had it published. And the principles and practices presented in the book had been something he and his family had been doing since the early 1980’s.

Today, those of us that refer to the concept and process of using cash value life insurance as a personal bank (Infinite Banking) tend to use the same terminology that Nash coined in his first edition.

Becoming Your Own Banker was published in 2000, and since then Nash has updated the book four times. The 5th Edition of the book is currently available on Amazon.

Austrian Economics

Austrian Economics is a school of economic theory that was founded by the Austrian Carl Menger. The school of thought was “founded” when Menger published his first book Principles of Economics in 1871, effectively criticizing the classical theory of economics that was commonly held at the time.

Menger proposed the “Subjective Theory of Value,” which stated that the price of a given service or good was NOT the cost to produce it (as proposed by classical economists), but the subjective price that someone was willing to pay. Many famous economists have followed and promoted his school of thought, such as: Ludwig Von Mises, Murray Rothbard, and Friedrich Hayek.

The Austrian school is foundational to Infinite Banking in that it views the Boom and Bust cycle (that most Americans have come to accept as inevitable), as nothing more than the unwanted result of excess bank credit in the economy.

Infinite Banking practitioners value the fact that they bank with insurance companies that are privately held and have a 100% reserve requirement on the money they loan. This is in sharp contrast to the fractional reserve banking system that is pervasive in the world and typically has a 10% reserve requirement, and therefore creates excess credit and consequently the boom and bust cycles.

A 10% reserve requirement means a bank that has 1,000,000 in bank deposits can loan out $900,000 in credit, keeping only 10% or $100,000 on deposit. This high leverage is one of the main criticisms of the traditional banking system vs infinite banking.

How Infinite Banking Works

Infinite Banking is accomplished by using the cash value in a properly structured life insurance policy to lend and borrow. As a result, those that are interested in self banking need to qualify for life insurance.

Infinite Banking is accomplished by using the cash value in a properly structured life insurance policy to lend and borrow. As a result, those that are interested in self banking need to qualify for life insurance.

With regard to Infinite Banking strategies, there are probably a myriad of ways in which individuals can use the money, but there are only a few ways in which the personal family bank can be structured.

The table below compares two common insurance products used for Infinite Banking:

| Feature | Whole Life Insurance | Indexed Universal Life (IUL) |

|---|---|---|

| Guaranteed Returns | Yes (3-5% minimum) | No, tied to market index |

| Dividend Potential | Yes (1-3% typically) | No dividends |

| Risk Level | Low, non-correlated | Moderate, market-linked |

| Loan Flexibility | High, with non-direct options | Varies, less predictable |

| Best For | Stability, long-term banking | Potential higher returns |

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

Dividend Paying Whole Life

The most popular method for creating a personal banking system is by purchasing a dividend paying whole life policy.

Dividend paying policies are those policies which are owned with a Mutual Insurance Company – those companies that are NOT owned by shareholders, but by the policy holders themselves.

Most would-be bankers choose to purchase a policy on themselves when they start, but you don’t have to be the insured to use the policy to bank. If you are un-insurable because of health reasons, you may choose to insure a loved one instead. As the owner of the policy you have complete control over the policy regardless of the insured.

When an individual purchases a dividend paying whole life insurance policy, a portion of their premium covers the cost of insurance and a portion goes toward the cash value (CV). The CV is the savings component of the policy, and it is this component that is used as your personal bank.

The insurance company pays a guaranteed minimum rate of return on the cash value of the policy – typically somewhere between 3-5%. In addition the policy is credited with a dividend annually based on the performance of the company. The dividend is considered to be an “overpayment of premium” and is therefore non-taxable.

Most mutual companies have a long track record of their dividend payments, and will often times boast that they even paid dividends during the Great Depression. The dividend is typically between 1-3%, which means the CV of a typical mutual whole life policy holder is anywhere between 4 and 6%. There are times when policy holders have earned over 11%, which may occur in high inflation-high interest rate environments.

Banking

All that has been explained thus far is just typical dividend paying whole life insurance – nothing fancy, and definitely not Infinite Banking. However, the CV lays the groundwork for the banking that will be done through the policy. Here is how it is done:

Banking requires lending, and the money that is lent out is based on the CV of the policy. These life insurance policy loans are the way in which a banker finances his business. To purchase a car, you need to take out a policy loan and pay it back. To purchase a college education, you need to take out a policy loan and pay it back.

The borrower does not have to be the owner of the policy. In fact, the owner of the policy (the banker) is able to lend to someone else that is going to pay back the policy loan. In doing so, the policy owner (the banker) could have others increase his CV at an accelerated rate.

All policy loans are charged an interest rate. However, and this is critical to remember, the interest rate is typically the same or less than the amount that is being credited. If it is the same, then it is called a wash loan, and if it is less, then there is an opportunity for arbitrage – earning a spread on your money.

Non-Direct Recognition Loans

Companies will either be Non-Direct Recognition vs Direct Recognition with regard to their loan accounting. Many Infinite Bankers feel strongly that Non-Direct Recognition companies are the only way to operate.

Here is why: A Non-Direct Recognition company will credit your cash value REGARDLESS of the amount of outstanding loans you have. In other words, if you have $100,000 in CV, and you have $80,000 in outstanding loans, the company will still credit you your dividend and interest on the full amount.

Example 1: $100,000 cash value – guaranteed interest of 4%, plus a 2.5% dividend = 6.5% total credit for the year. Total is $6,500 credited toward the CV. New total is $106,500.

Example 2: $100,000 cash value – $80,000 outstanding loan (this means the owner was given a check for $80,000 when the loan was originated. Guaranteed interest of 4%, plus a 2.5% dividend = 6.5% total credit for the year. Total is $6,500 credited toward the CV. New total is $106,500 in cash value.

There is no difference in credit here because the outstanding loan is not considered when crediting takes place.

Keep in mind that there are interest charges on these loans, so in Example 2 the total amount would have to be reduced by the interest charge, which may be less than the credit amount or may be the same.

But in Example 2, you have been given the $80,000 to invest in another venture. And perhaps that venture is providing a return of 5 or 6%. In which case you will earn the 6% plus the potential arbitrage from the policy.

Back to Top

Direct Recognition Loans

Direct Recognition companies will recognize the loan against your cash value, and will reduce the crediting accordingly.

Why would anyone want Direct Recognition companies if they plan on banking. Well, these companies are not dumb, they know what is happening and they want to be competitive, so typically these companies will reduce their interest rate on their policy loans to make it attractive and competitive to those that may be considering banking.

Another benefit of direct recognition companies is that when interest rates rise, the returns of direct recognition companies are typically higher.

Ultimately we have found that both types of companies can provide a compelling and competitive banking product.

Indexed Universal Life

Nelson Nash and most other authors that write about Infinite Banking suggest staying with Whole Life Insurance when choosing to practice an Infinite Banking strategy. However, almost all forms of permanent life insurance offer a savings component or cash value.

Universal Life, Indexed Universal Life, and Variable Universal Life all have cash values associated with the policies.

Most companies that offer UL, IUL, and VUL provide loan provisions that allow for banking. However, it’s important to pay attention to the underlying crediting and interest charges because they can vary drastically from one company to another.

The sharpest criticism directed at UL, IUL, and VUL policies with regards to infinite banking is that they are more vulnerable to market fluctuations versus whole life where you get a guaranteed return and dividend payment.

VUL is as risky as any other investment product that invests in the stock market because it is investing in very much the same way as a mutual fund.

UL and IUL choose to invest in options in order to try and attempt to provide a floor for their returns, but options are still very risky and in fact most people that own UL or IUL policies don’t even know that the company is using options to provide a return.

The point remains, UL, IUL, and VUL policies are riskier endeavors than Whole Life – and for most infinite banking practitioners, they prefer security over the potential extra gains.

If you want to learn more, check out our article on using IULs for Infinite Banking where we cover the finer points of how to make infinite banking work with indexed universal life insurance.

Paid-Up Additions

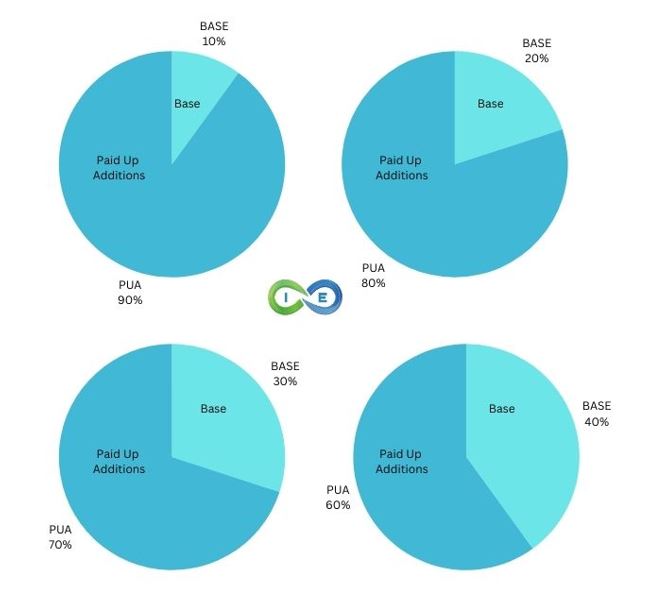

This rider, also known as an enricher rider, or additional insurance rider, is a great tool for those that want to maximize the cash value build-up in their policy.

Paid up additions can be defined simply as additional insurance that is paid in full at the time of purchase. In other words, if you have a $100,000 life insurance policy, and you purchase an additional $50,000 worth of insurance by paying a lump sum of $10,000.

The lump sum of $10,000 includes all fees and expenses required to cover the additional $50,000 worth of death benefit. The policyholder is not required to pay anything in addition to the lump sum because the coverage has been paid in full, or “paid up.”

The individuals that want to bank within their policy are typically looking to increase their cash value as quick as possible. And at the same time they want to minimize fees and insurance costs. The Paid-up Addition rider is the perfect solution.

As an example, with Paid-up additions an individual can pay premiums of $1000 a month, and have $10,000 in cash value at the end of year one of a whole life policy. And this is done while maintaining the tax benefits and avoiding the MEC limitations.

As illustrated in the above image, you can design an infinite banking policy in a number of ways. At I&E, we generally like to design the IBC policy so that 20% of the premium payment goes to the death benefit and 80% of the payment goes towards paid up additions. However, there are many factors to consider, (such as how soon you want to access your cash value), when determining the best way to design your whole life insurance for infinite banking and a different policy design may be warranted based on your specific goals.

Dividend Paid Up Additions

And with your whole life insurance policy’s annual dividend payment, you can allocate your dividend payment to additional paid up additions.

So not only are you paying more cash into the policy to overfund the whole life insurance policy, you are also allocating your dividend back into the policy for maximum compound interest growth.

Risk and Stability

With all investments there is an inherent risk that you can lose some or all of your money. However, whole life insurance is not an investment, but an asset that provides guaranteed savings, creating risk protection. The risk protection is due to whole life insurance being a non-correlated asset, which means it is not connected to the stock market.

Risk Management

Infinite Banking is most commonly executed via a properly structured cash value whole life insurance policy. Whole life insurance is considered one of the safest investment options in all of finance.

Consider this: banks in America own so much life insurance that there is a separate accounting acronym for these assets known as BOLI – Bank Owned Life Insurance.

BOLI is an asset used by banks to help with pay employee benefits. It typically takes the form of key man insurance, where the bank employee’s life is insured. Typically, the bank pays the premium and is the owner and beneficiary of the policy.

For banks with over $100 million in assets, the percentage owning BOLI stood at 71.0% as of September 30, 2018, and for banks with over $300 million in assets, the percentage owning BOLI stood at 77.6% as of September 30, 2018. Equias Alliance/Michael White Report 2018 Edition.

BOLI is considered a Tier 1 asset, which simply means that it is considered by the regulators to be the safest type of investment of those that are under regulations.

BOLI highlights the stability of whole life insurance, with 71-77% of large banks using it as a safe asset.

And don’t forget Corporate Owned Life Insurance or COLI. It is not just banks that load up on life insurance as a tier one asset.

Regulatory Considerations

All life insurance companies are regulated by the individual states within which they are conducting business. For any policy holder that purchases a life insurance policy, the agent that sold the policy must be licensed in the state it is sold. Licensing for the agent involves a set amount of hours of education as well as passing a proctored state sponsored test.

There are certain federal laws that govern all insurance companies, such as the anti-trust laws, but overall the Supreme Court has stated that insurance regulation falls upon the individual states.

The National Association of Insurance Commissioners was founded in the 1800’s to deal with the issues of law that were facing the industry. The voluntary association of commissioners was formed to set standards and best practices, conduct peer reviews, and to help coordinate regulatory oversight. (Source: Wikipedia)

Notable Successes

As mentioned earlier, the life insurance companies in America have done exceptionally well over the last 100 years, but most notable was probably during the period of the Great Depression.

The 1930’s in America were known as the decade of lost jobs and lost wages. But it was also a decade of bank and investment collapses. In spite of the massive amounts of business failure throughout the 1930’s, the life insurance companies faired extremely well.

Only a couple of life insurance companies failed, and that was due to having a board of directors that were embezzling funds.

In addition to the Great Depression success, the more recent, and probably more relevant Great Recession of the late 2000’s, had similar success. The International Monetary Fund estimated that major U.S. and European Banks lost as much as 2.8 trillion in toxic assets and bad loans in from 2007 to 2010. Lehman Brothers, the largest bankruptcy in America at the time, listed it’s debt at $613 billion. These bank losses are in sharp contrast to the insurance industry losses during that same period. There were only 11 insurance company insolvencies during that same time period, totaling $955 million.

To compare the respective losses, it would be like two individuals losing money in Las Vegas. One individual (the banker) lost $300,000 while the other individual (the insurer) lost only $100.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

Tax Benefits

Tax-Deferred Growth

Life Insurance Cash Values grow on a tax-deferred basis. Which means you will pay taxes on the growth of your cash value later – taxation has been deferred. However, most people that own cash value life insurance policies end up never paying taxes on the growth. More on this below.

Premiums paid for a life insurance policy with a cash value are paid for with after-tax dollars. Which means the dollars have already been taxed, so you don’t have to pay tax on those same dollars if you want to access them again. If you pay a $1000 premium and $500 is added to your cash value, you are allowed to withdraw that $500 again in the future without being taxed. The reason for this is because you were already taxed on the entire $1000 prior to paying the premium.

And since you policy has a guaranteed return, your cash value will grow every year. After 10 years of paying $500 per month toward your cash value, your account is at $100,000. But 10 years of paying $500 is only $60,000. Which means that you have $40,000 of potentially taxable growth – money that has not been taxed. This money, the growth in your cash value, is taxable. But you don’t get taxed on it every year, instead you get taxed only if you withdraw it from the account.

And life insurance policies typically have a first in first out schedule for withdrawals, which means that the first money that came in, is the first to go out. So you could withdraw up to $60,000 of your total cash value without being taxed. Keep in mind that this all refers to cash value withdrawals – there is another way of accessing your cash value as well, and it’s tax-free. You either pass on the death benefit tax free or you can access your cash value tax free via a loan.

Tax-Free Death Benefit

One of the biggest selling points of life insurance of all kinds, is that the death benefit is paid out to the beneficiaries tax-free. That is true for all life insurance including term life insurance, variable life insurance, indexed universal life, and whole life. If your policy death benefit is $1 million, and the insured dies, the death benefit is paid in entirety to the beneficiary tax-free.

In some policies the tax-free death benefit is awarded in addition to the cash value component. So if you have a death benefit of $1 million, and your cash value is currently at $400,000 when the insured dies, the beneficiary will receive the death benefit and the cash value – $1,400,000. Not all policies have this additive feature, and those that do require additional premium to cover the cost.

Tax-Free Policy Loans

Policy owners do not have to wait until death to access the cash value tax-free. Instead they can choose to take out a life insurance loan using their death benefit as collateral. These loans are not considered regular income because they are loans, as a result they are not taxable (tax-free). The loans do have a finance charge associated with them. But the finance charge is typically less than or equal to the amount that the cash value account is being credited.

When a policy loan interest rate is less than the cash value crediting rate, the policy owner can create arbitrage. If the policy loan interest rate is equal to the cash value crediting rate, the policy owner is essentially breaking even in what is considered a wash loan.

Many individuals used the policy loan provision of the life insurance policies to borrow and lend money for the purpose of infinite banking. When the policy owner can create arbitrage in addition to banking for profit with the policy, they have managed to maximize their policy potential.

Tax-free policy loans enable you to access your cash value without surrendering the policy and without tax liability, enhancing financial flexibility.

Costs and Commissions

Agent Commissions

Commission rates vary by company, but a general rule of thumb is that the agent will receive somewhere between 30% and 90% of the first year annual premium of the policy. As an example, let’s assume the policy has an annual premium of $1000. A first year commission payment to the agent earning 40% would be $400. But this is just one of the two commission payments the agent will receive.

The two types of commissions for an insurance agent are first year commission payments, and recurring commission payments. Recurring payments are payments paid every year based on the total premium paid, and typically are around 3-4%. In other words, in the example above, the agent would have received $400 in year one, and in year two would have received a recurring commission of $30. The recurring payments are given every year for a number of years, depending on the product sold.

The amount of commission is always based on the premium, but it is also based on the type of policy. Variable Life Insurance, Indexed Universal Life Insurance, and Whole Life Insurance have greater profit margins for the company and are therefore awarded a higher commission.

Lower Commissions

A whole life insurance policy designed for infinite banking pays the agent much less than a typical standard policy. That is because the structure of the policy focuses on paid up additions versus death benefit, which drastically reduces the agent’s commission depending on what the percentage of paid up additions versus death benefit, as illustrated above in the section on paid up additions.

Insurance Company Costs

Costs that are paid directly to the insurance company are called premiums. Premiums pay for the insurance that you are buying, the agent commissions, and pay for the investment portion of the cash value policy. Premiums are based on three main factors: your risk, the term, and your death benefit.

Life Insurance policy risk is based upon your age, sex, personal and family health history, occupation, and location. All of these factors are calculated and projected in accordance with the insurance company actuaries to arrive at a premium. Prior health problems may raise premiums. The older you are the higher your premiums. The more dangerous your occupation, the higher your premiums.

The term is the amount of time the insurance policy is in effect. If you buy 20 year term insurance at age 30, your premiums will be very low, because the odds of dying are also very low. If you buy permanent insurance that is guaranteed to age 120, your premiums will be much higher, because you are likely to die prior to age 120.

The death benefit you are purchasing is the amount of money that the policy beneficiaries receive in the event that the insured dies. If the death benefit is $10 million, the annual premium will be much higher than that of a death benefit of $100,000.

Performance and Challenges

Measuring Performance

Infinite Banking performance is difficult to measure on a macro level because there isn’t any recognized organization that tracks or monitors such data. Tracking the success of the whole life cash value is helpful, but ultimately not the whole picture when it comes to banking. The true power of Infinite Banking comes from the policy owners ability to keep the money in his or her bank moving – a paradigm known as the velocity of money.

Infinite Bankers that have excellent performance history have managed to keep their money consistently loaned out and moving. A typical example would be the individual that has $100,000 in cash value, with $80,000 of that money on loan and earning at least 10%. Typically that would mean the policy holder would be enjoying a minimum of 10% ROR, but also enjoying the growth coming from continued premium payments with paid-up additions.

The example above is that of a policy holder using the cash value to be a hard money lender for short term loans – these are the loans that command the higher interest rates. However, the cash value could also be used to invest in real estate, or business ventures. As long as there is a return on that investment, and the money is being paid back into the account, the money continues to move and the bank grows.

Growth of the bank only slows when the money sits in the account unused. It’s true that the cash value will continue to grow at the credited rate, but that rate is usually much less than most Infinite Bankers are seeking to find.

The velocity of money—keeping funds loaned out and repaid—is key to maximizing your Infinite Banking returns.

Challenges

As with all investment strategies the Infinite Banker has a variety of challenges. First of all the Infinite Banker needs to qualify for the policy before he or she can begin banking. In addition, the cash value needs some time to build up before there is much to create the bank. With a properly structured whole life policy that is built for max cash value accrual, it may only take a couple years before the bank is of sufficient size, but it’s not an overnight process.

In addition there is a learning curve associated with Infinite Banking that some are not willing to undertake. Many people are accustomed to paying their broker or advisor and they don’t want to think about much more. For these individuals Infinite Banking is going to be a bit more challenging. At InsuranceandEstates.com we try to help educate individuals that are interested in Infinite Banking so they have a solid understanding before they start.

For those that do take the time to qualify for the policy, learn the strategy, and implement the process, the rewards are apparent.

Notable Books

The books on Infinite Banking will provide the reader with the basic concepts, the typical vehicle for banking (permanent life insurance), and various comparisons with other forms of financing or banking.

Since Nash’s work, a few other people have followed suit and written their own version of the concept. One of the more popular books Bank on Yourself by Pamela Yellen, was published in 2009, and shares much of the same information presented in Nash’s book. The book also happens to be one long sales pitch for contacting her organization and working with one of her partners.

- Becoming Your Own Banker: Unlock the Infinite Banking Concept – R. Nelson Nash – The book that started it all. A short book, but one that covers the concept well enough to whet your appetite and educate even the least qualified student.

- Self Banking Blueprint: Our very own, Steve Gibbs, an estate planning attorney, on how to use life insurance for strategic self banking.

- What Would Billionaires Do? Garret Gunderson – offers fresh insight into an age old practice of the wealthy and uber rich.

- The Bank on Yourself Revolution: Fire Your Banker, Bypass Wall Street, and Take Control of Your Own Financial Future – Pamela Yellen – A well written follow-up book that explains the concept of Infinite Banking very well. If you can stomach the sales pitch that happens on every other page, you’ll learn a decent amount.

- Money. Wealth. Life Insurance.: How the Wealthy Use Life Insurance as a Tax-Free Personal Bank to Supercharge Their Savings – Jake Thompson – A concise and well written book that gives all the basics of the Infinite Banking Concept®. The examples are easy to follow and the chapters are pretty thin on the marketing fluff, which is a huge bonus. A quick and easy read to get familiar with the IBC.

- The Power of Zero – David McKnight – Not specifically about Infinite Banking, but does an excellent job of discussing cash value life insurance and the tax implications of such.

Debates and Controversies

For more, check out our comprehensive article on FAQs for Infinite Banking.

There is very little open and public debate regarding Infinite Banking. Most of the discussion centers around the underlying insurance products used to facilitate the banking – namely the permanent life insurance policies. There is plenty of debate about the efficacy of whole life, universal life, indexed universal life, and variable universal life. But rarely will you see a thorough debate regarding the efficacy of Infinite Banking itself.

Bloggers and financial writers will describe Infinite Banking, and then proceed to show whole life rates of return and state that they would prefer buying term insurance and investing the rest in a low cost index fund. This argument doesn’t actually address the Infinite Banking paradigm at all. It merely states that buying Term insurance and a low cost index fund can outperform a whole life policy in the short term. And in many cases it doesn’t even account for the long term consequences of the expiration of the Term insurance.

Infinite Banking is a paradigm for personal banking that cannot be replicated anywhere else by the average consumer. And personal banking is a powerful and incredibly profitable business. Those that attempt to minimize the advantages and strengths don’t accurately address the banking – they only do it lip service while criticizing permanent insurance.

However, it is true that not all permanent insurance products allow for equal participation in the Infinite Banking game. Some insurance products have policy restrictions on loans that seriously hinder the banking activity. While others seem to be tailor made for banking. If you are interested in Infinite Banking please consider our list of the the Top 10 Infinite Banking Companies. We do our best to highlight those companies we think offer the best possible products for the individual that wants to get into banking.

Is Infinite Banking Right for Your Financial Future?

Before diving into Infinite Banking, get a personalized analysis from our independent advisory team. We’ll help you determine if this strategy aligns with your financial goals and lifestyle.

- ✓ Receive a tailored breakdown of how Infinite Banking would work for you

- ✓ Compare Infinite Banking to traditional savings and investment options

- ✓ Understand the tax benefits and cash flow potential

- ✓ Get a clear explanation of setup costs and long-term commitments

Schedule your complimentary 30-minute Infinite Banking consultation today and explore your path to financial control.

No obligation. No pressure. Just expert guidance to help you decide if Infinite Banking fits your financial strategy.

4 comments

Matt Hanson

What company or companies would you recommend for small business owners just starting out with infinite banking? Healthy and ages 30-50, who can afford $200-$500 a month today, but want to add coverage annually and increase premium(s) as the bizz expands?

Insurance&Estates

Hi Matt, thanks for checking in. You can check out our article on this topic as a starting point: https://www.insuranceandestates.com/top-10-best-infinite-banking-companies/ and if you need further guidance connect with one of our Pro Client Guides, all well versed in IBC and self banking strategies. Best to you.

Steve Gibbs, Esq.

Derek

What I found interesting with a Direct Recognition company like Penn Mutual is that it will still give dividends against the loan amounts, it’s only a tad lower. Many agents tout Non-Direct because they say Direct Recognition companies pay 0% against the loaned amounts, but it’s simply not true (at least with Penn). For example, with Penn Mutual (not speaking for all other companies), the current dividend rate is 6.34% on the non-loaned amounts, while it’s 4.35% on the loaned amounts (it’s even more generous for policies over 10 years old). This is directly from their site. This is vastly different than what many agents say who push clients to their non-direct recognition company. Thoughts? Great articles and I’ve enjoyed your site! 😉 (*I’m not an agent).

Insurance&Estates

Derek,

Yes, we agree that the direct vs non direct recognition discussion is typically overblown by non-direct zealots. We love Penn Mutual, a direct recognition company. We also have favorite non-direct recognition companies also. It really depends on who the client is, what there goals and objectives are and the company that best fits that need.

Thank you for the valuable feedback. We are glad you have enjoyed the our site.

All the best,

I&E