If you follow sports, play sports professionally, or just for fun, you are likely familiar with the exorbitant salaries and bonuses that many top athletes receive…in some cases generating 7- or 8-figures per year. But, while such significant paychecks can provide mansions and fleets of high-dollar sports cars for these icons, it’s a different story for many pro athletes when they leave the field, court, or ice for the last time.

More often than not, short careers, along with the potential for injury, and oftentimes high spending habits, can put future financial security at risk for many current and former professional athletes. So, it is critical to have a good solid game plan in place – and it’s never “too early” to create one.

Why Athletes Need Specialized Life Insurance Planning: Professional athletes face unique challenges including abbreviated careers (averaging just 3-7 years depending on the sport), higher injury risks, specialized income structures including endorsements, and complex family and financial situations that require tailored insurance solutions beyond standard offerings.

Table of Contents

- The Retirement Reality for Professional Athletes

- The World’s Highest Paid Athletes

- Financial Challenges After Sports Careers

- Unique Life Insurance Needs for Athletes

- Types of Life Insurance Products for Athletes

- Best Life Insurance Companies for Professional Athletes

- Cash Value Life Insurance as a Wealth Building Tool

- Case Study: Jim Harbaugh’s Life Insurance Strategy

- Financial Planning Beyond Sports Careers

- Conclusion

The Retirement Reality for Professional Athletes

A career in professional sports – along with the fame and fortune that frequently go along with it – is a dream come true for many young athletes. But even for the few who actually make it into the “big leagues,” ongoing financial success and security is never guaranteed.

The career spans for professional athletes are remarkably short compared to traditional careers. According to a study by the RBC Sports Professionals group, the average playing career is:

- NFL (Football): 3.3 years

- MLB (Baseball): 5.6 years

- NBA (Basketball): 4.8 years

- NHL (Hockey): 5.5 years

Financial Reality Check: A stark 78% of professional athletes go broke after just three years in retirement, and 60% of NBA players file bankruptcy within five years of retiring. This makes specialized financial planning and life insurance strategies absolutely essential for professional athletes.

This equates to many pro athletes “retiring” before they have even hit the age of 30. So, whereas most “average” people have careers that span several decades, the majority of professional athletes only have a few short years to generate their massive incomes – and once that time is over, it can be difficult for them to survive on their savings for very long…if they have even saved anything at all.

The World’s Highest Paid Athletes – 2023

The 2023 list of the world’s 50 highest-paid athletes reads a lot like the Forbes 400 List – except that in many cases, these athletes generate far more money than top CEOs and founders of major corporations.

These highly paid pro athletes hail from a wide variety of sports, including golf, boxing, football, tennis, and even auto racing, with total 12-month earnings (generated from both on and off the field) that range from $45.2 million up to $136 million. Just the top ten alone have brought in more than $1.1 billion over the past year.

| Rank | Name | Sport | Total 12-Month Earnings | On the Field Earnings | Off the Field Earnings |

|---|---|---|---|---|---|

| 1 | Cristiano Ronaldo | Soccer | $136 M | $46 M | $90 M |

| 2 | Lionel Messi | Soccer | $130 M | $65 M | $65 M |

| 3 | Kylian Mbappe' | Soccer | $120 M | $100 M | $20 M |

| 4 | LeBron James | Basketball | $119.5 M | $44.5 M | $75 M |

| 5 | Canelo Alvarez | Boxing | $110 M | $100 M | $10 M |

| 6 | Dustin Johnson | Golf | $107 M | $102 M | $5 M |

| 7 | Phil Mickelson | Golf | $106 M | $104 M | $2 M |

| 8 | Stephen Curry | Basketball | $100.4 M | $48.4 M | $52 M |

| 9 | Roger Federer | Tennis | $95.1 M | $0.1 M | $95 M |

| 10 | Kevin Durant | Basketball | $89.1 M | $44.1 M | $45 M |

Source: Forbes

For many of these superstars, though, the dream lifestyle will eventually come to an end. And without a plan in place for generating incoming cash flow, day to day life could be very different in the future.

Plan Your Financial Future Today

Get a personalized life insurance strategy tailored for athletes. Protect your wealth and legacy with expert guidance.

No obligation, just expert advice for your financial goals.

Financial Challenges After Sports Careers

Failing to Plan

Not all retired athletes find continual success after their sports careers end. More often than not, pros who once lived the “good life,” filled with fancy accommodations and celebrity treatment, end up struggling financially – especially if they have no plans in place for how they will generate income going forward.

There is a long list of professional sports figures who have squandered countless amounts of money, invested poorly, and/or filed for bankruptcy, despite generating millions of dollars (or more) during their careers.

Several key factors contribute to the financial challenges many athletes face:

- Helping Family and Friends – Many athletes feel an overwhelming obligation to help family members and others who supported their careers

- Divorce and Legal Settlements – High-profile divorces often result in massive financial settlements

- Continued High Spending – Maintaining the lifestyle they became accustomed to during their playing days

- Poor Investment Decisions – Lack of financial knowledge leading to bad investment choices

- Short Career Spans – Limited time to generate peak earnings

Career Transition Challenge: According to LinkedIn Economic Graph data, approximately 27% of professional sports players took on sales roles after leaving the pros between 2015 and 2022, making sales the top post-retirement position for former athletes. Another 10% became entrepreneurs, often starting businesses related to their athletic background in sports and wellness.

10 Most Common Career Paths Former Athletes Enter

| Rank | Position | % of Transitions |

|---|---|---|

| 1 | Sales professional | 27% |

| 2 | Sports coach / instructor | 23% |

| 3 | Owner / founder | 10% |

| 4 | Financial analyst | 5% |

| 5 | Teacher | 5% |

| 6 | Business development professional | 4% |

| 7 | Financial advisor | 4% |

| 8 | Marketing specialist | 4% |

| 9 | Real estate agent | 3% |

| 10 | Recruiter | 3% |

Source: LinkedIn Economic Graph

Unique Life Insurance Needs for Professional Athletes

Professional athletes have specialized life insurance needs that differ significantly from the average person. Their unique circumstances require tailored solutions designed to address their specific challenges and opportunities.

Underwriting Challenges for Athletes

Athletes face several unique underwriting challenges when applying for life insurance:

- High-Risk Sports Classification – Combat sports, motorsports, and certain extreme sports may result in higher premiums or even declined applications

- Injury History – Previous injuries, surgeries, and ongoing treatments can affect underwriting decisions

- Medication Considerations – Performance-related medications and pain management prescriptions may impact ratings

- Specialized Medical Exams – More intensive medical screenings may be required for high-coverage policies

Sport-Specific Risk Assessment: Insurance companies classify different sports based on their inherent risks. For example, golf and tennis players typically receive more favorable ratings than football players or boxers. Understanding these classifications is critical when selecting the right policy and carrier for professional athletes.

High Income Considerations

The substantial income of professional athletes creates unique insurance planning opportunities:

- Income Replacement Needs – Coverage amounts must account for future potential earnings, not just current income

- Endorsement Protection – Insurance should consider both salary and endorsement income streams

- High Coverage Limits – Athletes often require policies in the multi-million dollar range

- Premium Financing Options – Specialized financing arrangements may be available for large policies

International Travel Impacts

Global competition and training schedules create additional insurance considerations:

- Frequent International Travel – Some policies restrict coverage based on travel frequency and destinations

- Foreign Residency Periods – Training camps and international seasons may affect eligibility

- Global Coverage Needs – Policies must provide protection regardless of where death or disability occurs

Types of Life Insurance Products for Athletes

Product Selection Strategy: There is no one-size-fits-all life insurance solution for professional athletes. The right policy depends on factors including sport type, career stage, health history, family situation, and long-term financial goals. Many athletes benefit from a combination of policy types to address different needs and timeframes.

Term Life Insurance

Term life insurance provides death benefit protection for a specified period, typically 10, 20, or 30 years. For athletes, term policies offer:

- Advantages:

- Lower initial premiums compared to permanent policies

- High coverage amounts available

- Simple structure and straightforward benefits

- Good for covering specific timeframes (career years, mortgage, children’s education)

- Disadvantages:

- No cash value accumulation

- Coverage ends when the term expires

- Renewal premiums increase significantly with age

- No tax advantages or wealth building component

Whole Life Insurance

Whole life insurance provides lifetime coverage with a cash value component that grows over time. For athletes, whole life policies offer:

- Advantages:

- Permanent coverage that doesn’t expire

- Guaranteed cash value growth independent of market performance

- Fixed premiums that don’t increase

- Potential dividend payments with participating policies

- Tax-advantaged growth and access to funds

- Excellent for wealth building and estate planning

- Disadvantages:

- Higher premiums than term insurance

- Less flexibility in premium payments

- Slower initial cash value growth

Universal Life Insurance

Universal life insurance provides permanent coverage with flexible premiums and death benefits. For athletes, universal life policies offer:

- Advantages:

- Flexible premium payments that can be adjusted

- Ability to increase or decrease death benefit

- Cash value growth tied to various options (fixed, indexed, or variable)

- Good for athletes with fluctuating income

- Disadvantages:

- Cash value growth not guaranteed in some variants

- Market risk exposure in variable options

- More complex structure

- Requires more active management

No-Medical-Exam Options

No-exam life insurance allows athletes to obtain coverage without undergoing a medical examination. These policies offer:

- Advantages:

- Simplified and accelerated underwriting

- Useful for athletes with pre-existing conditions

- Quick approval process

- Avoids invasive testing

- Disadvantages:

- Higher premiums for comparable coverage

- Lower coverage limits available

- May still include health questions and record reviews

THE ULTIMATE FREE DOWNLOAD

The Estate Planners Tactical Guide

Essential Legal Protection for Achievers

Best Life Insurance Companies for Professional Athletes

Not all life insurance companies have the same appetite for insuring professional athletes. The following carriers have demonstrated expertise and willingness to work with the unique circumstances of sports professionals:

Carrier Selection Criteria: When evaluating insurance companies for professional athletes, consider their experience with high-income individuals, their underwriting flexibility for high-risk occupations, their high-limit capacity, and their specialized products designed for sports professionals.

- Legal & General America – Known for favorable underwriting for certain sports categories and competitive rates

- MassMutual – Strong dividend performance and specialized high-net-worth planning team

- Pacific Life – Competitive rates for athletes and flexible underwriting

- Mutual of Omaha – Offers simplified issue policies beneficial for some athletes

- Guardian Life – Dividend-paying whole life with strong cash value features

- Penn Mutual – Strong permanent insurance options with favorable underwriting

- Prudential – Extensive experience with high-net-worth clients

- Northwestern Mutual – Industry-leading financial strength and dividend performance

- New York Life – Established high-net-worth planning division

Cash Value Life Insurance as a Wealth Building Tool

For professional athletes with short-duration, high-income careers, properly structured cash value life insurance serves as both protection and a wealth-building vehicle. Unlike term coverage, permanent life insurance offers both death benefit protection and tax-advantaged cash accumulation.

Why Cash Value Life Insurance Should Be Considered in Athletes’ Financial Plans

Cash value, or permanent, life insurance offers death benefit protection, along with cash value build up within the policy. This cash value is liquid and can provide numerous financial advantages, particularly for high-income athletes with abbreviated earning windows.

Just some of the advantages of permanent life insurance for athletes include:

- Guaranteed growth, not subject to stock market volatility

- Tax-deferred growth of the cash value

- Tax-free access to funds via policy loans

- Penalty-free withdrawals for certain healthcare or long-term care needs

- Protection from creditors and bankruptcy (in most states)

- Privacy (i.e., no need to report it to the IRS or include on FAFSA student loan forms)

- Estate planning benefits for wealth transfer to family members or charitable causes

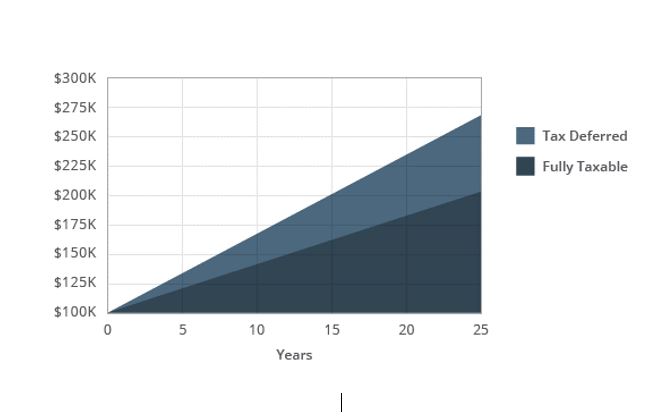

Tax Advantage Comparison: The difference in growth between taxable and tax-deferred accounts can be substantial over time. For example, $100,000 growing at 4% for 25 years would accumulate to $266,583 in a tax-deferred account versus just $208,691 in a taxable account with a 25% tax rate.

Fully Taxable vs. Tax Deferred Growth

The tax-deferred nature of the cash value growth means that there are no taxes due on the gain unless or until it is withdrawn above your basis in the policy (i.e. above the amount you have paid in premiums.) Therefore, these funds can grow and compound exponentially over time, especially compared to fully taxable accounts, with all other factors being equal.

Accessing Funds Through Policy Loans

The policy holder can access funds tax-free by taking a policy loan (versus a cash value withdrawal). Although many people don’t relish the idea of borrowing, doing so with cash value life insurance works differently than traditional loans from banks or other lenders.

In this case, there is no credit check and no “underwriting” associated with the life insurance loan. And, this type of “borrowing” doesn’t impact your credit score. Plus, interest will continue to accrue on the full amount of the cash value component – including the amount that is borrowed. In other words, you still earn interest and dividends on total cash value even though you have a policy loan.

That’s because the policy holder is actually borrowing from the insurance company and simply using the cash value as collateral. So, as an example, if your permanent life insurance policy has a cash value of $480,000 and you borrow $50,000 from it, interest will continue to accrue on $480,000.

In addition to that, if the loan is not repaid when the insured on the policy dies, the unpaid balance will be paid off using proceeds from the death benefit, and the remaining funds are then paid out to the named beneficiary(ies).

Dividend-Paying Whole Life Insurance

Dividend paying whole life, a type of permanent life insurance, offers several guarantees, such as a(n):

- Guaranteed level premium (flexible premium options are available)

- Guaranteed death benefit (that remains in force for life)

- Guaranteed accumulation of the cash value

There are some types of permanent life insurance that are structured to enhance the growth of the cash value. These include dividend-paying, or participating, whole life insurance policies from mutual insurance companies.

Dividends are considered a return of premium, and therefore, they are not taxed to the recipient. Policy holders generally can opt to receive dividends via direct payment, an addition to the policy’s cash value, or by way of additional death benefit coverage.

Adding tax-free dividends to the policy’s cash component is recommended because it can also offer significant tax advantages for the growth of the cash value. These dividends compound overtime growing cash value more rapidly. While the payment of dividends isn’t guaranteed, there are some mutual life insurance carriers that have paid a dividend to their policy holders consistently for more than 100 years.

Specially Designed Policies: For professional athletes, the best cash value policies are often “specially designed” with additional paid-up insurance or maximized cash value riders that direct more premium toward cash accumulation and less toward the initial death benefit. This structure enhances early cash value growth to create a more robust wealth-building vehicle.

Case Study: Jim Harbaugh’s Life Insurance Strategy

Harbaugh’s “Jackpot”

Jim Harbaugh, the former NFL quarterback and current football coach at the University of Michigan (his alma mater), provides an excellent example of how life insurance can be strategically used in compensation packages for sports professionals.

Not only is Harbaugh being paid a healthy 7-figure salary to coach the team, but the university is also helping him start a cash value life insurance policy as a part of his total benefit package.

In this particular case, the U of M loaned Harbaugh $4 million to initiate a cash value life (permanent) insurance policy, along with additional $2 million loans in each of the following five years to keep the plan and the coverage in force.

Strategic Benefits: Harbaugh’s policy, estimated to provide a $75 million death benefit, offers multiple advantages:

- The university can recoup its $14 million loan from the death benefit if necessary

- Harbaugh’s heirs would receive at least 150% of the premium amount tax-free

- Harbaugh can access the policy’s cash value tax-free via loans during his lifetime

- The policy structure helps secure his position until the contract term ends

So, what happens if Harbaugh were to pass away while the policy was still in force?

The death benefit proceeds – which are estimated to be approximately $75 million – would have been more than enough for Michigan University to recoup the $14 million that the school “loaned” him to pay the premium.

In addition, his heirs would also receive at least 150% of the amount that was paid in policy premiums. So, for instance, if the University of Michigan paid $10 million, and then Harbaugh passes away, his loved ones would receive a minimum payout of $15 million in income tax free death benefit proceeds.

Plan Your Financial Future Today

Get a personalized life insurance strategy tailored for athletes. Protect your wealth and legacy with expert guidance.

No obligation, just expert advice for your financial goals.

Harbaugh can also borrow from the policy’s cash value himself and access funds tax free – an added benefit to his overall pay plan. (This is opposed to taking taxable withdrawals from the cash value).

Using this type of “executive compensation” plan with permanent cash value life insurance, both Harbaugh and the University of Michigan essentially “win.” Here, even though the University could have retained control over the cash value for a certain amount of time, Harbaugh has immediate access to these funds.

One of the other enticing factors for the University is that Harbaugh’s cash value life insurance policy isn’t tied to the same regulations as 401(k) retirement plans. For example, the latter doesn’t have to be offered to all of the other employees (whereas 401k retirement plans typically must be, within certain parameters). Today, other colleges and universities have jumped on the cash value life insurance bandwagon to “sweeten the pot” when recruiting coaches and other top employees.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

“Properly” Designed

But not all permanent life insurance policies are equal. We recommend a properly structured policy to maximize cash value growth. We also recommend colleges and universities get second opinions from a trained insurance professional that understands properly structured policies and the types of insurance policies being considered.

Financial Planning Beyond Sports Careers

Key Financial Factors for Professional Athletes to Consider

When constructing a financial plan for the future, a life insurance retirement plan can play a key role. But, because everyone’s objectives, time frames, and risk tolerances can differ, there isn’t just one single plan that will work well for all investors and retirees across the board.

Plus, in addition to simply generating cash flow, there are other factors that retired sports professionals – and non-athletes, too – should also keep in mind in order to maximize what they generate from their investments and attain more current and future financial security.

These items include:

- Taxes – Current and future tax liability planning

- Inflation – Protecting purchasing power over decades

- Volatility – Managing market risks and recovery periods

- Longevity – Planning for potentially 50+ years of retirement

- Healthcare and/or long-term care needs – Especially important for athletes with injury histories

Volatility Warning: Market volatility and the “sequence of returns,” meaning some years the market is up and other years it’s down and the time it takes to recover from losses. Volatility can wreak havoc on a market based investment portfolio. There are no guarantees in the market. Planning appropriately for these outcomes is crucial.

Complementary Insurance Products

Professional athletes should also consider additional insurance products that work alongside life insurance to create comprehensive protection:

- Disability Insurance – Protects against career-ending injuries

- Critical Illness Insurance – Provides lump-sum payments for specific diagnoses

- Long-Term Care Insurance – Covers costs of extended care needs

- Key Person Insurance – For athletes who own businesses or have endorsement companies

- Specialty Coverage – For specific body parts crucial to the athlete’s sport

Common Investments – Both Good and Bad – Made by Retired Pro Athletes

One of the most common misconceptions about professional athletes is that they are financially secure for life. Given the salaries that many of these pros receive, it is easy to understand why people would think that.

But, due in large part to the shortened careers of most athletes, this is not necessarily the case – which is why these individuals must look at other avenues for generating financial security going forward. In addition to – or in lieu of – getting a job, investing can provide retired athletes with an alternative.

Many professional athletes make various investments, hoping to generate income, increase wealth, or both. Some of the more common investments that are made by former pro sports stars include:

- Real estate

- Stocks and bonds

- Car Dealerships

- Tech & Service companies

- Wind turbines

- Horse farms

- Restaurants

Some athletes invest in start-up companies, with hopes that the business will turn out to be the next Amazon or Google. Sometimes these investments pan out…but not always.

Success Stories: A number of retired athletes have successfully made their mark in the business world. For example, basketball Hall of Famer Magic Johnson has built a thriving business empire, at one time even being a part owner of the Los Angeles Lakers. Baseball great Nolan Ryan became a majority owner and chairman of a bank in his hometown of Alvin, Texas. Similarly, NBA star John Havlicek invested early in Wendy’s, which became a huge success.

Specialized Insurance Needs Based on Athletic Profiles

Different sports and athletic profiles require specialized insurance strategies. High-risk sports often require different approaches than lower-risk activities:

High-Risk Sports Considerations

- Combat Sports (Boxing, MMA, etc.) – May require specialty carriers or higher premiums

- Motorsports – Often need additional riders and coverage modifications

- Extreme Sports – May require policy exclusions or sport-specific coverage

- Football – CTE concerns may affect long-term underwriting

Lower-Risk Sports Approaches

- Golf/Tennis – Often qualify for preferred rates and higher coverage limits

- Baseball – Position-specific considerations (pitchers vs. position players)

- Basketball – Height/weight ratios may affect underwriting

International Athlete Solutions

For athletes who compete internationally or maintain residency in multiple countries:

- Multi-jurisdictional coverage strategies

- Currency protection features

- Travel exclusion management

- Cross-border wealth transfer planning

Insuring Endorsement and NIL Income

As endorsement deals and Name, Image, and Likeness (NIL) income become increasingly significant parts of athletes’ financial portfolios, specialized insurance solutions are required:

Emerging Trend: The sports insurance market has seen substantial growth in policies designed specifically to protect endorsement and NIL income streams. These specialized policies provide protection against both death and disability scenarios that could impact an athlete’s marketability and earning potential from these sources.

Endorsement Income Protection Strategies

- Brand value protection coverage

- Income continuation for surviving family members

- Future income potential calculations

- Business continuation planning for athlete-owned companies

Frequently Asked Questions About Life Insurance for Athletes

How does participating in high-risk sports affect life insurance rates?

High-risk sports participation typically results in higher premium rates, potential policy exclusions, or riders that limit coverage during sporting activities. However, working with specialized brokers who understand athletic careers can help secure more favorable terms from carriers experienced with insuring professional athletes.

Can professional athletes get no-exam life insurance?

Yes, some professional athletes can qualify for no-exam policies, but coverage limits may be lower and premiums higher than fully underwritten policies. For substantial coverage amounts ($5 million+), most carriers will require full medical underwriting, though simplified underwriting options are increasingly available for certain sports categories.

How do international competitions affect coverage?

International competition schedules can impact policy terms, with some countries triggering exclusions or rate increases. Athletes who compete globally should seek policies specifically designed to provide worldwide coverage without travel restrictions or with clearly defined parameters.

Should athletes wait until retirement to purchase permanent life insurance?

No, athletes should secure coverage during their active careers when their health is optimal for underwriting purposes. Premium costs increase with age, and injuries accumulated during a sports career can negatively impact insurability and rates if application is delayed until retirement.

How much life insurance coverage do professional athletes need?

Coverage needs vary based on income, obligations, and goals, but many financial advisors recommend 10-15 times annual income for athletes with dependents. High-earning athletes should consider factors including endorsement income, expected career length, family obligations, and wealth preservation goals when determining appropriate coverage amounts.

Conclusion: Securing Your Financial Future Beyond the Playing Field

While a “Hail Mary” pass might help win a football game as the final seconds tick away on the scoreboard, the same is not true when it comes to planning for a successful retirement. The right financial plan requires creating a viable strategy and then putting the best tools in place to get it done.

Although pro athletes may receive large paychecks, these paydays typically only last for a few short years at best. So, it is vital for sports professionals to save and invest wisely and to prepare for retirement just like everyone else.

Key Takeaways:

- Start financial planning early in your athletic career

- Work with advisors who specialize in professional athletes’ unique needs

- Consider cash value life insurance as both protection and wealth-building tool

- Create a comprehensive strategy that addresses both playing career and post-career needs

- Understand how your sport-specific risks affect your insurance options

- Plan for a potentially long retirement given the short duration of athletic careers

At Insurance and Estates, we have helped thousands of people (including professional athletes) grow, manage, and protect their wealth, assets, and income in all types of market and economic environments – and often with guarantees that they didn’t realize were available.

Whether you’re just getting started or you’re quickly approaching retirement, it is never too early to start planning. That’s where we can help. So, we invite you to look at your own numbers. Set up a time to discuss your short- and long-term financial, retirement, and legacy objectives with a member of our Pro Team at Insurance and Estates by calling (877) 787-7558. We look forward to meeting you and helping you move closer to your dreams and financial goals.

Secure Your Financial Future Beyond the Game

As a professional athlete, your unique financial challenges require a tailored strategy. Connect with our expert team at Insurance and Estates for a personalized analysis to ensure your wealth and legacy are protected long after your playing days.

- ✓ Get a customized life insurance plan designed for your sport, income, and career stage

- ✓ Explore cash value life insurance as a tax-advantaged wealth-building tool

- ✓ Understand how to protect endorsement and NIL income streams

- ✓ Receive clear guidance on managing risks like short careers and high-risk sports

Schedule your complimentary 30-minute financial strategy session today and start building a game plan for lasting financial security.

No obligation. No pressure. Just expert advice to help you craft a financial plan that supports your goals on and off the field.

Sources

2023 The World’s Highest-Paid Athletes. Forbes. May 16, 2023. https://www.forbes.com/lists/athletes/?sh=6f8bfeb95b7e

Michael Jordan Net Worth 2023. Sportskeeda. https://www.sportskeeda.com/basketball/michael-jordan-net-worth-and-income

Why do professional athletes go broke? By Shaye Galletta. Fox Business. February 2, 2022. https://www.foxbusiness.com/personal-finance/why-do-professional-athletes-go-broke

Five Reasons Professional Athletes Go Broke. March 25, 2013. Wyatt Investment Research. https://www.wyattresearch.com/markets/five-reasons-professional-athletes-go-broke/

Do Michael Jordan and Juanita Vanoy Boast the Largest Divorce Settlement in History with $168 Million. By Harnaaz Kaur. July 28, 2023. Sportsmanor. https://sportsmanor.com/nba-do-michael-jordan-and-juanita-vanoy-boast-the-largest-divorce-settlement-in-history-with-168-million/

Personal finances of professional American athletes. Wikipedia. https://en.wikipedia.org/wiki/Personal_finances_of_professional_American_athletes

Professional athletes need a retirement game plan. RBC Wealth Management. https://www.rbcwealthmanagement.com/en-us/insights/professional-athletes-need-a-retirement-game-plan

The next play: How pro athletes find their post-retirement careers. By Joseph Milord. September 8, 2022. LinkedIn News. https://www.linkedin.com/pulse/next-play-how-pro-athletes-find-post-retirement-careers-joseph-milord/

Estimated value of Jim Harbaugh’s life insurance policy? $75 million. Pro Football Talk. August 19, 2016. https://www.nbcsports.com/nfl/profootballtalk/rumor-mill/news/estimated-value-of-jim-harbaughs-life-insurance-policy-75-million

Jim Harbaugh’s Coaching Contract Shows the Value of Life Insurance. By Rachel Marshall. June 14, 2021. The Money Advantage. https://themoneyadvantage.com/jim-harbaugh-life-insurance/

Global Growth Insights, Sports Insurance Market Growth Report. 2023. https://www.globalgrowthinsights.com/market-reports/sports-insurance-market-105266

What Do Athletes Do With All Their Money? May 27, 2022. AWM. https://awmcap.com/blog/what-do-athletes-do-with-all-their-money