Opportunity cost isn’t just about money. Every choice you make each day creates ripple effects that touch everything from your bank account to your mental peace, spiritual path, and physical health.

Think about it like this: You’re planting seeds with every decision. Some folks only see the seed they’re giving up. But when you really get how opportunity cost works, you start seeing the whole garden of possibilities those seeds could grow into.

In this article, I’m going to break down exactly how opportunity cost shapes your life, the mindset you need to master it, and the discipline required to turn small daily choices into massive long-term wins. Because here’s the truth – understanding opportunity cost is the difference between watching life happen and making life happen.

What is Opportunity Cost?

Your opportunity cost can be defined as the benefit you choose to forego when deciding on a different path. Your opportunity cost may be money and resources, but it is also relates to your time. If you choose to spend your money for one thing, then you forego spending it on another. Similarly, if you choose to spend your time in one way, you are foregoing the opportunity to spend your time another way.

You see, life is one big opportunity cost, each day, every day. We are constantly assigning value to that which we choose and lesser value to the opportunity not chosen; we say “yes” to one thing and “no” to many other things.

As you are reading this article you are trading your time to gain insight into our thoughts on opportunity cost. Your opportunity cost is the opportunity that you gain deeper insight at the cost of your time. So, with that in mind, we will do our best to make this article worth your time, so you do not go away thinking the opportunity was not worth the cost.

Money Secrets of the Wealthy

What the Wealthy Teach Their Kids

Calculating Opportunity Cost

There is no single formula used for calculating opportunity cost. The concept of opportunity cost reflects the fact that, given a limited number of options or resources of whatever type, choosing one option means giving up the opportunity to choose another. And it may be multiples of another, where choosing 20 of option X means you must give up 40 of option Y.

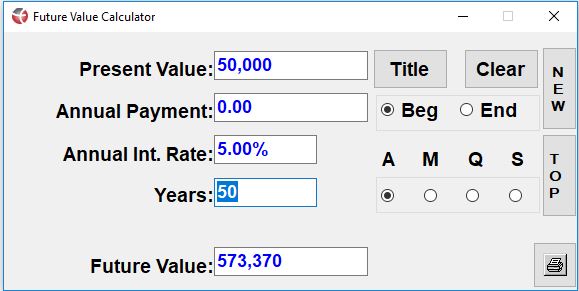

For a calculating opportunity costs example, suppose you are a healthy 30 year old who wants to buy a $50,000 BMW to impress your friends and family. And assume you pay all cash, rather than choosing to finance your vehicle, (which would result in an even higher opportunity cost than in our example).

By purchasing a $50,000 dream car at age 30, you are foregoing the opportunity of using that money elsewhere. And if that money were to earn 5% return over the remainder of your lifetime, your opportunity cost is $573,370 that you traded in for your shiny new car.

Using a simple cost-benefit analysis on the above opportunity cost example allows you to see the long term ramifications of your financial decision. Now granted, perhaps the BMW is needed and it creates value, or the perception of value, that benefits you in some tangible way. But if your shiny car is simply a status symbol, a simple cost-benefit analysis would lead you to foregoing the BMW today for the benefit of what that money can produce for you in the future.

Either/Or

Opportunity cost is theorized as an either/or proposition, where your decision leads to making a choice for one thing at the cost of the other thing. But as we will go into further below, opportunity cost may also be an AND, where the two choices meet at a future point in time for those who have the discipline to delay gratification in the present.

The Hidden Power of High Cash Value Whole Life Insurance

Most people see opportunity cost as a loss – choosing one thing means giving up another. But what if you could have both? This is where high cash value whole life insurance changes the game.

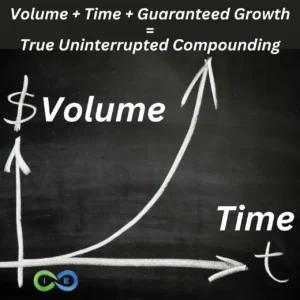

Think of it this way: Your policy grows through guaranteed cash value increases and dividends. But unlike money locked in retirement accounts or investments, you can access this growing asset through policy loans. This creates two streams of wealth building simultaneously:

-

Your Base Asset (The Policy):

- Your entire cash value continues growing even when you take loans

- Provides guaranteed returns

- Builds tax-advantaged wealth

- Creates generational wealth transfer

-

Your Investment Capital (Policy Loans):

- Use your policy loan to buy assets, such as cash-flowing real estate

- Fund business opportunities

- Invest in market opportunities

- Create additional income streams

You’re not choosing between saving money or investing money. Your dollar works in multiple places at once. While your policy grows, that same money can purchase assets that generate additional returns.

Banks use this strategy through BOLI (Bank Owned Life Insurance). They’re not just seeking death benefit protection – they want an asset that provides guaranteed growth while giving them access to capital for other investments.

The result? Instead of losing opportunity cost, you’re maximizing it. Your money grows in two places instead of one, creating multiple layers of returns from the same original capital.

Money – Items – Time

Opportunity cost applies to resources and assets primarily in terms of money, items, and time. But within each opportunity cost can be any or all three and how they correspond to your specific action or inaction.

An opportunity cost formula that can be used to express the opportunity cost relationship is as follows:

You can define opportunity cost as what you are giving up vs what you are gaining i.e. trade offs vs acquisitions.

For example, if I trade my time that I could have spent working on my business for spending that time with my kids, I am acquiring the opportunity to spend time with my kids at the cost of working on my business.

You see, opportunity cost is about assigning value to a myriad of potentialities and choosing the option that has the most value to you. Value is often relative and what is valuable to you may not necessarily be seen as valuable to me.

Production Possibilities Curve = Achieving Balance

Opportunity cost increases or decreases for a given choice as you move up and down the production possibilities curve. So in the above example, the more time I spend with my kids, the less valuable that time may become to them and the more costly the time is to me in relation to growing my business.

The key is to try and find balance in relation to cost vs opportunity. So in the above opportunity cost example, you would want to make sure that you are not neglecting your business but you are spending valuable time investing in your relationship with your kids.

Determining where the two decisions meet on the productions possibilities curve that maximizes your time spent on both endeavors is crucial if you are seeking to strike a balance between the two choices.

One last thought here before moving on, what if you were to incorporate your kids into your business, so you can accomplish both? In that case, you may have enlarged your production possibilities curve.

You see, innovative ideas and technology can grow your production possibilities curve so that you can accomplish more with your time that previously thought. The moral of the story, don’t settle for simply either/or, try and find the AND.

Another Opportunity Cost Example

The easiest opportunity cost examples are often considered in terms of financial decisions because you have a set number of known variables and resources.

Nvidia vs Bitcoin

For instance, if you have $10,000 to invest and you decide to invest it in Bitcoin instead of Nvidia stock, using the formula above, the opportunity cost is $1 invested in Nvidia stock per $1 invested in the Bitcoin. It takes time, of course, to determine whether an opportunity cost decision such as this was the right one.

In the example above, if Bitcoin provides a return of 10% a year over the next 10 years, while Nvidia stock only returns 5%, the decision would seem to be a good one. If the returns were reversed, you would have been better off investing in Nvidia instead of Bitcoin.

Now, can we achieve some balance between the two? At which point does investing in one choice make more sense than choosing another? And what if both Bitcoin and Nvidia stock perform poorly? What opportunity did I miss out on while I was focusing on Nvidia stock and Bitcoin? For example, perhaps real estate would have provided a higher return, particularly when considering the ability to leverage your purchase with other people’s money.

Obviously we cannot know all the variables. That is why opportunity cost is often the choice for one thing, at the cost of many alternatives. The best we can do is true and assess the pros and cons of our current opportunity and make a smart decision based on our known data.

Financial Discipline & Playing The Long Game

Success in life isn’t random. You need a gameplan built on habits that work. One of the most powerful tools? Understanding opportunity costs in everything you do. This skill maximizes both your time and money.

Financial Discipline: The Reality

Building strong money habits goes beyond knowledge. It requires the strength to choose delayed rewards when everyone else chases instant gratification. True financial growth demands the discipline to evaluate every financial decision’s long-term impact.

Financial discipline means taking control of your spending, making calculated money decisions, and prioritizing future wealth over immediate wants.

The Power of Delayed Gratification

Postponing a purchase today isn’t just about saving money – it’s about investing in tomorrow’s opportunities. Delayed gratification means weighing current desires against future potential.

This mindset extends beyond weeks or months. It’s about seeing years ahead, understanding how today’s choices shape tomorrow’s reality.

Balance matters. Being too extreme with saving can be as damaging as overspending. But consistently choosing immediate rewards over future gains limits your wealth-building potential.

This becomes crucial when considering retirement. Want financial freedom in your later years? The money you save today creates that possibility.

Consider infinite banking through life insurance. The strategy requires consistent funding before accessing its benefits. Skip the building phase, and you sacrifice significant compound interest growth.

The good news? Transforming your financial future doesn’t require dramatic lifestyle changes. Small adjustments in spending habits compound into significant gains over time.

The Real Impact: Daily Decisions

Take a simple daily choice – spending $7 on lunch. Seems minor, right? But multiply that across your work year. You’re spending $1,825 annually just on lunch breaks (roughly 260 work days).

Numbers tell the real story.

Invest that $1,825 yearly at a 5% return instead:

- 10 years: Grows to $25,000

- 15 years: Your annual interest exceeds your contribution

- 30 years: Balloons to $129,000

Want better numbers? Cut that lunch cost to $3.50 by bringing food or alternating days eating out. Your $912.50 annual savings at 5% over 30 years becomes $65,000.

This simple calculation reveals the true cost of daily habits. By understanding your spending patterns, you see opportunities for building real wealth.

Making Smart Trade-offs

Small spending deferrals create substantial future gains. This principle extends beyond money – it builds discipline that improves every area of life.

Examine your regular expenses through this lens. Your path to better finances often hides in plain sight, not in major lifestyle overhauls.

Key Areas to Evaluate:

- Regular “treat” purchases (snacks, convenience items)

- Digital entertainment spending (downloads, subscriptions)

- Social activities (dining out, events, entertainment)

- Impulse purchases (clothing, decorations, gadgets)

Shifting Your Money Mindset

Prosperity isn’t built on deprivation. Real wealth grows from understanding money’s potential.

Stop seeing it as giving up pleasures. Instead, evaluate each purchase’s opportunity cost. Ask: Does this spending serve my long-term goals? Could this money work harder elsewhere?

Consider the coffee example: Rather than spending $5 daily at cafes, invest in home brewing. Save $4 daily. Direct that savings into investments or a well-structured life insurance policy.

The outcome? Beyond the daily $4 savings, you gain compound interest’s multiplying power. That small daily choice between store-bought and home-brewed coffee could fund significant future opportunities – opportunities missed by those who never calculate the real cost of their habits.

Conclusion

Your daily money choices build tomorrow’s reality. By approaching spending with intention and discipline, you transform short-term desires into long-term wealth. These aren’t just financial decisions – they’re character decisions. The habits you build today determine who you become tomorrow. Make them count.

Money Secrets of the Wealthy

What the Wealthy Teach Their Kids