What is the best compound interest account for maximum growth in 2025? While high-yield savings accounts now offer up to 4.66% APY, there’s a superior account delivering 5.25%+ total returns completely tax-free. High cash value whole life insurance provides 4%+ guaranteed returns plus dividends, creating tax-advantaged compound growth that significantly outperforms taxable accounts. This guide reveals why tax-free 5.25%+ beats taxable 4.66% every time and offers the optimal combination of guaranteed growth, tax advantages, instant liquidity, and uninterrupted compounding.

💰 Compound Interest Key Facts (2025)

- Einstein’s Quote: “Compound interest is the eighth wonder of the world”

- Best 2025 Returns: High cash value whole life 5.25%+ tax-free vs. savings 4.66% taxable

- Tax Impact: 25% taxes turn 4.66% savings into 3.5% real return

- 30-Year Growth: $10,000 becomes $44,565 tax-free vs. $30,967 taxable

- Best Account Type: High cash value whole life (4% guaranteed + 1%+ dividends = 5.25%+ tax-free)

(Updated June 2025)

📊 Current Data Sources & Verification

- NerdWallet (June 20, 2025): High-yield savings rates up to 4.66% APY current verification

- Bankrate (June 17, 2025): Current compound interest account rates and Fed rate tracking

- Federal Reserve H.15 (June 20, 2025): Official federal funds rate at 4.25%-4.50% range

- Investopedia (June 2025): High-yield savings account rate rankings up to 5.00% APY

- CNBC Fed Coverage (June 18, 2025): Federal Reserve policy decisions and rate projections

- FRED Economic Data: Current effective federal funds rate at 4.33% (June 19, 2025)

All rates and data verified June 2025 from primary financial sources

Table of Contents

- Compound Interest Introduction

- Simple Interest vs Compound Interest

- Compound Interest vs Simple Interest Example

- How Taxes Destroy Compound Interest

- Penny Doubles Every Day for 30 Days

- Compound Interest Growth Over 20 & 30 Years

- Compound Interest Schedule

- The Best Compound Interest Accounts

- Cash Value Life Insurance as a Compound Interest Account

- The Best Compound Interest Account

- Traditional Bank vs Life Insurance

- Compound Interest + Velocity of Money = True Wealth Building

- Compound Habits

- Time is of the Essence

- Next Steps

📈 Compound Interest Quick Stats (2025)

More growth with compound vs simple interest over 30 years

Tax-free returns from best compound interest account

$10K grows to this amount with 4% compound interest (30 years)

Wealth reduction when compound growth is taxed annually

Compound Interest

It has been called the 8th wonder of the world, with most giving the nod to Albert Einstein. The quote goes like this “Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn’t {understand it] pays it.”

This article answers the question of just what compound interest is and explores the various types of compound interest accounts available. By taking advantage of compound interest, you can position yourself to build up your savings over the long term as the magic of earning interest on interest helps expand your wealth and magnify your legacy.

Compound interest is best understood by comparison to simple interest. Definitions of these two concepts are as follows:

Compound Interest vs Simple Interest Example

- Simple interest: Interest earned on invested principal over multiple periods of time that does not take into account the interest earned in earlier periods. In other words, interest is only paid on principal, not on any interest earned on that principal.

- Compound interest: Interest earned on invested principal over multiple periods of time that does account for the interest earned on the principal in earlier periods. Interest is earned on interest plus principal when compound interest is used. It is this “compounding” of principal and interest that creates huge long-term accumulation.

💰 Compound Interest vs Simple Interest: Key Facts (2025)

- $10,000 Investment at 4% for 30 Years:

- Simple Interest Result: $22,000 (grows $400/year consistently)

- Compound Interest Result: $32,434 (grows $1,247/year by year 30)

- Compound Interest Advantage: $10,434 more (47% greater return)

- Growth Acceleration: Compound interest earns 300% more annual interest by year 30

The compound interest example below demonstrates exactly why compound interest is called “the eighth wonder of the world.” When you invest $10,000 at 4% annual interest, the difference between simple and compound interest becomes dramatic over time.

Simple Interest Calculation: Linear Growth

Simple Interest Formula: Principal × Interest Rate × Time

With simple interest, you earn $400 every single year (4% of $10,000), regardless of how much your account has grown.

| Simple Interest at 4% over 30 years | |||||

|---|---|---|---|---|---|

| Year 1 | Year 5 | Year 10 | Year 20 | Year 30 | |

| Starting Value | $10,000 | $11,600 | $13,600 | $17,600 | $21,600 |

| Annual Interest | $400 | $400 | $400 | $400 | $400 |

| Year-end Value | $10,400 | $12,000 | $14,000 | $18,000 | $22,000 |

Compound Interest Calculation: Exponential Growth

Compound Interest Formula: Principal × (1 + Interest Rate)^Time

With compound interest, you earn interest on your interest. Each year’s interest gets added to your principal, making the next year’s interest payment larger.

| Compound Interest at 4% over 30 years | |||||

|---|---|---|---|---|---|

| Year 1 | Year 5 | Year 10 | Year 20 | Year 30 | |

| Starting Value | $10,000 | $11,698.59 | $14,233.12 | $21,068.49 | $31,186.51 |

| Interest Growth | $400 | $467.94 | $569.32 | $842.74 | $1,247.47 |

| Year-end Value | $10,400 | $12,166.53 | $14,802.44 | $21,911.23 | $32,433.98 |

🎯 THE COMPOUND INTEREST ADVANTAGE

$10,000 at 4% for 30 years:

Simple Interest: $22,000

Compound Interest: $32,434

Compound Advantage: $10,434 MORE (47% greater return)

What Makes Compound Interest So Powerful?

Year 1: Both accounts earn identical $400 interest

Year 10: Compound interest earns $569.32 vs. $400 simple interest (42% more)

Year 20: Compound interest earns $842.74 vs. $400 simple interest (111% more)

Year 30: Compound interest earns $1,247.47 vs. $400 simple interest (212% more)

The Magic Formula: By year 30, the compound interest account generates over 300% more annual interest than the simple interest account because it’s earning interest on $31,186.51 instead of just the original $10,000.

📊 2025 Compound Interest Account Reality Check

High-Yield Savings Accounts: 4.3-4.66% APY (taxable + rates fluctuate)

CDs: 4.0-4.5% APY (taxable + locked up + rates falling)

High Cash Value Whole Life: 4%+ guaranteed + 1.25%+ dividends = 5.25%+ total return (TAX-FREE)

🏆 CLEAR WINNER: 5.25%+ tax-free beats 4.66% taxable every time, plus guaranteed rates that never drop with Fed policy changes.

Bottom Line: Compound interest transforms your money into a growth machine where every dollar earned starts earning its own dollars. The longer you let it work, the more dramatic the difference becomes compared to simple interest accounts.

🎯 Section Takeaway: Compound Interest Power

$10,000 at 4% compound interest grows to $32,434 over 30 years vs. $22,000 with simple interest – a $10,434 advantage (47% more growth). The magic happens because compound interest earns 300% more annual interest by year 30 ($1,247 vs $400) since you’re earning returns on $31,186 instead of just the original $10,000.

Real-World 2025 Tax Impact on Compound Interest

💰 2025 Tax Check: Savings vs. Whole Life Insurance

- High-Yield Savings at 4.66% APY: Becomes 3.5% after 25% federal taxes

- $10,000 Savings Growth (30 years): $30,967 after taxes vs. $44,565 tax-free

- Tax Cost: $13,598 lost to taxes (30% of potential gains)

- Whole Life Insurance at 5.25%: 100% tax-free compound growth

| Tax Impact: $10,000 Growing for 30 Years | |||

|---|---|---|---|

| Account Type | Gross Return | After-Tax Return | Final Value |

| High-Yield Savings (Taxable) | 4.66% | 3.5% | $30,967 |

| Whole Life Insurance (Tax-Free) | 5.25% | 5.25% | $44,565 |

| Tax Advantage | – | +1.75% | +$13,598 (44% more) |

The extreme example below shows how devastating annual taxation can be to compound growth over longer periods.

Here is a chart of one dollar doubling 20 times and that same dollar doubling 20 times but taxed annually at 25%. Notice how paying even a marginal tax rate (25%) can absolutely destroy wealth building.

| Tax Impact: $1 Investment Doubling Annually for 20 Years | ||

|---|---|---|

| Year | Tax-Free Compounding | Taxable at 25% |

| 1 | $2.00 | $1.75 |

| 2 | $4.00 | $3.06 |

| 3 | $8.00 | $5.36 |

| 4 | $16.00 | $9.38 |

| 5 | $32.00 | $16.41 |

| 6 | $64.00 | $28.72 |

| 7 | $128.00 | $50.27 |

| 8 | $256.00 | $87.96 |

| 9 | $512.00 | $153.94 |

| 10 | $1,024.00 | $269.39 |

| 11 | $2,048.00 | $471.43 |

| 12 | $4,096.00 | $825.01 |

| 13 | $8,192.00 | $1,443.76 |

| 14 | $16,384.00 | $2,526.58 |

| 15 | $32,768.00 | $4,421.51 |

| 16 | $65,536.00 | $7,737.64 |

| 17 | $131,072.00 | $13,540.88 |

| 18 | $262,144.00 | $23,696.54 |

| 19 | $524,288.00 | $41,468.94 |

| 20 | $1,048,576.00 | $70,576.64 |

📊 Tax Impact: 93% wealth reduction ($978,000 lost to taxes)

Tax-free grows 15X more than taxable • $1,048,576 vs $70,577 final values

⚠️ Section Takeaway: Tax Impact Reality

Taxes reduce compound interest by 93% in extreme cases ($1M becomes $70K when taxed annually at 25%). For 2025 investors: high-yield savings at 4.66% becomes only 3.5% after taxes, while whole life insurance at 5.25% stays tax-free, delivering 50% better real returns.

Penny Doubles Every Day for 30 Days

A popular way to demonstrate the power of compound interest is to ask the question, “what would you rather have, $1,000,000 or a penny doubled every day for 30 days?”

Most people initially choose one million dollars. However, as you can see from the chart below, taking a penny doubled every day for 30 days is far and away the winner.

| Penny Doubling: The Power of Compound Growth Over 30 Days | |||||

|---|---|---|---|---|---|

| Day | Amount | Day | Amount | Day | Amount |

| 1 | $0.01 | 11 | $10.24 | 21 | $10,485.76 |

| 2 | $0.02 | 12 | $20.48 | 22 | $20,971.52 |

| 3 | $0.04 | 13 | $40.96 | 23 | $41,943.04 |

| 4 | $0.08 | 14 | $81.92 | 24 | $83,886.08 |

| 5 | $0.16 | 15 | $163.84 | 25 | $167,772.16 |

| 6 | $0.32 | 16 | $327.68 | 26 | $335,544.32 |

| 7 | $0.64 | 17 | $655.36 | 27 | $671,088.64 |

| 8 | $1.28 | 18 | $1,310.72 | 28 | $1,342,177.28 |

| 9 | $2.56 | 19 | $2,621.44 | 29 | $2,684,354.56 |

| 10 | $5.12 | 20 | $5,242.88 | 30 | $5,368,709.12 |

🎯 Compound Growth Power: The Penny Challenge

Starting Amount (Day 1)

Value at Day 20

Final Value (Day 30)

Growth Rate: 536,870,912% increase over 30 days through daily compounding

Demonstrates exponential growth power • $5.3 million from a single penny • Compound interest in action

Compound Interest Growth Over 20 & 30 Years

Let’s look back at the above example comparing simple interest to compound interest over 20 and 30 years. This allows us to really start to see the benefits of compound interest kicking in.

$10,000 at 4% simple interest for 20 years would grow to $18,000. Over 30 years at the same rate your $10,000 would grow to $22,000.

Using an online compound interest calculator we can calculate how much the same amount would grow to using compound interest:

Over 20 years at 4% compound interest your $10,000 would grow to $21,911.23 ($3,911.23 greater than using simple interest).

Over 30 years at the same rate it would grow to $32,433.98 ($10,433.98 greater than using simple interest, or 47% greater return with compound interest vs simple interest).

The added time for the compounding to work enables your original investment to grow significantly more than would have been the case if you had received simple interest on the money.

Given that even small amounts can provide substantial growth if they compound over a long enough period of time, it should be readily apparent from these examples that time is of the essence when it comes to maximizing the impact of compound interest on your savings.

The Earlier the Better

The flip-side of this is that if you fail to start saving early enough, it can be very difficult to make up for lost time due to the power of compounding. This is not to save that you shouldn’t set aside savings later in life, just that the earlier you start saving the better.

By giving your savings as much time as possible to compound in value, you can maximize the money you are able to amass for your financial goals, whether paying a child’s education, purchasing a home, providing retirement income, etc.

Compound Interest Schedule

While an account earning compound interest grows faster over time than one that is paid simple interest, not all compound interest accounts are compounded on the same schedule.

Some accounts are compounded yearly, some quarterly, some monthly, and some weekly or even daily.

The shorter the compounding time, the more rapidly an account will grow. Thus, an account that has interest compounded monthly will grow faster than one compounded yearly, and an account featuring daily compounding will grow faster than one compounding monthly.

The reason is the compound interest account is being credited interest each day, increasing the principle balance, which increases the effect of the interest credited. The balance “compounds” at a greater rate since interest is credited more often.

To avoid consumer confusion regarding the actual interest rate they are receiving on an investment or being charged on a loan, the concept of an effective interest rate is used.

Also known as an annual percentage rate, or APR, the effective interest rate tells you the actual interest rate you are receiving or being charged on an annual basis. This rate takes into account the frequency of compounding to determine the equivalent yearly rate.

Using an APR enables you to compare different compound interest rate accounts on an apples-to-apples basis when it comes to evaluating the interest rate.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

The Best Compound Interest Accounts

A number of cash and cash equivalent accounts feature compound interest. Bank savings accounts, mutual fund and brokerage account money market accounts, and life insurance cash accounts typically accrue compound interest.

Corporate and government bonds, on the other hand, often pay simple interest, although sometimes these products will have dividend reinvestment programs which enable compounding.

Mutual funds, whether they invest in equities (stocks), or fixed-income (bonds), allow reinvestment of both dividends and capital gains if they are open-ended, enabling compounding.

A distinction should be made between mutual funds, whether of the equity or fixed-income variety, and cash accounts. While mutual funds feature compounding, unlike cash accounts, any principal invested in these funds is at risk, whereas money held in cash accounts generally doesn’t place your principal at risk (the exception being those rare cases where a financial institution fails, although in such cases there is often some form of insurance covering cash account holders).

Cash Value Life Insurance as a Compound Interest Account

The cash account in cash value life insurance, also known as permanent life insurance, such as whole life and universal life typically receives compound interest.

After you’ve tended to your immediate liquidity needs by setting aside some cash for emergencies, placing money into dividend-paying whole life insurance can be a good way to build up cash savings.

Specific cash value whole life policies typically feature paid-up additions riders, which allow you to add cash to the account if you like.

The Best Compound Interest Account

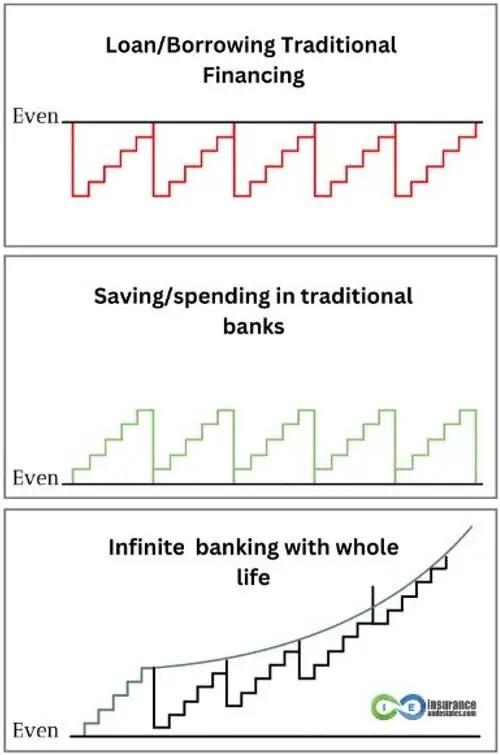

Whole Life Insurance stands out as one of the most powerful compound interest vehicles available, especially when utilized with the Infinite Banking Concept. As the comparison graphs illustrate:

Unlike traditional financing (where borrowing creates a cycle of progress and setbacks) or conventional bank saving (where withdrawals regularly interrupt growth), Infinite Banking with whole life insurance provides a continuous upward trajectory.

Your Whole Life policy grows cash value at a guaranteed rate plus potential dividends, creating true compound growth where interest earns interest over time. The critical difference becomes clear when you access your money: with policy loans, your entire cash value continues earning compound interest uninterrupted. This happens because you’re not withdrawing money—you’re using your policy as collateral while your full cash value keeps growing.

This creates the unique stair-stepping growth pattern shown in the bottom graph: your money works in two places simultaneously, avoiding the repeated setbacks seen in traditional methods. As your policy matures over decades, this uninterrupted compounding effect becomes dramatically more powerful, significantly multiplying your wealth.

The visual comparison makes it clear why this combination of guaranteed growth, uninterrupted compounding, and financial leverage makes Whole Life Insurance an exceptional compound interest account for building long-term wealth.

Traditional Bank vs Life Insurance

In light of our position that whole life insurance is the best compound interest account, please consider the following additional benefits that you receive in a high cash value whole life insurance policy versus a traditional bank savings account to store your “safe bucket” money.

| Traditional Bank Savings Account | High Cash Value Whole Life Insurance Policy | |

|---|---|---|

| Earnings Rate | The national average yield for savings accounts is 0.58 percent APY as of Dec. 18, 2023 (*Bankrate, December 13, 2023). But actual earnings are less after tax and not guaranteed. | Guaranteed (average) 3% interest. Plus an additional 2%-4% dividends. Tax-free, so net earnings of 5%-7%, which may increase as interest rates increase. |

| Withdrawals and Earnings | Amount available for withdrawals is lower because gains in the account are taxable. | Full amount of cash value is available for withdrawals. |

| Loans | Does not offer loans. Loan would have to be obtained through a bank or other lender. | Loans are available via the cash value, with no approval needed. Plus, the amount borrowed still continues to generate interest and dividends. |

| Loan Repayment | Amount and due date of repayments is determined by the bank or lender. If payments are late or missed, it negatively impacts your credit score. | No required loan payments. Policyholder determines when and how much is paid - or even IF payments are made. |

| Added Benefits Upon Death | Paid on Death (POD) to a beneficiary. | Death benefit is paid to beneficiary income tax free. |

| Living Benefits | None | ~Chronic Illness Rider - With a chronic illness diagnosis or need for long-term care, funds may be accessed from the death benefit. ~Accelerated Death Benefit - Death benefit funds may also be accessed in the event of a terminal illness diagnosis. ~Protection from 3rd party creditors - In most states, whole life insurance is protected from creditors, lawsuits, and bankruptcy. |

| Costs | Potential savings and checking fees. | Premium is required for death benefit. However, premium payments are leveraged for a larger death benefit payout - which is received income tax free by the beneficiary(ies). |

| Creditor Protection | Minimal. | Creditor protection based on individual state laws. |

🏆 Section Takeaway: Whole Life Insurance Advantage

High cash value whole life insurance delivers 5.25%+ tax-free returns (4% guaranteed + 1.25%+ dividends) vs. 3.5% after-tax from savings accounts. Additional benefits include policy loans for uninterrupted compounding, creditor protection, no age restrictions, and death benefit wealth transfer, making it the superior compound interest account for 2025.

Let’s look more closely at a few of these cash value life insurance benefits.

Highly competitive cash value returns:

Dividend paying life insurance companies cash value accounts have offered returns that have exceeded those offered by most other cash or cash equivalent accounts in recent years.

With these cash value accounts growing in the range of 4% guaranteed, they have rewarded policyholders with highly competitive performance for policyholders.

In addition, although not guaranteed, these mutual that offer participating policies have life insurance dividends, that are paid to policyholders income tax free. Dividends can increase your whole life policy return, with many top mutual offering dividends in excess of 6%.

Tax-favored growth:

Interest earned on a cash value account accumulates tax-deferred. This tax-favored growth enables your money to grow faster than would be the case if it were subject to yearly taxes.

You can withdraw earnings on your cash account free of taxation up to the amount of premiums you have paid into the policy, i.e. your basis. Withdrawals over your basis amount are subject to taxes.

Death benefit protection:

Life insurance is a highly effective method of transferring wealth. If your intention is to build up cash savings to protect your loved ones in case something happens to you, the death benefit protection offered by cash value life insurance will typically provide them with a greater amount than the cash value of your account.

Death benefit proceeds are income tax free to the recipient beneficiary. Additionally, you can gift life insurance cash value to your account beneficiaries without the gifts being subject to income or gift taxes providing the cash stays in the policy.

These gifts can take place during your lifetime. This contrasts with vehicles such as 401k plans or IRAs where taxes must generally be paid on funds passed down to your beneficiaries.

Control over your money:

Another advantage of cash value life insurance is that the funds can be withdrawn in the form of a partial withdrawal or you can borrow against your cash value through a policy loan.

Unlike 401ks or IRAs where a penalty typically applies to most 401k withdrawals before age 59 1/2, there is no such restriction on cash value accounts. And there is no required minimum distribution (RMDs) down the road.

Creditor and Bankruptcy Protections:

Many states offer life insurance creditor protection. If you are subject to a judgment or bankruptcy, the cash value in your life insurance is protected from creditors in many states. However, there is a lot of variance from state to state, so make sure you check your particular state’s creditor protection laws.

Compound Interest + Velocity of Money = True Wealth Building

This is the most important section of this article on compound interest growth because it describes how your money can grow in your savings account and how that same money can also be utilized for other investments — SIMULTANEOUSLY.

Mutual life insurance companies offer participating policies that pay you a guaranteed rate of return, plus potential dividends. You can borrow money from your account and use it for whatever you choose, such as to finance your own purchases, buying cash flow assets, whatever you choose.

Here is the magic. When you access the money in your cash account, you are actually taking out a life insurance loan by borrowing against the cash value in your policy. The cash value in your life insurance policy continues to grow, because it is still in there. It is still being credited with interest and potential dividends.

You now use your life insurance loan to purchase cash flow assets, such as real estate or other alternative investments like notes or bridge loans, your own business, what have you. Now you created cash flow and your life insurance policy cash value (and death benefit) continues to grow at the same time in your new asset.

Time is of the Essence

Time is the crucial element in making the most out of compound interest. The difference between an account earning compound interest (or a lifestyle of healthy habits) and one that earns simple interest is generally not all that substantial over short time periods. However, over extended periods of time the difference between simple interest vs compound interest can be great indeed. So don’t delay, start today!

Next Steps

If you would like to see how your own numbers look, schedule a strategy sesssion with one of our Pro Client Guides to see how powerful a compound interest life insurance strategy can be for you.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

36 comments

El Bee

Hello,

What are your thoughts on the MPI strategy snd do you sell them?

Steven Gibbs

Hello, thanks for commenting. We don’t currently sell under that particular branding; however, we do sell indexed universal life products. If you’re interested in exploring further and perhaps comparing to MPI, I recommend that you connect with our IUL expert Jason Herring by emailing him at jason@insuranceandestates.com and requesting a call. Jason has decades of experience in all aspects of permanent life insurance so I believe this will be beneficial for you.

Best, Steve Gibbs for I&E

Steven Gibbs is a licensed insurance agent, and the following agent

license numbers of Steven Gibbs are provided as required by state law:

Resident License; AZ agent #17508301,

Non-resident Licenses: TX agent #2273189, CA agent #0K10610,

LA agent #769583, MA agent #2049963, MN agent #40563357,

UT agent #655544.

Tom Devine

My phone number is xxx-xxx-xxxx. Please contact me ASAP, as I’d like to purchase an IUL before filing taxes.

Insurance&Estates

Hi Tom, go ahead and reach out to Jason Herring directly if you haven’t connected already by emailing him at jason@insuranceandestates.com. I’ll also pass you inquiry to him to reach out to you.

Best, Steve Gibbs for I&E

Steven Gibbs is a licensed insurance agent, and the following agent

license numbers of Steven Gibbs are provided as required by state law:

Resident License; AZ agent #17508301,

Non-resident Licenses: TX agent #2273189, CA agent #0K10610,

LA agent #769583, MA agent #2049963, MN agent #40563357,

UT agent #655544.

Jorge pineda

i need hold life insurance we compon entered

Jane

Hi, can you recommend a company which had this type of Cash Value Life Insurance as a Compound Interest Account available. I have spoken to several and they offer IUL however not a compound interest account. The numbers are also much lower as far as return and growth.

Insurance&Estates

Hello Jane, we work with top companies for this strategy and yours may vary depending on your goals.

If you haven’t already connected with our team, a great start is to request a call with Barry Brooksby by emailing him at barry@insuranceandestates.com.

Best, Steve Gibbs for I&E

Julianne

What is the cut off age for a profitable compound interest investment to begin please?

Insurance&Estates

Hello Julianne and thanks for connecting. There isn’t necessarily a cut off age as this could depend on how your policy is designed. For example if you’re older and lump sums are applied, this can expedite profitability. To take next steps, I recommend reaching out to Barry Brooksby at barry@insuranceandestates.com.

Best, Steve Gibbs for I&E

Malo

Can I withdraw my current retirement and roll them into a compounding interest life insurance policy without penalties?

Insurance&Estates

Hello Malo,

Thanks for commenting, generally speaking, you cannot roll qualified retirement account proceeds into an non-qualified account without taxation and penalities. That said, it sometimes makes sense to cash out an invest in non-qualified assets. To learn more, you could request a meeting with one of our experts by emailing Barry Brooksby at barry@insuranceandestates.com.

Best, Steve Gibbs, for I&E

Varad

Hello, how can I start putting money into a compounding interest account? What would be a good recommendation on an account type?

Insurance&Estates

Thanks for connecting. By compound interest account here, we are referring to a mutual whole life policy that has been utilzed to hold additional cash through paid up additions. To find out more about how this works, you could request a phone conversation by emailing our expert Barry Brooksby at barry@insuranceandestates.com.

Best, Steve Gibbs for I&E

Elvin

I am interested on a cash value life insurance policy. I live in Puerto Rico, do you have coverage here?

Insurance&Estates

Hello Elvin, thanks for connecting. I checked with our IBC expert Barry Brooksby and he thinks there is a company that can acccomodate you. To connect with him, request a call at barry@insuranceandestates.com.

Best, Steve Gibbs for I&E

Stephone Mcclouden

reaching out Regarding compounding interest account

Insurance&Estates

Hello Stephone, the best way to get started is to watch our webinar on this topic and if you’ve already done so, go ahead and email Barry to request a call at barry@insuranceandestates.com.

Best, Steve Gibbs for I&E

Stephanie Madden

My spouse and need guidance. We need to allocate for retirement. There is too much information to share here. I would be willing to arrange a more official form of communication.

Stephanie M.

Insurance&Estates

Hello Stephanie, if Barry hasn’t reached out to you, go ahead and reach out to him at barry@insuranceandestates.com to request a consulation in order to get started.

Best, Steve Gibbs, for I&E

John Covington

How can I start?

Insurance&Estates

Hello John, thanks for connecting. A great first step is to request a call with our IBC expert Barry Brooksby at barry@insuranceandestates.com.

Best, Steve Gibbs for I&E

Georganna Colquitte

I am very interested my email me

Joe Chiti

I wish to learn more and invest in a compound interest account

Insurance&Estates

Hi Joe and thanks for connecting. A great first step is to connect with our expert Barry Brooksby at barry@insuranceandestates.com so go ahead and send him your best contact information and request a call.

Best, Steve Gibbs for I&E

Cisco Leone

Interested in learning more and opening an account.

Is it possible to roll over a 401K into a Life Insurance Compound Account?

Thank you

Cevin Mckaskle

I need to get life insurance anyway and im also wanting to build wealth and do some investing in realistate soon .How do i get started in getting uninterrupted compounding interrest insurance ?Do i just apply for it when getting life insurance?

Insurance&Estates

Hello Cevin, the next step I recommend is for you to connect with our high cash value life expert Barry Brooksby. Send your contact information to him and request a call at barry@insuranceandestates.com.

Best, Steve Gibbs, for I&E

Jaime Govea

To whom it may concern,

I currently own a small business and would like to invest in what sounds like a cash compound uninterrupted interest account, where my goal is to start using that money for real estate investing. Can someone help me by explaining which direction is best and which company is in line for my goals.

Insurance&Estates

Hello Jaime, I recommend you watch our overview webinar on infinite banking with Barry Brooksby and when you’re ready, connect with him at barry@insuranceandestates.com to schedule a zoom call.

Best, Steve Gibbs for I&E

James P Bryant

hello i invest around 5000.00 every year in a traditional IRA and this gives me a substantial tax incentive on my tax refund . the IRA itself only pays about 2 percent . is there more benefit in a compound interest account and would it still bring me the same tax incentive on my refund ? just trying to figure this out before tax day comes . thanks

Insurance&Estates

Hello James, outstanding question and to get a thorough answer I recommend you connect with Barry Brooksby and get a side by side (truth concepts) comparison. You can connect with him directly at barry@insuranceandestates.com.

Best, Steve Gibbs for I&E

Robert Bousaleh

Interested in learning more and opening an account.

Thank you

Insurance&Estates

Hello Robert, to learn more, reach out to Barry Brooksby at barry@insuranceandestates.com.

Best, Steve Gibbs, Esq.

Paul Rawls

Dear Itzik

Please let me know the out come if you need some assistance please let me know for I was in the Navy also from 1970-1972. I can be reached @

Best Regard

Paul Rawls

itzik

I found out that while in the US Navy the Sfran base purser took out $192 from my $1726.14 earned while in the service of our country. The IRS was to begin taking out tax money from servicemen starting in 1956. I was never compensated for this error and looking at my service records I found the receipt for the tax money taken out from my pay. This was 64 years ago, and I have been trying to get an answer from the IRS but keep getting a run-around with their telephone services. I am trying to ascertain if the IRS owes me the compounded interest on this illegally taken out in 1955. I was separated from the Navy in feb 11th 1956. Is there anyway I can get an answer from them?? If they owe me that unreimbursed money then I would imagine they owe me over $7,000 . How can I get an answer from them???

Insurance&Estates

Thanks for reading. It sounds like you need to obtain a local attorney who focuses on working with Veterans issues. Best of luck in your efforts.

I&E