The Secret to Accelerated Cash Value Growth in Whole Life Insurance

If you’re looking to maximize the cash value in your whole life insurance policy, you’ve likely heard whispers about a powerful strategy called Paid Up Additions (PUAs). While most traditional whole life policies build cash value slowly, adding a PUA rider can significantly accelerate this growth, turning your policy into a powerful financial tool rather than just a death benefit plan. This comprehensive guide explores everything you need to know about Paid Up Additions: what they are, how they work, their benefits, and how to implement them effectively.

Table of Contents

- What Are Paid Up Additions?

- How Paid Up Additions Work

- Benefits of Paid-Up Additions

- How to Design a Policy with Paid Up Additions

- Paid-Up Additions vs. Other Options

- Potential Drawbacks to PUAs

- PUAs for Infinite Banking

- Purchase Paid Up Additions Rider at Policy Outset

- Next Steps

- Frequently Asked Questions

What Are Paid-Up Additions?

Fast Track Your Cash Value

Paid Up Additions DEFINITION: A rider on dividend paying whole life insurance that allows the owner of the life insurance contract to make additional contributions to the policy, resulting in the addition of paid-up life insurance, which increases both the death benefit and cash value.

By including a paid-up additions rider in your policy, you can make purchases of paid-up additional insurance with no proof of insurability, increasing both cash value and death benefit proportionately.

The additional paid-up life insurance can earn life insurance dividends, which compounds the cash value growth inside the policy. This creates a powerful snowball effect that traditional whole life policies simply can’t match.

How Paid Up Additions Work

You can purchase paid-up additions by making extra premium payments on a schedule determined by your insurance company, typically annually. These additional premiums are separate from your base premium and are entirely optional.

When you make a PUA payment, here’s what happens:

- The insurance company deducts a load fee (typically between 4% and 9%)

- The remaining amount purchases fully paid-up additional insurance

- This additional insurance immediately increases your cash value and death benefit

- These additional insurance units earn dividends just like your base policy

- Those dividends can purchase more paid-up additions, creating a compounding effect

For the typical whole life policyholder, the premium is fixed, and cash value accrues slowly but steadily. But what if you want to rapidly accelerate the growth of your cash value? This is where the paid-up additions rider becomes your secret weapon.

Benefits of Paid-Up Additions

Increase Your Cash Value

The main benefit of paid-up additions is significantly accelerated cash value accumulation and growth. Check out the illustration of a whole life policy’s cash value chart with PUAs versus a policy designed primarily for death benefit, and you’ll notice a sizeable difference.

Initially, a policy designed for maximum early cash value growth will have a lower death benefit. However, over time, the death benefit will continue to grow at an accelerated pace.

Accrue Interest vs. Paid Up Additions

Should you use your dividends to accrue interest or use them to purchase paid-up additional insurance?

- If you leave your dividends with the insurer to receive interest, that interest will be taxable.

- Alternatively, using dividends to purchase additional paid-up life insurance allows you to grow your cash value and death benefit in a tax-favored environment under IRC 7702.

- You can then use your cash value tax-free via a life insurance policy loan.

Since taxes are perhaps the #1 wealth destroyer, taking advantage of tax incentives in the IRC is usually the best route. This is why dividend-paying mutual insurance companies remain popular with financially savvy individuals.

Increasing Death Benefit and Cash Value

Using dividends to purchase paid-up additions is typically the default and most popular option for policyholders. The reason is simple: the additional coverage also pays dividends, which in turn purchase more insurance, which then pays more dividends, creating a powerful compounding cycle.

All the while, your policy cash value grows at an accelerating pace. That’s why I like to say that paid-up additions are the fast track for those with a slow and steady strategy. You still have the safety and consistency of a cash value life policy, but with a powerful growth accelerator built in.

How to Design a Whole Life Policy with Paid Up Additions

High cash value whole life is only as good as the policy design. Traditional whole life insurance focused on the death benefit, with the cash value portion being secondary. But whole life designed for early high cash value accumulation prioritizes cash value growth over death benefit.

Optimal Policy Structure

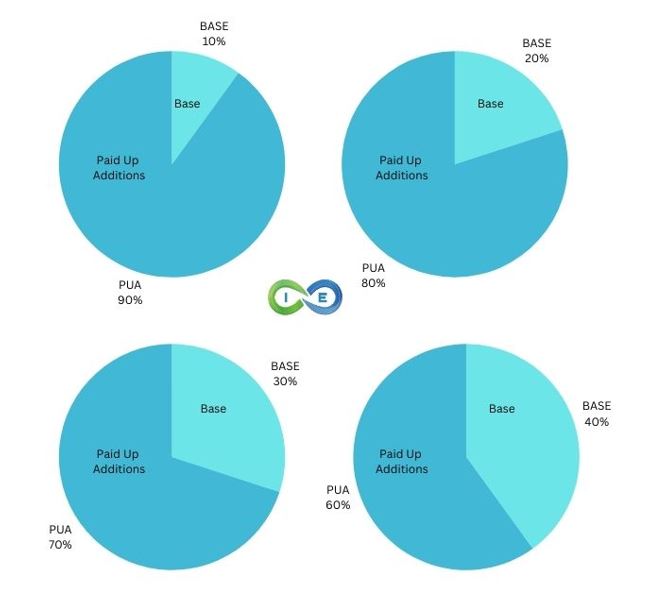

There are different ways to design and structure a whole life policy. Based on your individual needs, a policy may be designed in several different ways. The most popular designs blend base premiums and paid-up additions with these ratios:

| PUA/Base Ratio | Ideal For | Cash Value Performance |

|---|---|---|

| 60/40 | Balanced approach | Good |

| 70/30 | Growing cash value | Better |

| 80/20 | Maximizing early value | Excellent |

| 90/10 | Aggressive banking strategy | Superior |

The most effective policy designs often incorporate a term insurance rider in the first few years to keep the policy from becoming a Modified Endowment Contract (MEC) while maximizing PUA contributions.

Does that mean these are the ideal blends for your whole life policy? Of course not. The key is speaking to one of our Pro Client Guides who can help design the best high cash value whole life insurance policy based on your specific financial situation and goals.

Avoid the MEC

It’s important to note that you can only put so much money into your policy. An over-funded policy transforms into a modified endowment contract (MEC). If your policy “MECs,” you will lose some of the tax advantages of permanent life insurance.

The good news is you can avoid “MEC’ing” your policy by paying attention to correspondence from your insurance provider. Your insurer will provide ample time to remedy the situation and prevent your policy from changing into a MEC.

Paid-Up Additions Dividend Option

Not to be confused with the paid-up additions rider is the paid-up additions dividend option. Whereas the rider must be added to the whole life policy, the dividend option to purchase paid-up additions is a separate feature.

Life insurance dividends allow you to choose different options, such as:

- Taking the cash out (taxable)

- Reducing premium payments

- Accruing at interest (taxable)

- Buying additional paid-up life insurance (tax-advantaged)

We strongly recommend choosing the dividend option to purchase paid-up additions if your goal is to maximize cash value growth.

When both paid-up additions options—the dividend paid-up additions option and the separate paid-up additions rider—are used together, you create the optimal environment for maximum cash value accumulation and compound interest growth.

Exclusive to Whole Life Insurance

Other types of life insurance coverage, such as term life insurance and universal life insurance, do not offer paid-up additions. Only participating whole life policies from mutual insurance companies provide this powerful feature.

Having said that, other types of coverage, such as IUL insurance policies, have their own methods for building cash value.

That’s why it’s important to compare whole life vs. universal life to ensure you’re getting the best policy for your specific needs, goals, and objectives.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

Potential Drawbacks to PUAs

Fees

Paid-up additions can be defined as additional insurance that is paid in full at the time of purchase, minus a deducted amount the insurance company charges as a load fee.

Load fees vary by insurance company and can range from 4% to 9%, with certain unfavorable insurers reserving the right to raise fees up to 20%.

Example: If you have a $100,000 life insurance policy and purchase an additional $30,000 worth of insurance by paying a lump sum of $10,000, the lump sum includes all fees and expenses required to cover the additional $30,000 death benefit.

The policyholder is not required to pay anything beyond the lump sum because the coverage has been paid in full, or “paid up.”

Contribution Limits

Most policyholders may still be paying premiums on the original policy, but they may suddenly need to add coverage (perhaps after having another child and wanting to increase the death benefit).

The paid-up addition rider allows you to add coverage to an existing policy without proving insurability, which means no health questions or medical testing is required.

For this reason (no evidence of insurability required), life insurance companies protect themselves with caps that limit the amount of paid-up additions a policyholder can buy at any particular time.

Insurance companies implement these caps to prevent policy owners with declining health from massively increasing their death benefit through paid-up additions.

PUAs for Infinite Banking

If you’re familiar with the infinite banking concept®, you know that paid-up additions are an essential ingredient in a properly structured banking policy.

By purchasing additional paid-up insurance, you accelerate cash value growth. Your cash value directly affects your ability to utilize the policy for banking strategies.

As your cash value grows, you use your cash value life insurance as an asset to purchase other assets. Then you would use the cash flow from those additional assets to repay your policy loan, with interest.

Key Benefits of Paid-Up Additions for Infinite Banking:

- Faster cash value growth – Accelerates your banking capabilities

- Tax-advantaged environment – Grow your money without tax penalties

- Compounding effect – Dividends purchase more insurance which earns more dividends

- No medical underwriting – Add coverage without health exams

That is why whole life insurance is a great vehicle for a real estate wealth-building strategy.

The paid-up additions rider allows you to put more money into your policy than you borrowed out. This provides a tax-favored environment for your money, which also offers creditor protection depending on your state of residence.

Purchase Paid Up Additions Rider (PUAR) at Policy Outset

It’s important to note that you will likely want to add the rider at the same time you purchase the original life insurance policy.

Some companies may allow you to add the rider at a later time, but not all will. And even if they will, there will likely be the hurdle of medical underwriting to go through.

And one huge benefit of paid up additions is you can buy paid up additional insurance without having to go through medical underwriting.

In addition, keep in mind that not all riders are as flexible as others. Some paid up addition riders will allow you to add quite a lot, or very little, each year.

While others will require that you maintain a certain level of contribution each year in order to keep from losing the rider altogether.

Just make sure you are aware of the various rider options for adding coverage down the road.

Ready to Maximize Your Whole Life Policy with Paid-Up Additions?

Discover how a properly structured PUA strategy can accelerate your cash value growth by up to 70% and transform your policy into a powerful wealth-building tool.

Schedule your complimentary strategy session with one of our Pro Client Guides who specializes in optimizing PUA riders for maximum cash value.

SCHEDULE YOUR FREE PUA STRATEGY SESSION

We’ll analyze your specific situation and show you exactly how to implement the power of paid-up additions for your financial goals.

Frequently Asked Questions About Paid-Up Additions

What’s the difference between the PUA rider and the PUA dividend option?

The PUA rider is an optional feature that allows you to make additional premium payments to purchase paid-up insurance. The PUA dividend option is a way to use your annual dividends to purchase paid-up additions instead of taking them as cash. Using both together creates maximum cash value growth.

How much can I contribute to paid-up additions each year?

Contribution limits vary by company and policy design. Typical maximum PUA contributions range from 5-10 times your base premium, though some insurers have specific caps. Your goal should be to contribute as much as possible without triggering MEC status.

Can I skip PUA payments if needed?

Yes, unlike your base premium, PUA payments are typically optional. If you design your policy with an 80/20 PUA/base ratio, you only need to pay the 20% base premium to keep the policy in force. However, some companies may have minimum PUA payment requirements to maintain the rider.

What are the typical load fees on PUAs?

Typical load fees range from 4%-9% on PUA premiums, with some insurers reserving the right to charge up to 20%. These fees are deducted from your PUA payment before purchasing additional insurance.

Can I add a PUA rider to an existing policy?

Most insurance companies require adding the PUA rider when the policy is first issued. Some may allow adding it later, but this typically requires new medical underwriting. One of the main benefits of the PUA rider is the ability to add coverage without proving insurability, which is why it’s best added at policy inception.

What’s the best PUA/base ratio for infinite banking?

The most aggressive infinite banking practitioners often use 80/20 or even 90/10 PUA/base ratios to maximize early cash value. However, the optimal ratio depends on your specific situation, including your age, health, income, and financial goals. Our Pro Client Guides can help determine the best design for your banking strategy.

Are paid-up additions available with all life insurance companies?

No, paid-up additions are only available with participating whole life insurance policies offered by mutual insurance companies. Stock insurance companies and companies that offer only term or universal life insurance typically don’t offer PUAs.

How quickly will I see results from adding PUAs to my policy?

PUAs begin increasing your cash value immediately. Unlike the base policy, which may take years to build significant cash value, PUAs create immediate cash value (minus the load fee). This is why they’re so effective for accelerating the early growth phase of a whole life policy.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

16 comments

John C

On average, dollar for dollar, how much additional life insurance does each dollar of PUA buy? Or is there a specific formula?

Steven Gibbs

Hi John, thanks for reaching out and that’s an interesting question that may be tricky to answer because PUA is for adding cash to a policy rather than specifically securing addition death benefit. Also, how much death benefit it procures may vary based upon the company that is recommended for your specific situation. I recommend that you connect with Barry Brooksby by requesting 1-1 consultation at barry@insuranceandestates.com.

Best, Steve Gibbs for I&E

Steven Gibbs is a licensed insurance agent, and the following agent

license numbers of Steven Gibbs are provided as required by state law:

Resident License; AZ agent #17508301,

Non-resident Licenses: TX agent #2273189, CA agent #0K10610,

LA agent #769583, MA agent #2049963, MN agent #40563357,

UT agent #655544.

Brenda

Is there an age requirement for any of these insurances to pay into.

Are there any insurance companies that provide coverage for 70 year old with no known medical history.

SJG

Hello Brenda, yes depending upon your health there are options for a 70 year old to get started. You can request a call from our expert Denise Boisvert by emailing her at denise@insuranceandestates.com.

Best, Steve Gibbs for I&E

Thomas Swenson

Re grammar: In at least two places, replace “then” with “than”

Insurance&Estates

Hello Thomas, I appreciate your editing feedback; however, to me, your comment is less constructive than it could be because, in a quick review, I’m not seeing where those changes are warranted. If you’d like to offer something with more detail, such as some specific corrections, I’ll look more closely at this. Interestingly, 2 of our partners are attorneys and with extensive writing backgrounds. Still, we welcome all constructive feedback and the opportunity to improve our content.

Best, Steve Gibbs, Esq., for I&E

DJ

Great content Steve, thanks!

Maybe this “then” should be “than”?

The paid up additions rider allows you to put more money into your policy then you borrowed out. This provides a great tax favored environment for your money, which also offers creditor protection depending on your state of residence.

Insurance&Estates

Thank you DJ, we appreciate all corrections and clarifications and it looks like you’re correct in this case.

Best, Steve Gibbs for I&E.

Joel

I have questions regarding different riders

Insurance&Estates

Hello Joel, I best way to get a clear idea of how to proceed is to connect with an expert. I encourage you to reach out to Barry at barry@insuranceandestates.com to schedule a call.

Best, Steve Gibbs for I&E

ELIAS NDOU

I HAVE PAID UP POLICY IN METROPOLITAN .THEN I WANT TO WITHDRAW?CAN I WITHDRAW.?

Insurance&Estates

Hello Elias, it is tough to comment on someone’s policy without looking at it directly. Feel free to reach out to Jason Herring at jason@insuranceandestates.com for personal assistance.

Best,

I&E

Steve Risk

Learning a lot, thanks.

Grammar police: in paragraph “Exclusive to whole life insurance”, there should be their. 🙂

Insurance&Estates

Thank you.