Table of Contents

- Introduction

- Average Consumer Debt

- How to Borrow from Life Insurance to Pay Off Debt

- How Debt and Interest Work For or Against You

- You Can Beat the System By Becoming the System

- Creating Money Momentum in the Right Direction

- Additional Whole Life Insurance Benefits

- Properly Designing a Life Policy

- How to Fund Your Infinite Banking Policy

- Is Borrowing from Life Insurance Right for You?

Why You Should Use Life Insurance to Pay Off Debt

By converting payments into investments within a high cash value life insurance policy, individuals can erase bad debt and create an environment of true compound interest growth. Using life insurance to pay off debt while you are still alive challenges conventional financial wisdom. It opens up a pathway to financial freedom, making every dollar work in two capacities: diminishing debt and enhancing personal wealth simultaneously.

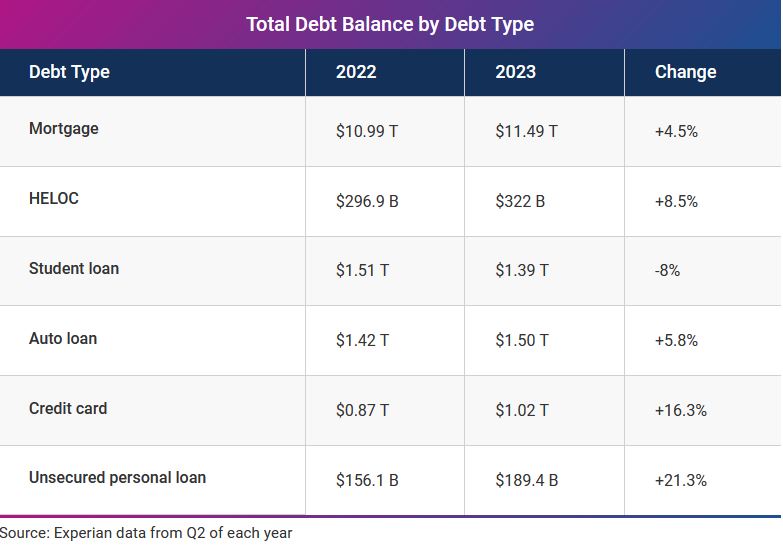

Average Consumer Debt

According to Experian, the average amount of total consumer household debt in the U.S. in 2023 is $103,358. This equates, on average, to Americans making debt payments that are nearly 10% of disposable income. This debt can comprise home mortgages, student loans, and credit card debt.

Recent data from 2025 shows this trend worsening, with credit card defaults reaching their highest level in 14 years. A concerning development is that nearly 100 million Americans are now struggling with medical debt, adding another layer of financial strain to already burdened households.

Recapturing Your Dollars

Regardless of how much debt you owe, though – or the type of debt you carry – any time you make a payment to a bank or other lender, that money is lost to you forever. However, using a properly structured whole life insurance policy focused on maximizing cash value growth can allow you to become your own banker and borrow money for making purchases and paying off existing debts, while at the same time continuing to significantly grow your wealth with true compound interest growth – and you can even do so using the very same dollars.

How to Borrow from Life Insurance to Pay Off Debt

Our resident expert on getting out of debt using life insurance, Denise Boisvert, provides a real life example of a client who used life insurance to pay off $30,000 of credit card debt.

By following these steps, individuals can effectively use the Infinite Banking Concept to manage and eliminate high-interest credit card debt, transitioning from financial strain to a position of financial control and growth.

Real-World Success: How Lenny Eliminated $30,000 in Credit Card Debt

The strategy to eliminate $30,000 of credit card debt using life insurance, as explained by Denise Boisvert, can be broken down into the following steps:

- Assessment of Current Debt: Evaluate the total amount owed across all credit cards. For example, Lenny had a total debt of $30,000 spread across three cards.

- Minimum Payments Adjustment: Identify each credit card’s minimum required monthly payments. Instead of paying more than these minimums, reallocate the excess payments towards the life insurance strategy.

- Infinite Banking Introduction: Redirect the funds above the minimum payments into a permanent life insurance policy structured for high cash value growth. Recapturing your debt in your policy creates a dual-purpose cash reserve that grows over time and can be borrowed against at lower interest rates.

- Debt Repayment Plan: Utilize the cash value from the life insurance policy to start paying off the credit cards, beginning with the smallest debts first to gain momentum—a technique similar to the debt snowball method.

- Year 1: Focus on the smallest credit card debt. For instance, Lenny aimed to clear his Home Depot card with a $5,000 balance by redirecting $600 monthly into the policy (the sum of the minimum payments and the redirected excess payments).

- Year 2 and Onwards: As you clear each debt, the previously allocated funds for those debts are added to the life insurance contributions, increasing the policy’s cash value more rapidly and enabling larger debt repayments in subsequent years.

- Continuous Monitoring and Adjustment: Monitor the policy’s cash value growth and adjust contributions as necessary, considering potential extra income sources like tax returns, bonuses, or gifts to expedite debt repayment.

- Policy Loan Repayment: After settling all credit card debts, the focus shifts to repaying the policy loans. Repayment is flexible and tailored to individual preferences and financial situations.

- Long-Term Financial Strategy: Even after paying debts, continue contributing to the life insurance policy. It serves as a debt repayment mechanism and a personal banking system for future financial needs, offering low-interest loans and growing tax-free.

- Legacy and Security: Besides debt management and financial flexibility, the policy also provides a death benefit, securing a legacy for the policyholder’s family in case of unforeseen events.

Recent Reddit Success Story: Turning $7,053.49 Credit Card Debt into Wealth

In a recent discussion on Reddit, a user shared their experience using the cash value of a whole life insurance policy to eliminate $7,053.49 in credit card debt. What made this story particularly compelling was how they continued funding their policy after debt elimination, effectively converting what was once a financial burden into a growing asset. This real-world example demonstrates how the strategy can work effectively when implemented with proper guidance and understanding of policy rules and tax implications.

How Debt and Interest Can Work For You or Against You

There are two primary types of debt. There is bad debt (destructive debt) and good debt (productive debt). Bad debt is going to be the kind of debt that takes money out of your pocket, also known as a liability. Good debt is the type of debt that puts money into your pocket, also known as an asset. The 🔑key is to eradicate bad debt and accumulate good debt. However, this is easier said than done.

Bad debt (and over-leveraged good debt) can be hazardous to your financial health – both in the short and long term. What many people don’t realize is that just like money can grow and compound over time, losses can also do the same. Therefore, what you ultimately lose by paying interest to someone else can be staggering.

Plus, throughout the years, the compound interest that YOU won’t earn on that money could be significant. In fact, compound interest can be powerfully negative when it is working against you.

For more on this topic of how much potential money you will make in your lifetime versus how much you will actually keep, please see our article on Your Maximum Lifetime Potential

Because people only earn a finite amount of money during their lifetime, sending a share of it to banks and other lenders in the form of interest instead of saving it for yourself is a primary reason why most people fall short of what they need for retirement and other financial goals.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

Opportunity Cost

Your opportunity cost is derived at by taking the purchase price of the item plus any sales tax, (You might also consider how much those dollars cost you in the first place before the government took its share), then you compare the cost to how much that amount of money would have made for you given time to grow in a compound interest account.

If you do decide to move forward with making a purchase, the next question to ask yourself is how you will pay for it. For instance, if you pay cash outright, you won’t have to worry about obtaining a loan and making payments. However, that cash will also be gone and unavailable for making any future purchases or investments (another example of opportunity cost). Nelson Nash, author of Becoming Your Own Banker, reminds us that we finance everything we buy, whether we get a loan or pay cash. Both have a “cost”.

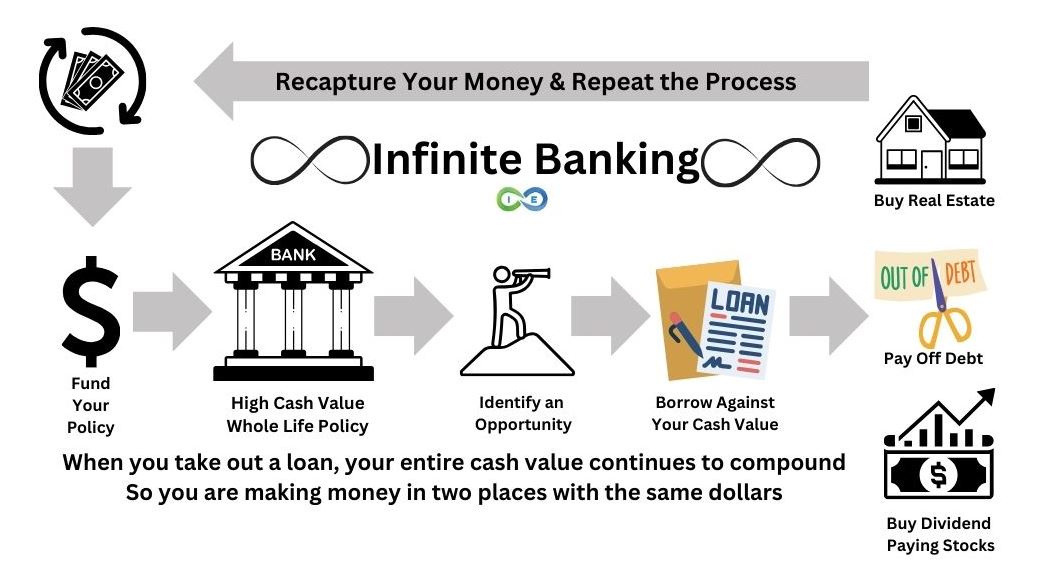

Infinite Banking

But there is a way that you can eliminate your debt, make future purchases, and allow the interest that you would otherwise have paid to a bank or lender to work for you at the very same time.

The Infinite Banking Concept, or IBC, allows you to become your own bank – and using this strategy can make the difference between your purchases being expenses or actually being investments.

So, ask yourself if debt is working for you or against you – and if the answer is the latter, using the Infinite Banking System could turn that around and not only allow you to pay your liabilities off faster, but also allow you to grow wealth safely, consistently, and with a number of nice built in guarantees.

You Can Beat the System By Becoming the System

Most people see life insurance as a way to pay off debt when you die. Typically, life insurance beneficiaries can receive the policy’s death benefit income tax free and use the funds for replacing lost income or paying off a mortgage and/or other debts of the insured.

You may also find advice out there that explains in basic fashion that you can borrow from your life insurance to pay off debt, using the cash value in a universal life insurance policy or a whole life insurance policy.

But there is another way that involves using permanent life insurance structured for high cash value growth to pay off your debt now, as well as to benefit from purchases you make in the future, while growing your savings in a tax advantaged manner, even if you don’t currently have a permanent life insurance policy.

A Financial advisor will often recommend that people pay down debt by:

- Working more (to earn more income)

- Spending less

- Refinancing their home (which essentially entails trading equity for “bad,” or unsecured debt)

- Consolidating all debts into one single larger balance

While these might be good options depending on your situation, there is a better way.

Why Traditional Debt Solutions Often Fail

According to 2025 financial analysis, many households attempt debt consolidation or refinancing without addressing the underlying spending habits that created the debt initially. A study from Northwestern Mutual found that Americans who successfully eliminated debt and maintained financial freedom had one thing in common: they established systems that prevented debt accumulation while simultaneously building wealth. This holistic approach is precisely what properly structured whole life insurance provides when used as part of a comprehensive debt elimination strategy.

💡 Using life insurance to pay off debt involves two coordinated strategies:

- Debt Snowball or Debt Avalanche

- Infinite Banking Concept (IBC)

Debt Snowball/Avalanche

Many debt reduction or elimination programs recommend the use of debt snowballing – and this can work when using the Infinite Banking Concept to pay off balances, too. Debt snowballing occurs when you pay off the debt with the smallest balance first, and then one by one, work your way up to paying off your larger debts.

This differs from debt stacking, aka debt avalanche, where you start with the debt that has the highest interest rate first and then work your way towards the one with the lowest rate.

Which one is best? It depends. Some people prefer one of the other based on their financial makeup. You can also run the numbers on each and see which one gives you the best outcome.

But if you are only using the debt snowballing or debt avalanche method you are missing a vital piece of the equation. By adding in this final piece of this get out of debt strategy, rather than being back to ground zero where you have no debt but also no money, you will instead pay off all your debt and have the all that money you used to pay off that debt sitting in your infinite banking policy.

The Infinite Banking Concept

The Infinite Banking Concept

The Infinite Banking Concept, (AKA “IBC”), has taken on a lot of other names, such as cash flow banking, be your own bank, family banking concept, bank on yourself, perpetual wealth strategy, becoming your own bank, circle of wealth, your family bank, and wealth maximization account.

Infinite banking is a strategy of using properly structured high cash value whole life insurance as your own personal “banking” system, rather than a traditional bank. The primary benefit? It provides a tax-favored vehicle with contractually guaranteed growth for your finances—unlike typical savings or money market accounts where your gains are taxed and interest rates fluctuate.

Here’s the key feature that makes IBC powerful: You can use your policy’s cash value as collateral to take out loans while your entire cash value continues earning compounded interest returns. This creates several advantages:

- When you borrow against your policy to purchase cash-flowing assets (like real estate or business investments), your original money keeps growing inside your policy.

- This unique structure means your money works for you in two places at once — earning compound interest in your policy while simultaneously generating returns through your investments.

- You can then use the cash flow from your investments to repay your policy loan (“recapitalizing your bank”) and repeat the process over and over, creating an expanding cycle of wealth.

Infinite Banking works equally well for eliminating credit card debt. Instead of using your paycheck to directly pay the credit card company, you:

- Fund your infinite banking policy with your income

- Take a policy loan to pay down your credit card debt

- Continue earning compound interest on your full cash value while eliminating the debt

- Use your death benefit as the ultimate collateral for the loan

This approach means the same dollars that eliminate your debt also build wealth through your policy—something impossible with traditional debt repayment methods.

Creating Money Momentum in the Right Direction

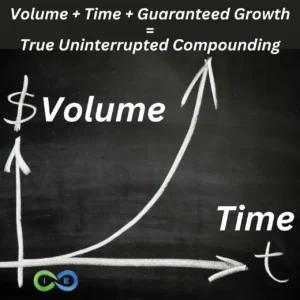

Velocity of Money

The Velocity of Money is a term that every banker knows and most of the masses have never heard. This concepts refers to the banker’s understanding that money cannot stay stagnant AND the faster money moves, the more profits are made.

When you incorporate a properly structured whole life insurance policy you can use the same dollars that you otherwise would have used for your debt payoff, but by redirecting them, not only will your debt be eliminated, but your money will also continue to grow and compound.

The right permanent life insurance policy will allow you to “recycle” your money by borrowing money to spend, then putting money back in the policy’s cash value to “repay” it, and then spending the same dollars again. In fact, by repeating this process over and over again, an Infinite Banking program can gain a tremendous amount of momentum.

The cash value grows faster when using the Infinite Banking strategy because you are paying the interest that you were previously sending to other lenders to your own “bank” instead. Recapturing this interest is huge, because not only does the interest end up in your bank instead of a “traditional” lender’s, but also because that interest goes on to generate more of its own interest through compounding.

And as you pay back your loan to your banking policy, the loan is decreasing, which means the interest you are paying on that loan is decreasing. So you pay down your debt, then you pay down your life insurance loan, and in the end you are out of debt and have amassed cash value in your policy that can now be used to purchase cash flowing assets, or simply earning interest plus dividends in a safe environment, unconnected to market volatility.

Paid-Up Additions

An infinite banking policy is enhanced by adding a paid up additions (PUA) rider to the policy. This rider allows equity to build in the policy’s cash value almost immediately. With the PUA rider, additional dollars are placed into the policy to increase the cash value’s performance.

In this case, each dollar of premium that is allocated to the paid up additions rider will create a small paid-up life insurance policy that has its own cash value created right away. Essentially, you are only contributing the required minimum amount of premium to fund the insurance portion of the base policy and placing the rest of the money into the cash value to grow and compound.

There are different ways to structure an infinite banking policy. For those who want access to as much cash as possible in the shortest time, a 90/10 policy design might be best. However, long term that might not be the most efficient policy design, so it is important to work with your agent on what policy design will be best for you based on your specific goals.

Dividends

Dividend paying whole life policies that are purchased through mutual insurance companies are also eligible to receive dividends (although life insurance dividends are not guaranteed). These are received tax free and when added to the cash value, they can further add to the compound growth – which in turn can increase your borrowing power. Many mutual insurance companies have been paying life insurance dividends consistently for decades – and in some cases, for more than 100 years.

Unlike borrowing from a traditional bank, there is no credit check required when you borrow from life insurance to pay off debt. Nor is there an endless stack of application paperwork required. Rather, you simply contact the insurance company, tell them how much you need to borrow, and you will typically have the funds within just days.

Case Study: The $40,000 Credit Card Transformation

In a recent financial planning discussion, a couple considered cashing out a $30,000 whole life policy to reduce their $40,000 credit card debt. After consulting with an expert in the Infinite Banking strategy, they instead kept their policy intact, structured an additional policy with a focus on PUA riders, and implemented a modified debt snowball approach. Within 38 months, they had eliminated their credit card debt while simultaneously growing their policy’s cash value to over $45,000. This strategic approach not only eliminated their debt but converted what would have been “lost” interest payments into a growing asset they now control.

Additional Whole Life Insurance

In addition to using life insurance to pay off debt, there are many other whole life insurance benefits that you could take advantage of, too, such as:

✅Tax advantaged growth. The funds that are in the cash value of a life insurance policy grow tax deferred. This means that there is no tax due on the gains unless or until they are withdrawn. But when you borrow funds from the cash value instead, they are received tax free. So, this is a win-win.

✅Guaranteed return. Your policy’s cash value will receive a guaranteed return that is set by the insurance company. And, even though this rate may not be as high as a “potential” gain in the stock market, there are also no losses.

✅Protection of principal and previous gains. Because your cash value is protected in any type of stock market or economic environment, there are no losses to make up for – so your money can continue to grow and compound over time.

✅Death benefit. Because your IBC plan is a life insurance policy, the death benefit coverage can be used as a financial “safety net” for your loved ones and legacy intentions (such as making a donation to a favorite charity). If you die prematurely, your death benefit goes to your beneficiary tax free, which they can then use to pay off any existing debt you owed.

✅Penalty-free access to funds for potential healthcare needs. Many life insurance policies have an accelerated death benefit rider that will allow you to access a portion of the death benefit proceeds penalty free if the insured is diagnosed with a chronic, critical, or terminal illness or if they require long-term care services. An accelerated death benefit rider can be extremely beneficial if certain medical or healthcare services are not covered under health or long-term care insurance.

✅Protection from creditors. In most states, life insurance cash value is protected from creditors. This can include bankruptcy and lawsuits. There are many states that offer protection for your entire cash value and death benefit.

✅Tax free retirement income supplement. By taking advantage of the policy loan feature, you can access funds tax free to supplement your retirement income – regardless of what the then-current tax rates are. In addition, this tax free income won’t count against your Social Security retirement benefits when determining whether or not they will be taxed.

✅Dollars Working Double Time. In addition, one of the most significant perks of using a properly structured whole life insurance infinite banking policy is the fact that you can borrow against it while at the same time still generating a return on the full amount of your cash value. This is because you are not technically borrowing money from the cash value itself, but rather from the insurance company, and simply using the cash value as collateral, which will be taken out of your death benefit if you never pay back the loan.

So for example, if there is $120,000 in your policy’s cash value, and you borrow $50,000, your policy’s cash value return will continue to be generated on the full $120,000. This is another example of benefiting from the same dollars twice.

Wash Loan

Taking it a step further, it may even be possible to receive the borrowed funds cost free as well as tax free. This is because, even though the insurance company typically charges interest on policy loans, this interest could be offset by the return that the money in your cash value is continuing to earn.

For instance, if the insurer charges 5% interest on the policy loan, and the funds that are in your cash value are also generating a compounding return of 5%, then you will have secured a no cost distribution. And, if the return on the cash value is higher – which it could be, due to added growth factors like dividends – it is possible for you to generate a profit. This is a concept known as arbitrage, which entails earning an interest rate that is higher than the loan rate on the funds that you have borrowed.

And as you pay down your life insurance loan, the actual interest that you pay will be less and less as the principal on the loan goes down. So as you are making 5% compounded in your policy and paying down a 5% interest loan to the insurance company, you are still coming out ahead on your money as the principal amount you owe on the loan decreases.

Loan Payback on Your Terms

One last thing about life insurance loans is that you choose how much and when to pay back the loan. And you can also choose to never pay back the loan if that makes the most sense for your situation. If you die with an outstanding loan, the life insurance company will take the loaned portion out of your death benefit, with the remaining death benefit going to your beneficiary.

Properly Designing a Life Policy to Maximize Growth, Cash Flow, and Purchasing Power

Term life insurance does not build cash value. And not all permanent life insurance policies are right for use with the Infinite Banking Concept. For example, guaranteed universal life insurance does not grow cash value at a high enough rate.

Rather, this strategy requires a specifically designed policy that focuses on minimizing the death benefit and maximizing the cash value. Some people opt for an IUL for IBC, but that comes with its own potential problems.

Further, because everyone’s goals and needs are different, there isn’t one single policy that will work for all investors and retirees across the board. Therefore, it is necessary to custom design a high cash value whole life policy that works for you, which will largely entail structuring the base premium versus the paid-up additions to match your goals.

As an example, you could build a policy where the base premium (i.e., the premium amount that is necessary to keep the policy in force) is your minimum payment and your paid up additions are your “flexible” premiums. That way, you can comfortably make your base premiums, but yet also have the ability to place more cash into your policy to enhance the growth of the cash value.

How to Fund Your Infinite Banking Policy

If you’re already struggling with debt or all of your income is already being spent on other obligations, how can you fund an infinite banking policy?

There are some ways that you could find the funds you need, such as:

✅Transferring money out of low-yielding financial vehicles. While you may want to keep some of your money in “safe” places like money markets or CDs, these accounts don’t typically generate as high of a return as the cash value in a permanent life insurance policy designed for high cash value. Plus, you will eventually have to pay taxes on any gains in traditional savings vehicles. So, you could consider moving at least some of your funds.

✅Redirecting some retirement plan contributions. If you participate in an employer-sponsored retirement plan, such as a 401(k), you could redirect at least some of these contributions into your personal banking system. In this case, your money isn’t going away. It is just going into an alternate financial vehicle.

✅Increasing your income. Today, there are many ways to generate extra income on your own schedule, rather than having to get another “job.” For example, freelancing, driving for ride sharing sites like Uber or Lyft, delivering food and grocery items through Door Dash or Instacart, or taking on a variety of other side gigs.

✅Making – and sticking to – a budget. Sticking to a budget can help to prevent you from making unnecessary and impulse purchases, leaving you more money for your IBC policy.

✅Reviewing your current expenses. Take a close look at what you are currently spending on bills like cable, cell phone, and incidentals such as gym memberships and subscriptions. There could be room to cut some costs here, too.

✅Paying yourself (i.e., your infinite banking policy) first. One of the best ways to ensure that you have money available for your Infinite Banking policy is to “pay yourself first.” By making your premium a priority, you can oftentimes still come up with what you need for paying your other living expenses each month.

Addressing the Mindset Shift

Recent financial psychology research highlighted in Northwestern Mutual’s 2025 financial outlook reveals that successful debt elimination requires more than just tactical strategies—it demands a fundamental shift in how individuals think about money flows. When implementing the Infinite Banking approach to debt elimination, clients report that the most profound change wasn’t just in their debt levels but in their relationship with money itself. By visualizing themselves as the banker rather than the borrower, they began making decisions from a position of empowerment rather than scarcity.

Is Borrowing from Your Life Insurance to Pay Off Debt the Right Strategy for You?

If you have debt that you would like to eliminate more quickly than originally anticipated – whether that is a mortgage balance, vehicle loan, student loan, unsecured credit card debt …or all of these – a properly structured life insurance policy could provide you with a viable solution, one that could also help you build up your wealth at the same time. And the life insurance specialists at Insurance and Estates can help.

Eliminate Debt and Build Wealth with Denise’s Expertise

Ready to break free from debt and turn your payments into wealth? Denise Boisvert, featured in our video above, has helped clients like Lenny erase $30,000 in credit card debt using whole life insurance and the Infinite Banking Concept. Schedule a session with her to discover how you can do the same.

- ✓ Get a custom debt elimination plan using a high-cash-value policy

- ✓ Learn how to pay off credit cards, mortgages, or student loans faster

- ✓ See projections for growing tax-free wealth while clearing debt

- ✓ Explore Infinite Banking to finance your business or investments

Book your free 30-minute Debt Freedom Strategy Session with Denise today to take control of your finances.

No obligation, no pressure—just expert guidance to wipe out debt and build lasting wealth.