Buying Life Insurance for a Grandchild

Although many people believe that life insurance should only be carried on a family’s income earner(s) or others who have financial dependents, there are some good reasons to consider having life insurance for grandchildren. The right type of life insurance policy for a grandchild can provide them with current and future financial security by giving them a solid head start on growing and protecting wealth and maintaining a financial safety net.

For instance, while the death benefit is in place for the unexpected, some policies also allow tax-advantaged savings that can be used for a wide range of other wants and needs, like college tuition and education costs or the down payment on a new home purchase.

Purchasing life insurance for grandchildren can also keep the premium payments low because typically, the younger the insured is at the time of application, the lower the cost of the coverage.

Before buying life insurance for grandchildren, though, it is important to understand how different policies work, along with the purchasing requirements, so that you know which plan – if any – may be the best option.

Table of Contents

- Introduction

- Eligibility and Permissions

- Types of Policies Available

- Whole life insurance for grandchildren example

- Financial Considerations

- Best Practices for Buying Life Insurance for Grandchildren

- Top Life Insurance Companies for Grandchildren

- Transferring Policy Ownership

- Alternatives to Life Insurance for Children

- FAQs

- Pros and Cons

- Conclusion

Required Permissions to Purchase a Life Insurance Policy for a Grandchild

A typical question we receive is if grandparents can buy life insurance on a grandchild. The short answer is yes. And although buying life insurance for a grandchild can be a relatively easy process, doing so does require obtaining consent from the child’s parent or legal guardian. Consent from a parent or guardian is needed because a minor cannot give legal consent on their own. If, however, you are the child’s legal guardian, then you may consent for the policy on his or her behalf.

Types of Life Insurance Policies Available for Grandchildren

As with adults, there are different types of life insurance policies available for children, too. These include term and permanent.

Term Life Insurance

With term life insurance, there is only death benefit coverage, with no cash value or investment build up. Term life insurance policies provide coverage for a certain period of time, or “term,” such as 10, 20, or 30 years.

If the insured wishes to continue coverage after a term insurance policy has expired, the new premium will typically be higher, based on the individual’s then current older age, along with any possible health issues that could make them a higher risk to the insurance company.

Because of their short-term, “temporary” coverage, term life insurance is oftentimes not the best life insurance option for minors, and as such, very few insurers even offer term life insurance for children, as most term life insurance policies are not available until age 18.

Permanent Life Insurance

A permanent life insurance policy provides both death benefit protection and cash value. Unlike term insurance, permanent policies will generally remain in force for the life of the insured, as long as the premium is paid. The funds in a permanent policy’s cash value component grow tax deferred, meaning that there is no tax due on the gain unless or until it is withdrawn.

It is also possible to borrow funds from the cash value of a permanent life insurance policy’s cash value. In this case, the money can be accessed tax free. Plus, even when funds are borrowed, a return continues to be generated on the entire amount of the cash value.

Whole Life Insurance

With whole life insurance – the most basic type of permanent coverage – the premium amount typically will not increase – even as the insured gets older and if they develop an adverse health condition. Therefore, a child could lock in a low rate for the remainder of their lifetime.

The best type of policy for a young child is going to be a participating whole life insurance policy that grows cash value and pays out an annual dividend payment. So, not only can a permanent life insurance policy offer coverage in case of the unexpected, but the cash value in these dividend paying whole life insurance policies can provide other valuable benefits, such as:

- Savings for college

- Future retirement savings

- Ability to borrow money tax free

- Guaranteed insurability for life

- Low lifetime premiums

Example Whole Life Insurance Policy for a Grandchild

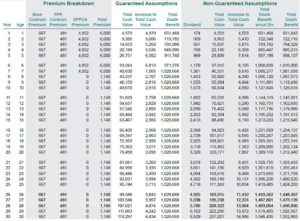

In this example, grandma and grandpa wanted to buy a whole life insurance policy on their newborn grandchild. They wanted to put $50,000 into the policy. So we designed a dividend paying whole life insurance policy so that the grandchild’s grandparents could fund the policy over a 7-year time frame to avoid the policy becoming a modified endowment contract.

The following whole life insurance for grandchildren illustration is based upon a 7-Pay whole life insurance policy for a newborn boy. The first 7 years of the policy are funded by base premium and paid up additions for a total annual premium of $6,000 annually. The paid up additions drop off after year 7 and the base premium is $1,148. The projected cash value by age 18 is over $108,000. By age 30, the death benefit has grown to $1.5 million and the cash value to over $237,000.

Why High Cash Value Whole Life Insurance for Kids is Awesome!

Financial Considerations

The cost of life insurance on a grandchild can depend on several factors, such as:

- Type of policy

- Amount of death benefit coverage

- Age of the child (at the time of application)

- Child’s health condition

- Insurance company offering the policy

For instance, the cost of a whole life insurance policy on a child will remain the same throughout their lifetime – which can provide them with ongoing peace of mind, as well as continued cash value build up.

Because the growth of cash value in whole life insurance policies is guaranteed – and protected in any type of stock market or economic environment – there is no risk of loss. This can differ from other types of financial products for grandchildren, such as mutual funds, money in a 529 college savings plan, or even safe but fully taxable investments.

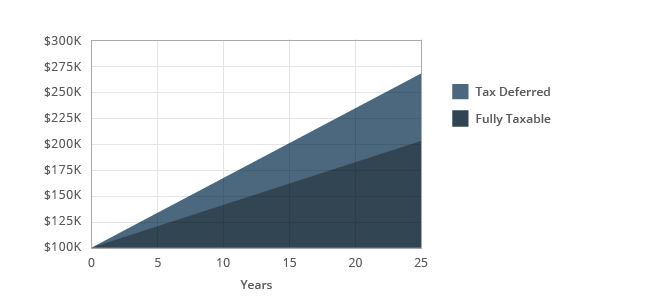

Tax Deferred versus Fully Taxable Growth

Consider tax deferred growth and tax free access to the cash value in whole life insurance policies versus taxable accounts, such as typical investment or savings accounts. The chart below shows the difference in the growth of an account funded with $100,000 growing over 25 years at 4% in a tax-deferred versus a fully taxable account. In 25 years, the tax-deferred account would grow to $266,583 versus $208,691 in a taxable account with a 25% tax rate.

Best Practices for Buying Life Insurance for Grandchildren

When considering life insurance for a grandchild, some of the key steps should include the following:

- Health history of the child’s family

- Type of policy

- Amount of coverage

- Goals / objectives (i.e., college savings, future home purchase, etc.)

- Insurance company offering the policy

When determining the right policy and insurance company, there are also several factors to consider. These can include:

- Premium rate

- Premium mode (i.e., ongoing for life, limited pay for a certain number of years, single premium)

- Surrender / early withdrawal fees

- Insurer financial ratings (i.e., the financial stability and claims paying reputation of the insurance company)

It is usually best to obtain quotes from more than one insurer so you can compare the premiums and the benefits. Working with a life insurance specialist who has access to multiple insurance carriers can make this process easy and fast. Having a life insurance expert as your guide can also better ensure that you have properly completed and submitted all of the application paperwork and other necessary information.

Top Life Insurance Companies for Grandchildren

While many insurance companies offer whole life insurance policies for minors, there are certain carriers that may be a better option than others. Some of the leading insurers that sell high cash value whole life insurance for grandchildren include:

- Penn Mutual

- MassMutual

- Lafayette Life

Should I choose Gerber Life Insurance Company?

We have a complete article on the Gerber Grow Up Plan, so feel free to head over there for a more in depth review. Here are some key takeaways.

- Coverage and Age: It offers initial coverage amounts ranging from $5,000 to $50,000, catering to parents, grandparents, or legal guardians who wish to secure life insurance for a child.

- Automatic Coverage Doubling: The plan includes an automatic doubling of the insurance coverage when the child turns 18, with no increase in the monthly premium.

- Ownership Transfer: The policy ownership transfers from the purchaser to the child at age 21, granting the child guaranteed lifetime insurance protection, provided premiums are paid on time.

- Guaranteed Future Insurability: The plan allows for the purchase of additional coverage at standard adult rates without proof of insurability, up to 10 times the original amount.

- Cash Value: Like all whole life policies, the Grow-Up Plan builds cash value over time that can be borrowed against, offering a financial resource for future needs.

- Payment Protection Option: An additional feature is available where, in the event of the policy owner’s disability before the child reaches 21, all due premiums will be covered.

- Maximum Coverage: The policy caps the total coverage amount at $500,000, including all exercised Guaranteed Purchase Options.

- Considerations: When evaluating the Gerber Grow-Up Plan, it’s important to weigh the lifelong coverage benefits against the costs and to compare it with traditional whole life policies, such as the high cash value example we provided, especially considering factors like the face value limits, cost relative to coverage, underwriting process, and unique features like coverage doubling and guaranteed future insurability.

Transferring Policy Ownership

The owner of a life insurance policy is the individual who controls that policy during the insured’s lifetime. An owner usually pays the premium. They also have the right to change the beneficiary(ies) and decide whether to cancel, surrender, or gift the policy. The owner may be the insured or someone else, such as a parent or grandparent.

Some insurance companies will automatically transfer the ownership of whole life insurance policies from a grandparent (or parent or guardian) to the child/insured, once the child turns age 18 or 21 (depending on the insurer). In other cases, you may be able to transfer the policy ownership at any time (within certain guidelines).

Transferring the ownership of the whole life insurance policy generally requires you to complete a change of ownership form, which the insurance company can provide. An “absolute assignment” involves transferring the ownership and all of the rights of the policy to someone else. This decision is irrevocable, so once it is in place, it cannot be reversed.

Generally, the transfer of policy ownership to the grandchild is a tax free transaction. It is important to ensure that the premium continues to be paid so that the coverage remains in force and the tax advantaged cash value build up continues.

Alternatives to Life Insurance for Grandchildren

Depending on your objectives for life insurance on a grandchild, there may be some alternatives, such as a(n):

- 529 college savings plan. A 529 plan is an education savings vehicle that may be used to pay for college and other educational-related expenses for the account beneficiary. The money in a 529 college plan growth tax deferred, and can be withdrawn tax free for qualifying expenses. However, if the expenses are not qualified, the withdrawals are taxable. Also, certain 529 plan rules can differ from state to state, including the maximum contribution amount. For more, see 529 Plan vs Cash Value Life Insurance.

- IRA (Individual Retirement Account). An IRA may also allow you to save on behalf of a grandchild(ren). The growth of IRA funds is tax deferred or tax free, depending on whether the IRA is traditional or Roth. For a child to have his or her own IRA account, they must have earned income. IRAs also have maximum annual contribution limits. And, if a non-spouse beneficiary (such as a grandchild) inherits your IRA, they must withdraw all of the money from the account within ten years.

- Custodial account. A custodial account is usually created by a parent or grandparent for the benefit of a minor. These accounts allow you to save on the child’s behalf. There are no contribution or income limits, nor restrictions on how the money is used for the child. Depending on the investments in the account, there may be a risk of loss, though. Also, the child must typically be between the age of 18 and 25 when money from a custodial account is transferred to them.

Buying Life Insurance for Grandchildren FAQs

Buying life insurance can come with many questions and concerns – especially if the coverage is for a child or grandchild. Some of the most frequently asked questions may include:

When can you buy life insurance for a grandchild?

Typically, a child becomes eligible for life insurance coverage at 14 or 15 days old. Depending on the insurer, a child may be eligible for obtaining children’s life insurance until they are in their teens.

What is the difference between children’s life insurance and child policy riders?

Unlike a standalone policy, a child’s life insurance rider is an add on to an adult’s policy that provides supplemental coverage under certain circumstances. In this case, the adult is the primary insured and the child is secondary. The coverage is often limited with a rider. Also, these options do not build up any cash value for the child.

What if your grandchild has special needs?

While the premium may be higher, getting a life insurance policy for a special needs grandchild could be a great way to lock in coverage for them that will last throughout their lifetime (as long as the premiums are paid).

Pros and Cons of Buying Permanent Life Insurance for a Grandchild

| Advantages of Permanent Life Insurance for Grandchildren | Disadvantages of Permanent Life Insurance for Grandchildren |

|---|---|

| Locks in guaranteed future insurability | Death benefit is usually low |

| Locks in a low premium rate | Premium could be used for other, alternative types of investments or financial vehicles |

| Tax advantaged cash value build up | Cash value rate of return may be lower than other investment alternatives |

| Use of cash value for college expenses, home purchase, etc. | |

| Funds for final expenses, if needed |

Should You Get Life Insurance for Your Grandkids?

Obtaining life insurance for your grandchildren can be a great way to give them a solid financial foundation and to show them how much they mean to you. While many other gifts lose value over time, the cash value in a whole life insurance policy will continue to grow and be used for a wide range of needs throughout your grandchild’s lifetime.

Purchasing life insurance for a grandchild also means that you can be with them in spirit going forward during meaningful times in their life – such as their marriage and birth of their children – even if you cannot be there in person.

Secure Your Grandchild’s Future with Whole Life Insurance

Give your grandchild a financial foundation with a whole life insurance policy that builds cash value and lifelong security. Our independent advisory team can guide you in choosing a policy tailored to your family’s goals, ensuring wealth-building opportunities and peace of mind for your grandchild’s future.

- ✓ Receive a personalized analysis of whole life insurance options for your grandchild

- ✓ Learn how to lock in low premiums and maximize tax-advantaged cash value growth

- ✓ Discover how the policy can fund education, home purchases, or retirement

- ✓ Get clarity on ensuring lifelong insurability and building generational wealth

Schedule your complimentary 30-minute consultation today and explore how whole life insurance can empower your grandchild’s financial journey.

No obligation. No sales pressure. Just expert guidance to help you choose the best whole life insurance policy for your grandchild’s long-term success.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept