What is Private Family Banking?

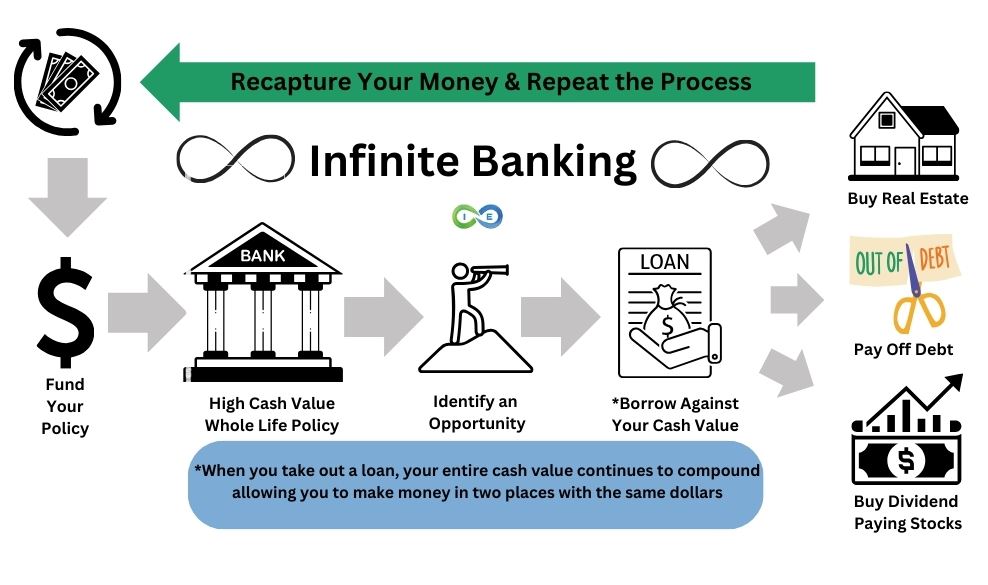

Private family banking is a personal finance strategy designed as an alternative to the traditional model of turning to banks for capital preservation. The the idea is to use a properly designed dividend paying whole life insurance policy from a mutual life insurance company as a source of easily accessible liquidity that can be tapped without diminishing the growth-earning capacity of your existing cash value. Private family banking provides a personal and family-based financial planning strategy that leverages cash value stored within your whole life insurance policy to exponentially grow your wealth as you become your own banker.

Infinite banking, becoming your own banker, the “bank on yourself” approach, and private family banking are all variations on this central theme: by developing your own private family bank using life insurance, you are enabling long-term wealth expansion in an life insurance asset that offers tax benefits, guaranteed growth, and a leveraged death benefit, that provides the unique opportunity to leverage your dollars in two places at once.

When you practice being your own banker using a whole life insurance policy, you are not literally chartering a family bank to fund purchases and investments. Instead, you are using a whole life policy as your own bank to participate in private family banking, rather than using a traditional bank. Consider the following benefits of using whole life insurance as your bank versus a traditional savings account.

| Traditional Bank Savings Account | High Cash Value Whole Life Insurance Policy | |

|---|---|---|

| Earnings Rate | The national average yield for savings accounts is 0.58 percent APY as of Dec. 18, 2023 (*Bankrate, December 13, 2023). But actual earnings are less after tax and not guaranteed. | Guaranteed (average) 3% interest. Plus an additional 2%-4% dividends. Tax-free, so net earnings of 5%-7%, which may increase as interest rates increase. |

| Withdrawals and Earnings | Amount available for withdrawals is lower because gains in the account are taxable. | Full amount of cash value is available for withdrawals. |

| Loans | Does not offer loans. Loan would have to be obtained through a bank or other lender. | Loans are available via the cash value, with no approval needed. Plus, the amount borrowed still continues to generate interest and dividends. |

| Loan Repayment | Amount and due date of repayments is determined by the bank or lender. If payments are late or missed, it negatively impacts your credit score. | No required loan payments. Policyholder determines when and how much is paid - or even IF payments are made. |

| Added Benefits Upon Death | Paid on Death (POD) to a beneficiary. | Death benefit is paid to beneficiary income tax free. |

| Living Benefits | None | ~Chronic Illness Rider - With a chronic illness diagnosis or need for long-term care, funds may be accessed from the death benefit. ~Accelerated Death Benefit - Death benefit funds may also be accessed in the event of a terminal illness diagnosis. ~Protection from 3rd party creditors - In most states, whole life insurance is protected from creditors, lawsuits, and bankruptcy. |

| Costs | Potential savings and checking fees. | Premium is required for death benefit. However, premium payments are leveraged for a larger death benefit payout - which is received income tax free by the beneficiary(ies). |

| Creditor Protection | Minimal. | Creditor protection based on individual state laws. |

The private family banking approach allows personal wealth stored within a whole life insurance policy to continue growing and compounding while also facilitating other wealth-building investments, such as purchasing cash flowing assets.

Real Estate Example

The policy loan is paid back gradually at a low interest rate while the cash value securing the loan continues to earn compounding interest the entire time.

Essentially you earn money in your investment and in your policy, simultaneously, so that your dollars are working in two places at once.

After the policy loan is repaid, you have the wealth stored in the policy, plus all additional growth earned, and the newly acquired income-generating asset. The policy’s cash value is again available as a source of investment capital, and you can repeat the process toward the goal of long-term wealth accumulation. But, this time, you have the income generated by the first asset to apply toward paying back the policy loan.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

How Does Private Family Banking Work?

Whole life insurance policies provide both a death benefit and cash value that builds with each premium payment and earns interest. Wealth stored as cash value in your whole life policy has high liquidity and can be accessed by surrendering a policy outright, making a partial withdrawal, or taking out a policy loan.

Private family banking relies on policy loans because, when you surrender a policy, you are giving up the right to the future death benefit, dividends, and any additional policy growth. And if you make a partial withdrawal, the withdrawn funds reduce the policy’s cash value and future growth potential that takes place within your policy.

When can I take out a loan?

Importantly, when you own a policy, you have a contractual right to policy loans. Eligibility for policy loans starts once a whole life insurance policy has accumulated sufficient cash value. The policy might need to be in place for a minimum period before the right kicks in, and the maximum loan value will be set at a certain percentage (usually 80 or 90 percent) of accrued cash value. But the insurance company can’t deny the loan. It doesn’t matter what your credit score is.

Buy Other Assets

Private family banking expands wealth-building potential by using contractual policy loans to acquire other appreciating assets.

Because policy loans are backed by existing cash value, they have minimal borrowing costs and low interest rates.

Just as importantly, policy loans don’t come with any set repayment schedule, so you can pay back a loan at a schedule that works for your financial plan without any late fees.

If you don’t have access to cash, you usually can’t acquire investments. However, even if you happen to have sufficient liquid savings available to purchase an investment asset with cash, the cash is no longer earning interest after you make the investment—the investment will hopefully be appreciating, but the cash itself won’t be (at least not for you).

Part of what makes the personal family banking approach attractive is that, while a policy loan is outstanding, the cash value securing the loan is still earning interest in the policy.

Your Cash Value Does Two Jobs At Once

So, cash value is working for you in two ways—it’s allowing you access to capital to invest, and it’s still growing itself. The continuing growth in the policy offsets some or all of the interest charged on an outstanding policy loan.

Using Life Insurance to Pay Off Debt

That interest rate works out to $2,000 per year—money that is effectively wasted. But, if you have enough accrued cash value in your whole life insurance policy for a $10,000 policy loan to pay off the credit card, you can

- (1) get rid of the debt,

- (2) save the $2,000 per year in interest, and

- (3) continue earning interest on the cash value securing the loan.

Then, you can pay off the policy loan at your own pace at a much, much lower interest rate. Even if it takes three years to pay back the policy loan, the net financial outcome will be a huge gain.

Advantages of Private Family Banking

Some of the private family banking advantages are inherent benefits of whole life insurance. That is, even if you don’t fully implement a personal family banking strategy, just having a whole life policy will provide very real financial benefits to you and your family.

First, cash value whole life insurance is a reliable, effective tool for building long-term wealth. Cash value increases with each premium payment and earns compounding interest. That means the insurer is paying interest on both the “principal” paid into the policy via premium payments and the interest that has already accrued.

Whole life insurance dividends paid by mutual life insurance companies add significantly more to a whole life policy’s growth potential because, when invested back into a policy, cash value derived from dividends also earns compounding interest. As cash value increases, dividend payments from the insurer generally get larger.

Basically, the higher cash value rises, the faster it grows—a snowball effect.

The wealth-building potential of whole life insurance policies is further enhanced by the tax-deferred status of policy growth. Instead of paying income tax on the interest and dividends earned each year, you don’t incur any tax liability until growth is actually withdrawn from a policy.

Policy loans are tax free, so, unless you surrender a whole life insurance policy or withdraw more than the total premiums paid in, cash value won’t be reduced for taxes. And if the policy is eventually paid out as a death benefit, the proceeds, including growth, will be tax free.

Tax Free Death Benefit

The death benefit itself is another inherent advantage of whole life insurance. Even before a whole life policy has had enough time to accumulate much cash value, the death benefit provides financial protection to loved ones.

If disaster strikes, the insurance company pays out the policy’s face value income tax free to the named beneficiary. Surviving family members can use the tax free death benefit as a means of support or as a head-start toward building their own personal wealth.

No Loan Payback Schedule

The personal family banking system relies on the general advantages of whole life insurance to provide a low-risk, low-stress lending source.

When you take a policy loan, you don’t have to stretch your budget to make the payments because you can pay back the loan at your convenience.

You also don’t have to risk depleting your cash savings—and leaving your family exposed if a financial emergency arises—to capitalize on a promising investment opportunity.

And there’s no risk that the insurance company will decide to sue you and obtain a civil judgment if you don’t repay a policy loan. The insurer just waits and deducts any outstanding loan balance from a future death benefit payout or policy surrender.

Creditor Protection

And, finally, wealth stored as cash value in a whole life insurance policy is at least partially protected under the bankruptcy and creditor attachment laws in most states.

Typically, cash value is legally exempt from attachment up to a statutorily defined dollar amount, similar to homestead laws protecting residences. Neither a creditor with a judgment nor a bankruptcy trustee can attach cash value up to the protected amount.

In some states, the exemption amount is unlimited, which means in those states all wealth held in a whole life insurance policy is shielded from creditors and survives a bankruptcy intact.

Choosing the Right Policy for Private Family Banking

When using whole life insurance as part of a personal financial strategy, it’s vital that you select the right company and policy.

Because much of the strategy relies on accumulation of cash value, you’ll want a policy designed to optimize early policy growth, often using paid-up additions.

These “be your own banker” policies are designed to have a lower death benefit starting off but higher early cash value accumulation.

Overfunding your life insurance can also markedly reduce the time it takes to build cash value, though there is a limit, which is based on the policy’s face value.

If premium payments go over that limit, the IRS treats the policy as a modified endowment contract, rather than as life insurance, and it will lose some of the tax advantages.

Another important attribute for a whole life insurance policy used in private family banking is dividend eligibility. To earn dividends, a policy must be a participating life insurance policy issued by a mutual insurance company. Dividends are a small portion of the company’s profits distributed to policyholders as return of premium. They’re not technically guaranteed, but some insurers have consistently paid dividends every year for decades—or even for a century in a few cases.

Whole life insurance policies also come with numerous optional living benefit riders varying between companies. There are available riders that allow a policy to pay for long term care, increase the death benefit in the event of accidental death, or add on supplemental term coverage effective during the early years of the policy.

Conclusion

When properly implemented, the private family banking approach helps individuals and families escape debt and build long-term wealth with less of the stress, fees, and interest that come with working with a bank.

An experienced life insurance professional can help you decide if you are a good candidate for private financial banking, and, if so, help you find a whole life policy well-suited to your personal situation and wealth-building objectives.

So what are you waiting for? The team at I&E is ready and able to help you get the best policy for private family banking. Give us a call today and experience the I&E difference.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept