By Denise Boisvert, Debt Elimination Master

What if you could pay off your 30-year mortgage in just 13–15 years without increasing your monthly payments? It sounds impossible, but thousands of Americans are discovering how to achieve this using the Infinite Banking Concept (IBC), a powerful strategy that doesn’t require earning more money or refinancing your home. This comprehensive guide provides a step-by-step blueprint to pay off your mortgage early with IBC, complete with real numbers, practical examples, and actionable insights. If you’re frustrated by mortgage payments that barely reduce your principal, this strategy could transform your financial future, turning your home from a liability into a wealth-building asset.

Table of Contents

- The Mortgage Trap Most Americans Face

- Infinite Banking: A Game-Changing Approach

- Real Numbers: A Step-by-Step Example

- Case Study: Paying Off a $300,000 Mortgage

- After Payoff: Two Powerful Scenarios

- Additional Benefits of IBC

- Step-by-Step Implementation Guide

- IBC vs. Traditional Payoff Methods

- Common Questions About IBC

- Is IBC Right for You?

- Conclusion: From Liability to Asset

- Frequently Asked Questions

Key Insight

Infinite Banking lets you pay off your mortgage in half the time while building tax-free wealth, offering control and flexibility traditional methods can’t match.

The Mortgage Trap Most Americans Face

When you make a traditional mortgage payment, you’re essentially renting your home from the bank for the first 10–15 years. Your hard-earned money benefits the lender far more than your own wealth. Let’s break down the challenges:

Interest-Heavy Payments

In a conventional 30-year mortgage, approximately 70–80% of your early payments go toward interest, not principal. For example, on a $250,000 mortgage at 4.5%, your first monthly payment of $1,267 includes only $267 toward principal and $1,000 toward interest. This slow equity buildup means you’re barely closer to owning your home outright, even after years of payments.

The Illiquidity Trap

The equity you do build is locked in your property, inaccessible without significant hurdles. To tap into it, you must:

- Apply for a Home Equity Line of Credit (HELOC), requiring qualification, credit checks, and closing costs

- Refinance, incurring substantial fees and potentially a new 30-year term

- Sell your home, disrupting your life and incurring real estate fees

This lack of liquidity limits your ability to respond to emergencies or seize investment opportunities, leaving your wealth trapped.

The Opportunity Cost

Every dollar sent to the mortgage company is a dollar that could be growing elsewhere. Traditional financial advice fixates on “getting out of debt” without acknowledging the wealth-building potential of those funds. Many homeowners overlook mortgage-related opportunity costs, missing chances to grow assets that could outpace their mortgage interest. By prioritizing debt repayment over strategic wealth creation, you’re sacrificing long-term financial growth.

Infinite Banking: A Game-Changing Approach

Using the Infinite Banking Concept to pay off your mortgage involves a fundamental shift in how you view your money. Instead of funneling cash to the bank, you store it in a high cash value whole life insurance policy, creating a personal banking system that works for you.

How IBC Works for Mortgage Payoff

The IBC strategy unfolds in three key phases:

- Redirect Cash Flow: Instead of placing discretionary income or savings in low-yield bank accounts, you fund a specially designed high cash value whole life insurance policy.

- Build Liquid Equity: As your policy’s cash value grows tax-free, you maintain complete access to these funds, unlike home equity.

- Strategic Deployment: Once sufficient cash value accumulates, you borrow against your policy to make lump sum payments directly to your mortgage principal.

This approach creates a powerful dynamic: your cash value earns interest and dividends while principal payments slash your mortgage term, saving years of interest. Your money works in two places simultaneously, accelerating debt reduction and building wealth.

Transform Your Financial Future with Denise’s New Book!

Designing a Debt-Free Life: Discover how to use high cash value life insurance and the Infinite Banking Concept as a tax-free strategy for financial freedom.

- ✓ Eliminate credit card debt without cutting your lifestyle

- ✓ Wipe out your mortgage years early with no extra income

- ✓ Fund major purchases without using traditional banks

- ✓ Create generational wealth with tax-free growth

Stop living paycheck to paycheck and start building lasting wealth using the same strategy banks have used for over 150 years.

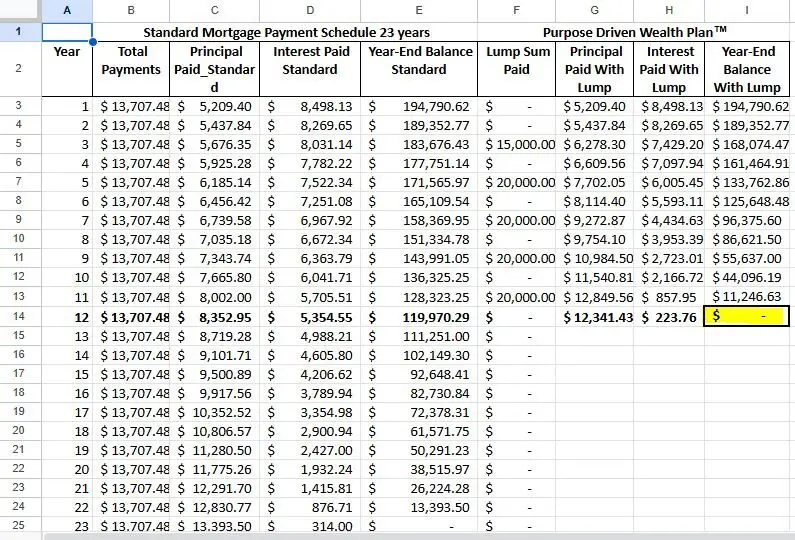

Real Numbers: A Step-by-Step Example

Let’s examine a real-life example with specific numbers:

The Initial Scenario

- Mortgage Balance: $195,000

- Remaining Term: 23 years

- Monthly Payment: $1,100 ($13,707 annually)

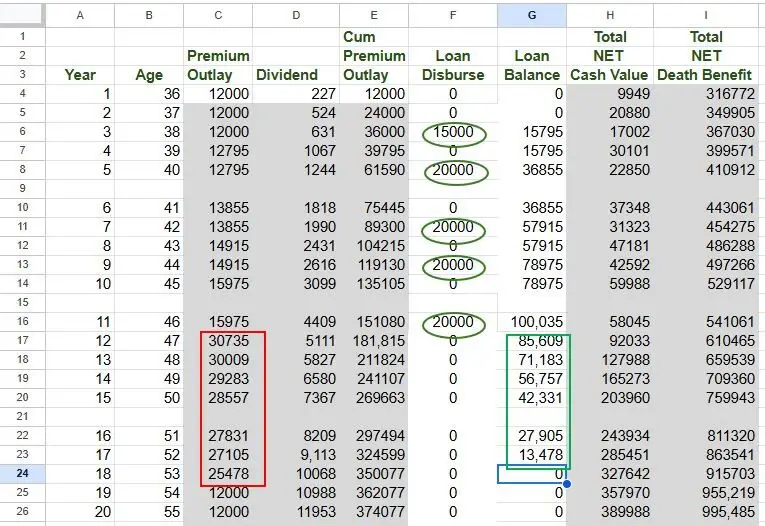

IBC Strategy Implementation

With a properly structured IBC policy, the homeowner makes these moves:

- Year 3: Borrows $15,000 from policy cash value, applies to principal

- Year 5: Borrows $20,000, applies to principal

- Year 7: Borrows $20,000, applies to principal

- Year 9: Borrows $20,000, applies to principal

- Year 11: Borrows $20,000, applies to principal

Remarkable Results

Traditional Schedule (after 12 years):

- ~ $120,000 owed

- 11 years of payments left

IBC Strategy:

- Mortgage paid off in 13 years

- Saves 10 years (~$137,000 in payments)

- Eliminates tens of thousands in interest

Case Study: Paying Off a $300,000 Mortgage

Sarah, a 40-year-old teacher, had a $300,000 mortgage at 4% over 30 years, with a $1,432 monthly payment. Frustrated by slow equity growth, she started an IBC policy, contributing $10,000 annually. By year 4, her cash value reached $38,000, and she borrowed $20,000 to reduce her principal. She repeated this every 2–3 years ($20,000 in years 6, 8, 10, 12). By year 14, her mortgage was paid off, saving 16 years and ~$170,000 in payments. Her cash value, growing at ~4%, hit $150,000 by age 55, offering tax-free income potential. “IBC gave me control and a wealth-building asset while freeing me from my mortgage,” Sarah said.

After Payoff: Two Powerful Scenarios

Once your mortgage is paid off, IBC offers two compelling paths:

Never Repay Policy Loans

Concerned about the ~$100,000 in policy loans from our example? Remarkably, you don’t need to repay them. Your cash value and death benefit continue growing. By age 60:

- Cash value: ~$470,000

- Death benefit: >$1,000,000

You’ve paid off your home and built significant wealth, even with outstanding loans.

Redirect Mortgage Payments

For even greater impact, redirect your $1,100 monthly mortgage payment to repay policy loans. By age 60:

- Cash value: ~$578,000

- Death benefit: >$1,200,000

This transitions seamlessly to tax-free retirement income via policy loans, leveraging your policy’s growth.

Expert Tip

IBC’s tax-free policy loans let you reduce your mortgage principal without increasing taxable income, preserving deductions like the standard deduction.

Additional Benefits of IBC

Beyond mortgage reduction, IBC provides unique advantages:

- Chronic Illness Rider: Acts like long-term care coverage, accessing death benefits for chronic conditions, included at no extra cost.

- Accelerated Death Benefit: Provides funds if terminally ill, enhancing security without additional premiums.

- Financial Flexibility: Unlike home equity, cash value remains liquid for emergencies, investments, or life changes, giving you unparalleled control.

- Tax Advantages: Cash value grows tax-deferred, policy loans are tax-free, and death benefits pass income tax-free to heirs, maximizing wealth.

- Creditor Protection: In many states, cash value is shielded from creditors, offering security home equity lacks.

These benefits create a robust financial foundation, far beyond what traditional payoff methods offer.

Step-by-Step Implementation Guide

To use IBC for mortgage payoff, follow these steps:

- Establish Your Policy: Secure a high cash value whole life policy with:

– A paid-up additions (PUA) rider to accelerate cash value growth

– A low base premium (10–20%) to prioritize cash value over death benefit

– Non-Modified Endowment Contract (MEC) compliance to maintain tax advantages - Fund Consistently: Commit 10–25% of income to premiums for 5–7 years, adding lump sums (e.g., bonuses) to boost growth.

- Monitor Growth: Track cash value against your mortgage balance, starting loans when cash value nears premiums paid and is sufficient for meaningful principal reductions.

- Execute Lump Sum Payments: Borrow $15,000–$25,000, apply directly to principal, and confirm with your lender to ensure accurate reduction.

- Choose Loan Repayment: Options include paying annual loan interest, setting a repayment schedule, or redirecting mortgage payments post-payoff.

- Repeat the Process: Make lump sum payments every 2–3 years, adjusting based on cash flow and policy performance to maximize payoff speed.

A well-designed policy ensures liquidity, tax-free growth, and alignment with your mortgage payoff goals, creating a powerful wealth-building system.

IBC vs. Traditional Payoff Methods

| Method | Time Saved | Monthly Cost Increase | Liquidity | Wealth Building |

|---|---|---|---|---|

| Biweekly Payments | 4–5 years | ~8% (extra payment) | Locked in home | None |

| Extra Principal ($100/month) | 2–4 years | ~10% | Locked in home | None |

| Extra Principal ($500/month) | 8–10 years | ~30–50% | Locked in home | None |

| 15-Year Refinance | 15 years | 30–50% | Locked in home | None |

| IBC Strategy | 15–17 years | None | Full access | Significant |

IBC outperforms by maintaining liquidity, building a wealth asset, and avoiding payment increases, offering unmatched flexibility and growth potential.

Common Questions About IBC

Isn’t Whole Life Insurance Expensive or a Bad Investment?

IBC policies emphasize cash value accumulation, not death benefits, offering guaranteed growth, tax advantages, liquidity, and contractual stability. They’re not traditional “investments” but banking systems designed for control and flexibility, ideal for mortgage payoff and wealth building.

What If Interest Rates Change Dramatically?

IBC adapts to economic shifts. If mortgage rates drop, you can refinance while continuing IBC. If policy loan rates rise, adjust loan utilization or repayment schedules. Your strategy remains flexible, unlike rigid traditional methods.

How Does IBC Affect My Taxes?

IBC delivers significant tax benefits: cash value grows tax-deferred, policy loans are tax-free, and death benefits pass income tax-free. As your mortgage shrinks, interest deductions phase out, but for most, the standard deduction now exceeds itemized deductions. Consult a tax professional for personalized advice.

What If I Want to Move or Sell My House?

Unlike other payoff methods, IBC is portable. If you sell your home, apply proceeds to a new property or redirect funds to other goals. Your policy remains intact, offering unmatched flexibility.

Is IBC Right for You?

The IBC mortgage payoff strategy is ideal for homeowners who:

- Have stable income to fund a policy consistently

- Plan to stay in their home for at least 5–10 years

- Value financial flexibility and control over their money

- Can fund both their mortgage and policy premiums

- Are disciplined and patient with long-term financial strategies

This isn’t a “get out of debt fast” scheme but a methodical approach to eliminate debt while building a lasting financial asset.

Conclusion: From Liability to Asset

Using Infinite Banking to pay off your mortgage isn’t just about becoming debt-free—it’s about fundamentally changing your relationship with money. By implementing this strategy, you’re:

- Taking control of your financial future

- Creating a personal banking system you own

- Building wealth while eliminating debt

- Establishing a legacy for future generations

Traditional approaches treat mortgages and financial growth as separate issues. IBC integrates them into a cohesive strategy, paying off your home in half the time while growing a valuable asset. The real power lies in what happens after: a paid-off home and a growing cash value that provides options for retirement, investments, or legacy planning. Ready to explore how Infinite Banking could transform your mortgage into a wealth-building tool? Analyze your situation to see what this strategy can do for you.

Ready to Pay Off Your Mortgage in Half the Time?

Before implementing this powerful infinite banking mortgage strategy, get a personalized analysis from Denise Boisvert. She’ll show you exactly how this approach could work with your specific mortgage and financial situation.

- ✓ See your personalized mortgage payoff timeline using infinite banking

- ✓ Discover how much you could save in interest payments over the life of your loan

- ✓ Learn the optimal policy design and funding strategy for your income level

- ✓ Understand exactly when and how to make strategic lump sum payments

Schedule your complimentary consultation with Denise today and get your customized infinite banking mortgage elimination plan.

No obligation. No sales pressure. Just expert guidance to help you determine if infinite banking can transform your mortgage into a wealth-building tool.

Frequently Asked Questions

What is the Infinite Banking Concept?

It’s a strategy using high cash value whole life insurance to create a personal banking system, offering tax-free growth, liquidity, and mortgage payoff acceleration.

How does IBC accelerate mortgage payoff?

Policy loans fund lump sum principal payments, reducing the mortgage term while cash value grows tax-free, working in two places at once.

Are policy loans risky?

No, if managed properly. Loans are tax-free, and cash value continues earning interest. Non-repayment reduces death benefits but not wealth.

What if I sell my home?

Your IBC policy is portable, letting you redirect funds to a new property or other goals, unlike other payoff methods.

Is IBC too expensive?

IBC policies prioritize cash value, offering guaranteed growth and tax benefits, making them cost-effective for mortgage payoff and long-term wealth.

Transform Your Financial Future with Denise’s New Book!

Designing a Debt-Free Life: Discover how to use high cash value life insurance and the Infinite Banking Concept as a tax-free strategy for financial freedom.

- ✓ Eliminate credit card debt without cutting your lifestyle

- ✓ Wipe out your mortgage years early with no extra income

- ✓ Fund major purchases without using traditional banks

- ✓ Create generational wealth with tax-free growth

Stop living paycheck to paycheck and start building lasting wealth using the same strategy banks have used for over 150 years.