Infinite Banking is a financial strategy that utilizes high cash value whole life insurance policies to create a private banking system. This approach empowers individuals to manage and grow their wealth with autonomy, aligning with the legacy-building principles found in Proverbs 13:22. By functioning as both a wealth accumulation tool and a robust asset protection mechanism, Infinite Banking offers a unique framework that minimizes reliance on traditional banking institutions. It provides a stable financial platform for building substantial inheritance. It allows policyholders to borrow against their policy’s cash value to invest in wealth-generating opportunities without interrupting the compounding interest. Through this strategy, individuals can secure financial prosperity for future generations while fostering financial self-sufficiency and empowering themselves to manage their wealth more intentionally and effectively.

Infinite Banking Legacy Creation

Table of Contents

- Introduction to Infinite Banking

- Understanding Infinite Banking

- The Role of Whole Life Insurance

- Financial Empowerment through Infinite Banking

- Legacy Building with Infinite Banking

- Overcoming Challenges

- Conclusion

- Next Steps

Introduction to Infinite Banking

Legacy and Wealth in Proverbs 13:22

Leaving a lasting legacy, deeply rooted in the wisdom of Proverbs 13:22—”A good man leaves an inheritance to his children’s children”— strongly resonates with the principles of Infinite Banking. This strategy empowers you to manage and grow your wealth in a way that benefits you during your lifetime and secures financial prosperity for future generations. Utilizing a high cash value whole life insurance policy as your personal banking system, you step into a realm of financial autonomy that aligns seamlessly with the Biblical vision of legacy creation.

As a steward of your finances, preserving wealth across generations is a paramount concern, and Infinite Banking offers a unique framework for achieving this. The policy’s structure, featuring the growth of cash value, which you can access tax-free, ensures that your assets are protected and poised for growth. This approach minimizes reliance on traditional banking institutions and the volatility of market-driven investments, providing a stable financial platform to build a substantial inheritance.

Infinite Banking enhances your ability to act intentionally as a steward of your wealth. It allows you to borrow against the policy’s cash value to invest in wealth-generating opportunities or address financial needs without interrupting the compounding interest on your entire cash value balance. This dual benefit ensures that your dollars work for you in two places at once—within the policy and in your chosen investments—mirroring the Biblical principle of prudent and multiplied stewardship. Through an infinite banking strategy, you secure your financial future and forge a lasting legacy that honors the spirit of generational prosperity.

The Advantages of Infinite Banking for Asset Protection

Infinite Banking is a multifaceted tool, providing a mechanism for wealth accumulation and a formidable shield against creditors and legal challenges. This dual functionality is crucial for ensuring your assets are grown and securely retained within the family over generations.

Using a dividend paying whole life insurance policy, you place your money in a vehicle with creditor protection in many states. In financial challenges or legal disputes, the cash value accumulated within your policy may be protected from creditors, ensuring that these assets remain intact and within your control. Such protections vary by state, but they commonly provide a layer of security that traditional investment vehicles cannot offer.

Moreover, the privacy afforded by whole life insurance policies further shields your financial activities from public scrutiny and potential legal vulnerabilities. Unlike bank accounts and other financial assets, which third parties can examine through standard financial inquiries, the details of a life insurance policy—including the cash value and any loans taken against it—are not publicly accessible. This privacy reduces the likelihood of legal challenges targeting these assets, adding an extra layer of security.

Integrating Infinite Banking into your financial strategy creates a strong framework for building and protecting wealth. This strategy ensures you pass down your assets as intended without being diminished by external claims or disputes, safeguarding your family’s financial legacy.

Understanding Infinite Banking

Creating Your Own Financial Ecosystem

Infinite Banking capitalizes on the unique feature of dividend paying whole life insurance policies that allow you to borrow against and repay the cash value. This mechanism fosters financial flexibility and optimizes your control over your finances and the accumulation of interest, setting a solid foundation for immediate liquidity and long-term growth.

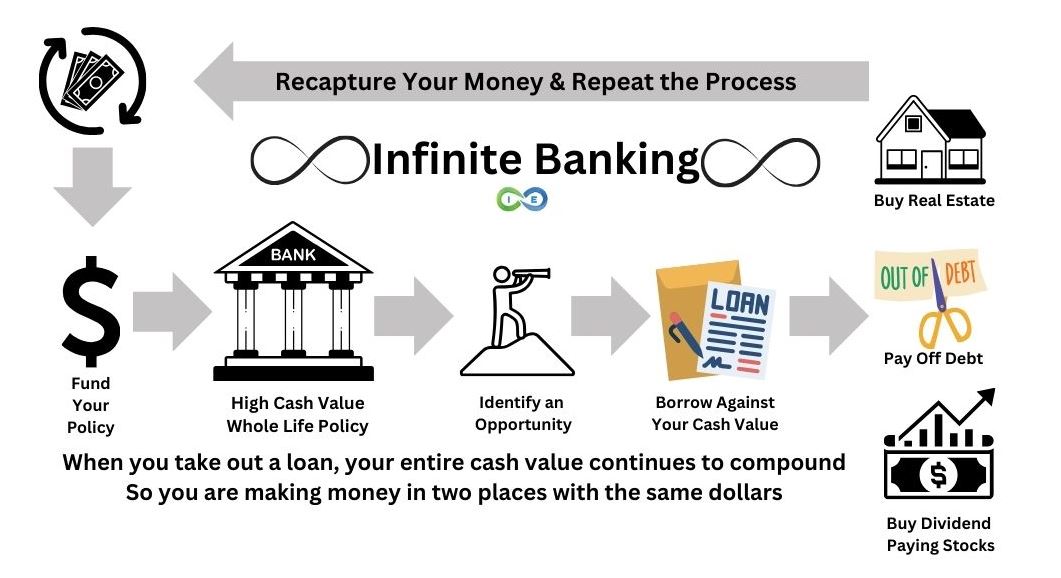

When you borrow against the cash value of your whole life insurance policy, you take out a loan from the insurance company using the accumulated cash value as collateral. What is particularly compelling about this process is that even though you use this cash as collateral, your entire cash value continues to earn interest. This means your money is working in two places simultaneously—supporting ongoing investments while still growing within the policy through uninterrupted compounded interest.

Repaying the loan offers further advantages. You have the flexibility to set your repayment terms, which you can tailor to match your financial situation. The insurance company does not enforce a strict schedule, allowing you to repay the loan on your timeline. This flexibility is critical for optimizing cash flow, especially when your financial inflows are variable. Additionally, by repaying the loan, you restore the full borrowing power of your cash value, readying it for future needs or investment opportunities.

This borrowing-and-repaying dynamic enhances your financial control by allowing you to manage your liquidity needs without disrupting the growth trajectory of your investments within the policy. It ensures that your financial strategy is reactive to immediate needs and proactively builds a vigorous, compounding asset base. This strategic approach aligns perfectly with the principles of Infinite Banking, where your personal wealth management system not only serves current financial demands but also systematically builds and preserves wealth for future use.

Optimizing Cash Flow Management with Infinite Banking

Optimizing cash flow management through Infinite Banking offers a transformative approach to handling personal and business financial streams, enhancing liquidity, and ensuring stability without relying on external financial institutions. By utilizing the strategic advantages of high cash value whole life insurance, you can establish a reservoir of readily accessible funds while continuing to grow your wealth.

For Personal Finance: Infinite Banking allows you to use the cash value of your life insurance policy as a personal emergency fund or for major expenses. Instead of liquidating investments or taking on high-interest debt from credit cards or unsecured loans, you can borrow against your policy. This approach keeps your investments intact and growing and provides liquidity for unexpected expenses or investment opportunities. The ability to repay the loan on your terms helps manage cash flow efficiently, ensuring you do not strain your finances.

For Business Operations: Businesses often face cash flow challenges due to seasonal revenue fluctuations or unexpected expenses. With Infinite Banking, business owners can tap into their policy’s cash value to smooth out cash flow bumps, which is invaluable for covering short-term operational costs, capital improvements, or even funding expansion efforts without the need for traditional bank loans. The same principles apply here—while the cash value is borrowed against, it continues to earn interest, thereby not depleting the asset.

Enhancing Financial Stability: By having immediate access to cash and the flexibility to repay it at a pace that suits your financial situation, you reduce your dependency on external credit sources, which often come with strings attached, such as variable interest rates or stringent repayment conditions. This autonomy in managing your liquidity enhances your overall financial stability, as you are less likely to be impacted by external credit market fluctuations.

Strategic Repayment Plans: Repayment of loans taken against your policy’s cash value should be strategic. Although you can set your repayment schedule, planning repayments when your cash inflows are strong is advantageous. This repayment keeps the policy’s cash value growing optimally and prepares you for future borrowing needs, effectively allowing you to cycle through borrowing and repaying as part of your broader financial strategy.

By integrating these strategies, Infinite Banking becomes a powerful tool for optimizing cash flow management. It allows high-net-worth individuals and business owners to maintain liquidity and financial stability while building a foundation for long-term wealth accumulation and legacy planning.

The Role of Whole Life Insurance

Building a Financial Foundation

Whole life insurance, the ultimate asset when used with the Infinite Banking concept, offers several structural benefits crucial for effective legacy planning. These benefits include stable cash value growth, tax advantages, and a guaranteed death benefit, providing a secure foundation for building and preserving wealth across generations.

Stable Cash Value Growth: One of the most significant advantages of whole life insurance is the guaranteed cash value growth. Unlike other investment vehicles that may fluctuate with market conditions, the cash value in a whole life insurance policy grows at a predetermined rate the insurance company sets. This steady growth ensures that your policy accumulates value reliably year after year, providing a solid financial foundation upon which you can draw for personal loans or further investment without the risk associated with other volatile assets.

Tax Advantages: Whole life insurance is favored for its tax benefits, crucial in legacy planning. Cash value growth in a whole life insurance policy is tax-deferred, meaning you do not pay taxes on the growth as it accrues. Additionally, the death benefit paid to your beneficiaries upon passing is generally tax-free. The tax-free death benefit can represent a significant tax advantage, ensuring more wealth transfer to your heirs rather than eroded by taxes. Furthermore, loans taken against the policy’s cash value are not taxable events, providing tax-free liquidity during your lifetime.

Guaranteed Death Benefit: Besides serving as a financial tool during your lifetime, whole life insurance provides a guaranteed death benefit, a critical component of legacy planning. This benefit ensures that a predetermined amount of money will be passed on to your beneficiaries, providing them with financial security and support after your passing. This guaranteed sum can alleviate potential financial burdens on your family, contributing to the financial stability of future generations.

Dividend Payments: Many whole life policies are with mutual insurance companies, which may pay dividends to policyholders if the company performs well financially. These dividends can purchase additional paid-up insurance, increasing the death benefit and the policy’s cash value without additional out-of-pocket expense. Over time, this can significantly enhance the policy’s value, further boosting the legacy you leave behind.

These structural elements of whole life insurance make it an invaluable tool in legacy planning. It provides financial security and growth during one’s lifetime and ensures that one’s wealth is preserved and passed on efficiently and effectively to future generations.

Comparing Whole Life Insurance with Other Private Banking Alternatives

Whole life insurance, when utilized within the Infinite Banking concept, offers distinct advantages that cater to the unique financial needs of the affluent. Compared to other financial management solutions, such as private banking, investment funds, and trusts, whole life insurance stands out for its privacy, control, and the ability to provide bespoke services. Here’s how:

Privacy: Whole life insurance offers a high level of privacy that is not typically available in other financial instruments. Unlike bank accounts or investment holdings, in which third parties can scrutinized through public records or exposed to legal investigations, the cash value and death benefit of a whole life insurance policy are private and do not appear on personal balance sheets or public records, offering an extra layer of privacy. This aspect of whole life insurance is particularly appealing for high net-worth individuals and anyone who values discretion in their financial affairs.

Control: One of the most significant advantages of whole life insurance within the Infinite Banking framework is the degree of control it affords policyholders over their financial assets. Unlike traditional investment accounts, where decisions are often in the hands of fund managers, whole life policyholders have direct control over their funds. They can decide when and how much to borrow against the policy’s cash value without needing to undergo credit checks or fulfill loan qualifications. This autonomy allows for more flexible and responsive management of personal and business finances.

Bespoke Services: Whole life insurance policies can be highly customized to meet the specific needs of the affluent. This customization includes the addition of various riders, such as disability waivers or accelerated death benefits, which can provide additional protection depending on the policyholder’s circumstances. Furthermore, the structure of dividends and the allocation between base premiums and paid-up additions optimize growth and liquidity based on individual financial goals. This level of customization is akin to the bespoke services provided by private wealth management but with the added benefits of the insurance framework.

Comparison with Other Financial Solutions:

- Private Banking: While private banking offers tailored financial services and investment advice, it generally lacks the insurance benefits and tax advantages associated with whole life policies. Additionally, private banking services often incur higher fees and require substantial minimum balances.

- Investment Funds: They serve their purpose but are subject to market volatility and offer less privacy and control. While they can provide significant returns, they do not offer guaranteed growth or tax-free life insurance benefits.

- Trusts: Although trusts are excellent for estate planning and can provide specific tax advantages, they are often complex and expensive to set up and manage. Trusts do not offer liquidity or personal control over assets that whole life insurance does, as trustees control trusts.

In summary, for affluent individuals looking for a robust financial management tool that provides privacy, control, and tailored financial solutions, whole life insurance offers a compelling option, particularly when integrated with the Infinite Banking concept. This integration enhances financial flexibility and contributes to proper legacy planning and wealth preservation.

Financial Empowerment through Infinite Banking

Self-Sufficiency in Wealth Management

Infinite Banking fundamentally shifts how families manage their wealth by providing a system that empowers them to handle their financial needs internally, reducing their reliance on traditional banking institutions. This concept, centered around using high cash value whole life insurance policies, enables families to be your own bank. Here’s how Infinite Banking fosters this independence and internal management of resources:

Creating a Personal Banking System: At the heart of Infinite Banking is using the cash value accumulated in a whole life insurance policy as a personal bank. This cash value grows over time, istax-deferred, and is accessed tax-free via loans without the typical approval processes required by traditional banks. This liquidity means that families can finance large purchases, invest in opportunities, or manage emergencies using their resources without external approval.

Enhanced Financial Control: By borrowing against the cash value of their insurance policy, families have immediate access to funds, but under terms they set themselves. Negotiating with external lenders or adjusting to their terms and timelines is unnecessary. This level of control is valuable in managing cash flow for both expected and unexpected expenses, allowing families to decide when and how to repay the loans without the risk of altering their credit scores or public financial records.

Minimizing Interest Expenses: Traditional loans often have high-interest rates, which can consume a significant portion of a family’s income over time. With Infinite Banking, the interest paid on loans taken against a whole life insurance policy goes back into the policy, not to an external lender. Essentially, you are paying interest to yourself, keeping the money within your personal economy. This internal recycling of funds preserves more of your wealth and compounds your policy’s growth.

Continuous Growth and Liquidity: Even when you take out a loan against the policy, the policy’s entire cash value continues to earn interest. This unique feature of whole life insurance ensures that your asset continues to grow, enhancing your financial base year after year. The liquidity provided by easy access to the cash value allows families to capitalize on investment opportunities without waiting for loan approvals or liquidating other assets at inopportune times.

Educational and Legacy Benefits: Infinite Banking also includes an educational component, teaching family members about financial management, the power of compound interest, and strategic investment. This knowledge transfer is critical to legacy building, ensuring that future generations possess the skills and mindset to manage and grow the family’s wealth independently.

Reduced Financial Stress and Enhanced Stability: Families enjoy a more stable and predictable financial environment by reducing dependence on traditional banks and external financial products that may fluctuate with market conditions. This stability is crucial during economic downturns or when the market is volatile, providing a safe harbor that protects the family’s financial well-being.

Infinite Banking provides a financial management tool and fosters a holistic approach to wealth creation and preservation. It empowers families to manage their finances with greater autonomy, ensuring their wealth serves them and not vice versa. Through this system, families can achieve a more secure financial future, tailor their economic activities to their needs, and pass on a powerful financial legacy to their descendants.

Infinite Banking for Diversifying Investment Portfolios

Infinite Banking offers a dynamic and flexible approach to personal finance, mainly through life insurance policy loans that can fund investments across a broad spectrum of opportunities. By leveraging the cash value of a whole life insurance policy, you can access funds to invest in diverse fields such as real estate, private equity, and even more exotic ventures like art and collectibles. Here’s how this works and the advantages it provides:

Accessing Policy Loans: The cash value in your whole life insurance policy serves as collateral for policy loans, which you can initiate without the lengthy approval processes typical of traditional banks. This access to your money via collateral allows you to quickly and easily access capital when a timely investment opportunity arises, whether it’s a real estate deal that needs to close soon, an opportunity to invest in a promising start-up, or the chance to acquire a beaten down stock or crypto that you have been tracking.

Real Estate Investments: Real estate is a popular investment choice for those practicing Infinite Banking because it can generate immediate cash flow through rentals and long-term capital appreciation. Using policy loans to finance property purchases allows you to maintain liquidity and leverage your policy’s growth while potentially increasing your wealth through real estate. You can then use the cash flow from these properties to repay the policy loan, effectively making your investments self-sustaining.

Investing in Private Equity: Private equity involves investing in private companies, often resulting in higher returns than publicly traded companies. However, these investments usually require significant capital and are less liquid. Policy loans can provide the needed funds without disrupting other investments or cash reserves. This access to funds allows you to diversify your portfolio into higher-risk, higher-return assets while using your life insurance policy’s steady, predictable growth as a financial backstop.

Maintaining Investment Momentum: One of the key advantages of using policy loans for such investments is that your whole life insurance policy continues to earn interest on the entire cash value, even on the portion you’ve borrowed against, providing uninterrupted, compounding over time, which can offset the costs of interest on the loan. Essentially, your money works for you in two places at once—within the policy and in your investment—maximizing your financial growth and efficiency.

Strategic Financial Management: By using policy loans to fund diverse investments, you maintain control over your financial strategy. Based on your overall financial goals and the performance of your investments, you decide when to take out a loan, how much to invest, and when to repay. This level of control is crucial for effectively managing and growing wealth to your personal and family objectives.

In summary, Infinite Banking and the strategic use of policy loans allow you to explore and invest in various fields, enhancing your portfolio’s diversity and potential for high returns while maintaining the stability and growth of your core financial assets. This approach broadens investment opportunities and reinforces financial autonomy and legacy building.

Legacy Building with Infinite Banking

Securing Generational Wealth

Infinite Banking offers an intentional wealth-building strategy for securing financial assets and ensuring they are efficiently passed down to future generations with minimal loss. This approach, centered around using high cash value whole life insurance policies, is especially advantageous for legacy planning. Here’s how Infinite Banking facilitates the efficient transfer of wealth:

Tax Efficiency: One of the primary benefits of using whole life insurance in Infinite Banking is its tax advantages. The cash value growth within these policies is tax-deferred, meaning you don’t pay taxes on the interest, dividends, or capital gains as they accrue. More importantly, the death benefit—paid to beneficiaries upon the policyholder’s passing—is generally received tax-free. This tax-free death benefit avoids the significant tax burden accompanying other inheritance forms, such as estate taxes on property or retirement account distributions, ensuring that more of your accumulated wealth reaches your heirs.

Bypassing Probate: Whole life insurance benefits are paid directly to the beneficiaries listed on the policy, bypassing the probate process. Probate can be lengthy and costly, potentially tying up assets and reducing the amount that eventually gets passed down. By avoiding probate, your beneficiaries can access the funds more quickly and without the associated legal costs, ensuring that your legacy is transferred efficiently and intact.

Continued Asset Growth and Loan Repayment Flexibility: Your life insurance policy’s cash value grows each year, independent of market fluctuations, providing a stable asset growth environment. Additionally, if you or your beneficiaries choose to take loans against the policy, the flexible repayment terms mean that outstanding loans do not necessarily hinder the policy’s growth. This flexibility allows for better financial management and planning, ensuring that assets are maximized and preserved according to family needs and circumstances.

Controlled Distribution of Wealth: Infinite Banking gives you control over how your wealth is distributed over time. Instead of a one-time disbursement, you can structure the policy to provide ongoing benefits to your heirs, helping manage the transfer of wealth in a way that aligns with your and your beneficiaries’ financial goals and needs. This transfer control ensures that younger beneficiaries grow into their inheritance responsibly.

Preservation of Family Wealth: By using policy loans strategically throughout your lifetime, you can fund major expenses—like education, down payments on homes, or seed money for business ventures—without diminishing other investment assets that are intended for legacy purposes. This strategic use of financial resources helps preserve family wealth across generations, ensuring that your financial legacy is maintained and utilized to foster wealth creation for future generations.

In summary, Infinite Banking secures your financial assets against market risks and taxes and ensures that these assets are passed down efficiently and with minimal loss through strategic policy management. This preserves your legacy and benefits your loved ones, aligning with your long-term financial and familial goals.

Philanthropy through Infinite Banking

Infinite Banking offers high net worth individuals a strategic avenue to extend their legacy beyond the confines of their family by funding charitable endeavors. This concept leverages the financial flexibility and benefits of high cash value whole life insurance to make significant philanthropic impacts. Here’s how you can use Infinite Banking to support charitable causes effectively and create a broader legacy:

Tax Benefits: Leveraging your whole life insurance for charitable giving can also provide tax advantages. For instance, if you name a charity as a beneficiary of your policy, the death benefit they receive is typically tax-free. This tax-free death benefit maximizes the impact of your gift, as the charity will receive the total amount without deductions. Moreover, depending on how you structure your contributions, there might be opportunities to claim tax deductions for the premiums paid on the policy, mainly if you involve a charitable trust in your planning.

Creating a Charitable Legacy Fund: You can structure your whole life insurance policy to make a charitable legacy fund. By allocating part of your policy’s benefits or setting up a trust as a beneficiary, you can ensure that a substantial amount of your wealth goes directly to charity upon your passing. This approach not only provides long-term funding for causes important to you but also ties your name and legacy to ongoing philanthropic work.

Enhancing Charitable Giving with Dividends: Your policy dividends can increase the death benefit and cash value, but you can also direct them toward charitable efforts. Annually directing dividends to charity can create a regular stream of giving, akin to establishing a foundation but without the associated administrative complexities.

Lifetime Philanthropic Planning: Infinite Banking facilitates a proactive approach to philanthropy during your lifetime. Rather than waiting to bequest money after passing, you can begin seeing the impact of your contributions now. This proactive approach allows you to witness the benefits of your generosity and helps establish a solid philanthropic tradition within your family, inspiring future generations to continue your charitable legacy.

In conclusion, Infinite Banking offers high net worth individuals a powerful tool to expand their legacy beyond their immediate family, including charitable giving. This approach furthers philanthropic causes and ensures that your legacy is remembered and honored in diverse and impactful ways, reinforcing the values you cherish during your lifetime and beyond.

Overcoming Challenges

Navigating Infinite Banking Complexities

Managing high cash value whole life insurance policies, especially within the Infinite Banking framework, can present particular challenges. These challenges can range from understanding the complexities of policy management to adapting to regulatory changes that may affect how these policies function. Here are some common challenges along with practical solutions to help families manage these policies effectively:

Complexity of Policy Details:

- Solution: Education is critical. It’s crucial to understand the intricacies of your policy—how cash value accumulates, the impact of loans on your policy, and how dividends work. Work with a knowledgeable insurance professional specializing in Infinite Banking to get regular reviews and updates on your policy. Attending workshops or seminars on Infinite Banking can also provide deeper insights and operational knowledge.

Adapting to Regulatory Changes:

- Solution: Regulatory changes can impact the benefits and management of whole life insurance policies. To stay ahead, maintain a relationship with a financial advisor who can alert you to relevant regulatory changes. Additionally, subscribing to newsletters from reliable financial advisory firms or insurance providers can keep you informed about changes in the insurance landscape that might affect your strategy.

Maintaining Discipline in Repayment of Loans:

- Solution: Whole life insurance for Infinite Banking offers loan repayment flexibility, but it requires financial discipline. Set up a structured repayment plan that mimics regular loan obligations to ensure consistent growth of your policy’s cash value. Treat repayments like any other financial commitment by setting reminders or automating the process as much as possible.

High Premium Commitments:

- Solution: Whole life policies, especially those designed for cash value accumulation, require higher premium commitments, which can be challenging to maintain. Where possible, consider structuring the policy with flexibility in premium payments or choosing a lower initial death benefit to reduce the premium cost. Use paid-up additions to increase the policy’s value and benefits as financial circumstances improve.

Managing Cash Flow to Fund Premiums:

- Solution: Effective cash flow management is essential, particularly for families that allocate significant funds towards policy premiums. Regular financial planning sessions can help forecast and allocate funds appropriately without disrupting your family’s budget. Tools like cash flow calculators and budgeting apps can also assist in maintaining a healthy balance between income, expenditures, and insurance premium obligations.

Ensuring Succession and Continuity:

- Solution: Planning for succession and continuity is essential, as policies can last a lifetime and beyond. Ensure that beneficiaries are designated and understand their roles and responsibilities regarding the policy. Additionally, consider involving your heirs in discussions about the financial strategies underpinning your Infinite Banking approach to prepare them for future management.

By addressing these challenges with proactive strategies and thoughtful planning, families can effectively manage their whole life insurance policies within the Infinite Banking framework. This policy management enhances their ability to maintain and grow their financial assets and ensures that the legacy aspects of their planning are solidly in place.

Advanced Estate Planning with Whole Life Insurance

Managing large estates requires a sophisticated approach to estate planning, focusing on optimizing tax efficiency and ensuring strict legal compliance. High-worth individuals often face complex financial landscapes that require advanced strategies to preserve wealth and minimize tax liabilities. Here are key considerations and strategies for managing large estates within the legal framework:

Use of Trusts:

- Strategy: Trusts are pivotal in managing large estates for tax efficiency and legal compliance. Establishing irrevocable trusts, such as life insurance trusts (ILITs), can remove the policy’s death benefit from your taxable estate. This means it is not subject to estate taxes, which can be significantly high for large estates. Trusts can also stipulate how assets are distributed to beneficiaries, ensuring that wealth is allocated according to your wishes and protected from potential creditors or legal disputes.

Annual Gifting to Reduce Estate Size:

- Strategy: Utilize annual gift tax exclusions to gradually transfer wealth during your lifetime, thereby reducing the size of your estate and potential estate taxes upon death. In 2023, you can give up to $16,000 per recipient without incurring gift tax. For married couples, this amount doubles. Such gifting can include cash or shares of a business, strategically reducing your taxable estate while benefiting your heirs immediately.

Strategic Use of Charitable Contributions:

- Strategy: Charitable giving can be an effective method to reduce taxable estate size. By setting up charitable remainder trusts or foundations, you fulfill philanthropic goals and shift substantial amounts of wealth out of your taxable estate. Moreover, these contributions can provide you and your heirs with significant tax deductions, reducing current income taxes and potential estate taxes.

Advanced Life Insurance Strategies:

- Strategy: Policies structured within an irrevocable life insurance trust can offer more than just a death benefit; they can serve as a vehicle for passing wealth to the next generation without the burden of estate taxes. However, when putting your policy into an ILIT, you limit your ability to utilize the policy for infinite banking.

Family Limited Partnerships (FLPs):

- Strategy: FLPs are entities that allow business owners to transfer assets like family businesses or real estate to their heirs while retaining control over the management of the assets. Transferring partial interest in the partnership can also leverage valuation discounts for lack of marketability and minority interests, reducing the value of transferred assets for estate and gift tax purposes.

Regular Estate Plan Reviews and Compliance Checks:

- Strategy: Estate laws and tax regulations can change, impacting the effectiveness of current estate planning strategies. Regular reviews of your estate plan with legal and tax professionals ensure that your strategy remains compliant with current laws and as efficient as possible. This proactive review helps adapt to changes in tax law, family dynamics shifts, or financial situation changes.

By integrating these strategies, high-net-worth individuals can confidently navigate the complexities of estate planning, ensuring that their wealth is managed efficiently, passed on effectively, and aligned with their long-term financial and legacy objectives. Each strategy should be tailored to individual circumstances, often requiring the guidance of experienced estate planners, tax professionals, and legal advisors to achieve the best outcomes.

Conclusion

The Infinite Potential of Infinite Banking>

In conclusion, Infinite Banking offers a compelling array of strategic benefits specifically tailored to the needs of high net worth families, focusing on enhancing financial independence and securing a lasting legacy. By leveraging high cash value whole life insurance policies, families can create a resilient financial system that serves dual purposes: managing wealth efficiently and preparing for future generations’ prosperity.

Financial Independence:> Infinite Banking fosters financial independence by reducing reliance on traditional banking institutions. This approach allows families to control their financial interactions more directly, managing loans, payments, and investments within the framework of their policies. Using the cash value of life insurance policies as a private bank provides liquidity and creates a buffer against market volatility, ensuring stable, predictable financial growth. This autonomy in financial decision-making empowers families to tailor their financial activities to meet their immediate needs and long-term goals best.< Enhanced Legacy Security: Perhaps most importantly, Infinite Banking secures tax-efficient and legally compliant legacies. The growth of the policy’s cash value and the tax-free status of the death benefit ensures that a significant portion of a family’s wealth is transmitted to the next generation without being eroded by taxes or legal complications. Furthermore, bypassing probate speeds the transfer of assets, simplifying and securing the process of wealth transition to heirs. Adaptability and Future-Proofing: Infinite Banking is not static; it adapts to include new financial products and technologies, from digital assets to innovative insurance riders. This adaptability ensures the strategy remains relevant and effective, even as financial landscapes evolve. It also positions high net worth families to take advantage of emerging opportunities, maintaining their leading edge in wealth management. Education and Empowerment: Beyond financial mechanics, Infinite Banking educates and empowers generations. Involving family members in managing the policy and its uses instills financial literacy and responsibility, essential skills for maintaining and growing inherited wealth. This educational aspect ensures that the legacy is financial and intellectual, providing future generations with the knowledge to continue building upon the foundation laid by their predecessors. In essence, Infinite Banking is more than just a financial strategy; it is a comprehensive approach to wealth management that provides high net worth families with the tools necessary to achieve financial independence and secure their legacy. It empowers them to manage their wealth with foresight and precision, ensuring their legacy is preserved and enhanced for future generations.

The Role of Trust and Transparency in Financial Partnerships

Maintaining a transparent relationship with your life insurance advisor ensures that the Infinite Banking strategy effectively aligns with your family’s values and financial goals. This transparency is critical because it fosters mutual understanding and trust, which is essential for tailoring a financial plan that meets and anticipates the complex needs of high net worth families. Here’s why this relationship is so crucial:

Tailored Strategy Development: Infinite Banking is highly customizable, and achieving an optimal setup requires detailed knowledge of your financial situation, goals, and family dynamics. An open and transparent relationship with your advisor enables them to design a policy that fits your unique circumstances precisely. This ongoing relationship includes selecting the right policy features, funding strategies, and withdrawal plans aligning with your immediate needs and long-term aspirations.

Ongoing Adaptation to Changing Needs: Over time, your financial needs and goals may evolve due to changes in family structure, economic conditions, or personal priorities. Regular and honest communication with your advisor ensures that your Infinite Banking strategy adapts in response to these changes. This communication can involve adjusting premium payments, reassessing the policy’s growth strategy, or recalibrating the balance between liquidity and growth to serve your evolving needs better.

Education and Empowerment: A transparent relationship ensures that your life insurance advisor acts as a mentor, educating you and your heirs about the intricacies of Infinite Banking and the management of your policy. This education is crucial for empowering current and future generations to make informed decisions about their finances, reinforcing the family’s ability to independently maintain and grow its wealth.

Ensuring Compliance and Efficiency: The regulatory landscape affecting life insurance and financial transactions can be complex and subject to change. An advisor who thoroughly understands your financial standing and goals can ensure that your Infinite Banking strategy remains compliant with current laws and regulations while maintaining its efficiency and tax advantages. This proactive compliance is crucial for avoiding potential legal pitfalls and ensuring the strategy remains effective.

Building Trust and Confidence: Transparency leads to trust, the foundation of any successful advisory relationship. When you trust that your advisor fully understands your values and goals, you can have confidence in their recommendations and strategies. This trust also makes it easier to discuss new opportunities or concerns that may arise, facilitating a proactive rather than reactive approach to financial management.

In summary, we cannot overstate the importance of maintaining a transparent relationship with your life insurance advisor. It is essential to ensure that the Infinite Banking strategy is customized to your family’s specific needs and goals and managed effectively over time. This relationship supports the strategic, efficient, and compliant use of Infinite Banking, helping to secure a robust financial legacy for generations.

Next Steps

Guidance on Getting Started with Infinite Banking

Getting started with Infinite Banking requires thoughtful preparation and a strategic approach, particularly involving using high cash value whole life insurance policies to manage your finances. Here’s a step-by-step guide to help you begin your journey with Infinite Banking based on insights from the comprehensive guide:

- Educate Yourself:

- Action: Start by gaining a thorough understanding of the Infinite Banking concept. Read books, such as Nelson Nash’s “Becoming Your Own Banker,” and consume related content like articles, webinars, and videos to familiarize yourself with the principles and practices of Infinite Banking.

- Assess Your Financial Goals:

- Action: Reflect on your long-term financial objectives. Consider how Infinite Banking can align with your goals for retirement, wealth accumulation, debt management, and legacy planning. Clear goals will guide the structuring of your policy.

- Consult with a Professional:

- Action: Connect with a life insurance advisor who specializes in Infinite Banking. Look for someone with extensive experience designing high cash value whole life policies and a deep understanding of the strategy’s nuances. Ensure this professional is someone you can build a transparent and trusting relationship with, as they will be crucial in tailoring your policy to your needs.

- Choose the Right Policy and Insurer:

- Action: Select a whole life insurance policy from a reputable mutual insurance company known for its financial stability and history of favorable dividends. Your advisor can help compare different policies and companies to find the best fit based on your financial situation and goals.

- Structure Your Policy for Cash Value Growth:

- Action: Work with your advisor to structure your policy to maximize cash value growth, considering factors like your premium affordability, the split between base premiums and paid-up additions, and the inclusion of appropriate riders that can enhance the policy’s performance and benefits.

- Implement Funding Strategies:

- Action: Decide on your funding strategy. This strategy could involve regular premium payments, lump sum contributions, or a combination. Consider backdating the policy to save age to increase funding capabilities in the first year.

- Begin Using Your Policy:

- Action: Once your policy is active, utilize your cash value through policy loans to finance purchases or investments. This step is crucial in practicing the Infinite Banking concept, as it involves managing your financial activities through your own banking system created by the policy.

- Monitor and Adjust Your Strategy:<

- Action: Regularly review your policy and financial strategy with your advisor to ensure it continues to meet your needs and adapt to any changes in your financial life or goals. This adaption could involve adjusting premium payments, reinvesting dividends, or taking additional loans.

- Educate Your Heirs and Family:

- Action: As Infinite Banking can be part of your legacy, educate your heirs about the concept and strategies. Ensuring they understand how to manage and benefit from it will be crucial for maintaining the strategy across generations.

By following these steps, you can effectively initiate your journey into Infinite Banking, leveraging a whole life insurance policy as a financial safety net and a powerful tool for building and managing your wealth. With the proper preparation and guidance, Infinite Banking can transform your approach to personal financial management, providing significant control, flexibility, and security.

Contact Us

Connect With I&E! Schedule a Conversation with one of our Pro Client Guides to Discuss Strategies for Your Family, Your Investments, or Your Business, using Your Own numbers- https://www.insuranceandestates.com/proclientguide/introduction/ or email 📧 request to: info@insuranceandestates.com