Table of Contents

- Introduction

- Self Banking Blueprint

- IBC Webinar

- Top 10 Best IBC Companies Criteria

- Do you recommend IULs for IBC?

- Simply a Guide

- Criteria 1 – Mutual Company vs. Stock Company

- Criteria 2 – Performance History

- Criteria 3 – Stability

- Criteria 4 – Flexibility

- Criteria 5 – Overall Suitability

- A Few Notes on Direct vs. Non-Direct Recognition

- Top 10 Infinite Banking Life Insurance Companies

- Top 10 Infinite Banking Companies Comparison

- Ameritas

- Foresters

- Guardian

- Lafayette Life

- MassMutual

- Mutual Trust Life

- National Life Group

- OneAmerica

- Penn Mutual

- Security Mutual Life

- Whose Missing?

- Conclusion

Introduction

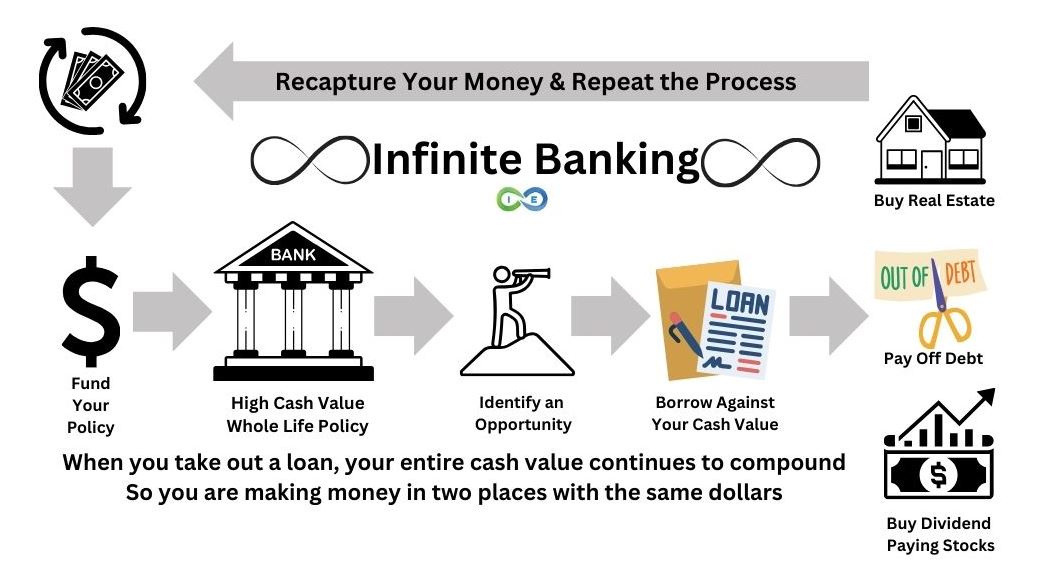

Imagine having a financial tool that acts as your personal bank, grows tax-free, and builds generational wealth. That’s the power of the Infinite Banking Concept® (IBC), also known as Becoming Your Own Banker©, Bank On Yourself©, or Cash Flow Banking. But here’s the catch: not all insurance companies are created equal when it comes to IBC.

At Insurance & Estates, we frequently hear from people who are sold on the IBC idea but stumped on how to get started. The roadblock? Finding the right insurance expert and, crucially, selecting the best life insurance company for their needs.

Here’s what you need to know: The foundation of IBC is a dividend-paying whole life insurance policy from a top-tier mutual insurance company. These policies are more than life insurance – they’re powerful financial tools that create a “personal banking system.” By using your policy’s cash value as collateral, you can fund purchases and investments that you’d typically finance through a traditional bank.

The magic happens when you cut out the middleman (goodbye, banks!) and funnel all your financial transactions through your IBC policy. Instead of paying interest to banks, you’re paying it to yourself, creating a powerful cycle of wealth accumulation. It’s like having a turbo-charged savings account that also protects your family’s financial future.

But if you want IBC success, you don’t want just any whole life policy. That’s why choosing the right company is crucial. In this guide, we’ll walk you through the top contenders in the infinite banking arena, helping you make an informed decision to kickstart your journey to financial freedom. We want to provide you with 10 solid and highly rated life insurance companies but it is important to know that the best life insurance companies for infinite banking use riders that are ideal for IBC use and also have a proven track record of long-term dividend success and stability.

Ready to discover which companies lead the pack in the infinite banking world? Let’s dive in.

Key Point: Infinite Banking uses a dividend-paying whole life policy to create a personal banking system, allowing you to finance purchases and investments while paying interest to yourself, not banks.

Self Banking Blueprint

Download your free copy of our eBook, The Self Banking Blueprint. This is our gift to you. Provide a valid email so you can get on our email list and receive top tier educational content on all things infinite banking, whole life, wealth building and estate planning.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

IBC Webinar

If you are new to Infinite Banking, we recommend you check out the following webinar to help you get better acquainted with IBC and learn why so many people are becoming their own banker. When you are ready, you can schedule a call with Infinite Banking Practitioner, Barry Brooksby, for personalized illustrations and to look at your own numbers.

Top 10 Best IBC Companies Criteria

Before we jump right into the companies themselves, let’s look at our reasoning behind the top 10 list. We have certain criteria for Infinite Banking and we want to share it with you.

Keep in mind that ultimately the success or failure of a given methodology will come down to execution. You can have the perfect product, but if you fail to implement it, you won’t see the results you anticipated. In other words, the best microphone in the world can’t make you into a phenomenal singer. It takes diligent, disciplined practice to get good at something.

Selecting the best infinite banking company is vital, but a poorly designed policy can undermine even the strongest provider, leading to suboptimal performance. Design and Company are equally critical is choosing a policy tailored to your unique financial goals. This requires partnering with an agent skilled in infinite banking nuances, who can expertly balance paid-up additions, base premiums, and term riders. That’s why working with experienced professionals, like the team at I&E, is essential for maximizing your policy’s potential.

Do you recommend IULs for IBC?

Whether or not you should use indexed universal life insurance for infinite banking is a great question and it is difficult to answer because the answer ultimately depends on the client. Most people looking into infinite banking have read Nash’s book and prefer whole life for IBC.

But there are people who are not “purists” when it comes to IBC and they want to see what the best company will be, whether it is whole life or indexed universal life.

Often we will still recommend whole life for the unique benefits it offers vs IULs, such as fixed costs and guaranteed growth. However, it is certainly possible that the long term growth of indexed universal life could be superior to whole life.

In the end, it really comes down to each individual’s preference. And the good news is many of the companies listed here in our top 10 also offer excellent indexed universal life insurance policies.

Simply a Guide

And finally, we want to say that this list is to be used only as a guide, and ideally only as a starting point in conversing with a qualified representative that is familiar with these companies and the concept.

Life insurance requires underwriting, which means that not all people are treated the same. For example, if you’re a smoker or have a history of cancer in your family, you will have less options than those with ideal health. So even though we provide this list as our top 10 companies for Infinite Banking, we know that your top 10 companies may differ because of your unique situation.

Needless to say, our top 10 companies all provide high cash value life insurance, and they also provide policies that are meant to maximize cash value growth and accumulation.

Ultimately we hope this guide provides a glimpse of what to look for when shopping for an Infinite Banking policy.

Key Point: This top 10 list is a starting point. Your unique health and financial situation may affect which companies are best for you, so consult a qualified IBC professional.

Criteria 1 – Mutual Company vs. Stock Company

According to Kiplinger’s Personal Finance Magazine, when you’re searching for cash value life insurance, a mutual company is your best bet.

The reason a mutual life insurance company is ideal for you, as opposed to a stock company, is that you become “members” of the mutual company. As members, you “participate” in the insurance company’s investment gains.

As participants, you, the policyholders in a mutual company, receive “dividends” on the cash value of your policies. These dividends are considered a return of premium, not income, so they are tax-free for you.

Just to clarify, the dividend is considered a return of overpaid premium (this represents the profit the company made throughout the year, and it goes back to you, the policyholders). In a stock company, much of the profits would go to the shareholders, not to you, the policyholders.

Furthermore, mutual life insurance companies tend to focus on long-term growth and stability. In contrast, stock companies must appease both long-term policyholders like yourselves and meet the short-term goals of stockholders, creating somewhat of a conflict of interest.

Key Point: Mutual companies are ideal for IBC because policyholders receive tax-free dividends and benefit from the company’s focus on long-term growth.

Criteria 2 – Performance History

(cash value accumulation, loan rates, dividend payments)

Whole life insurance cash value growth is crucial for you in the Infinite Banking Concept because this cash value serves as the fund for all your banking needs. Without a significant cash pool, your banking options become severely limited.

Participating Life Insurance

Remember, dividends are not guaranteed, a point often highlighted by critics of participating whole life insurance. The top 10 Infinite Banking life insurance companies you consider should have a consistent record of paying dividends. This consistency is crucial for a reliable expectation of enhanced cash value growth.

Though dividends aren’t guaranteed, the participating whole life insurance companies you might choose for Infinite Banking have historically shown a strong capability to continue paying dividends through various economic conditions, including the Great Depression and the Great Recession.

Loan Rates

Life insurance loan rates are also vital in your Infinite Banking strategy. In designing your Infinite Banking whole life insurance policy, you must carefully consider the cost of loans against the ongoing dividend rates. The aim here is often to maintain a favorable “arbitrage”.

Your focus should be on selecting top whole life insurance companies known for building cash value and ensuring ongoing growth, regardless of any loans against the life insurance. This approach allows for leverage and multiple levels of wealth building. Therefore, a company’s history with loan interest rates becomes significantly important for you.

Key Point: Choose companies with a strong history of dividend payments and favorable loan rates to maximize cash value growth and wealth-building potential.

Criteria 3 – Stability

(company history, reliability)

Your top choices for Infinite Banking life insurance companies should have a proven history of stability, as this is crucial for establishing your own banking system and meeting your financial needs.

Therefore, your focus should be on well-established mutual whole life insurance companies that demonstrate robust financial health and possess high credit ratings.

We used A.M. Best’s ratings as a standard for comparison among these companies. Additionally, consulting Standard & Poor’s ratings can provide you with further insights.

Criteria 4 – Flexibility

(products, design, convertibility, options for paid up additions)

Simply put, you’ll find that some companies offer more flexibility than others in terms of premium design and “paid up additions” (which means adding cash value to your policy), allowing you to structure a policy that aligns with your goals.

For our purposes, flexibility refers to both the availability of various products, flexibility in allowing for paid up additions, AND other ways of accommodating those seeking to maximize cash value accumulation.

Flexibility is critical for those that are interested in Infinite Banking because there are a variety of strategies for maximizing growth and funding your banking needs.

Some companies offer one way to bank via your policy, so the agents may tell you that it’s “perfect” for Infinite Banking. But in reality, they are forcing you to bank in a confined space – something that might be a serious hindrance down the road.

Key Point: Flexibility in premium design and paid-up additions is essential for tailoring an IBC policy to your specific financial goals.

Criteria 5 – Overall Suitability

(for strategic purposes, infinite banking, conduit wealth building)

The suitability of a given company for Infinite Banking is based on the criteria mentioned above as well as the training and education of the agents and home office.

Companies that have been given training in the infinite banking concept are easier to communicate with when you’re attempting something you haven’t done before in the infinite banking sphere.

Finally, it is also worth mentioning that our top Infinite Banking companies are all licensed to offer its whole life insurance policies in at least 40 of the 50 states.

A Few Notes on Direct vs. Non-Direct Recognition

This distinction refers to whether policy loans will negatively impact the dividend rate paid on the policy cash value. Obviously taking policy loans are a major aspect of the policy growth in the infinite banking world. It simply means that the policy will continue to perform normally. This includes the payment of dividends at FULL rates, regardless of the amount of policy loans owed.

Although non-direct recognition companies tend to hold great reverence in the Infinite Banking world as opposed to direct recognition companies, we’ve found that many direct recognition companies have a record of solid performance EVEN where Infinite Banking strategies are used, and may provide superior long term performance. In other words, don’t rule them out!

Key Point: Don’t dismiss direct recognition companies, as many still offer strong performance for Infinite Banking strategies.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

Top 10 Infinite Banking Life Insurance Companies

Please note, although we list the companies based on our rankings below, the brief review of each company that follows is in alphabetical order.

6. OneAmerica

7. Ameritas

8. Security Mutual Life

9. Mutual Trust

10. National Life Group

Top 10 Infinite Banking Companies Comparison

| Company | A.M. Best Rating | S&P Rating | Recognition Type | 2025 Dividend Rate | Paid-Up Additions Flexibility | Top Product for IBC |

|---|---|---|---|---|---|---|

| Penn Mutual | A+ (Superior) | A+ | Direct | 6.12% | Excellent | Accumulation Whole Life |

| Lafayette Life | A+ (Superior) | AA | Non-Direct | 5.75% | Excellent | Patriot Whole Life |

| Foresters | A (Excellent) | N/A | Non-Direct | 6% | Excellent | Advantage Plus II |

| MassMutual | A++ (Superior) | AA+ | Direct | 6.40% | Very Good | High Early Cash Value |

| Guardian | A++ (Superior) | AA+ | Direct | 6.1% | Very Good | 10-Pay Whole Life |

| OneAmerica | A+ (Superior) | AA- | Non-Direct | 5.85% | Excellent | Legacy/Legacy 121 with IDO Rider |

| Ameritas | A (Excellent) | A+ | Direct | 5.75% | Good | Growth Whole Life (10-Pay) |

| Security Mutual Life | A- (Excellent) | N/A | Non-Direct | 5.40% | Good | WL4U LP100 |

| Mutual Trust | A (Excellent) | A | Non-Direct | 5.50% | Very Good | Horizon with Maximum Accumulation Dividend |

| National Life Group | A (Excellent) | A+ | Non-Direct | 5.25% | Good | FlexLife |

Disclaimer: The 2025 dividend rates listed are based on the best information available to us at the time of publication. Dividend rates are not guaranteed and may vary. Please verify current rates directly with the respective insurance company before making any decisions.

Ameritas

Ameritas has been around since 1887, making the company over 134 years old. Ameritas is a financially strong company and maintains an A rating with A.M. Best. The company practices direct recognition, and has a long history of paying dividends to eligible policyholders.

Ameritas Growth Whole Life is limited pay life insurance that allows the policy to be fully funded in 10 years. You can add a flexible paid up rider to rapidly increase cash value growth.

And like many of the companies in this list, the whole life policy also has living benefits that allows you to access a portion of your policy’s death benefit for terminal, chronic or critical illness.

For more on this member of our top 10 Infinite Banking insurance companies, please stop by our Ameritas Life Insurance review.

Foresters

Foresters Financial offers one of the only participating no medical exam whole life insurance policies in the industry. You can get up to $400,000 20-Pay or Paid-Up at 100 whole life insurance without an exam.

Foresters Financial is proud of their A rating with A.M. Best and they are an innovator in the world of life insurance underwriting. With a guaranteed insurability rider option, we recommend considering this option while shopping for a company.

Foresters has a strong dividend history. The dividend interest rate has remained above 6% for the past 13 years (8.6% dividend in 2005), and was at 6.2% for 2016.

For more on this member of our top gliding insurance companies, please stop by our Foresters Financial review.

Guardian

Guardian is a top rated company (A++ superior Best, AA+ – second highest among 22 ratings by S&P), and also direct recognition, but one that is committed to the concept of treating whole life insurance as an asset.

They promote a type of Infinite Banking strategy among their agents. And even though they are a direct recognition company, it hasn’t negatively impacted policy performance in most cases.

When it comes to accumulating cash value, Guardian’s 10 pay limited pay life insurance product, when structured properly, is apparently their strongest offering (blended with paid up additions).

One word of caution, watch their career agents closely if you choose to work with them. The career agents have a tendency to prefer the less advantageous Guardian L-99 product.

It is worth pointing out that Guardian also has excellent customer service ratings. They also get extra marks for flexibility due to the variety of options for premium payment models.

For more on this member of our top 10 Infinite Banking insurance companies, please check out our Guardian Life review.

Lafayette Life

Lafayette Life is a non-direct recognition company that has captured a good segment of the infinite banking zealots. We believe this company’s popularity stems from its non-direct recognition status, sound business rating (A+ Best, AA second highest rating out of 22 by S&P) and excellent track record.

Standard & Poor’s gave the following as a reason for their rating:

- Very strong financial security characteristics

Lafayette Life has a distinct advantage over other companies in a lump sum policy, where you place an initial large lump sum payment into the policy to jump start the cash value growth. Of course, you need to have access to a large amount of cash to do this, so it is not for everyone. But if you happen to have a large amount of money sitting idle and looking for a home, then Lafayette Life might be a great fit.

For more on this member of our top 10 Infinite Banking insurance companies, please stop by our Lafayette Life review.

MassMutual

MassMutual tends to shy away from being associated with the infinite banking concept because there are people out there that try and pitch infinite banking without talking about life insurance. However, that is not the way we operate and we always make sure our clients know exactly what they are buying.

MassMutual is a juggernaut in the whole life insurance market and sits among the top choices for all kinds of reasons which include cash value accumulation and wealth building. Further, this company is continuously among the top performers in the critical category of the history of payment of dividends.

They offer an excellent model for paid up additions and their 10 pay product is tremendously effective at maximizing cash value growth.

MassMutual has won the coveted A.M. Best rating of A++ Superior, and a AA+ rating from S&P, and makes the cut as an overall suitable whole life insurance product for anything from wealth building to obtaining a permanent death benefit for family security.

Check out our MassMutual Whole Life Insurance review for more.

Mutual Trust Life

Mutual Trust Life Solutions, aka MTL Insurance Company, aka Mutual Trust Financial Group, aka “The Whole Life Company”®, was founded in 1904 as a mutual insurance company. In 2015, Mutual Trust became part of Pan American Life Insurance Group, which deals in insurance and financial services.

MTL knows IBC, having designed a proprietary dividend option geared towards the idea of maximum cash value accumulation.

The Maximum Accumulation Dividend® option works in tandem with the Flex Pay Paid-Up Additions Rider or Annual Premium Paid-Up Additional Insurance Rider, providing maximum cash value accumulation on a continual basis, while avoiding a modified endowment contract.

We at I&E believe this is a great company. However, if we had one negative to speak of it would be the lower ratings it has received in contrast to its peers. MTL has a Comdex ranking of 78, which reflects a lower overall financial rating vs the competition. As of January 2024, MTL has an A rating from A.M. Best and an A rating from Fitch.

For more on this member of our top IBC companies list, please visit our Mutual Trust Life Solutions review.

National Life Group

With an A.M. Best rating of A, an A+ for S&P and a Comdex ranking of 80, National Life Group (NLG), aka National Life VT, aka Life Insurance of the Southwest, is a mutual insurance company offering competitive dividends among its peers. Accelerated benefits for both chronic illness and terminal illness are available.

For more on this member of our top 10 Infinite Banking insurance companies, please check out our review of National Life Group review.

OneAmerica

One America is a good mutual company (A+ rating with A.M. Best) and also made our top 10 list because it is a “non-direct recognition” company that offers tremendous flexibility with its paid up additions rider option for their whole life policy. One America offers whole life insurance through American United Life, “AUL.”

OneAmerica offers what is called a declining paid up additions load. This just means that folks can slowly decrease the amount of paid up additions being paid. However, this can come back to haunt you if people decrease the paid up addition too much. By doing so, it can undermine their strategy for growing the cash value.

Indexed Dividend Crediting Option (IDO) Rider – Legacy and Legacy 121 policyholders can participate in market moves earning up to double their dividend, without sacrificing whole life guarantees.

For more on this member of our top 10 Infinite Banking insurance companies, please check out our American United Life review

Penn Mutual

PennMutual is an excellent mutual company (A+ by A.M. Best) offering some of the best high cash value whole life policies and gets very high marks in a number of areas.

Penn Mutual’s Standard & Poor’s rating is A+, which is the fifth highest of 21, and they highlighted the following reasons for their rating:

- Very strong financial risk profile

- Very strong capital adequacy

- Strong business profile

They are a direct recognition company, and yet their track record of policy performance for cash accumulation is exceptional.

They ALSO score among the highest on our list for flexibility in paid up additions payment options.

Another exciting thing about this company is that their sales data reveals a large following of independent brokers. This is in contrast to some of our other choices who operate largely through a captive sales force.

Penn Mutual’s dividend rate has stayed level every year since the 2008 financial crisis.

For more on this member of our top 10 Infinite Banking life insurance companies, please check out Penn Mutual review.

Security Mutual Life

Security Mutual Life is a non-direct recognition company that offers participating whole life insurance focused on personal banking strategies, such as the infinite banking concept.

SML has an A- rating from A.M. Best, which is the 4th highest rating of 15 offered by Best Company.

Security Mutual Life offers four different types of whole life insurance policies as part of its Security Designer WL4U product line, which include:

- WL4U LP121

- WL4U LP100

- WL4U LP65

- WL4U 10Pay

The most popular product for personal banking is the WL4U LP 100. This is a whole life insurance policy that is payable to age 100. Among the many riders offered are a Chronic Illness Benefit, Enhanced Paid-Up Additions rider, and a 5-year Own Occupation Disability Waiver of Premium rider.

For more on this top infinite banking company, please see our Security Mutual Life review.

Whose Missing?

Ohio National

Ohio National was once a part of our top 10 but it is no longer a solid mutual company that we would recommend when practicing infinite banking. Although it gained high recognition as a strong contender for offering policies that foster cash accumulation, due to the company “de-mutualizing” we can no longer offer it as an option in good faith.

And although it is a non-direct recognition company, recently they’ve been edged out by our other choices for a few additional reasons. They seem to lack some flexibility for paid up additions.

Another apparent issue is that, similar to Guardian, many of the agents promote certain whole life products that may not be ideal for cash accumulation as some of their other products.

For more, please visit our Ohio National review.

Conclusion

In conclusion, while we’ve shared our insights on the top Infinite Banking companies, the key to your success lies in partnering with a seasoned professional. The real game-changer is finding a veteran life insurance agent who not only understands the intricacies of these policies but also has the patience to address all your questions and concerns.

Key Point: Partnering with a seasoned IBC professional is crucial for designing a policy that maximizes your financial success.

87 comments

Donna

I am interested in a $300K-500K policy. A am a resident of GA and would like to have a list of available agents

Steven Gibbs

Hello Donna,

You can visit our Pro Team page on our website.

I recommend that if you’re interested in Infinite Banking, connect with either Denise@insuranceandestates.com or Barry@insuranceandestates.com by emailing or scheduling on their respective calendar there.

To your success!

Steve Gibbs for I&E

Steven Gibbs is a licensed insurance agent, and the following agent

license numbers of Steven Gibbs are provided as required by state law:

Resident License; AZ agent #17508301,

Non-resident Licenses: TX agent #2273189, CA agent #0K10610,

LA agent #769583, MA agent #2049963, MN agent #40563357,

UT agent #655544.

Sonya McKinney

I am a licensed broker in Ohio. I am interested in contracting with some of these compinies that have whole life for infinite banking purposes. I also was sondering if these companies train you to write the infinite banking policies.

Steven Gibbs

Hi Sonya, thanks for connecting. I forwarded your inquiry to Barry Brooksby who has an agent training program and can address any questions. You can also reach out to him at barry@insuranceandestates.com.

Best, Steve Gibbs for I&E

Steven Gibbs is a licensed insurance agent, and the following agent

license numbers of Steven Gibbs are provided as required by state law:

Resident License; AZ agent #17508301,

Non-resident Licenses: TX agent #2273189, CA agent #0K10610,

LA agent #769583, MA agent #2049963, MN agent #40563357,

UT agent #655544.

Danny

I just started my own business. I am interested in learning how to get into ibc and grow my business at the same time. Is that possible. I live in Oregon. And I’m just 35. Healthy and my family has a great life expectancy so far. I don’t have a lot of money or any schooling that I can remember that would be useful in my situation. That being said. I understand the concept fully. I have heard about ibc throughout the last year or two. And I feel I can competently invest in my life without being confused about it. I’ve been thinking about it and I’m ready. If there are any reasons why I can’t implement the request about building my company while preparing for my future passing. I would like to hear anything you have to help me out with. Thanks.

Danny peck, owner/manager Dplean LLc.

A mobile mechanic service/dealer. Working for a brighter future today. After fixing the problems from yesterday.

Steven Gibbs

Hello Danny, thanks for checking in. I recommend you reach out to our IBC expert Barry Brooksby to see what options are available to you at this point. You can email barry@insuranceandestates.com to request a call.

To your success,

Steve Gibbs for I&E

Steven Gibbs is a licensed insurance agent, and the following agent

license numbers of Steven Gibbs are provided as required by state law:

Resident License; AZ agent #17508301,

Non-resident Licenses: TX agent #2273189, CA agent #0K10610,

LA agent #769583, MA agent #2049963, MN agent #40563357,

UT agent #655544.

Brian

Hi, I am located in Central Virginia and an very interested in IBC. I have done my own research, and believe i understand the concept.Is there someone in my region that can educate me further on the subject?

SJG

Hi Brian, thanks for connecting.

Our experts are licensed in all 50 states so perhaps a good first step is to email Denise Boisvert if you haven’t yet connected with her to request a call at denise@insuranceandestates.com.

Best, Steve Gibbs for I&E

Steven Gibbs is a licensed insurance agent, and the following agent

license numbers of Steven Gibbs are provided as required by state law:

Resident License; AZ agent #17508301,

Non-resident Licenses: TX agent #2273189, CA agent #0K10610,

LA agent #769583, MA agent #2049963, MN agent #40563357,

UT agent #655544.

Jery W.

Yes, I’m very interested in IBC. I’m currently 46 and live in Plano, Texas (Dallas suburb). Do you know of an Agent/Advisor in this area that could help me get my IBC started? Thanks.

SJG

HI Jery, I believe Denise has reached out to you.

Best, Steve Gibbs for I&E

Steven Gibbs is a licensed insurance agent, and the following agent

license numbers of Steven Gibbs are provided as required by state law:

Resident License; AZ agent #17508301,

Non-resident Licenses: TX agent #2273189, CA agent #0K10610,

LA agent #769583, MA agent #2049963, MN agent #40563357,

UT agent #655544.

Gilbert Herring

Hello

I’m currently trying to find a Whole life policy thru the IBC concept that can maximize the High Cash Value products without crossing into MEC 7.

I currently live in Maryland and I’m 62 yrs and in good health not on any medications and would like to get in touch with an Agent or Advisor to discuss the best options for my future situation

Thanx in advance

Gil Herring

SJG

Hello Gilbert, thanks for connecting. Go ahead and reach out to Denise Boisvert by emailing her at denise@insuranceandestates.com to schedule a video conference to review any available options.

Best, Steve Gibbs, for I&E

Steven Gibbs is a licensed insurance agent, and the following agent

license numbers of Steven Gibbs are provided as required by state law:

Resident License; AZ agent #17508301,

Non-resident Licenses: TX agent #2273189, CA agent #0K10610,

LA agent #769583, MA agent #2049963, MN agent #40563357,

UT agent #655544.

Joseph Cruz

Good Day,

Iam living in Guam a Territory of the United States out in the Pacific.Would I be able to have access to any of the Whole Life insurace Companies living on Guam..please let me know..

Respectfully

Joseph

SJG

Hello Joseph, sorry for the delayed response. The rule is you have to be in the U.S. or Puerto Rico with U.S. citizenship or green card.

Best, Steve Gibbs for I&E

Steven Gibbs is a licensed insurance agent, and the following agent

license numbers of Steven Gibbs are provided as required by state law:

Resident License; AZ agent #17508301,

Non-resident Licenses: TX agent #2273189, CA agent #0K10610,

LA agent #769583, MA agent #2049963, MN agent #40563357,

UT agent #655544.

Domenic

Barry, I’ll preface the following comment by saying that I appreciate all the work you do in creating this content to educate the public on this and so many other topics. I am also a partner with New York Life.

That said, I find it interesting that New York Life is not on this list if you’re being objective. You mentioned in previous comments that New York Life is on your top 10 dividend paying whole life companies but not top 10 for IBC. Seems to me, based on your criteria: Mutuality, Performance History, Stability, Flexibility, and Overall Suitability…New York Life is superior to most of, if not all of the companies on this list when it comes to these infinite banking criteria.

Of course, NYL is a mutual and a non0direct recognition company. NYL has a 177 year history with some of the most reliable policy illustrations in the industry. Policies designed for banking build cash value build faster in early years compared to our competitors. You, yourself rate Ney York Life in your top dividend paying companies. With 177 years and a 100 comdex rating, NYL stands head and shoulders above the other companies on this list when it comes to stability. With PUA purchases up to 10X annual standard base premium, and a Custom Whole Life suite with as little as 5 year paid up policies ranging up to paid up by age 75, NYL offers maximum flexibility. Finally, when it comes to overall suitability, NYL agents are trained on whole life banking early on. We even have a specific illustration concept called “Bank on Whole Life.” While this may not be as robust an example as some policy owners may want to use their policy, it does demonstrate the company’s commitment to the concept. So, what keeps New York Life off of this list exactly?

With New York Life, like any other carrier, the agent will make all the difference when it comes to making sure the policy is designed in a way that best fits the client’s objectives. Thanks for reading!

Insurance&Estates

Hello Domenic and thanks for connecting. Actually, Barry is our resident IBC expert but he does not write the articles. These are created by a number of our team members based upon our priorities which do include a preferance for non captive carriers because they offer flexibility for agents seeking to provide the best options for consumers. There are many top mutual companies to be sure and sometimes when folks work with a particular provider they want us to change our ratings. These preferences and rankings are largely a matter of our collective opinion based upon our own established criteria and having worked with numerous companies.

Best to you in your endeavors.

Steve Gibbs, for I&E

William

I find it interesting reading your responses to why Northwestern Mutual isn’t on your list. They are literally #1 in this space (AAA credit rating with stable outlook, never missed a dividend payment in 165+ consecutive years, pays more in dividends each year then the next 3 competitors COMBINED at $6.5 billion) but because you’re not affiliated with them you can’t sell them. Of course they wouldn’t make your list! What you failed to mention is that anyone affiliated with Northwestern can sell any of these other companies AS WELL as NM. You should at least give these people the real facts. NM’s mortality margin ratio is the best in the industry, has the lowest expense ratio and the highest investment yield. In the end it’s all about structure, maximum over funded. You should also mention that the dividend interest rates aren’t regulated. Tell people to run the exact policies side by side from different companies and see what the cash value is at the same compared age. The fact that they aren’t even on this list at all is alarming. The amount of misinformation out there is unfortunate. They don’t make the list because they’re captive… did you know that if someone affiliated with NM sold a MassMutual policy they’d make more money in commissions? Don’t get me wrong, your list has some amazing companies obviously but it’s mind blowing that THE best company didn’t even make the cut. Northwestern Mutual, MassMutual, Guardian Life, and NY Life are the leading 4, there is no debate.

SJG

Hi William, my uncle who has passed was a top producer at NW Mutual for many years. While there are some things to like about the company, there are other things, like their loan rates that aren’t as impressive (your comment on total dividends paid isn’t that relevant in my opinion) when considering the rates and when performance is weighed against some of the competition. Also, we both know that most of the top mutual whole life companies have an impressive track record for paying dividends so… Believe it or not, you’re not the first NW Mutual guy to get upset and weirdly I’ve only experienced this elsewhere with Guardian:) Both are top companies in the space and yet understand that this is our criteria which is based upon our opinion, and one of our priorities is whether the company is captive or non-captive. Point being, if I wanted to be selling NW Mutual then I would be doing exactly that and I don’t so… Still, if you’re selling whole life you’re doing a good thing, keep up the great work.

Ryan Kempkens

Hello, I’m a new agent with New York Life, after reading Becoming Your Own Banker by Nelson Nash I made a career change. Is flexibility the main reason why NYL didn’t make this list? It seems I might be best off to become independent as soon as possible would you agree?

Insurance&Estates

Hello Ryan and thanks for commenting. You’re correct, New York Life is a fine company but captive and we tend to prefer companies that offer flexibility for consumers. If I were starting out I would gravite toward non-captive mutuals. We do offer some agent programs so let us know if we can help further.

Best, Steve Gibbs for I&E

Alex

Hello, I live in New Hampshire and am looking to get connected with an agent for more information.

Insurance&Estates

Hello Alex, we work all over the country so if you’re interested in more information you can connect with our high cash value expert Barry Brooksby by emailing him at barry@insuranceandestates.com.

Best, Steve Gibbs for I&E

Scottie

What’s your preference or pros and cons between Forester and Lafayette Life?

Insurance&Estates

Hello Scottie, these kinds of questions are tricky in the context of blog comments. Lafayette and Foresters are both good companies; however, we’ve worked much more with Foresters in recent years. To get clearer information, the best next step is to schedule a call which you can do by emailing Barry Brooksby at barry@insuranceandestates.com.

Best, Steve Gibbs for I&E

bob

which companies are in NEW YORK to sell IBC ?

Insurance&Estates

Hi Bob, at this point to my knowledge Mass Mutual and Foresters are available there but Foresters may be pulling out in the very near future so time may be of the essence there. To get more specific information, you could request a call with Barry by emailing him at barry@insuranceandestates.com.

Best, Steve Gibbs for I&E

Jerry Patton

Trying to find a company to work with. Looking for prices per month. How soon could I get a loan if I stock pile the policy in the beginning. I have term looking for a more solid way of banking.

Insurance&Estates

Hello Jerry, if you’re looking for a company to work with, our IBC expert Barry Brooksby is highly experienced and you can see he gets rave reviews. You can request a call by emailing him at barry@insuranceandestates.com.

Best, Steve Gibbs, for I&E

Andrew Adkins

I am looking forward educating and helping others bank on themselves, may I have someone reach out about the contracting process?

Insurance&Estates

Hi Andrew, I believe Barry reached out to you about his agent training which I advise you to consider.

Best, Steve Gibbs for I&E

Joseph DELLO RUSSO

Looks like this website is still being managed. I’m just starting out and need some guidance. Is Barry still available and still a good point of contact?

Insurance&Estates

Hello Joseph, yes we are not only managing this site but are committing to providing educational content and exceptional service focused on high cash value life strategies:) Yes, Barry is a great point of contact and I forwarded your request to him. If you haven’t yet connected, go ahead and email him at barry@insuranceandestates.com.

Best, Steve Gibbs for I&E

Wendell

Hello How long would I have to wait until I make a withdraw from my policy

Insurance&Estates

Hell Wendell, good question and the answer depends on policy design and goals to an extent. I recommend you discuss this and similar questions with our IBC expert Barry Brooksby.

You can e-mail him at barry@insuranceandestates.com to request a call.

Best, Steve Gibbs for I&E

Paula Johnson

I’d like to purchase a policy for my daughter who is 29. The goal is to retire before 66. She currently has a whole life, term, and Roth IRA. She may not be in the most aggressive vehicles. Northwestern Mutual is one of her companies. don’t remember others.

Insurance&Estates

Hi Paula, I’m not sure if you’ve connected with one of our experts yet; however, I recommend you start with Barry Brooksby be e-mailing him a request to connect at barry@insuranceandestates.com.

Best, Steve Gibbs for I&E

Jane

I found the infinite banking concept very interesting. However, will I loose the tax write off benefit from mortgage interest if I borrow from my own life insurance?

Insurance&Estates

Hi Jane, good question and yes if you were to finance a personal residence through your policy, you would lose the interest deduction. Thus, we wouldn’t generally recommend that move to someone with good credit who could qualify for good financing. In this circumstance an IBC policy loan would be more advantageous for investment real property for many reasons discussed in our various real estate webinars.

Best, Steve Gibbs for I&E

DAVID REY

how exactly do you buy an infinite banking policy? Can you set it up online or do you have to talk to an insurance agent?

Insurance&Estates

David,

Due to the customization of the policy it is recommended that you speak to an infinite banking practitioner. You can reach Barry Brooksby at barry@insuranceandestates.com for specific policy information.

Best, I&E

John

I have a couple policies with NYL that I’ve had for years, my agent is somewhat familiar with the concept. I would like to know if you have someone very familiar with IBC that could advise me?

Thanks!

Insurance&Estates

Hello John and thanks for commenting. If you have an agent, you may want to discuss the concept in more detail with him/her. If you’d like a second opinion, you can connect with Barry Brooksby at barry@insuranceandestates.com and ask for a phone call.

Best, Steve Gibbs for I&E

Barry

Great writeup and execution of the IBC Concept. I met Nelson and worked the IBC concept back in the early 90’s -2010 era. It is a solid Life Changer and I like how your firm handles the educational side for the Consumer!

I am looking to get back into the business and may be getting in touch with you to discuss the IBC method.

Barry

Insurance&Estates

Sounds good Barry and thanks for commenting – nice to hear of your experience with IBC and meeting Mr. Nash. When you’re ready, the guy to talk to is also Barry (Brooksby) and you can e-mail him at barry@insuranceandestates.com.

Best, Steve Gibbs for I&E

Donna Grothen

I live in Nebraska am very interested to set this up for my family

Insurance&Estates

Hi Donna,

Our IBC Practitioner Expert, Barry Brooksby, can help you. I suggest that you connect with him directly at barry@insuranceandestates.com to schedule a call.

Best, Steve Gibbs, for I&E

D. massey

Looking for an honest answer. I have read alot on infinite banking and believe I understand the concept enough to become tenacious with going forward . My confusion is , is it worth wild to start this at age 50 ? No harm in an honest answer

Insurance&Estates

Hello, my honest answer is that IBC is absolutely something that can work well for someone at age 50. The key is using the PUA rider and design to add more cash to the policy and expedite cash value growth. A lot would depend on what you’re able affort and other factors such as your overall health. To explore further, connect with Barry at barry@insuranceandestates.com.

Best, Steve Gibbs for I&E

Joshua

I currently have State Farm. Is this not a good option?

Insurance&Estates

Hello Joshua, I can only say that State Farm is captive and not a company that we’ve encountered having dealt with numerous infinite banking products and experts. The question you need to ask is whether it is really a high cash value policy, having been designed and implemented for cash value accumulation. Reach out to Barry at barry@insuranceandestates.com to explore this further.

Best, Steve Gibbs for I&E

Sam

Correct me if I’m wrong the problem with mass mutual they don’t allow policy loans the first year.

Insurance&Estates

Hello Sam, thanks for commenting. Barry Brooksby works regularly with Mass and would be best to answer your question. Feel free to e-mail him directly at barry@insuranceandestates.com.

Best, I&E

John smith

Is there a cost to having your company help with setting up an insurance policy for IBC?

Insurance&Estates

Hello John, we do help people regularly set up IBC polices. We get paid by the insurance company as a commission for setting up so there is no fee coming directly from the customer. To get started, feel free to connect with jason@insuranceandestates.com.

Best, Steve Gibbs, for I&E

Michael Bradley

Can you put me in connect with and send me a list of IBC expert insurance brokers in NEW JERSEY that offer whole life insurance utilizing the Infinite Banking concept. Interested in getting a Whole life policy that maximizes and builds cash value fast.

Insurance&Estates

Hello Michael, our Pro Client Guides are licensed in NJ and can help. I’ve forwarded your request to Jason Herring and either he or Barry Brooksby will reach out to you.

Best,

Steve Gibbs for I&E

Carlos H

How do you become an independent licensed insurance agent? Is there a website I can go to if I wanted to become more knowledgeable on this IBC Policies and offer them to people I know or family members?

Insurance&Estates

Hello Carlos, Jason Herring can help you with this and I suggest you connect with him at jason@insuranceandestates.com.

Best, Steve Gibbs for I&E

Robert Stutes

I am very interested in getting more information on this IBC system.

Thank you.

Insurance&Estates

Hello Robert, thanks for commenting…you one of our IBC experts has most likely reached out to you already. If you haven’t yet connected, e-mail barry@insuranceandestates.com and send a contact phone number and best time to call.

Thank you. I&E

Irving Babbitt

Can you put me in connect with and send me a list of IBC expert insurance brokers in Texas that offer whole life insurance utilizing the Infinite Banking concept. Interested in getting a Whole life policy that maximizes and builds cash value fast. I am very Interested Forester.

Insurance&Estates

Hello Irving, our IBC expert Barry is licensed in TX and you’re welcome to connect with him if you haven’t already. Go ahead and reach at barry@insuranceandestates.com.

Best,

Steve Gibbs for I&E

Daniel Grumelli

Quick question. Is it possible to set up an infinite banking policy taking into account that I am not a resident in the US?

Insurance&Estates

Hello Daniel, thanks for commenting. I believe one of our self banking experts has already reached out to you. If not, connect with barry@insuranceandestates.com.

Best,

Steve Gibbs for I&E

JD Destajo

I have an IUL with Transamerica and a whole life insurance from new york life. Im interested in consolidating my policies and if it can be replaced by one of these other companies the better.

Im also interested in the critical care insurance and living benefits. Would you guys be able to help out?

Kevin Attride

Would you provide the evaluation matrix you created in ranking these top 10? I would like to better ascertain their strengths and weaknesses when compared to each other.

Kevin

Insurance&Estates

Hello Kevin, thank you for reading and commenting. We really didn’t use a “matrix” per se in reaching our conclusions, as this review is somewhat subjective and is largely based upon our collective experience working with various companies. I’ll refer you back to excerpt of the article if you’d like to consider our criteria.

Best, Steve Gibbs for I&E

Excerpt: […it’s helpful to know that the criteria for our Top 10 Infinite Banking companies is identical to the criteria for our Top 10 Dividend Paying Life Insurance Companies – due to the fact that we value the same criteria for both (stability, performance, flexibility, etc.)]

K

Can you put me in connect with and send me a list of insurance brokers in Georgia that offers whole life insurance utilizing the Becomingyourownbank and BOY concept. Interested in getting a Whole life policy which maximizes cash value through PUAR. Interested in brokers who sale WL policies through non-direct recognition carriers such as Security Mutual, Lafeyette, American United, and Forester.

Insurance&Estates

Hello, I’ve forwarded your information to our National Sales Director, Jason Herring. Thanks for your confidence.

Best. Steve Gibbs for I&E.

Paul Wawrzynski II

Your reason for not listing northwestern mutual is they have captive agents. Are there any other reasons ?

Insurance&Estates

Hi Paul, thanks for your comment. Yours is not the first we’ve had about NW Mutual. Honestly, there are many great companies and it is tough to narrow down a “criteria” for selecting “our best” picks. Truly, this is a subjective set of criteria that boils down to our opinion. We tend to favor non-captive companies because they, in keeping with our mission, favor freedom of choice and unbiased advise for the consumer. We also tend to favor lean companies that perhaps spend less on marketing, funneling more money back to policy holders. Anyhow, these picks are truly just our opinion so if you’re a NW Mutual fan, feel free to pursue their products with an experienced adviser there, as they are an outstanding company to be sure.

Best,

Steve Gibbs, for I&E

Paula Johnson

My daughter has Northwestern Mutual. I am not sure how aggressive her policy is or the maximization of PUA. Can the balance be changed mid stream? I would still like to gift her a 2nd whole life policy that I fund.

Insurance&Estates

Hi Paula, the PUA amount would be connected the death benefit and overall policy design. You may need a NW Mutual agent to help with that specific policy and we do not currently work with them. I did send you an e-mail to connect with Barry concerning your other request.

Best, Steve Gibbs for I&E.

Michael Addison

As a licensed independent agent, I would like more info on contracting with some of the carriers in your article. Very informative Article.

Manuel Chavez

Would like to request information regarding contracting for these or any insurance companies as agent to provide and offer the type of insurance product as an independent agent. I have license and would like to promote and provide this type of product to clients if possible.

Insurance&Estates

Manuel,

Please be on the lookout for our reply using the contact info you provided.

Sincerely,

I&E

James Corr

Good article but why were New York Life and Northwestern Mutual excluded from the list?

Insurance&Estates

James,

We excluded NY Life and Northwestern Mutual because they did not make our favored top 10 companies to use for infinite banking. Northwestern Mutual requires captive agents. We like NY Life and have them listed as one of our top 10 dividend paying whole life insurance companies.

Sincerely,

I&E

Adolfo Jimenez

Thanks for the article, I understand why Northwestern Mutual is not included in this list but it’s still not clear to me why New York life is not. Can you explain? thanks

Insurance&Estates

Adolfo,

We excluded NY Life and Northwestern Mutual because they did not make our favored top 10 companies to use for infinite banking. Northwestern Mutual requires captive agents. We like NY Life and have them listed as one of our top 10 dividend paying whole life insurance companies.

Sincerely,

I&E

Eric

I would like to see some illustrations for a 400,000 20 pay plan. I am 54 years old. How much premium annually could I put down and stay non-mec

Insurance&Estates

Hi Eric,

We will reach out to you shortly with some additional information. Thanks for stopping by.

Sincerely,

I&E

Garry Freeman

Like Eric I would like to see some illustrations for a 300,000 10 or even 7 pay plan. I am 58 years old, and again like Eric how much premium annually could I over fund and stay non-mec

Will

Recently turned 49 and Saw quote for 250000 20-pay. Is it possible to accelerate the pay-up after the 20-pay is in effect or must I simply start with 10-pay option with a lower DB (if necessary) in order to really maximize CV ?

Insurance&Estates

Hello Will and thanks for commenting. To get the best answer for your question, I suggest you connect with Barry Brooksby, our high cash value life expert, by e-mailing him directly at barry@insuranceandestates.com.

Best, Steve Gibbs, for I&E

Tim

Do any of the Companies that you know of allow

Sales by phone (not face to face)

I live in a remote area

This would be for IBC or BOY

Thanks for the help

Tim

Insurance&Estates

Tim,

Most companies allow sales over the phone or skype if you live in a remote area. We sent you an email with some more information on using cash value life insurance for infinite banking.

Sincerely,

I&E