Did you know that certain life insurance policies can serve as powerful financial tools while you’re still alive? Beyond the tax-free death benefit for your loved ones, properly structured permanent life insurance can provide immediate access to cash value that grows tax-deferred, offering financial flexibility throughout your lifetime.

Table of Contents

Key Takeaway: Whole Life Insurance, especially when properly designed with paid-up additions, generates immediate cash value that you can access tax-free through policy loans, providing financial flexibility while maintaining death benefit protection.

Life Insurance Policies That Generate Immediate Cash Value

The type of life insurance policy that generates immediate cash value is Whole Life Insurance. Properly designed dividend paying whole life insurance policies typically have immediate cash value and offer more flexible options and features for cash value accumulation compared to other types of permanent life insurance policies such as universal life, indexed universal life, and variable universal life insurance policies.

Additionally, single premium whole life insurance generates immediate cash value because it is fully funded right away, meaning the cash value component can build up quickly as soon as the premium is paid.

Policy Design Matters

The design of traditional whole life insurance focused on the death benefit, with cash value as an afterthought. Contemporary high cash value whole life insurance policies focus on cash value accumulation and growth.

When structuring a whole life insurance policy, the base premium pays for the death benefit. Some whole life insurance policies have a fixed death benefit that is maintained by paying the base premium. Cash value growth occurs but it is a slow growth that doesn’t show much fruit until around the 10-year mark.

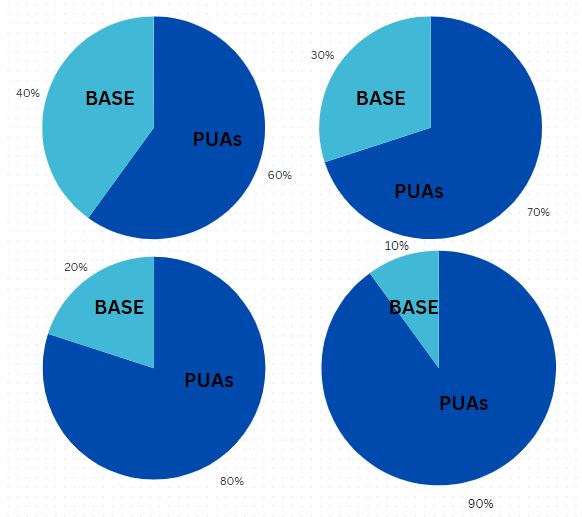

In contrast, a high cash value whole life insurance policy focuses on paid-up additions versus the base premium. When you structure the policy with the majority of the premium going towards the paid up additions rider, the cash value growth occurs at a much higher rate. The policy design allows the cash value to generate immediately, with access up to 90% of the cash value from day one.

Common high cash value whole life policy designs include paid-up additions to the base policy blends such as 60/40, 70/30, 80/20, and even 90/10. However, it doesn’t imply that these blends are universally ideal for every policyholder. The crucial step is to consult with one of our Pro Client Guides who can craft the optimal high cash value whole life insurance policy specifically tailored to your unique preferences and requirements.

Single Premium vs Lump Sum Whole Life Insurance

When funding high cash value whole life insurance, there are options for adding lump sums and yet this shouldn’t be confused with a single premium product known as a Modified Endowment Contract. Lump sum premiums need to be part of a strategically designed whole life insurance policy in order to avoid the MEC status.

The main difference between single premium MEC policy and a lump sum whole life insurance policy is that the single premium policy’s cash value grows tax-deferred, whereas the lump sum policy’s cash value grows tax-free.

Both types of whole life insurance policies when properly designed, the single premium life insurance and the lump sum life insurance, have a tax-free death benefit that grows as the insured ages.

How Life Insurance Cash Value Works

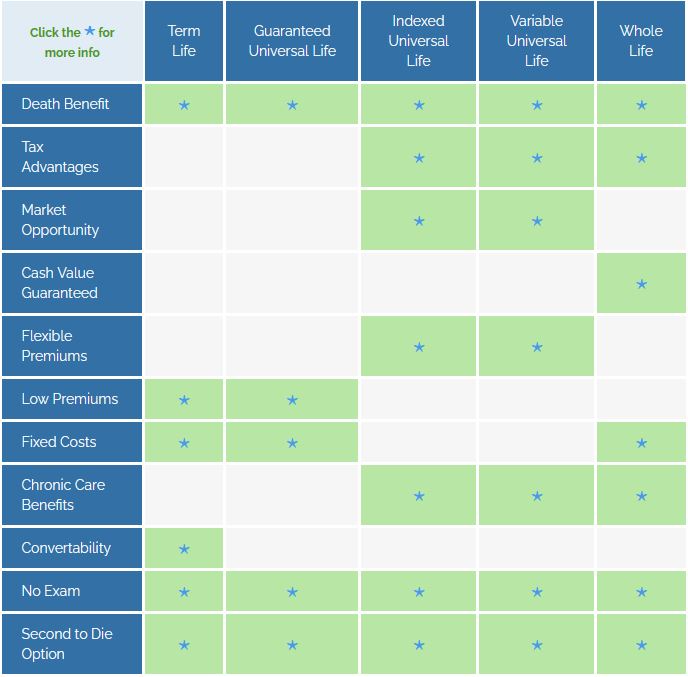

Although there are many different types of life insurance policies in the marketplace today, there are two primary categories. These are term life insurance and permanent life insurance.

Term Life Insurance

Term life insurance provides death benefit coverage for a pre-set period of time (provided that the premium is paid), such as 10 years, 20 years, or even 30 years. Term is the most basic form of life insurance, as there is no cash value component associated with the policy. After the time period, or “term” of coverage has elapsed, the policy will typically expire.

One enticing feature that is associated with term life insurance is that the premium is usually low – especially if the insured is young and healthy at the time they apply for the coverage. However, if the convertible term life insurance coverage is renewed in the future, the premium will be based on the insured’s then-current age and health condition.

Therefore, the premium cost of term life insurance could escalate significantly – and in some cases, if the insured has contracted an adverse health condition, they may not be able to renew the coverage at all.

Cash Value Life Insurance

Conversely, permanent life insurance, also known as cash value life insurance, offers a death benefit and a cash value component. In most cases, as long as the premium is paid, a permanent life insurance policy will remain in-force – even as the insured ages – and regardless of whether they incur any serious health issues.

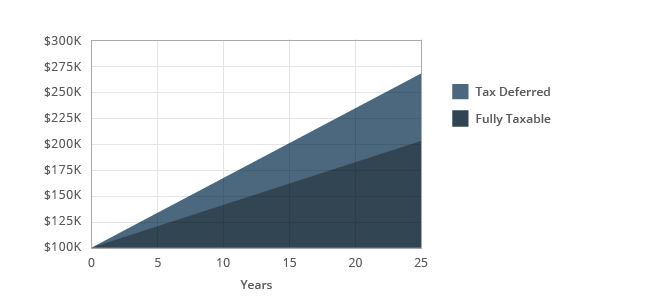

The funds that are in the cash value account of a permanent life insurance policy are allowed to grow on a tax-deferred basis. This means that there is no tax on the growth unless or until it is withdrawn.

Tax-Deferred vs. Fully Taxable Growth

When comparing the tax advantages of whole life insurance policies, which offer tax-deferred growth and tax-free access to cash value, against taxable accounts like typical investment or savings accounts, the contrast becomes evident. For instance, consider an account funded with $100,000 growing over 25 years at a 4% rate. In a tax-deferred account, it would grow to $266,583 over this period, whereas in a fully taxable account with a 25% tax rate, it would only reach $208,691.

Tax deferral can help to increase the cash value account in a policy more quickly because a return is being generated on the:

- Premium(s)

- Potential dividends

- Previous gains

- Funds that would have otherwise been paid in taxes

How much growth is attained – and how long it can take funds from the cash value component to increase – can depend on several factors. One of the biggest of these is how and when the policy’s premium(s) is paid in, and how the return in the account is generated.

How to Access Your Cash Value

How Soon Can You Borrow from Your Life Insurance Policy?

There are a couple of ways that you may access funds from a cash value life insurance policy’s cash value component. These include:

- Withdrawals

- Loans

When you withdraw money from a permanent life insurance policy, you will be taxed on the portion of the money that is considered gain, i.e., over your basis in the policy. The amount that you are taxed will correspond with your then-current income tax rate and bracket.

Federal Income Tax Rates

| Tax Rate % | Single | Married Filing Jointly | Head of Household |

|---|---|---|---|

| 10% | Up to $11,000 | Up to $22,000 | Up to $15,700 |

| 12% | $11,001 to $44,725 | $22,001 to $89,450 | $15,701 to $59,850 |

| 22% | $44,726 to $95,375 | $89,451 to $190,750 | $59,851 to $95,350 |

| 24% | $95,376 to $182,100 | $190,751 to $364,200 | $95,351 to $182,100 |

| 32% | $182,101 to $231,250 | $364,201 to $462,500 | $182,101 to $231,250 |

| 35% | $231,251 to $578,125 | $462,501 to $693,750 | $231,251 to $578,100 |

| 37% | Over $578,125 | Over $693,750 | Over $578,100 |

In addition, you may also incur an early withdrawal, or “surrender” charge if you are using a universal life insurance policy. A surrender period for these types of cash value life insurance policies typically last for several years. The amount of the surrender charge – which is stated as a percentage of the withdrawal – will generally decrease over time until it disappears altogether. Properly designed high cash value whole life insurance does not have surrender charges.

Borrowing Money Tax-Free from Whole Life Insurance

If you plan to borrow money from your life insurance policy, you can generally do so as soon as there is enough money built up to take a loan in the amount that you need. Policy loans can be taken tax-free, so there are no surrender/early withdrawal charges. Nor will you have to pay tax on the funds that you borrow – as long as they are repaid either during the insured’s lifetime, or afterwards through the death benefit proceeds.

Although most people do not like to borrow money and increase the amount of their debt, taking loans from whole life insurance can actually have a number of advantages – starting with the fact that the money is received tax-free. This means that you can count on a certain amount of money to spend, regardless of what the income tax and capital gains tax rates are at that time.

In addition, unlike getting a loan from a bank or other traditional lender, borrowing from a cash value life insurance policy will not impact your credit score.

Similarly, there is no approval process to go through in order to qualify for a life insurance policy loan. In many cases, you can have the money in hand within just days (or less).

Advantages of Whole Life Policy Loans

- Tax-free access to funds

- No credit check or application process

- No mandatory monthly payment schedule

- Interest continues to accrue on your full cash value amount

- Potential for dividends to offset loan interest

It is important to note that the life insurance company will typically charge interest on a policy loan. Although, the interest rate is usually lower than a bank loan or credit card. In addition, there is no mandatory monthly payment for repaying these borrowed funds. (Although a balance will accrue).

If the insured passes away while there is still a remaining balance (plus accrued interest) on the life insurance policy loan, the remainder will be repaid using proceeds from the death benefit. Then, the remaining amount will be distributed to the policy’s beneficiary(ies).

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

Whole Life Bonus

There is also an additional “bonus” that is associated with borrowing from a properly structured whole life insurance policy, and that is the return on the cash value account continues to be generated as if no money was taken from the account…because, technically, it hasn’t.

For example, if your whole life policy’s cash value is $80,000 and you borrow $40,000, interest received from the life insurance company will continue to accrue on the full $80,000 in the cash value account. This is because you are actually borrowing money from the insurance company and only using the cash value as collateral.

Some life insurance companies also pay dividends to their policyholders. Life Insurance Dividends are considered to be a return of excess premiums, and are not taxed. Even though dividends are not guaranteed, there are some insurers that have consistently made dividend payments for more than 100 years. In some cases, dividends might even be enough to cover the interest on the policy loan, in turn, making the borrowed money “free” to you.

Choosing the Right Policy

5 Key Factors to Consider When Choosing a Life Insurance Policy That Generates Immediate Cash Value

Purchasing a whole life insurance policy can be a long-term financial commitment. So, it is essential that you consider several important criteria when doing so. These should include knowing about the following:

1. The amount you can borrow from the particular policy.

All life insurance companies (and policies) can have different rules regarding how much you can borrow. Typically, though, the most you can borrow is up to 90% of the cash value.

2. How soon you can start borrowing.

You can generally borrow from your life insurance policy as soon as there is enough cash value built up for what you need. If you pay your policy’s premiums monthly or annually, though, it can take longer for the cash to accumulate as compared to a single premium life insurance policy.

Different companies have different timelines on how soon you can take out a loan against your cash value. There are companies that like you to wait 30 days, while other companies have a 90-day period they prefer you wait before taking out a loan.

3. The amount of the premium.

Just like making any other “high ticket” purchase, before you commit to buying a life insurance policy, you should make sure that you compare several plans. This is because the amount of the premium can differ from one to another – even with the same amount of coverage, features, and benefits. In this case, it can help if you work with an independent life insurance specialist who can run several policy comparisons for you.

4. Whether the policy is participating or non-participating.

Participating life insurance policies pay dividends (if applicable), which could help you to increase the return on the cash value. Non-participating whole life insurance policies do not pay dividends to policyholders. Therefore, if you have a choice, choosing a participating policy is the best route to take.

5. Financial Strength of the Company

The financial strength and stability of the life insurance company matters, so it is recommended that you check out the financial strength and stability of the insurance carrier, as well as its reputation for paying its claims.

You can do this by reviewing the ratings that the insurer has been given by Standard & Poor’s, A.M. Best, Moody’s, and/or Fitch Ratings. You will typically want to stick with insurance carriers with ratings of A or better. A life insurance specialist can also assist you with finding this information.

Customizing the Right Life Insurance Policy for Your Specific Needs

A properly structured permanent life insurance policy with immediate cash value could be an integral foundation of your overall financial and retirement plan. There are many different policy options, though, so it is critical that you go with the one that best fits your particular needs, goals, risk tolerance, and time frame.

Get Expert Guidance on High Cash Value Life Insurance

At Insurance and Estates, our mission is to ensure that consumers truly understand how certain financial vehicles can impact their short- and long-term financial goals.

If you would like to obtain more information on generating income tax-free funds – while at the same time protecting your loved ones in case of the unexpected – contact us today!

Discover if High Cash Value Life Insurance is Right for You

Before choosing a permanent life insurance policy, get a personalized analysis from our independent insurance specialists. We’ll help you understand how immediate cash value policies can align with your wealth-building goals and provide tax-free financial flexibility.

- ✓ Receive a detailed comparison of different whole life insurance designs and their cash value potential

- ✓ Understand exactly how paid-up additions can maximize your immediate and long-term cash value

- ✓ Learn specific strategies to access your policy’s cash value tax-free for retirement, business, or major purchases

- ✓ Get clarity on carrier financial strength, dividend performance, and policy loan provisions

Schedule your complimentary 30-minute Cash Value Strategy Session today and take the first step toward building accessible, tax-advantaged wealth inside a life insurance policy.

No obligation. No sales pressure. Just expert guidance to help you determine if a high cash value whole life insurance policy is the right fit for your long-term financial strategy.

Frequently Asked Questions

Which type of life insurance policy generates immediate cash value?

Whole Life Insurance, particularly when properly designed with paid-up additions, generates immediate cash value. Single premium whole life insurance also provides immediate cash value since it’s fully funded upfront.

How soon can I borrow from my life insurance policy?

With a properly designed whole life insurance policy, you can typically access up to 90% of your cash value after a short waiting period, often 30-90 days depending on the insurance company. Single premium policies generally allow access to funds sooner than policies with regular premium payments.

Are life insurance policy loans tax-free?

Yes, policy loans from a life insurance policy are received tax-free. Unlike withdrawals, which may be taxable if they exceed your cost basis, loans allow you to access funds without creating a taxable event as long as the policy remains in force and the loan is either repaid during your lifetime or through the death benefit.

What is the difference between single premium and lump sum whole life insurance?

A single premium whole life policy is funded with one large payment and is classified as a Modified Endowment Contract (MEC) with tax-deferred growth. A lump sum whole life insurance policy is strategically designed to accept large payments while maintaining tax-free growth and avoiding MEC status. Both provide immediate cash value, but have different tax implications.

Do I have to pay back a life insurance policy loan?

No, there is no mandatory repayment schedule for life insurance policy loans. However, interest will accrue on the outstanding balance. If the loan is not repaid during your lifetime, the remaining balance plus interest will be deducted from the death benefit before it’s paid to your beneficiaries.

What happens to my cash value when I borrow from my whole life policy?

When you borrow from a whole life policy, the insurance company continues to pay interest and/or dividends on your full cash value amount, as if no money was taken out. This is because technically you’re borrowing from the insurance company using your cash value as collateral, not withdrawing the cash value itself.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept