In this comprehensive guide to infinite banking, we share our experience and insights into the most effective Infinite Banking policies. We carefully weigh the pros and cons of this self banking strategy while exploring practical real-world applications in areas like real estate investments and debt elimination.

Drawing from our team’s 70+ years of combined experience designing optimal Infinite Banking whole life policies, we lay the educational foundation you need to become your own banker using life insurance. This guide will help you understand how to take control of your financial future through this powerful but often misunderstood strategy.

Infinite Banking Concept Comprehensive Guide

Table of Contents

- Key Takeaways

- What is the Infinite Banking Concept?

- How to Qualify for Infinite Banking

- How to Structure an Infinite Banking Whole Life Policy

- Infinite Banking Case Study

- Comparing Infinite Banking with Traditional Bank Savings

- Pros of the Infinite Banking Concept

- Cons of the Infinite Banking Concept

- Infinite Banking Examples

- 10 Steps to Set Up Infinite Banking

- Best Infinite Banking Companies

- Next Steps

- FAQs

1. Key Takeaways

- Coined by Nelson Nash, the Infinite Banking Concept involves using a whole life insurance policy designed for high cash value as your personal banking system.

- An infinite banking whole life insurance policy is from a mutual insurance company, structured with a paid-up additions rider to maximize cash value growth.

- A featured benefit is that when you borrow against the policy’s cash value to purchase investment opportunities, you are still earning compound interest on your entire cash value account balance, while earning a return on your investment opportunity, making your dollars work for you in two places at once.

- Pros include non-correlation with the stock market, improved cash flow and liquidity, personal family financing, tax advantages, creditor protection, financial leverage, and privacy.

- Cons include potential cost prohibitions, mandatory annual payments, creditor protection variances, the need for discipline, and qualification requirements.

- Steps to start infinite banking and become your own banker include gaining education, setting financial goals, consulting with a professional, choosing the right policy, funding the policy, using it to finance purchases, and repeating the process.

2. What is the Infinite Banking Concept?

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

The Infinite Banking Concept, coined by Nelson Nash in his book Becoming Your Own Banker: Unlock the Infinite Banking Concept, transforms how you think about personal finance. Rather than using traditional banks, this strategy involves creating your own banking system using a high cash value whole life insurance policy.

What makes this approach different is the focus on maximizing cash value growth rather than the death benefit. Traditional whole life policies are primarily designed for the protection element, but a properly structured infinite banking policy prioritizes accessible cash value while maintaining the protection benefits.

This strategic shift allows you to finance your transactions through an asset that more effectively grows and preserves your wealth. The philosophy behind this approach is captured perfectly in Nash’s own words:

…your need for finance, during your lifetime, is much greater than your need for protection. – N. Nash

By recognizing that your financing needs typically exceed your protection needs during your lifetime, infinite banking positions your insurance policy as both a protection vehicle and a sophisticated financing tool that can transform your financial strategy.

Other Names

The Infinite Banking Concept has been marketed using many different names across the financial industry, including:

- Cash flow banking

- Private family banking

- Bank on yourself

- Perpetual wealth strategy

- Becoming your own bank

- Circle of wealth

- Perpetual wealth system

Despite the variety of terms and branding, all these approaches fundamentally refer to the same core concept – creating a personal banking system that you control using properly structured whole life insurance. This concept of “being your own bank” remains consistent across all these variations, even though marketing materials and specific implementation details might differ slightly between practitioners.

Primary Benefit

The primary benefit of using whole life insurance for infinite banking is that it creates a contractual asset with multiple advantages that traditional banking can’t match:

- Guaranteed tax-deferred growth of your cash value

- Tax-free access to your money through policy loans

- Guaranteed minimum rate of return

- The ability to leverage your dollars in ways conventional banking doesn’t allow

When compared to typical bank accounts or money market accounts, the differences become clear. Traditional banking vehicles tax any interest or gains you receive, offer no guarantee on interest rates (which can drop to nearly zero during economic downturns), and provide no leverage mechanism for your deposited funds.

With infinite banking, you’re creating a financial foundation that combines growth, tax advantages, guarantees, and leverage capabilities within a single asset. This multi-dimensional approach to managing your money provides flexibility and control that conventional banking simply doesn’t offer.

Your Banking System

Nash’s perspective shifts the entire conversation from rate of return to volume of money. While traditional financial advice focuses on comparing investment returns between whole life insurance and the stock market, Nash advocates for redirecting your entire income through a policy, not just a small percentage.

The conventional banking system encourages saving 10-15% of your income in tax-deferred accounts, focusing on maximizing returns in those limited funds. In contrast, Nash’s strategy involves channeling your entire income through a tax-free environment, dramatically increasing the base amount that benefits from compounding growth and tax advantages.

This fundamental shift from focusing on percentage returns on a small portion of income to optimizing the total volume of money working for you in a tax-advantaged environment creates an astronomical difference in long-term wealth accumulation.

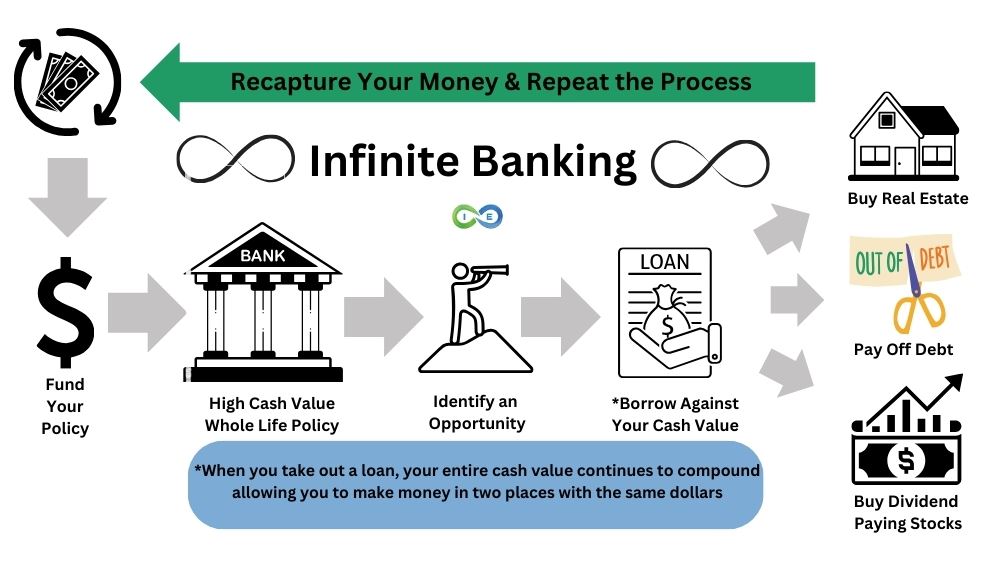

Your Dollars at Work in Two Places at Once

What makes infinite banking possible is your ability to borrow against your policy’s cash value to purchase income-generating assets while still earning compound interest on your entire cash value. This strategy puts your money to work in two places simultaneously: growing in your policy and generating returns through investments. You then use investment income to repay your policy loan, allowing you to repeat this process indefinitely.

The whole idea is to recapture the interest that one is paying to banks and finance companies for the major items that we need during a lifetime, such as automobiles, major appliances, education, homes, investment opportunities, business equipment, etc. – N. Nash

3. How to Qualify for Infinite Banking

To qualify for infinite banking you will need to pass the life insurance underwriting requirements for the particular insurer you are applying with. The typical qualification process is as follows:

- 🤝Connect with an agent who specializes in structuring whole life insurance policies designed for infinite banking.

- 💬Explain what you are looking for and what your goals are.

- 🖥️Have the agent run some illustrations for you based on your own numbers.

- ✍️Put together an application with your agent for the company of your choice.

- 📋Meet the underwriting criteria, which may include a paramedical exam.

- 📑You application, medical results, and other data will be verified by the underwriting team at the company.

- ✅The insurer will provide you and your agent with your results, at which time you can decide on the specifics of your policy based on the rate class you received.

- 🔒Final delivery requirements will follow and you can make your first premium payment so that your policy goes in force.

4. How to Structure an Infinite Banking Whole Life Insurance Policy

Paid-Up Additions

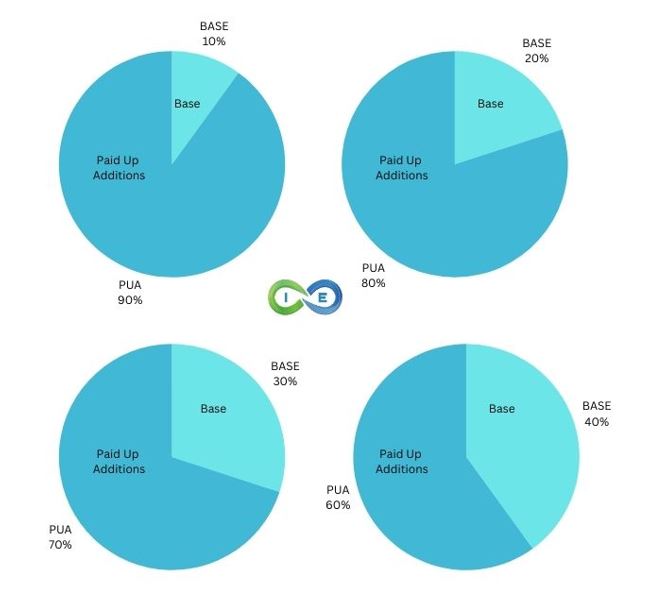

A properly designed infinite banking policy uses high cash value whole life insurance from a mutual insurance company. Unlike traditional policies, these dividend-paying whole life insurance policies are structured so the majority of premium payments are directed toward paid-up additions rather than the base premium.

The typical structure follows either a 65/35 or 80/20 split between paid-up additions and base premium. The optimal ratio depends on the client’s specific needs – some prefer a 90/10 split to maximize immediate cash value access, though this might slightly reduce the long-term internal rate of return.

Many infinite banking policies also incorporate a term insurance rider. This rider temporarily increases the death benefit (usually for the first 10 years or less), which helps the policy pass the 7-pay test under section 7702 and avoid being classified as a modified endowment contract (MEC).

Based on our extensive experience, the most effective whole life policy designs for infinite banking use PUA/Base premium ratios of 60/40, 70/30, 80/20, or even 90/10, depending on individual goals and circumstances.

Paid Up Additions = Lower Agent Commissions

Most life insurance agents earn commissions primarily from the base premium portion of policies. Since infinite banking policies intentionally minimize the base premium (keeping it at just 10-40% of the total payment) in favor of paid-up additions, agents earn significantly lower commissions on these specialized policies.

This commission structure creates a misalignment of incentives. Many agents are reluctant to design or recommend infinite banking policies despite their potential benefits to clients, as doing so substantially reduces their own compensation compared to traditional whole life policies with larger base premiums.

This helps explain why it can be challenging to find agents truly experienced in and committed to designing optimal infinite banking policies – the financial incentive often pushes them toward recommending conventional policy structures instead.

How Much Do You Need To Start Infinite Banking

- Traditional advice: Save 10-15% of income in tax-deferred accounts, focus on ROI.

- Nash’s IBC approach: Funnel entire income through a tax-advantaged whole life insurance policy.

Nowadays, putting 100% of your income into a policy might not be an option due to different financial underwriting criteria than when Nash wrote his book. However, a good goal to shoot for is 25% of your income. You can also add a large lump sum to begin, which will greatly enhance the growth of your policy over your lifetime. So the minimum amount would be around $500 a month. And the maximum amount would be up to 25% of your annual income.

Direct vs Non-Direct Recognition

While Nelson Nash originally recommended non-direct recognition companies for implementing the infinite banking concept, our extensive experience shows that direct recognition companies often perform favorably as well. The distinction between direct and non-direct recognition shouldn’t be your primary consideration when selecting a company.

Direct recognition means the insurer acknowledges outstanding policy loans and applies an adjusted dividend rate to the borrowed portion of your cash value. Non-direct recognition companies apply the same dividend rate regardless of any outstanding loans. The adjusted rate in direct recognition policies may be higher or lower than the standard rate, depending on the specific insurer.

What’s crucial to understand is that regardless of which approach a company takes, you continue receiving dividends on your entire cash value – even the portions you’ve borrowed against. This is a fundamental feature that enables the “money working in two places at once” benefit of infinite banking.

The most important factors to prioritize are overall cash value growth potential and selecting the right company with a strong financial foundation and consistent dividend history. These elements will have a far greater impact on your infinite banking success than whether the company uses direct or non-direct recognition.

Dividend Payments

One of the many benefits of dividend paying whole life insurance is the annual dividend payment. According to Nelson Nash,

If the owner uses the dividend to purchase Additional Paid-Up Insurance (no cost for acquisition, sales commissions, etc.) the result is an ever-increasing tax-deferred accumulation of cash values that support an ever-increasing death benefit.

Using you dividend to purchase paid-up additions further enhances your cash value and death benefit, helping to optimize your infinite banking policy.

5. Infinite Banking Case Study

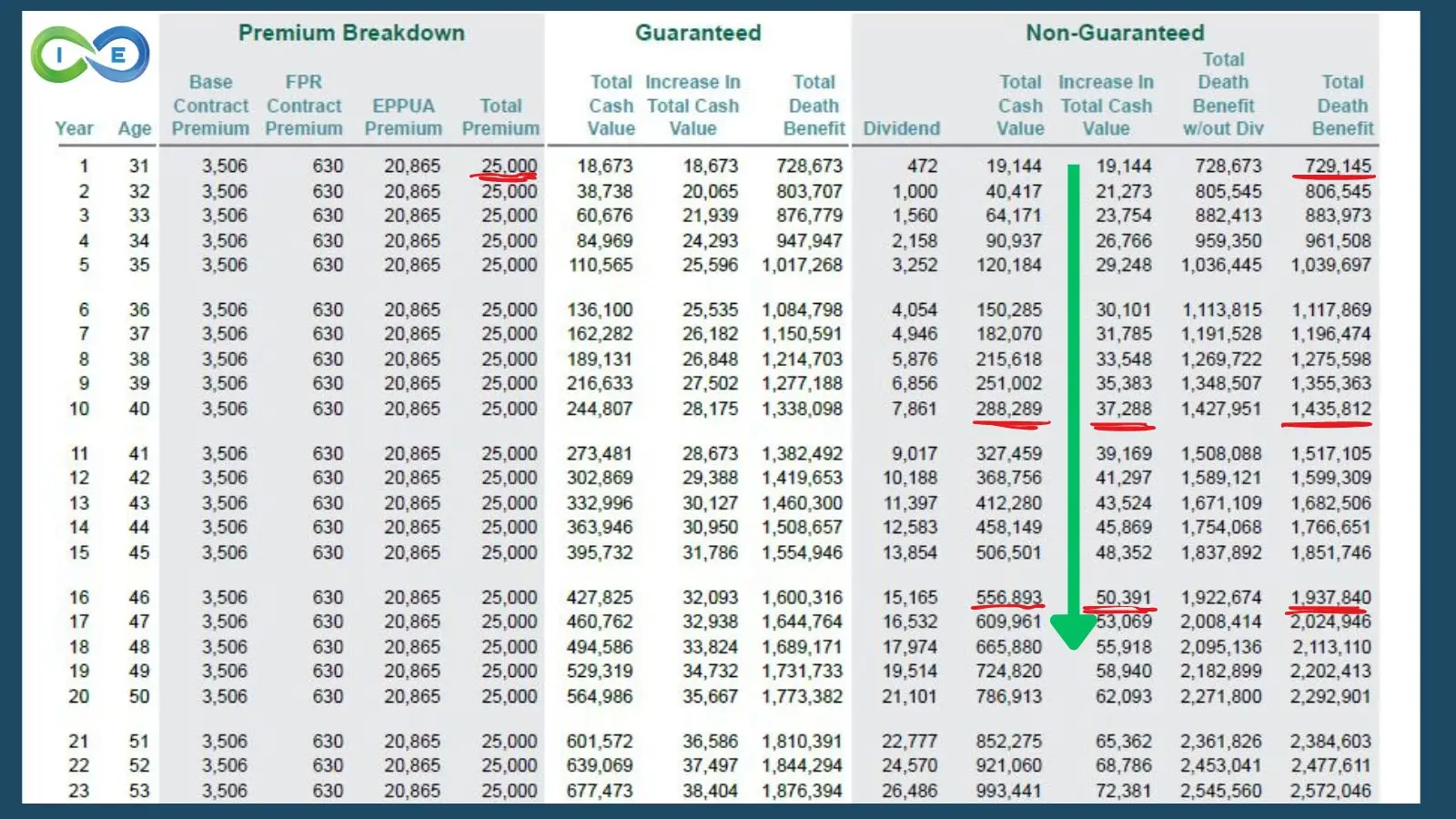

Meet Ethan, a 30-year-old business owner who discovered a powerful financial strategy that’s been a game-changer for both his family and his business. At the heart of Ethan’s approach is a whole life insurance policy designed with a focus on cash value growth.

Here’s the breakdown of Ethan’s plan:

- Policy Type: Whole Life Insurance with emphasis on cash value accumulation

- Annual Premium: $25,000

- Starting Age: 30 years old

- Family Status: Married with 2 young children

Let’s walk through Ethan’s financial journey together and see how high cash value life insurance can be a game-changer for you too. Imagine you’re in Ethan’s shoes – you’re 30, married with two young kids, and running your own business. You’re doing well, but you want to make sure your family’s future is secure and your wealth keeps growing.

Let’s Look at Ethan’s Policy Growth*

Impressive, right? Let’s break down what this means for you:

- Family First: From day one, your family has over $729,000 in protection. By year 16, that’s nearly $2 million! Talk about peace of mind.

- Your Money, Growing: See how your cash value takes off? By year 10, you put in $25,000 and your cash value grows at $37,288, which is $12,288 more than what you’re putting in. That’s your money working for you! And look what happens in year 16. You pay your premium of $25,000 and your cash value grows at $50,391, which is more than double what you paid into your policy. So you cash on cash return in year 16 is over 100%!

- Borrow Smart, Grow Faster: Here’s a cool trick – you can borrow against your cash value without paying taxes on the gains. It is your Financial Swiss Army Knife. This policy isn’t just about protection. It’s a tool you can use to grab opportunities when they come up. Stock market or Bitcoin dip? Real estate deal? You’ve got funds ready to go.

- Snowball Effect: Notice how both your cash value and death benefit keep growing? That’s the magic of compound growth, my friend.

- Instant Net Worth Boost: That death benefit? It’s like giving your net worth an immediate upgrade, closer to what you’re really worth (because let’s face it, you’re priceless to your family).

- Inflation? No Sweat: As your death benefit grows, it helps keep pace with rising costs over time.

What Does This Mean for You?

- You’re Covered: Your family’s financial future gets more secure every year.

- Your Money Multitasks: While it’s growing, it’s also there for you to use. Need to invest in your business or grab a hot investment? Your policy’s got your back.

- You’re in Control: Unlike other investments, you decide when and how to use your money. No need to sell at a bad time just because you need cash.

- Tax Perks Galore: Borrow against your policy? No taxes. Death benefit to your family? Tax-free. Keep Uncle Sam out of your (and your families) pocket.

- Legacy Locked In: You’re not just growing wealth; you’re creating a legacy that can last generations.

Let’s Sum It Up

Look, we know everyone’s financial journey is unique. But whether you’re focused on growing your business, securing your family’s future, or building long-term wealth (or hey, why not all three?), a strategy like Ethan’s could be your financial secret weapon.

Consider how infinite banking creates balance in your financial life. You want protection for your loved ones, but you also need your money to grow. You require flexibility to seize opportunities, yet you crave stability and certainty. That’s precisely what we’re seeing in Ethan’s case – one strategy delivering multiple benefits.

Remember, this is about creating options for yourself, security for your family, and opportunities for your future. It’s about sleeping better at night knowing you’ve built a financial system that works hard for you around the clock, even when you’re not thinking about it.

The real power lies in transforming how your money works – from passive storage to an active financial engine that serves multiple purposes simultaneously.

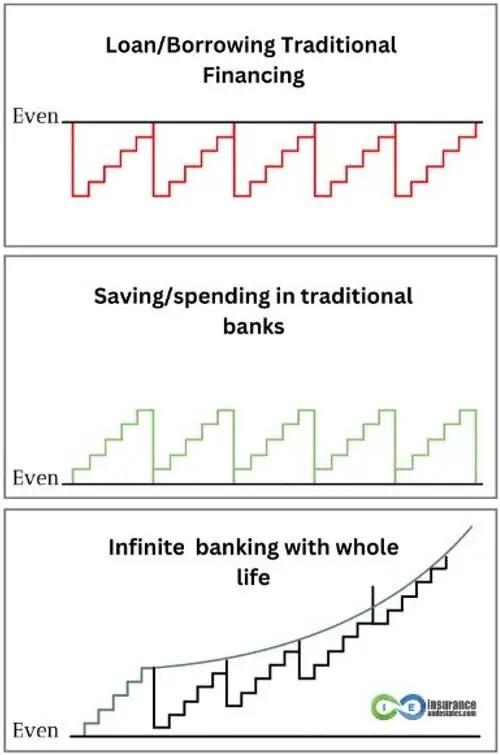

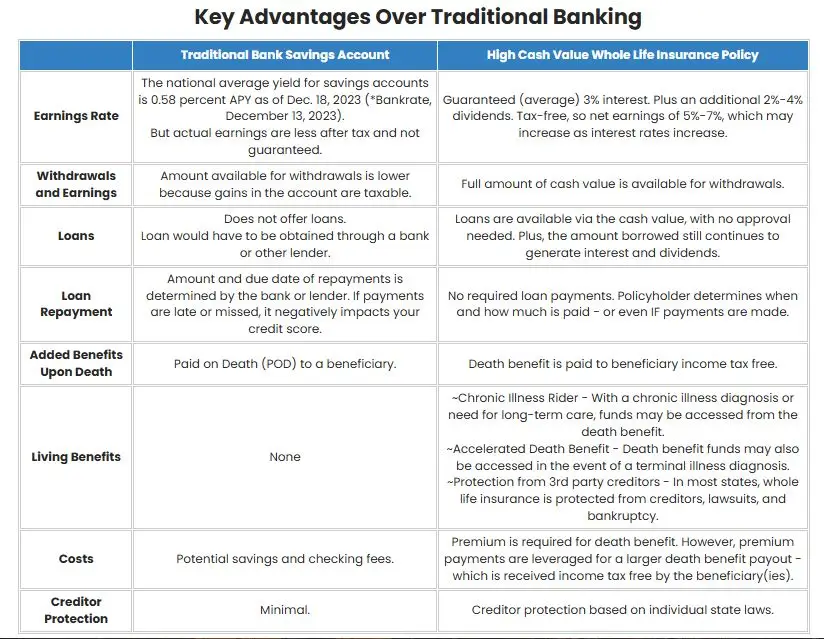

6. Comparing Infinite Banking Vs Traditional Banking Methods

The graph below visually illustrates the fundamental difference between traditional financing, conventional banking, and infinite banking using whole life insurance.

In the top panel, traditional borrowing creates a “sawtooth” pattern where you build wealth and then deplete it each time you borrow, constantly resetting your financial progress. You never truly get ahead because each loan depletes your capital.

The middle panel shows traditional saving and spending patterns. While there is some growth over time, frequent withdrawals from savings accounts interrupt compound growth, creating a stepping pattern with limited upward momentum.

The bottom panel demonstrates why infinite banking is so powerful. When you borrow against your policy (rather than from it), your entire cash value continues growing uninterrupted. Even as you take policy loans for investments or expenses, the underlying growth trajectory remains upward. This allows your wealth to compound continuously despite periodic borrowing, creating substantially greater long-term growth compared to traditional methods.

This is the essence of “making your money work in two places at once” – your policy value keeps growing even while you’re using those funds elsewhere through policy loans.

Another thing to consider is where do your store your money. You may have your money in 401ks, IRAs, or investment accounts, but you most likely also have your money sitting in a bank. However, consider the following benefits of storing your cash in high cash value whole life insurance policy vs a traditional bank savings account.

7. Pros of the Infinite Banking Concept

This section delves into the numerous advantages this financial strategy offers that we have experienced first hand by practicing Infinite Banking ourselves.

1. Non Correlated Asset

Imagine having part of your money in a safe harbor that doesn’t rise and fall with the stock market or housing prices. That’s what whole life insurance offers, a financial foundation that remains steady regardless of market volatility.

Your foundational money deserves a protected home. Whole life insurance provides just that, with guaranteed cash value growth year after year. Think of it as your “safe bucket,” a reliable asset that helps shield you from financial storms while creating stability in our often unpredictable world.

This protection becomes especially valuable during retirement. When markets drop 20-40% (and they will), the last place you want to draw income from is a depleted investment account. That’s when your high cash value whole life policy truly shines, offering an alternative income source during market downturns without forcing you to sell investments at a loss.

By having this steady foundation, you gain both peace of mind and the freedom to confidently pursue opportunities when they arise, knowing your financial core remains protected.

2. Improves cash flow and liquidity

When you strategically use a whole life insurance policy with the infinite banking concept, you significantly enhance your cash flow and liquidity. Your policy serves as a financial asset that delivers true compound interest growth in a tax-advantaged environment.

Let’s compare this to equity in real estate. How accessible is the equity in your home or investment properties? Not very. To tap into real estate equity, you must either sell the property outright, qualify for a HELOC, or go through the complex process of a cash-out refinance.

In contrast, with your infinite banking policy, you have immediate and unrestricted access to your cash value. Accessing your money is remarkably simple – just call your insurance company and request a check. Within days, you’ll have the funds in hand. No qualifying. No property appraisals. No credit checks. No paperwork hassles.

This instant liquidity gives you the freedom to seize opportunities or handle emergencies without the delays and hurdles that come with accessing equity in other assets. You maintain complete control over your money, using it when and how you choose, while it continues growing even as you borrow against it.

3. Personal Banking System

Another benefit of infinite banking is that you are in control (i.e. the owner and operator) of your own personal banking system. You are using life insurance as your own bank as you become your own banker.

Becoming your own banker means you can:

- take a loan on your *money,

- purchase other assets

- use your new asset to pay back your policy loan, and

- you then repeat the process ad infinitum.

*And don’t forget that even with an existing loan, your entire infinite banking policy’s cash value balance is still growing due to guaranteed returns and dividends.

4. Tax Advantaged Compound Interest

With an infinite banking strategy you are placing your equity into a tax-advantaged storehouse for later use. The cash in your storehouse is in a true compound interest account because you are never paying taxes on gains. And to avoid ever paying taxes on your infinite banking policy’s growth and keeping your principal intact you can access your money through tax-free loans.

5. Leverage

Life insurance provides a tax free death benefit for your beneficiary. Although a death benefit is not the main focus of an infinite banking strategy it does provide a leveraged tax free payout to a loved one should you die prematurely, which provides peace of mind knowing that your loved ones are taken care of if you die young. And your death benefit will grow over time, so that the older you get the greater the legacy you leave behind.

6. Tax Deferred Dividend Growth

Your whole life insurance policy’s cash value offers tax-deferred growth, giving you a significant advantage over taxable accounts. Even better, you can completely avoid ever paying taxes on this compound growth by accessing your money through life insurance loans rather than withdrawals.

The policy provides guaranteed cash value growth, ensuring your money continues to compound consistently year after year regardless of economic conditions. This guaranteed component creates a solid foundation for your banking system.

Beyond these guarantees, your cash value grows further through life insurance dividends. While dividends aren’t guaranteed, the top mutual insurance companies recommended for infinite banking have remarkable track records – most have paid dividends every single year for over a century, even through the Great Depression, world wars, and financial crises.

When you receive dividends, you can use them to purchase additional paid-up life insurance. This strategy allows your dividend payments to go directly back into your policy, accelerating your cash value growth and simultaneously increasing your death benefit. This compounding effect becomes increasingly powerful over time, enhancing both the living benefits you can access and the legacy you’ll eventually leave behind.

7. Tax Free Access to Your Cash Value

You have tax free access to your cash value through life insurance policy loans. providing the following benefits:

- Your entire cash value account balance included the portion used as collateral for your loan keeps growing tax-deferred in your policy.

- You can repay your loan whenever you want, or not at all—you’re in charge of the rules. However, it’s advisable to at least cover the interest.

- You decide on the repayment schedule, whether it’s yearly, monthly, quarterly, or not at all.

- With top cash value companies, you’ll face a low-interest rate on your policy loan, often comparable to what your policy earns, effectively making it a “wash” or “zero-net interest” loan.

- You can take out a policy loan anytime, for any reason, without a credit check or the need to qualify. This loan is private, won’t appear on your credit report, and won’t affect your credit score.

- Unlike loans from traditional retirement savings plans like 401(k)s, there are no penalties for taking a life insurance loan.

8. Guarantees

Whereas other types of permanent life insurance involve some level of risk, whole life insurance provides guarantees, which is the opposite of investment risk. And when your money is getting a guaranteed return year in and year out, it takes the pressure off of you to rush into potentially bad investment opportunities.

Whole life insurance guarantees:

- Guaranteed cash value accumulation

- Guaranteed death benefit

- Guaranteed fixed premiums

- Guaranteed compounding interest rate growth

9. Private

For many asset classes, your financial information is surprisingly accessible to the public. Running a credit report or title search reveals significant details about your financial holdings and activities. This transparency may be uncomfortable for those valuing financial privacy.

In contrast, whole life insurance offers a remarkable level of privacy. Your policy’s information – including the cash value you’ve accumulated – remains confidential and doesn’t appear on standard financial reports or searches that others might conduct.

Furthermore, when you take out a policy loan as part of your infinite banking strategy, this transaction stays completely private. Unlike traditional loans that appear on your credit report and potentially impact your credit score, policy loans remain between you and your insurance company. This provides an exceptional level of financial privacy in an era when most financial transactions are increasingly tracked and reported.

For individuals concerned about financial privacy, this confidentiality represents a significant yet often overlooked advantage of implementing the infinite banking concept using whole life insurance.

10. Creditor Protection

There are many states that provide creditor protection for life insurance. So, if you are faced with some financial strife, your cash value may be sheltered from creditors. Additionally, if you are sued, your money in your policy may be protected from a judgment.

Note: This map is based on available information and is not legal advice and you should consult with an attorney in your state if you have any questions regarding the below information.

8. Cons of the Infinite Banking Concept

1. Cost prohibitive

While the infinite banking concept can seem challenging for those on tight budgets, there’s a practical threshold to make it truly effective – around 10% of your income or at least $300 monthly. This investment is what allows the strategy to generate meaningful results over time.

The good news? Many people have “hidden money” flowing through the cracks in their financial lives. Our team specializes in identifying these overlooked funds, whether it’s unnecessarily high insurance premiums, inefficient debt structures, or spending patterns that could be optimized.

We’ve helped countless clients discover money they didn’t realize they had access to, making infinite banking affordable without requiring dramatic lifestyle changes. This financial “excavation” often reveals enough to fund a policy while maintaining your current standard of living.

Remember, implementing infinite banking isn’t about stretching your budget to the breaking point – it’s about redirecting existing money flows more efficiently through a policy that builds wealth while providing flexibility and protection.

2. Mandatory Annual Payments

While infinite banking policies do require premium payments to stay in force, there’s a smart way to design your policy for flexibility during financial ups and downs.

The key is structuring your policy with a small required base premium (just 10-20% of your total contribution) and allocating the majority (80-90%) toward paid-up additions, which are optional.

Here’s how this might work in practice: Your policy could have a required monthly payment of only $200, while allowing optional contributions up to $1,000. When money is tight, you simply make the minimum $200 payment to keep your policy active. When your finances improve, you can fully fund your policy up to the $1,000 maximum to accelerate your cash value growth.

This flexibility provides a safety valve during challenging financial periods while still allowing you to maximize growth when possible. It’s a practical design feature that acknowledges the reality of fluctuating incomes and unexpected expenses that everyone faces at some point.

3. Creditor Protection Variances

As you can see on the chart above, not all states have the same creditor protections, so this is a drawback to infinite banking if you live in a state where you have limited protection, if any. The good news is, if you ever move to a state with better creditor protection you will be granted that states protection, rather than have to adhere to your old states lack of protection.

4. Requires discipline

The infinite banking concept is for a disciplined individual focused on seeing this through to the end. As Nelson Nash would say, You have to be an “honest banker.” The long term growth of your policy’s cash value is fueled by borrowing against your policy AND PAYING IT BACK! If you don’t pay back your policy, you will slow the growth, and ultimately miss out on maximizing your policy to pass on as a legacy.

5. You Have to Qualify

Infinite banking involves getting the right cash value life insurance policy. And as with any life insurance policy, you must qualify by taking a life insurance medical exam. And if you have health issues, it may be harder for you to qualify for an infinite banking policy. One work around is to get life insurance policies on children and grandchildren and teach them infinite banking financial principles.

6. Funding Lag Time

When starting an infinite banking policy, be aware that it takes time for your cash value to equal your total contributions. Depending on your policy structure, this equilibrium point typically occurs around years 4-7.

This is an important consideration if you need immediate access to all your contributed funds. During these early years, your accessible cash value will be less than what you’ve put in.

This initial period is an investment in your long-term financial strategy. The policy is building its foundation during these years, setting the stage for accelerated growth later on. As your policy matures beyond this break-even point, you’ll likely find the benefits – tax-advantaged growth, liquidity, death benefit protection, and the ability to finance your own opportunities – far outweigh the initial period of reduced accessibility.

7. Not Diversified

When you establish an infinite banking policy, you’re not merely putting all your money into a single investment – you’re creating a financial infrastructure that actually enhances diversification in a more strategic way.

The guaranteed elements of your policy – guaranteed cash value growth, guaranteed death benefit, and guaranteed fixed premiums – provide financial certainty that acts as your stable foundation. This stability eliminates the conventional need to diversify for risk protection within this portion of your financial plan.

The real diversification happens at the next level: when you use your policy as a financing system to acquire other assets. By borrowing against your policy to invest in real estate, business opportunities, stocks, or other cash-flowing investments, you’re actually practicing a more sophisticated form of diversification.

This approach gives you the best of both worlds – the guaranteed growth and protection of your banking foundation plus the potential higher returns from diverse investments you finance through that foundation. Rather than breaking the diversification rule, you’re applying it at a higher level while maintaining control and enjoying tax advantages that traditional diversification strategies can’t offer.

9. Infinite Banking Examples

We have many infinite banking webinars available. Below are two infinite banking examples where we demonstrate how the principles of Infinite Banking come alive in everyday lived out scenarios.

Real Estate Investing with Infinite Banking

Here is a real life case study of a real estate investor using high cash value whole life insurance and infinite banking to maximize real estate returns.

- The whole life insurance policy is utilized as a conduit to run transactions through, so that you are earning compound interest on your whole life policy’s entire cash value account balance, and you are also making money on the real estate investment.

- You can then use the cash flow from your real estate investment to pay down your whole life insurance loan, which allows you to use your cash value again for when the next investment opportunity presents itself.

- You may also plan on flipping the property, so you can wait on paying back the loan until you have sold the property.

Debt Relief Using Infinite Banking

In this case study on using life insurance to pay off debt, the Infinite Banking Concept is applied to eradicate $30,000 of credit card debt through a strategic approach involving a properly designed whole life insurance policy.

- Initially, the total debt is assessed and excess payments beyond minimums are redirected into a high cash value whole life insurance policy, establishing a growing cash reserve.

- This reserve is then utilized to systematically pay off credit card debts starting with the smallest balances, employing the debt snowball method to build momentum.

- As debts are cleared, funds allocated for those debts enhance the whole life insurance contributions, thereby accelerating the policy’s cash value and facilitating larger repayments.

- Continuous monitoring allows for adjustments, leveraging additional income sources to expedite the process.

- Following the clearance of credit card debts, the focus shifts to repaying the policy loans.

The strategy not only resolves debt but also sustains contributions to the whole life insurance policy, serving as a financial growth tool and ensuring a legacy through its death benefit, thereby providing both immediate financial relief and long-term financial security.

10. Ten Steps to Set Up Infinite Banking

To be your own banker you would want to implement the following 10 steps:

- 📚Education: Before you take any of the steps below it is important to gain a certain level of understanding about how Infinite Banking works. We recommend you familiarize yourself with the infinite banking concept by reading Nash’s book and watching our many videos on the subject.

- 💰Financial Goals: Another important point is to reflect on your long-term financial goals. Consider how implementing the Infinite Banking Concept aligns with these objectives, including retirement planning, wealth accumulation, or debt management.

- 🤝Consult with a Professional: It is also highly advisable to consult with an infinite banking professional, such as our Pro Client Guides, who have years of experience designing and implementing this strategy. They can provide tailored advice based on your financial goals and situations, drawing form their own lived out experiences and expertise.

- 🛡️💲Cash Value Life Insurance: Make sure you choose the best cash value life insurance policy. In our experience you want a high cash value whole life insurance policy from a mutual insurance company, although we have had clients find success with indexed universal life insurance.

- 📄Life Insurance Riders: The riders for your infinite banking policy dictate how much early cash value you will have available. Finding the correct blend of base premium and paid up additions is key. There may also be a need for a term rider on your policy so that you avoid your policy becoming a MEC.

- 💵Fund your Bank: You may choose to pay monthly or annually. You also may want to put in a large lump sum payment upfront. And you may qualify for backdating your policy to save age, which allows you to fund the policy with more money in the first year than you normally would be able to.

- 💰Finance Your Purchases: Look for investment opportunities, such as paying off debt or buying real estate, business ventures, or dividend paying stocks. You can borrow against your cash value and use the funds to purchase other assets or eliminate bad debt. And the best part is that the money in your whole life insurance policy’s cash value account is still compounding, so you are making money on your entire cash value balance and in the investment opportunity you used the loan to purchase, that way your dollars are working in two places at once.

- 🔄Recapture Your Money: Pay your loan back, with interest, as if you were actually recapitalizing your own bank. This way you pay back your loan as quickly as possible, so that you can move forward with the next step.

- ♾️Repeat the Process: The infinite banking concept is about keeping money momentum going. Once you get started, keep at it. And over your lifetime you will have acquired other assets, as well as growing your cash value and death benefit.

- 📜Plan Your Estate: There is a good chance you will have acquired a sizeable estate, so good estate planning is necessary to make sure you pass on your legacy. This may look different for one person to the next, but whether you plan to leave your estate to family or charity, it is important to plan ahead so that your family or charity can receive the full extent of your disciplined work.

11. Best Infinite Banking Companies

The key to finding the best infinite banking companies is to understand the nuances of each company, such as the different riders available and policy design variables, to structure the most efficient policy designed for maximum cash value access and growth.

12. Conclusion and Next Steps

An infinite banking strategy requires a shift in mindset as you step out of traditional roles as a passive saver and step into the empowering position of becoming your own banker. It’s about taking control of your financial future, not through complex market maneuvers, but through a simple shift in how you use and grow your money.

An infinite banking strategy requires commitment, discipline, and a willingness to think differently about personal finance. The rewards are worth the effort, which are greater financial control, peace of mind, and the satisfaction of knowing that your financial strategy is proactive, not reactive.

As we conclude, remember that the Infinite Banking Concept is a journey, not a destination. It’s a continuous process of learning, applying, and refining a strategy that aligns with your personal financial goals and values.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

13. Frequently Asked Questions About Infinite Banking

Is infinite banking a scam or legitimate financial strategy?

How does infinite banking perform during economic recessions?

Can I use infinite banking to fund my child’s education?

What happens to my infinite banking policy if the insurance company fails?

How does infinite banking affect my retirement planning?

Can I convert an existing whole life policy to an infinite banking policy?

What’s the difference between infinite banking and the LEAP system?

How long does it take to see meaningful results from infinite banking?

56 comments

Jay Ram

Amazing articles here. My wife and I learned about Infinite Banking and were VERY dubious at first. But after extensive research, we are certain this is perfect for our needs. Who would I reach out to for more info? I’ve tried contacting through the info@ email address a couple of times but haven’t gotten a reply. Glad I found your site with all these great articles on Infinite Banking and hope to speak soon.

Steven Gibbs

Hello Jay and thanks for connecting! Go ahead and reach out to Barry Brooksby by requesting a call at barry@insuranceandestates.com.

Best, Steve Gibbs for I&E

Steven Gibbs is a licensed insurance agent, and the following agent

license numbers of Steven Gibbs are provided as required by state law:

Resident License; AZ agent #17508301,

Non-resident Licenses: TX agent #2273189, CA agent #0K10610,

LA agent #769583, MA agent #2049963, MN agent #40563357,

UT agent #655544.

Bwhite

I don’t see the part about direct and non direct recognition. Wouldn’t non direct work better with policy loans? Especially if there are multiple loans over time? Love some feedback.

SJG

Direct vs non-direct recognition is debated amongst IBC professionals. Don’t think the question of multiple loans is a huge concern, though again this could be debatable. In my experience, non-direct carriers pay higher dividends on average so perhaps it evens out. I don’t think this is a major determining factor in selecting top companies.

Best, Steve Gibbs for I&E

Brent white

If in had 100k and borrowed 80k it seems like non direct recognition would make a significant difference. This is me just talking I do not the the exact answer. I really want to look at the numbers to see. I’m a big fan of guardian life insurance but I would love to see this compared to say a Lafayette life. Thank you for you incredible article. I’m going through the Nelson Nash Institute as we speak. See at the think tank!

Evelyn

Would it be smart to take a HELOC to pay debt first to have more cash available and then open a Wholelife insurance?

SJG

Hello Evelyn, this is a financial question that is tough to answer in a blog post setting without a better understanding of your financial picture. Alot could depend on the interest rate on the HELOC yet other concerns should also be factored in. Best to schedule a call with one of our pro-team members and a good start would be emailing Denise at denise@insuranceandestates.com.

Best, Steve Gibbs for I&E

Bryce

I’m interested in knowing more about infinite banking. Could I set up a meeting time to discuss it?

Insurance&Estates

Hello Bryce, if you haven’t yet connected with someone, go ahead and request a call from Barry Brooksby at barry@insuranceandestates.com.

Best, Steve Gibbs for I&E

UK Investor

Hi there. I noticed that all your products (and those online) pertaining to the IBC are US based. Are there any practitioners you are aware of or any information available of IBC implementation in the UK? I also noticed that you did not answer the question asked in your comments about this above. I(/we, your UK based readers) would appreciate your experienced view on this please. Thank you, in advance of course.

Insurance&Estates

Hello, we can offer products to overseas folks under certain conditions. To inquire further, go ahead and request a call with Barry Brooksby at barry@insuranceandestates.com if a team member hasn’t already reached out to you.

Best, Steve Gibbs for I&E

Jeffery Barker

I’m about to sell my home in Phoenix Arizona and move back to property that I own in Texas I was wondering how I would go about taking the proceeds from the sell of my house and investing in whole life insurance to start my own IBC and was wondering if you could reach out to me to get me in touch with someone in this area that I could talk to that would help me with the the money or the proceeds that I’m going to get an investing it into such a program

Insurance&Estates

Hello Jeffrey, if you’re talking about your primary home, you may be able to just take the proceeds and invest them in a policy if your homestead tax exemption applies. This can all be worked out in a zoom consultation. To start that process, go ahead and email our IBC expert Barry Brooksby to request a meeting at barry@insuranceandestates.com.

Best, Steve Gibbs for I&E

Lance Daugharty

Good evening after reading your thorough report I would like to speak with Barry at his earliest convenience to get some verbal information on this matter. Thank you for your time.

Insurance&Estates

Hello Lance, thanks for connecting. If you haven’t yet received an email or call from Barry, go ahead and request a call by emailing him at barry@insuranceandestates.com.

Best, Steve Gibbs, Esq.

ify

Hello.

My husband and I are interested in opening accounts but need directions. Pls help.

Insurance&Estates

Hello, thanks for connecting. A great first step is to request a call with our IBC expert Barry Brooksby at barry@insuranceandestates.com.

Best, Steve Gibbs for I&E

Troy Claiborne

I am interested in opening a whole life insurance policy.

Insurance&Estates

Hello Troy, thanks for connecting. To get started, go ahead and email Barry Brooksby to request a call at barry@insuranceandestates.com.

Best, Steve Gibbs for I&E

Reasonable Check

What a novelty! An insurance advocate promoting the most expensive insurance policy out there. While some points about IBC are certainly valid, e.g., liquidity compared to other investment options like real estate and certain stock market investments, other concepts are skimmed over without much deliberation. How about where someone puts in $1k a month and you say, “At the end of year one, they would have nearly $10,000 in cash value available.”? Let’s say you’re not stretching and you’ve actually paid only $2k for the policy at that point. I’m a 35 male who pays less $500/year for a $500k (twice the value of your example’s policy) term policy. I take my $11.5k, including my $1.5k savings over whole life and invest where I see fit. If I plug that into an index fund where history tells me I’ll average 8% or better, accounting for boom AND bust years, and I have an account value of ~$12.5k. I’m now $2.5k ahead of your example. Sure, you’ll say, but it could also lose money and IBC using whole life is more secure with flexible loan options. My question is, how are AIG, Berkshire, Humana, Zurich and all the other insurance providers able to offer these plans with the interest gaining account balances? What devices do they use to make money with all those premiums? Seems to me like I saw a lot of them getting into some financial trouble with their investment selections sometime around 2007-08. I think they were called mortgaged-backed securities? If you give your money to those who then go and invest in the stock market (because the returns are much better than IBC), have you really safeguarded your money at all? I’d ask AIG customers how secure they felt before Uncle Sam stepped in and kept the company holding their “infinite bank” funds from going belly up. Also, you stated, “Consider that normal stock market returns are taxed around 20% or more.” This is only true for those investing for less than 1-year. You can’t just compare the least desirable aspects of the stock market with the most desirable of IBC and be considered impartial. Capital gains (gains on investments over 1 year) will limit the average person’s taxes to 15%, and that’s only for non-tax benefited, i.e., NOT 401k’s and IRA’s which both have tax benefits. Also left out that those yields you noted in whole life policies are likely non-guaranteed and the guaranteed yield on your accounts is probably closer to 1-2%, with the POTENTIAL to make 5-6%, which is still less than average annualized return of the stock market (8-10%). To those still reading this comment, I’m sorry for the long post, and please use an investment strategy other than IBC. Buy a term policy to protect your loved ones instead, or at least review other financial resources/forums where they are not trying to directly sell you the product/service being discussed.

Insurance&Estates

Dear Unreasonable Cynic, I am an estate planner first and have been advocating for permanent life insurance solutions for years and really not for the purpose of “selling products”. There is nothing original in your commentary – just typical trashing of insurance products with the end game of promoting Wall Street based investing. Worse part is, this isn’t constructive. Mutual whole life companies didn’t get in trouble in 2007-2008 and by the way, all of Wall Street was in trouble around that time, no? You’re even admitting here there are some valid points about IBC. I encourage you not to fall into the trap of advocating 1 size fits all solutions. Saying things like “buy a term policy to protect your loved ones…” How about for those who follow your advice until their term expires and health issues prohibit getting coverage? I’ve observed folks in this situation when life insurance is needed for liquidity. Your “by the numbers” attack approach lacks reasonableness. There is no one size fits all.

John

I hear a lot about the ibc concept but this is always from North American sources. Is there any information for those of us in the UK?

James

“loan money out to your own company,

charge your company interest,

then your company pays you for the use of your money,

your company can write off the interest,

you recoup the interest, which

you use to pay back your policy loan, and

you then repeat the process ad infinitum.”

When I get the interest from my own company, do I need to pay tax? If so, I need to charge much higher interest rate to my own company to pay back my life insurance company to break even.

Insurance&Estates

Hello James and thanks for commenting. The short answer is that you need to be careful when considering writing off interest from a policy loan to your company. Barry Brooksby can talk with you about this in detail and you can e-mail him at barry@insuranceandestates.com to request a call.

Best, Steve Gibbs for I&E

Bolu

Quick question:

Say I have a policy of $250,000 and a premium of $500 per month. After 12 months of contributions, I’d have contributed $6,000. Say I take loan of $10,000 against that policy,

1. Will it be possible to take a loan more than what I have contributed so far?

2. What will the repayment plan for the $10,000 loan be?

3. Am I at liberty to determine my repayment amount and duration?

4. Say I am paying back $1,050 over 10 months (principal & interest), does that mean I need to be paying $1,550 every month now, being Premium and repayment?

Looking forward to reading your answers.

Insurance&Estates

Hello and thanks for commenting. Your illustration is bit problematic because these policies include a base premium and paid up (cash) additions. The rate at which cash value builds varies between policies and companies, so an actual illustration would be required to meaningfully address how much of a loan you can take after 12 months. Generally though, you would NOT be able to borrow more than contributed in a 12 month period. The repayment plan on a policy loan is whatever you decide to pay back; however, we encourage folks to pay at least what they would be required to pay in a conventional loan. For a more specific look at this, I encourage you to check in with Barry Brooksby at barry@insuranceandestates.com and have an actual illustration prepared.

Best, Steve Gibbs, for I&E

Bolu

Thanks Steve.

I will reach out to Barry promptly.

Guy A

What if you are in your 60’s. Can you pay one large single premium and be up and running ?

Insurance&Estates

Hi Guy,

Paying one single premium creates a modified endowment contract, which is not ideal. Instead, paying into your policy over a number of years is usually the best route to take full advantage of the various life insurance tax benefits and incentives under the tax code.

Best,

I&E

Adolfo

So, what’s the advantage for someone age 66, retired, with a mixed portfolio of IRAs (traditional and Roth), real estate, and savings totaling roughly $1.8M?

Insurance&Estates

Hello Adolfo and thanks for your question. The advantage would be to create predictable estate growth through WL guarantees for at least a portion of your assets, to an extent not possible with IRAs AND creating tax advantages due to flexibility of policy cash value and option for policy loans AND due to non-taxed death benefit passing to heirs.

If you’re interested in exploring options in more detail and obtaining specific examples (scenarios) connect with Barry Brooksby at barry@insuranceandestates.com.

Best, Steve Gibbs for I&E

Jc

Life insurance loans can be taxable. There are taxable events so every situation needs to be looked at carefully before doing this.

Insurance&Estates

Hello John, thanks for commenting. While I agree that every situation needs to be looked at, I’m not aware of one where a policy loan was taxable. This is simply a matter of the IRS definition of what constitutes income in my experience and if it is a “loan”…

Best, Steve Gibbs for I&E

Andrew

The possibility of being taxed on a life insurance loan is next to none. The IRS cannot charge taxes on debt. It is similar to the way you can perform a cash out refinance on your home and take money out of your home’s equity as debt that cannot be taxed

Thomas Major

I’m guessing the author mistakenly forgot to mention the pro related to paying simple interest on loans like home loans, versus giving a devil what typically can equal 100% interest fee on a 3.5% compound interest loan.

Insurance&Estates

Hi Thomas, excellent point and thanks for reading.

Best, I&E

Brian Terry

Would a 401 k plan borrowed against and repay loan – it’s also tax free and you are “paying yourself “Interest. The 401k account can be in a non market fund eg stable value bonds or money market to ensure no stick market volatility. There is zero cost with this , but no insurance or DB but there are other ways to cover that

Thanks

Insurance&Estates

Hello Brian, thanks for commenting. You can check out our article on 401k loans and withdrawals: https://www.insuranceandestates.com/401k-withdrawals-and-loans/

for a better idea on this as well as our article on policy loans: https://www.insuranceandestates.com/life-insurance-loans/. Point being, 401k loans come with many repayment conditions and thus are not what they’re cracked up to be. When you answer this, you might not be as concerned about replacing the DB given the “night and day” difference with policy loans which are entirely flexible and totally liquid. Just my opinion.

Best, Steve Gibbs for I&E

Phuoc

You say that IBC is independent from whole life insurance. OK. What other vehicle(s) could I utilize to implement this? Everything I read in the PROs except non-correlated asset I can achieve without using a whole life policy and non-correlated asset is a non-issue in terms of importance in the long run.

Insurance&Estates

Hello and thanks for commenting. It is our finding that whole life is the best vehicle for IBC due to its numerous attributes discussed in the article. When you’re mentioning another vehicle its unclear what you mean. If you’re aware of another asset that works better than whole life for IBC, we would be very interested to hear about it. As I’ve often said, think about whole life like a piece of real estate, with a minimum guaranteed return, plus likely dividends based upon 100+ years of history, plus tax free accumulation + liquidity + leverage. When you try to swap for other assets you run into unpredictability in terms of growth and costs.

Best, Steve Gibbs for I&E

Philip Battaglia

What is the difference of using whole life and IUL for this strategy and can you explain why one is better than the other.

Thanks

Insurance&Estates

Hello Philip, thanks for reading and commenting. This would be a small novella to answer in a blog post. I suggest connecting with Barry Brooksby who is our infinite banking expert at barry@insuranceandestates.com and we’ve asked him to reach out to you as well.

Best, Steve Gibbs for I&E

Terry Harrell

Hi.im Terry can i draw all my money out my 401k while I’m still working a 6 to 4 to invest in my bank

Insurance&Estates

Hello Terry, thanks for commenting. Withdrawal from a 401k is a taxable event and may be subject to a penalty if you’re a younger person. Still, there are cases where it makes sense to withdraw and this should be discussed in a confidential setting with an expert.

Best, I&E

Joel Garcia

when you pull all of your 401k out, it is taxable and usually penalized for up to 50%.

Joel G

SJG

Hello Joel, thanks for commenting. We actually do NOT recommend that people “pull out all of their 401ks”. That said, the actual tax ramifications would be the 10% penalty if you’re younger plus whatever the taxes are based upon your bracket. With this in mind, there are cases where it may be advisable to convert a portion of tax deferred assets now and pay taxes at current rates vs later when taxes may be higher. There is also the ongoing question of whether you want to pay taxes on the seed or the harvest. It’s common knowledge in the estate planning world that qualified accounts are extremely inflexible in older years. RMDs are required and often force retirees into higher tax brackets. I suggest that you ponder these truths because there is a widespread idea not ever touch your 401k. Where does this ardent conviction come from? I’ll let you speculate.

Best, Steve Gibbs for I&E

Steven Gibbs is a licensed insurance agent, and the following agent

license numbers of Steven Gibbs are provided as required by state law:

Resident License; AZ agent #17508301,

Non-resident Licenses: TX agent #2273189, CA agent #0K10610,

LA agent #769583, MA agent #2049963, MN agent #40563357,

UT agent #655544.

Paige

Could you explain when it would be beneficial to draw down a 401k and put into an IBC policy?

Insurance&Estates

Hello, thanks for inquiring. Reach out to one of our experts, Jason Herring, at jason@insuranceandestates.com and send a preferred phone contact and best time to call if you haven’t connected with him already.

Best,

I&E

kevin Gardiner

thanks team if i lived in the usa i would use your services

Dwayne

Need the information for estates planning.

mike z

Hello. I am xx male non smoker looking to set up a ten pay whole life participating life insurance. I intend to drop a term policy I have once this is set up. My timeline is to start drawing down my 401K @ 59.5 pay state and local taxes and invest xxxxx per year. I locked in my 401K balance in a fixed return investment currently xxxxx @2.5% . I’m planning to work till 67yrs I’m married 3 kids 5,7,14 yrs old, Spouse 54 homemaker . We are currently funding a indexed whole life policy for spouse xx per year with similar guaranteed returns and accessible cash value thru loans. I’m looking at your plan to offset xx year old son’s college costs in 4 or 5 years. Included in my 401K balance is about xx Roth funds 100% vested, over 5years old. I’m not ready to buy today but like to get info . Thanks Mike Z

Steven T

Hello Steve Gibbs,

Great videos!!! New business owner, also about to get my Realtors license (WA), yet still keep my Clark Kent as IT Lead in the Financial business space. I am also married, 21 yrs, w/ home technician (also new business owner) and three kids: 15,12 and 9. So I want to start with 3 UIL and 3 WLP (2 for me; 1 for wife) as my base contributing 12K -15k per year for each WLP and 5-7k per year for UIL. Afterward, would like to broker (seek my WA insurance lic.) – possibly a part of your team as I am with many clients to follow my lead. I want flexible premiums, best life benefits and riders as well as keep my fees minimal with dividends eventually paying ALL overhead. Please call me or send follow-up e-mail to inlikeu@hotmail to get started. Timeline to start: 11/30/18. Thank You in advance, Steve T

Insurance&Estates

Hello Steven!

Thanks for your enthusiastic feedback and interest in starting your planning and potentially working with our I&E Pro Client Guide team. Given your various interests, I’d like to have Jason Herring reach out to you. He is our most experienced Guide for IUL products and he works with new agents who are interested in affiliating. The catch is that he’s on a mission trip to Honduras right now so his response time won’t be as efficient as usual. I’ll pass your information to him and just ask that you give him some time to respond.

Best to you.

Steve Gibbs, Esq.

Jack Maverick

This is one of the few really coherent and illuminating articles that I’ve read on the subject of “infinite banking” – whoever scribbled it, great job.