R. Nelson Nash, born in 1931, revolutionized personal finance with his development of the Infinite Banking Concept (IBC). This innovative approach challenges traditional financial wisdom by advocating the use of dividend-paying whole life insurance as a personal banking system. Nash’s ideas have empowered countless individuals to take control of their financial futures and build lasting wealth.

Table of Contents

- The Life of Nelson Nash

- Nash’s Faith and Financial Philosophy

- The Birth of the Infinite Banking Concept

- The Austrian Economics Foundation

- Nash’s Critique of Traditional Banking

- Key Principles of the Infinite Banking Concept

- Modern Academic Validation of Nash’s Vision

- The Mathematics of Volume-Based Banking

- Volume and Scalability

- Designing an Infinite Banking Policy

- The Grocery Store Analogy

- The Visual Reality of Volume-Based Banking

- Nash’s Teaching Methods

- The Nash Legacy and Generational Wealth

- The Infinite Banking Concept in Practice

- IBC vs. Traditional Financial Vehicles

- Addressing Common Concerns

- Faith-Based Community Applications

- Frequently Asked Questions

- Next Steps

The Life of Nelson Nash

Early Years and Education

Robert Nelson Nash was born on March 15, 1931, in Greene County, Georgia. He grew up in Athens, Georgia, where he developed a strong work ethic and a curiosity about finance. Nash graduated from the University of Georgia with a B.S. in Forestry in 1952, a background that would later influence his financial thinking, particularly regarding compound interest over long periods.

Military Service and Career Transitions

Following graduation, Nash served two years in the U.S. Air Force (1952-1954) as an aerial photo interpreter. He later joined the North Carolina Army National Guard as a fixed-wing pilot, eventually earning Master Aviator Wings over a 30-year military career.

Nash’s professional life saw several transitions. He worked as a forestry consultant in North Carolina for nine years before moving to Birmingham, Alabama, in 1963 to continue his forestry work. In 1964, Nash made a pivotal career change, entering the life insurance business – a decision that would ultimately lead to the development of the Infinite Banking Concept.

Personal Connection: Nash’s forestry background gave him a unique perspective on long-term growth and compound interest. Just as trees grow exponentially over decades, he saw how properly structured financial systems could create similar compounding effects in personal finance.

Personal Life

Throughout his life, Nash was devoted to his family. He was married to Mary Edwards Williams for 66 years until his passing in 2019. Together, they raised three children: Debby, Barrington, and Kimberly.

Nelson Nash’s Faith and Financial Philosophy

Nelson Nash’s approach to finance was deeply intertwined with his Christian faith. His religious beliefs played a significant role in shaping his financial philosophy and the development of the Infinite Banking Concept (IBC).

Biblical Financial Principles

Nash often referred to biblical principles in his teachings about finance. He believed that the Bible offered timeless wisdom about money management, stewardship, and the ethical use of resources. For Nash, the concept of becoming your own banker aligned with the biblical principle of good stewardship – making the most of the resources one has been given.

The Moral Dimension of Finance

Nash viewed finance not just as a mathematical or economic issue, but as a moral one. He believed that the traditional banking system often led people into debt and financial bondage, a state he saw as contrary to biblical teachings. In contrast, he saw IBC as a way to achieve financial freedom and independence, aligning with his interpretation of biblical financial wisdom.

Nash on Mutual Aid: “When properly understood and practiced, the Infinite Banking Concept creates a system where individuals can support one another while maintaining personal responsibility. This mirrors the early Christian community’s approach to caring for each other’s needs while respecting individual dignity.”

Stewardship and Legacy

The idea of leaving a legacy, which is central to IBC, was also influenced by Nash’s religious views. He often spoke about the importance of generational wealth transfer, not just in financial terms, but as a way of passing on values and financial wisdom to future generations. This aligns with the biblical concept of leaving an inheritance for one’s children and grandchildren.

Faith-Based Teaching Style

Nash’s teaching style, characterized by its conversational tone and use of parables and real-life examples, was reminiscent of biblical teaching methods. He often used stories and analogies to explain complex financial concepts, much like the parables found in the Bible.

Ethical Considerations

Nash’s emphasis on ethical financial practices was rooted in his Christian beliefs. He was critical of what he saw as manipulative or exploitative financial practices and advocated for a more transparent and equitable approach to personal finance.

Community and Mutual Support

While IBC is primarily focused on individual financial management, Nash’s Christian background also influenced his views on community and mutual support. He encouraged the sharing of knowledge and resources within communities, reflecting the Christian principle of mutual care and support.

Nash believed that financial systems should foster community well-being rather than exploitation. He saw IBC as a way for families and faith communities to create supportive financial networks where:

- Family members could provide financing for one another’s needs

- Church communities could establish financial resources independent of traditional banking

- Charitable giving could be enhanced through strategic policy design

- Financial wisdom could be shared across generations

Contentment and Financial Peace

Nash often spoke about the importance of contentment and finding peace in one’s financial life. This perspective was deeply rooted in his Christian faith, which emphasized finding fulfillment beyond material wealth.

The Birth of the Infinite Banking Concept

Nash’s experience as a life insurance agent, spanning over 35 years, provided him with unique insights into the financial industry. He worked with prestigious companies like The Equitable Life Assurance Society of the U.S. and Guardian, earning numerous accolades.

However, it was Nash’s personal experiences, particularly in real estate investing, that led to the development of IBC. In the early 1980s, Nash found himself struggling with high interest rates on his real estate investments. This financial pressure, combined with his knowledge of life insurance and his forestry background, led to the insight that would become the Infinite Banking Concept.

Over 20 years, Nash refined his ideas, testing them in his own life and observing their effectiveness. The culmination of Nash’s financial philosophy came in 2000 with the publication of his seminal work, “Becoming Your Own Banker,” which introduced the Infinite Banking Concept to a wider audience.

The Austrian Economics Foundation of Nash’s Philosophy

Nelson Nash’s development of the Infinite Banking Concept was heavily influenced by the principles of Austrian Economics. This school of economic thought provided the theoretical underpinning for many of Nash’s ideas about money, banking, and personal finance.

Key Principles of Austrian Economics in Nash’s Work

- Subjective Theory of Value: Austrian Economics emphasizes that the value of goods and services is subjective, determined by individual preferences rather than intrinsic worth. Nash applied this principle to his critique of traditional financial planning, arguing that individuals should have more control over their financial decisions based on their personal values and goals.

- Time Preference: The Austrian concept of time preference, which states that individuals prefer present goods over future goods, influenced Nash’s approach to long-term financial planning. IBC encourages individuals to think in terms of long-term wealth building, challenging the short-term thinking often prevalent in personal finance.

- Capital Theory: Austrian Economics views capital as a structure of heterogeneous goods used in production. Nash’s concept of using whole life insurance as a personal banking system reflects this idea of capital as a tool for creating future wealth.

- Criticism of Fractional Reserve Banking: Austrian economists are critical of fractional reserve banking, viewing it as a source of economic instability. Nash shared this view, which formed a key part of his critique of the traditional banking system and his advocacy for becoming your own banker.

- Business Cycle Theory: The Austrian theory of the business cycle, which attributes economic booms and busts to monetary expansion by central banks, informed Nash’s skepticism of traditional financial institutions and his emphasis on personal financial sovereignty.

- Entrepreneurship: Austrian Economics places a strong emphasis on entrepreneurship as a driving force in the economy. Nash’s IBC encourages individuals to think like entrepreneurs in managing their personal finances, taking control and making strategic decisions.

Austrian Economists Who Influenced Nash

Nash was particularly influenced by several prominent Austrian economists:

- Ludwig von Mises: Nash often cited Mises’ work, especially his critiques of central banking and fiat currency.

- Friedrich Hayek: Hayek’s ideas on the decentralization of knowledge and the importance of individual decision-making in complex systems resonated with Nash’s approach to personal finance.

- Murray Rothbard: Rothbard’s criticisms of fractional reserve banking and advocacy for a 100% reserve gold standard influenced Nash’s thinking on the nature of money and banking.

- Hernando de Soto: While not strictly an Austrian economist, de Soto’s work on the importance of property rights and formalizing “dead capital” aligns with Nash’s IBC. De Soto’s emphasis on leveraging assets and creating systems that empower individuals economically parallels Nash’s approach of using whole life insurance as a formal, accessible way to store and grow personal capital.

Austrian Connection: Nash’s financial philosophy was deeply influenced by Austrian Economics’ focus on individual sovereignty, criticism of central banking, and emphasis on sound money principles. His approach to banking through life insurance embodied these ideas by creating a personal financial system independent of traditional banking institutions.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

Nelson Nash’s Critique of the Traditional Banking System

Nelson Nash’s development of the Infinite Banking Concept was deeply rooted in his critical view of the traditional banking system. His perspective was shaped by his study of Austrian Economics and his personal experiences with the financial industry.

The Parasitic Nature of Banking

Nash viewed the traditional banking system as inherently parasitic. He argued that banks, by their very nature, extract wealth from individuals and businesses without providing commensurate value. In his view, every time a person takes out a loan or uses a credit card, they’re feeding into a system that primarily benefits the banks rather than the individual.

Fractional Reserve Banking

One of Nash’s primary criticisms was directed at the practice of fractional reserve banking. He saw this as a form of legalized fraud, where banks are allowed to lend out more money than they actually have on deposit. Nash argued that this system creates money out of thin air, leading to inflation and economic instability.

Interest and the Velocity of Money

Nash was particularly concerned with the amount of interest the average person pays over their lifetime. He estimated that the typical American spends around 34.5 cents of every dollar on interest, a figure he found alarming. He believed that by recapturing this interest through the use of whole life insurance policies, individuals could significantly improve their financial situations.

He argued that by becoming your own banker, you could keep your money in motion, continuously cycling it through your policy for personal loans and repayments, rather than letting it sit stagnant or flow to traditional banking institutions. This approach, Nash contended, not only saves on interest payments but also accelerates the growth of wealth by maintaining a high velocity of money within one’s personal economy.

The Illusion of Bank Ownership

Nash challenged the common perception that individuals own the money in their bank accounts. He pointed out that once money is deposited in a bank, it legally becomes the property of the bank. The depositor is merely a creditor of the bank, a situation Nash found problematic.

Government-Sponsored Retirement Plans

Nash was also critical of government-sponsored retirement plans like 401(k)s and IRAs. He saw these as tools used by the government to control people’s money and behavior. He argued that these plans are subject to rule changes at the government’s discretion, making them less reliable than privately owned financial instruments like whole life insurance policies.

The Banking Mindset

Beyond criticizing the banking institutions themselves, Nash also took issue with what he called the “banking mindset” prevalent in society. He believed that people had been conditioned to think like bank customers rather than like bankers. This mindset, he argued, keeps people financially dependent and prevents them from taking full control of their financial lives.

The Alternative: Becoming Your Own Banker

As an alternative to the traditional banking system, Nash proposed that individuals should strive to become their own bankers through the use of dividend-paying whole life insurance policies. He believed that by doing so, people could:

- Recapture the interest they would otherwise pay to banks

- Have more control over their money

- Create a stable, predictable financial system for themselves

- Build wealth more efficiently over time through true compound interest growth

- Establish a legacy that could be passed down to future generations

Nash’s critique of the banking system was not just about identifying problems; it was about empowering individuals to take control of their financial lives. Through the Infinite Banking Concept, he offered a practical alternative to what he saw as a flawed and exploitative system.

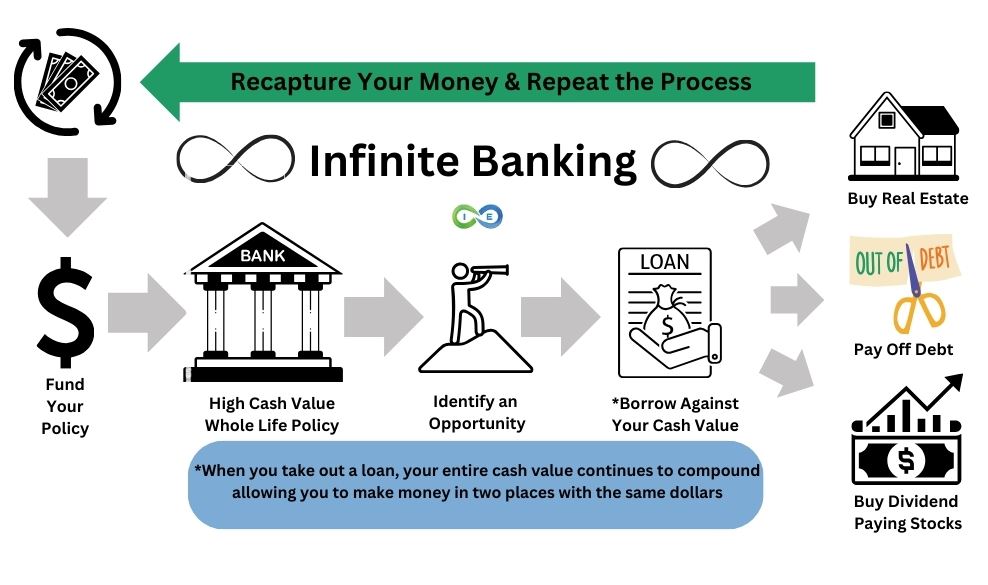

Key Principles of the Infinite Banking Concept

The Infinite Banking Concept is built on several fundamental principles:

- Everything is financed: Nash emphasized that whether you borrow money or use your own, you’re always financing your purchases through either interest paid or opportunity cost.

- Utilizing dividend-paying whole life insurance as a financial tool: These policies, when properly structured, serve as powerful financial instruments.

- Becoming your own banker: This involves using the cash value of your life insurance policy as a personal banking system.

- Recapturing the interest typically paid to banks and financial institutions: By borrowing against your policy, you pay interest to yourself rather than to a bank.

- Creating a personal economy that grows independently of external financial systems: This provides financial control and flexibility.

Nash’s Insight: “The problem in America is not that people aren’t saving enough money – it’s that they are being penalized in their attempt to accumulate wealth by forces that are totally unnecessary.”

Modern Academic Validation of Nash’s Vision

Nash’s Austrian economic insights have been proven mathematically correct by modern academic research. Studies from Ernst & Young, Wade D. Pfau, and Michael Kitces demonstrate that integrated strategies combining whole life insurance with investments deliver:

- 78% more retirement income than conventional investment approaches

- 228% more legacy wealth across all market scenarios

- Superior risk management with guaranteed floors that eliminate sequence of returns risk

This research validates Nash’s core thesis: the banking system extracts wealth through what he calculated as 34.5% of every dollar Americans spend on interest. His Volume-Based Banking approach—channeling entire income through personal policies rather than saving small percentages—has been proven mathematically superior to traditional investment advice.

Nash’s vision has evolved from Austrian economic theory to academically validated strategy. The research confirms what he understood intuitively: individual monetary sovereignty delivers measurably better outcomes than dependence on fractional reserve banking and market speculation.

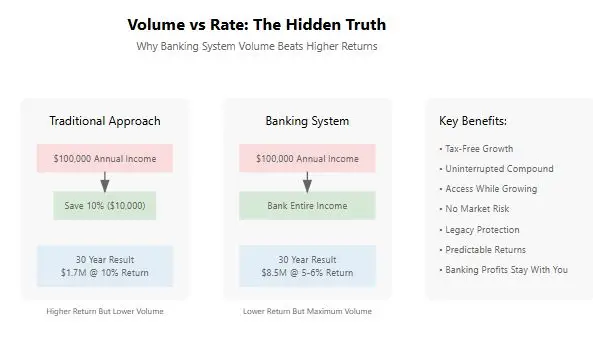

The Mathematics of Volume-Based Banking

Nash’s most revolutionary insight wasn’t about policy mechanics—it was about the mathematical advantage of volume over rate optimization. His calculation that Americans spend approximately 34 cents of every dollar on interest over their lifetime reveals the true opportunity cost of conventional financial planning.

The 34% Interest Recapture Advantage

Consider the mathematical reality of Nash’s volume principle:

- Traditional approach: Save 10-15% of income while paying interest on mortgages, car loans, credit cards, and other financing

- Volume-Based Banking: Redirect the 34% that typically flows to interest payments through your personal banking system

$100,000 annual income × 34% interest factor = $34,000 annually

Over 30 years: $34,000 × 30 = $1,020,000 in total interest payments

Volume-Based Banking captures this $1+ million flow within your system rather than transferring it to financial institutions.

This mathematical advantage compounds exponentially. While conventional advice focuses on optimizing returns on small savings amounts, Nash understood that controlling the volume of capital flow creates wealth regardless of interest rates.

Volume vs. Rate: The Critical Distinction

Traditional financial planning asks: “What return can I get on my 10% savings rate?”

Nash’s approach asks: “How can I capture the 34% of my income that’s flowing to interest payments?”

The volume approach consistently outperforms rate optimization because:

- Larger capital amounts compound more significantly than higher percentages on smaller amounts

- Systematic income redirection eliminates opportunity costs of conventional banking

- Tax advantages multiply the effect across the entire volume, not just investment gains

Volume and Scalability

Nelson Nash’s approach was heavily influenced by two key principles: the importance of volume and the scalability of the system.

1. Volume Over Rates:

Nash emphasized that success in IBC comes from consistently growing your banking system, much like how successful retail businesses focus on volume rather than high profit margins. He believed that the steady accumulation of cash value through regular premium payments and policy loans was more important than chasing high interest rates or returns.

Nash on Volume vs. Rate: “People always talk about return on investment and compare whole life insurance with the stock market, but what’s crucial is that you put your entire income into a policy so that the volume of your return exceeds what you could ever make in the stock market. We’re not talking about rate of return; we’re talking about volume.”

- Traditional advice: Save 10-15% of income in tax-deferred accounts, focus on ROI.

- Nash’s IBC approach: Funnel entire income through a tax-advantaged whole life insurance policy.

2. Scalability Through Multiple Policies:

To illustrate the scalability of IBC, Nash shared his personal experience of owning 49 life insurance policies at one point. This approach demonstrated that:

- The concept can be expanded to accommodate growing financial needs.

- Multiple policies can be used to create a more robust and flexible banking system.

- The principles of IBC can be applied repeatedly, amplifying its benefits.

Nash’s focus on these aspects underscores the potential of IBC as a long-term wealth-building strategy. By prioritizing volume and demonstrating scalability, he showed how individuals could create a substantial personal banking system over time, continually expanding their financial capacity and control.

Designing an Infinite Banking Policy

Nash provided detailed guidance on structuring a policy for IBC:

1. Dividend Paying Whole Life

Use a dividend-paying whole life policy from a reputable, financially strong insurance company.

2. Mutual Insurance Company

The company should be one of the Top Mutual Insurance Companies versus stocks companies. You can go here to read more about the differences between mutual vs stock insurance companies and why mutual companies are the best choice for infinite banking.

3. Avoid the MEC

Structure the policy to maximize cash value growth while staying within IRS guidelines to avoid creating a Modified Endowment Contract (MEC).

4. PUAs

Utilize a Paid-Up Additions (PUA) rider to increase the policy’s cash value more rapidly.

5. Structure

Aim to get as close to the MEC line as possible without crossing it, reducing the amount of immediate death benefit while emphasizing the banking aspects of the system.

The Infinite Banking Concept: A Grocery Store Analogy

Nash often used the analogy of running a grocery store to explain the Infinite Banking Concept. Here’s how the parallel works:

- The Grocery Store = Your Whole Life Insurance Policy

- Just as you own a grocery store, you own your insurance policy.

- Store Inventory (Canned Goods) = Cash Value in Your Policy

- The more inventory you stock, the more you have to sell. Similarly, the more cash value you build, the more you have to “bank” with.

- Stocking Shelves = Paying Premiums

- Regularly stocking your shelves (paying premiums) ensures you always have inventory (cash value) available.

- Selling Goods = Taking Policy Loans

- When you need money, you “sell” your inventory by taking a policy loan.

- Restocking Shelves = Repaying Policy Loans

- Just as you restock shelves after selling goods, you repay policy loans to maintain your “inventory” of cash value.

- Store Profits = Policy Dividends and Interest

- Your store (policy) generates profits (dividends and interest) which can be reinvested to grow your business.

- Opening New Branches = Starting Additional Policies

- As your banking system grows, you might open new “branches” (additional policies) to expand your capacity.

- Front Door vs. Back Door

- Always use the “front door” (pay back loans with interest) rather than the “back door” (defaulting on loans) to maintain the integrity and growth of your system.

- Volume, Not Rates

- Success comes from consistent, volume-based operations rather than chasing high interest rates.

This analogy illustrates how becoming your own banker through IBC is similar to running a successful business, emphasizing consistent growth, reinvestment, and responsible management.

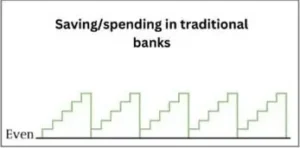

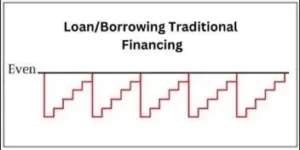

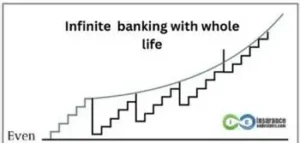

The Visual Reality of Volume-Based Banking

While Nash’s grocery store analogy explains the operational mechanics of IBC, the visual reality demonstrates why Volume-Based Banking creates systematically different wealth outcomes compared to conventional financial systems.

Three Financial Systems Compared

Traditional Banking: Flat Wealth Cycles

Characteristic: Repetitive save-and-spend cycles with no wealth accumulation. Each financial decision starts from zero, with no compounding between cycles.

Conventional Borrowing: Wealth Destruction

Characteristic: Negative wealth spirals where each borrowing decision reduces net worth and future financial capacity through interest payments to external institutions.

Why This Isn’t “Just a Bigger Savings Account”

The ascending step pattern of Volume-Based Banking occurs because:

- Uninterrupted Compound Growth: Your full cash value continues earning returns even when borrowed against

- Interest Recapture: Loan repayments flow back to your system rather than to external institutions

- Volume Efficiency: Larger premium amounts create better policy economics and reduced proportional expenses

- Tax Optimization: The entire system operates within tax-advantaged structures

This visual distinction explains why Nash owned 49 policies and advocated for “annual premiums equal to annual income”—not because he loved insurance, but because he understood that volume of capital flow determines wealth outcomes more than rate optimization.

Nash’s Teaching Methods

Nash developed a unique seminar-based approach to teach IBC. For years before publishing his book, he traveled across the country, delivering in-depth seminars that often lasted several hours. These seminars became the foundation for “Becoming Your Own Banker.”

Nash was known for his engaging Southern charm and his ability to make complex financial concepts accessible to a wide audience. He used simple, relatable examples and a healthy dose of humor to convey his ideas.

The Nash Legacy and Generational Wealth

Nash’s impact on personal finance extended beyond his seminars and book. He established the Nelson Nash Institute (NNI) to ensure the continued spread and evolution of his ideas. Even after Nash’s passing on March 27, 2019, at the age of 88, the IBC movement has continued to grow.

Building a Multi-Generational Legacy

At the heart of Nash’s financial philosophy was the concept of legacy building. He viewed IBC not merely as a personal financial strategy but as a multi-generational approach to wealth creation and stewardship.

Nash on Legacy: “The greatest gift you can give your children and grandchildren isn’t just money—it’s the financial wisdom to manage that money and the values to steward it responsibly.”

Structuring Policies for Future Generations

Nash advocated specific strategies for integrating IBC into estate planning and creating a financial legacy:

- Juvenile Policies: Setting up policies for children and grandchildren at young ages to maximize growth potential and minimize premium costs

- Policy Ownership Structures: Utilizing various ownership arrangements (personal, trust-owned, corporate-owned) to optimize tax treatment and control

- Policy Design for Transfer: Creating policies specifically intended for eventual transfer to heirs

- Education Component: Teaching family members about the system before they inherit it

Multi-Generational Case Example

Nash often illustrated his legacy concepts with multi-generational examples:

- Grandparent establishes policies for grandchildren at birth

- Premiums are paid for 18-20 years while teaching the principles

- Ownership transfers when grandchildren reach adulthood

- New adult owners have fully-capitalized banking systems to start their financial lives

- Process repeats with the next generation

This approach creates an expanding family banking system that grows exponentially over generations, providing financial security and opportunity to future family members while reinforcing values of financial stewardship and independence.

Actionable Steps for Legacy-Building with IBC

- Start Early: Establish policies on children/grandchildren when they are young to maximize growth and minimize costs

- Create a Family Banking Committee: Involve family members in decision-making processes regarding policy loans and investments

- Document Your System: Create written guidelines for how your family banking system should operate after your lifetime

- Schedule Regular Family Financial Meetings: Use these to teach IBC principles and demonstrate policy operations

- Consider Trust Arrangements: For greater control over how and when policies transfer to heirs

- Designate a Family Banking System “Custodian”: Someone who fully understands IBC to help guide the next generation

Faith-Based Community Applications of IBC

Nash’s Christian worldview significantly influenced his approach to mutual aid and community support through financial structures. His vision extended beyond individual applications of IBC to encompass how faith communities could leverage these principles.

Community Banking Concepts

Nash envisioned faith communities implementing variations of his banking concept to create supportive financial networks:

- Church Policy Pools: Congregations establishing collective policies to fund ministry initiatives and support community needs

- Faith-Based Lending Circles: Groups of believers creating mutual support systems through coordinated IBC policies

- Ministry Endowments: Using IBC structures to create perpetual funding for mission work and local outreach

- Community Development Funds: Providing capital for faith-aligned business ventures and economic development

Ethical Finance: Nash believed that IBC aligned with biblical principles of stewardship, honest money, and mutual care. He saw policy loans as a way to finance community needs without the ethical concerns he associated with traditional fractional reserve banking.

Practical Applications for Faith Communities

- Church Building Funds: Using policy loans to finance construction while growing cash value

- Pastoral Support: Creating policies to supplement clergy retirement and housing needs

- Mission Funding: Establishing policies that generate ongoing cash flow for mission projects

- Disaster Relief Reserves: Building flexible capital pools that can be accessed quickly during community crises

- Educational Support: Funding scholarships and faith-based education initiatives

Nash often pointed out that early Christian communities practiced forms of mutual aid that reflected his banking principles—sharing resources while maintaining individual responsibility and dignity.

IBC vs. Traditional Financial Vehicles

Understanding how the Infinite Banking Concept compares to conventional financial approaches is essential for evaluating its potential benefits.

| Feature | IBC (Whole Life) | 401(k)/IRA |

|---|---|---|

| Control | Owner-controlled; you decide when and how to use your money | Governed by employer and government rules; penalties for early access |

| Liquidity | Policy loans available anytime with no questions or qualifications | Penalties and taxes for withdrawals before age 59½ with limited exceptions |

| Tax Treatment | Tax-deferred growth; tax-free access via policy loans; tax-free death benefit | Tax-deferred growth; fully taxed as ordinary income upon withdrawal |

| Legacy/Inheritance | Direct transfer to beneficiaries; no probate; income-tax-free death benefit | Subject to Required Minimum Distributions (RMDs); inherited IRAs taxed as income |

| Market Risk | Low risk; guaranteed cash values; non-guaranteed dividends have been consistently paid by top companies | High exposure to market volatility; no guarantees; potential for significant losses |

| Contribution Limits | No IRS-imposed limits (subject only to insurance underwriting) | Strict annual contribution limits set by IRS |

| Access to Capital | Can leverage for major purchases while continuing to earn returns on full value | Withdrawals permanently reduce account value and future growth potential |

| Creditor Protection | Strong protection in most states from creditors and lawsuits | Variable protection depending on state laws and ERISA status |

This comparison highlights why Nash advocated for IBC as a more flexible, controlled, and multi-purpose financial tool compared to conventional retirement accounts.

The Infinite Banking Concept in Practice

Implementing IBC involves several key steps:

- Establishing a properly structured, dividend-paying whole life insurance policy

- Nash focused on capitalizing the policy over at least 4-7 years, ideally longer for greater profitability, however, policy can be designed so that 90% of the cash value is available within 30 days.

- Using policy loans to finance purchases or investments

- Repaying the policy loans, effectively paying interest to oneself

- Repeating this process to continually grow one’s personal banking system

Nash suggested that, ultimately, annual life insurance premiums should equal annual income, though this might take 20-25 years to achieve for the average individual.

Addressing Common Concerns and Misconceptions

Nash addressed several common objections to IBC in his work:

- “Whole life insurance is too expensive”: Nash argued that it should be viewed as a strategic asset rather than an expense.

- “I can get a better return elsewhere”: Nash emphasized that IBC is about how you finance purchases, not just about investment returns.

- “It takes too long to build significant cash value”: Nash stressed the long-term nature of wealth building and the ongoing benefits throughout the policy’s life.

Frequently Asked Questions About the Infinite Banking Concept

How does the Infinite Banking Concept work?

The Infinite Banking Concept works by using specially designed dividend-paying whole life insurance policies as personal banking systems. You pay premiums to build cash value in your policy, which you can then access through policy loans. When you borrow against your policy, you’re technically borrowing from the insurance company using your cash value as collateral, but your policy continues to grow as if you hadn’t borrowed at all. As you repay these loans with interest, you’re essentially paying yourself rather than a bank. This creates a growing pool of capital that you control, allowing you to finance purchases, investments, and expenses while maintaining the growth of your policy.

What are the tax implications of IBC?

The Infinite Banking Concept offers several tax advantages. First, the cash value in your policy grows tax-deferred, meaning you don’t pay taxes on the growth as it accumulates. Second, when you access cash through policy loans, these transactions are not considered taxable events by the IRS (unlike withdrawals from retirement accounts). Third, if properly structured, you can access cash value beyond your basis (the amount you’ve paid in premiums) without triggering taxes through strategic use of policy loans. Finally, the death benefit passes to your beneficiaries income-tax-free. However, if you surrender a policy with gains above your cost basis, you may owe taxes on those gains. Always consult with a qualified tax professional for your specific situation.

How do policy loans affect death benefits?

When you take a policy loan, the death benefit is reduced by the outstanding loan amount plus any accrued interest if you pass away before repaying the loan. For example, if your policy has a $500,000 death benefit and you have an outstanding loan of $100,000 (including interest), your beneficiaries would receive $400,000. This reduction occurs because the insurance company has already advanced you part of the death benefit through the loan. However, the policy remains in force, and as you repay the loan, the full death benefit is restored. This feature makes careful loan management an important aspect of legacy planning with IBC.

Do I need to qualify medically for an IBC policy?

Yes, whole life insurance policies used for the Infinite Banking Concept typically require medical underwriting. The insurance company will assess your health through a combination of health questions, medical exams, and review of your medical records. Better health ratings result in lower premium costs and more favorable policy terms. However, even individuals with some health issues can often qualify for policies, though possibly at higher premium rates. Some insurance companies offer simplified underwriting options with less stringent health requirements, though these may come with trade-offs in policy performance.

Can I use IBC if I’m older or have health issues?

Yes, though with some modifications to the approach. Older individuals (typically over 50) or those with health challenges can still implement IBC strategies by: 1) Using policies with more immediate cash value access, 2) Considering policies on healthier family members where you’re the owner but not the insured, 3) Using graded death benefit policies that build cash value despite health issues, or 4) Creating a “banking system” using policies on children/grandchildren that you control initially. While premiums may be higher or growth slightly slower, the fundamental principles of becoming your own banker still apply.

How is IBC different from investing in the stock market?

IBC and stock market investing serve different purposes in a financial strategy. IBC focuses on creating a consistent, guaranteed financing system with stable growth, while stock market investing aims for appreciation through market participation and risk tolerance. Key differences include: 1) IBC offers guaranteed growth and protection against market downturns, while stocks have no guarantees, 2) IBC provides immediate liquidity without selling assets, 3) IBC creates tax advantages through policy loans rather than capital gains, and 4) IBC serves as both a financing system and death benefit protection. Nash often recommended using policy loans to finance investments in other assets, combining the advantages of both approaches.

How long does it take to build a functional IBC system?

A functional IBC system begins working immediately, but typically takes 4-7 years to become fully capitalized and efficient. In the first year, approximately 60-80% of premiums go toward establishing the policy, with increasing efficiency each year thereafter. By year 4-5, a well-designed policy has substantial cash value that can be accessed and recycled through policy loans. Nash emphasized that even though full capitalization takes time, you begin participating in the banking function from day one, and that proper policy design can allow access to 60-90% of premium dollars within the first year, depending on age, health, and policy structure.

Can I use my 401(k) or IRA to fund an IBC policy?

You cannot directly roll over qualified retirement funds (401(k), IRA, etc.) into a whole life insurance policy without triggering taxes and potentially penalties. However, some IBC practitioners use strategic partial withdrawals or loans from retirement accounts (when eligible) to fund premiums. Others implement a gradual shift in their saving strategy, directing new contributions toward an IBC policy instead of qualified plans. Nash generally recommended against qualified plans altogether, suggesting individuals would be better served building their banking system from the beginning rather than participating in tax-deferred vehicles with government restrictions.

What happens if the insurance company fails?

Insurance companies used for IBC should be mutual companies with strong financial ratings and long histories of stability. These companies are heavily regulated at the state level and required to maintain substantial reserves. Additionally, each state has guarantee associations that provide protection (typically $100,000-$500,000 per policy, depending on the state) in the rare event of an insurance company failure. Nash recommended using multiple companies to diversify this already minimal risk. Historically, policy owners in failed insurance companies have typically had their policies transferred to stronger companies rather than losing their coverage and cash values.

How does inflation affect an IBC strategy?

Whole life insurance has built-in protection against inflation through several mechanisms: 1) Dividend rates tend to rise in higher inflation environments as insurance companies invest in new bonds at higher yields, 2) The death benefit can be structured to increase over time, maintaining purchasing power, 3) The velocity of money principle (using your policy for financing while it continues to grow) helps outpace inflation through compounding effects, and 4) As your banking system grows, you can increase premium payments to scale with inflation. Nash viewed IBC as significantly more inflation-resistant than traditional banking deposits or fixed-income investments.

Can businesses implement IBC?

Yes, businesses can implement IBC strategies through corporate-owned life insurance (COLI). This approach offers several advantages: 1) Creating a corporate financing system for equipment purchases, expansion, or operating capital, 2) Establishing key-person insurance protection, 3) Funding buy-sell agreements between partners, 4) Providing supplemental executive benefits, and 5) Creating tax-advantaged assets on the company balance sheet. Nash frequently worked with business owners to implement IBC within their companies, emphasizing how business entities could benefit from the same banking principles as individuals.

What happens to my IBC policy if I stop paying premiums?

If you stop paying premiums on a whole life policy used for IBC, several options are available: 1) Use accumulated dividends to pay premiums temporarily, 2) Convert to a paid-up policy with a reduced death benefit using the reduced paid-up option, 3) Use existing cash value to continue the policy as extended term insurance, or 4) Take a policy loan to pay premiums. In a properly designed IBC policy, after 7-10 years, there should be sufficient cash value and dividends that the policy can sustain itself without additional premium payments if necessary, though continued funding is optimal for maximizing the banking function.

Is IBC suitable for anyone, or just high-income individuals?

Nash designed IBC to be adaptable to various income levels and financial situations. While high-income individuals can capitalize their banking systems more quickly, Nash emphasized that the principles work for anyone who: 1) Has regular income that can support consistent premium payments, 2) Takes a long-term perspective on wealth building, and 3) Is committed to learning the banking function. For those with limited means, Nash recommended starting with a smaller policy and gradually increasing premiums as income grows. He believed the discipline and financial education inherent in the IBC process were especially valuable for those with modest incomes.

Faith-Based Community Applications of IBC (Continued)

Biblical Stewardship Model

Nash frequently connected his IBC approach with biblical principles of stewardship. He saw parallels between the Bible’s teachings on financial responsibility and his system:

- Careful Stewardship: “For which of you, intending to build a tower, does not sit down first and count the cost, whether he has enough to finish it” (Luke 14:28) aligned with Nash’s emphasis on thoughtful financial planning

- Generational Transfer: “A good man leaves an inheritance to his children’s children” (Proverbs 13:22) supported his focus on legacy planning

- Avoiding Debt Bondage: “The borrower is servant to the lender” (Proverbs 22:7) reinforced his critique of traditional banking dependence

Church and Ministry Applications

Nash envisioned several practical applications for faith communities:

- Church Building Fund Alternatives: Rather than traditional debt financing for church construction, congregations could establish policies owned by the church that build value while providing access to capital

- Missionary Support Systems: Creating policies that generate ongoing cash flow for mission work through the banking function

- Minister Retirement Provisions: Supplementing often inadequate pastoral retirement plans with dividend-paying policies

- Congregation Assistance Funds: Establishing policies that allow for flexible lending to congregation members in need

Practical Example: A church with 100 families could establish a congregational banking policy where each family contributes $100 monthly. This creates a growing pool of capital that can be used for building needs, community outreach, emergency assistance for members, and eventually generating dividend income to support ongoing ministry – all while creating a legacy for future generations of the congregation.

Faith-Based Financial Education

Nash believed churches could serve as centers for financial education, particularly teaching IBC principles:

- Offering seminars and study groups on biblical financial principles

- Establishing mentorship programs pairing financially experienced members with younger families

- Creating resource libraries with materials on IBC and faith-based financial management

- Developing youth programs that teach financial literacy from a biblical perspective

Nash saw these educational efforts as part of the church’s discipleship mission, helping believers apply their faith to all areas of life, including finances.

The Future of IBC

Today, the Infinite Banking Concept continues to gain traction in the financial world. As traditional financial systems face increasing scrutiny and volatility, many are turning to IBC as a means of creating financial stability and independence.

Nash envisioned IBC as a multigenerational strategy, capable of creating a perpetual banking system that could be passed down to future generations.

Modern Adaptations and Evolution

Since Nash’s passing, practitioners have continued to refine and adapt IBC strategies to address evolving economic conditions and financial needs:

- Integrating IBC with other asset protection strategies like trusts and LLCs

- Adapting policy designs to work within changing tax and insurance regulations

- Developing educational technology to make IBC concepts more accessible

- Creating community networks of IBC practitioners who collaborate on financing projects

These innovations build upon Nash’s core principles while making them relevant to contemporary financial challenges.

IBC in a Changing Financial Landscape

Several trends make Nash’s ideas particularly relevant today:

- Economic Uncertainty: Increasing market volatility has heightened interest in financial systems with guaranteed growth components

- Evolving Retirement Planning: Concerns about the long-term viability of government programs has led many to seek private alternatives

- Financial Independence Movement: Growing interest in personal financial sovereignty aligns with Nash’s emphasis on control and self-sufficiency

- Multigenerational Planning: Increasing focus on legacy planning and generational wealth transfer resonates with IBC’s long-term perspective

These factors suggest that Nash’s influence will continue to grow as more individuals seek alternatives to conventional financial planning.

Conclusion

R. Nelson Nash’s contributions to personal finance have been truly revolutionary. Through the Infinite Banking Concept, he challenged conventional financial wisdom and offered individuals a path to greater financial control and prosperity.

Nash’s ideas remain profoundly relevant in today’s economic climate. As individuals seek alternatives to traditional banking and investing methods, the principles of IBC offer a compelling solution. By becoming their own bankers, people can take charge of their financial futures, build lasting wealth, and achieve a level of financial independence that might otherwise seem out of reach.

The legacy of Nelson Nash lives on through the countless lives he has impacted and the ongoing growth of the IBC movement. His vision of financial empowerment continues to inspire and guide individuals toward a more secure and prosperous future.

Next Steps

Take Control of Your Financial Future with IBC

If you’re intrigued by the Infinite Banking Concept and want to explore how it might benefit your financial future, take the next step. Our team of Pro Client Guides is ready to provide personalized consultations tailored to your unique financial situation and goals.

- Get answers to your specific questions about implementing the concept

- Receive detailed illustrations of how IBC could work for you

- Access ongoing coaching to help you maximize the benefits of IBC

Don’t let this opportunity to transform your financial future pass you by. Contact one of our Pro Client Guides today and start your journey toward becoming your own banker.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

Sources

Becoming Your Own Banker by R. Nelson Nash

The Source of the Source of Nelson Nash’s Infinite Banking Concept, Ryan Griggs