📖 Estimated Reading Time: 12 minutes

Table of Contents

Most people spend their entire lives making banks rich while staying financially dependent on institutions that profit from their money. Volume-Based Banking (VBB) offers a different approach: become your own bank by channeling as much of your income as possible through a properly designed whole life insurance policy instead of traditional bank accounts.

This strategy shifts focus from rate of return to volume control. Rather than hoping for high returns on small amounts of money sitting in bank accounts earning 0.5%, you build substantial volume in your own banking system earning guaranteed returns while maintaining complete control over your capital.

The concept is simple: why make traditional banks wealthy with your deposits and loan payments when you can build your own family banking system that grows your wealth instead of theirs?

What Is Volume-Based Banking?

Volume-Based Banking replaces your traditional banking relationships with a properly structured whole life insurance policy that functions as your personal bank. Instead of storing money in savings accounts and borrowing from external lenders, you build cash value in your policy and borrow from yourself.

The key insight: traditional banks make money by taking your deposits, paying you minimal interest, then lending that same money back to other people at much higher rates. With VBB, you capture both sides of this equation – the growth on your deposits and the interest you would have paid on loans.

Core Principles of Volume-Based Banking

1. Volume Over Rate

Control larger amounts of capital at guaranteed rates rather than chasing higher returns on smaller amounts subject to market volatility.

2. Your Bank, Your Rules

Eliminate dependence on traditional bank approval processes, credit checks, and lending restrictions by becoming your own source of financing.

3. Compound Growth on Total Volume

Your entire cash value continues earning compound interest even when you have outstanding policy loans – a feature unique to properly designed whole life insurance.

4. Strategic Capital Deployment

Use policy loans to fund investments, Roth IRA contributions, real estate purchases, and business opportunities while your money continues growing in your banking system.

Traditional Banks vs. Your Banking System

The advantages of Volume-Based Banking become clear when compared directly to traditional banking relationships:

| Traditional Bank Savings Account | High Cash Value Whole Life Insurance Policy | |

|---|---|---|

| Earnings Rate | The national average yield for savings accounts is 0.58 percent APY as of August 2025 (Bankrate). But actual earnings are less after tax and not guaranteed. | Guaranteed (average) 3-4% interest. Plus an additional 2%-3% dividends. Tax-free, so net earnings of 5%+ which may increase as interest rates increase. |

| Withdrawals and Earnings | Amount available for withdrawals is lower because gains in the account are taxable. | Full amount of cash value is available for withdrawals. |

| Loans | Does not offer loans. | Loans are available via the cash value, with no approval needed. Plus, the amount borrowed still continues to generate interest and dividends. |

| Loan Repayment | Amount and due date of repayments is determined by the bank or lender. If payments are late or missed, it negatively impacts your credit score. | No required loan payments. Policyholder determines when and how much is paid – or even if payments are made. |

| Added Benefits Upon Death | Paid on Death (POD) to a beneficiary. | Death benefit is paid to beneficiary income tax free. |

| Living Benefits | None | -Chronic Illness Rider – With a chronic illness diagnosis or need for long-term care, funds may be accessed from the death benefit. -Accelerated Death Benefit – Death benefit funds may also be accessed in the event of a terminal illness diagnosis. |

| Costs | Potential savings and checking fees. | Premium is required for death benefit. However, premium payments are leveraged for a larger death benefit payout – which is received income tax free by the beneficiary(ies). |

| Creditor Protection | Minimal. | Creditor protection based on individual state laws. |

The comparison reveals why properly designed whole life insurance functions as a superior banking alternative. You earn higher guaranteed returns, maintain complete control over borrowing, and build substantial death benefit protection – advantages traditional banks cannot match.

Banking Replacement Reality

Volume-Based Banking replaces traditional banking relationships with a system you own and control. Instead of making banks wealthy with your deposits and loan payments, you build your own family banking institution that grows your wealth while providing superior access to capital.

The Volume Strategy: Channeling Your Income

The foundation of Volume-Based Banking lies in channeling as much of your income as possible through your own banking system instead of traditional banks. This creates substantial volume under your control rather than enriching financial institutions that profit from your deposits.

Maximizing Your Volume Capacity

Insurance companies typically limit whole life premiums to approximately 25% of your annual income, though this varies by company and individual circumstances. The key is to channel as much as possible within these limits to maximize your banking system’s growth.

Here’s how this looks across different income levels:

$80,000 Annual Income:

- Maximum potential: ~$20,000 annually (25%)

- Monthly banking system funding: $1,667

- Traditional banking alternative: $80-400 annual earnings in savings

$150,000 Annual Income:

- Maximum potential: ~$37,500 annually (25%)

- Monthly banking system funding: $3,125

- Traditional banking alternative: $150-750 annual earnings in savings

$250,000+ Annual Income:

- Maximum potential: ~$62,500+ annually (25%)

- Monthly banking system funding: $5,200+

- May require more than one policy for optimization

Volume vs. Traditional Banking Mathematics

The mathematical advantage becomes clear when comparing volume-based approaches to traditional banking:

Traditional Banking Approach:

$20,000 in savings account × 0.58% = $116 annual growth (before taxes)

After 22% tax rate: $90 actual growth

Plus: External loan payments to banks for major purchases

Volume-Based Banking Approach:

$20,000 annual premiums × 5% growth = $1,000 annual growth (tax-deferred)

Plus: Policy loans eliminate external bank payments

Plus: Death benefit protection from day one

The difference compounds dramatically over time. By year 10, traditional banking might provide $900-1,200 in total growth, while Volume-Based Banking could generate $15,000+ in cash value plus substantial borrowing capacity.

Building Your Financial Infrastructure

Volume-Based Banking creates financial infrastructure rather than just savings. This infrastructure provides:

Capital Accumulation: Guaranteed growth on substantial volume rather than minimal returns on small amounts

Lending Capacity: Access to capital without credit applications, approval processes, or bank lending restrictions

Wealth Protection: Death benefit leverage that protects your family’s financial future from day one

Tax Efficiency: Growth and access without the tax burden that reduces traditional savings effectiveness

The Compound Interest Advantage

One of the most powerful features of Volume-Based Banking is how compound interest works on your total cash value, even when you have outstanding policy loans. This mechanism is unique to properly designed whole life insurance and cannot be replicated with traditional banking.

How Continued Growth Works

When you take a policy loan, your entire cash value continues earning guaranteed interest and dividends as if you never borrowed anything. Here’s the simple explanation:

-

Your Policy Cash Value: $100,000

- You take a $30,000 policy loan for a car purchase

- Your full $100,000 continues growing at 5% = $5,000 annual growth

- You make principal payments on the loan (example: $500/month = $6,000/year)

- Interest is only charged on the remaining loan balance

- After one year: $24,000 loan balance remaining (down from $30,000)

- Interest cost decreases as you pay down principal

- Key advantage: Your money compounds on the full $100,000 while you control and minimize interest costs through strategic principal payments

This is fundamentally different from traditional banking where withdrawn money stops earning returns immediately.

The Mathematics of Uninterrupted Growth

Consider a real-world scenario over 10 years:

Traditional Banking:

- Save $30,000 for car, money sits idle earning 0.58%

- Buy car, savings depleted to zero

- Start saving again from $0

- No growth on money used for purchase

Volume-Based Banking:

- $50,000 cash value earning 5-6% continuously

- Take $30,000 policy loan for car

- Full $50,000 continues compounding growth

- Repay loan over time while money keeps growing

After 10 years, the Volume-Based Banking approach could result in $80,000+ in cash value plus a paid-off car, while traditional banking might show $15,000-20,000 in accumulated savings.

Loans, Cash, or Policy Loans

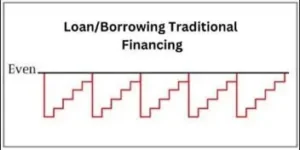

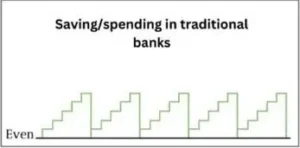

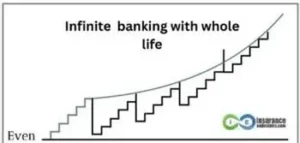

These three charts illustrate the fundamental difference between Volume-Based Banking and traditional approaches:

Image 1 – Traditional Financing: Shows the “reset to zero” problem where each borrowing cycle starts over. You save money, spend it, start saving again from zero – creating flat growth patterns with repeated resets.

Image 2 – Traditional Bank Savings: Shows minimal, flat growth over time. Money sits idle earning practically nothing, creating virtually no wealth accumulation.

Image 3 – Infinite Banking with Whole Life: Demonstrates uninterrupted compound growth. Even when you borrow against your policy, the base continues growing upward. This is the key advantage – your money never stops working.

Strategic Deployment: Using Your Bank

Volume-Based Banking becomes most powerful when you use policy loans strategically to fund investments and opportunities while your banking system continues growing. This approach enhances rather than replaces traditional investment strategies.

Roth IRA Funding Strategy

One of the most effective uses of policy loans is funding Roth IRA contributions:

Traditional Approach: Wait until you have “extra” money to fund Roth IRA, often missing contribution opportunities

VBB Approach: Take policy loan to maximize annual Roth contributions ($6,500-7,500), repay from cash flow while your policy continues growing

Result: You capture tax-free growth in both your banking system and your Roth IRA, maximizing your tax-free bucket accumulation.

Market Opportunity Deployment

Volume-Based Banking provides an opportunity fund for market downturns:

Market Crash Scenario:

- Stock market drops 30-40% (like 2008, 2020)

- Most people panic-sell or have no capital to deploy

- VBB practitioners take policy loans to buy discounted assets

- Policy cash value continues growing regardless of market conditions

This strategy allows you to buy low during others’ panic while maintaining your guaranteed foundation. With VBB, you operate from a position of strength, rather than fear.

Real Estate and Business Financing

Policy loans provide financing for major opportunities without traditional bank approval:

Real Estate Down Payments: Access capital immediately for real estate investments without mortgage pre-approval delays

Business Investments: Fund business acquisition opportunities without business loan applications or credit checks

Equipment Purchases: Finance business needs without equipment financing restrictions

Education Funding: Pay for education without student loan dependencies

The Opportunity Fund Concept

Your Volume-Based Banking system functions as a perpetual opportunity fund:

- Always Available: Capital ready for deployment within 30 days

- No Approval Required: You control access to your own money

- Flexible Repayment: Pay back on your schedule, not a bank’s schedule

- Continued Growth: Your money works while deployed elsewhere

This eliminates the common problem of seeing great opportunities but lacking available capital to act quickly.

Strategic Deployment Advantage

Volume-Based Banking enhances your investment strategy by providing guaranteed capital access while your money continues growing. You can fund Roth IRAs, buy discounted stocks, and seize other asset opportunities without depleting your banking system’s growth trajectory.

Implementation for Any Income Level

Volume-Based Banking scales across income levels, though the strategy becomes more powerful as volume increases. The key is starting with sustainable premiums and growing your banking system over time.

Starting at Different Income Levels

$50,000-75,000 Annual Income:

- Start with $500-1,000 monthly premiums

- Focus on building emergency fund replacement

- Use policy loans for smaller opportunities (Roth funding, minor purchases)

- Plan to scale up as income grows

$75,000-150,000 Annual Income:

- Target $1,000-2,500 monthly premiums

- Replace traditional savings and CD strategies

- Use for car purchases, home improvements, education funding

- Begin real estate down payment strategies

$150,000+ Annual Income:

- Maximize allowable premiums ($3,000-5,000+ monthly)

- Consider multiple policies for optimization

- Major investment deployment capabilities

- Business financing and opportunity fund development

Gradual Implementation Strategy

Most successful Volume-Based Banking practitioners start conservatively and increase commitment as they experience results:

Year 1: Start with 10-15% of income to test the strategy and build comfort

Year 2-3: Increase to 20% as cash value accumulates and borrowing begins

Year 4-5: Scale toward maximum allowable premiums (25%) based on results

Year 5+: Consider additional policies or business applications

This approach allows you to experience the banking replacement benefits while maintaining financial flexibility during the learning phase.

Volume-Based Banking works with your qualification limits and cash flow reality. Start with base premiums and scale PUA contributions as your banking system proves itself. The paid-up additions structure provides flexibility – pay only base premiums during tight months, maximize PUA when cash flow allows. Plus, our lifetime coaching ensures you have expert guidance as your banking system evolves and your financial situation changes.

Lump Sum Acceleration Opportunities

Insurance companies often allow larger lump-sum payments in the first year or two, which can dramatically accelerate your banking system development:

Common Lump Sum Sources:

- Annual bonuses and tax refunds

- Inheritance or gift money

- Business sale proceeds or stock option exercises

- Existing savings account transfers

- Real estate sale profits

Front-loading your policy can improve early cash value accumulation and provide faster access to meaningful borrowing capacity.

Company Selection Criteria

Choosing the right insurance company is critical for Volume-Based Banking success:

Financial Strength: A+ rated companies with 100+ year operating histories

Dividend History: Consistent dividend payments for decades (many companies since 1880s)

Policy Design: Flexibility through paid-up additions for maximum cash value accumulation

Loan Terms: Competitive policy loan rates and flexible repayment options

Customer Service: Responsive support for policy management and loan processing

Getting Started

Beginning your Volume-Based Banking journey requires careful planning and proper implementation. Here’s your step-by-step approach:

Step 1: Assess Your Financial Foundation

Before implementing VBB, ensure you have:

- Stable income that can support consistent premium payments

- High-interest debt eliminated or manageable payment plans

- Basic emergency fund (1-2 months expenses) for immediate needs

- Clear understanding of your monthly cash flow patterns

Step 2: Calculate Your Volume Capacity

Determine how much income you can channel through your banking system:

- Start with 10-15% of gross income for conservative approach

- Plan progression toward 20-25% as system develops

- Identify potential lump-sum acceleration opportunities

- Consider seasonal income variations and flexibility needs

Step 3: Design Your Banking System

Work with advisors who understand infinite banking to ensure:

- Maximum cash value accumulation policy design

- Appropriate death benefit structure for your situation

- Optimal premium payment schedule and flexibility

- Multiple policy strategies for higher income earners

Step 4: Implement and Monitor

Begin building your banking system with:

- Consistent premium payments to establish foundation

- Conservative initial borrowing to gain experience

- Annual policy reviews to track cash value growth

- Gradual scaling of loan activity as confidence builds

Step 5: Deploy Strategically

Use your banking system for:

- Emergency expenses without depleting traditional banks

- Roth IRA funding to maximize tax-free accumulation

- Market opportunities during downturns

- Major purchases while maintaining compound growth

- Business and real estate financing needs

Frequently Asked Questions

How is this different from just saving money in a bank account?

Traditional bank accounts earn minimal interest (0.58% average) and require external loans for major purchases. Volume-Based Banking earns 5%+ returns while providing loans from your own system. Your money continues growing even when borrowed, creating simultaneous growth and access impossible with traditional banking.

What happens if I need my money immediately?

Policy loans are typically available within 30 days with no credit checks, approval processes, or qualification requirements. You can access up to 90% of your cash value while your full balance continues earning returns. This provides superior liquidity compared to many traditional savings vehicles.

How much should I put into Volume-Based Banking?

Most people start with 10-15% of their income and scale up to 20-25% (insurance company limits) as they experience results. The goal is channeling as much volume as possible through your own banking system instead of enriching traditional banks with deposits and loan payments.

What about my 401(k) and other investments?

Volume-Based Banking enhances rather than replaces investment strategies. You can use policy loans to fund Roth IRA contributions, buy stocks during market downturns, or make real estate investments while your banking system continues growing. This provides capital access without disrupting your investment timeline.

What are the risks of this strategy?

The primary risk involves over-borrowing relative to cash value growth. Insurance companies limit borrowing to prevent problems, and conservative management eliminates most risks. Unlike market-based strategies, you cannot lose principal to volatility, and your growth is contractually guaranteed.

How long does it take to see results?

Cash value begins accumulating immediately, with meaningful borrowing capacity typically available within 2-3 years. The strategy’s power accelerates over time as your banking system grows. Most practitioners see significant advantages within 5-7 years of consistent implementation.

Can I do this with term life insurance?

No. Term insurance provides temporary death benefit protection but builds no cash value. Volume-Based Banking requires permanent whole life insurance with cash value accumulation and borrowing capabilities. The cash value is what creates your banking system.

What if the insurance company fails?

Work only with A+ rated companies with century-long operating histories and consistent dividend payments. These companies have survived multiple economic crises, wars, and market crashes. Additionally, state guarantee associations provide policyholder protection, though failure of highly-rated companies is extremely rare.

Ready to Replace Your Traditional Banking Relationship?

Before implementing Volume-Based Banking, get a personalized analysis from our banking alternative specialists. We’ll show you exactly how this strategy would work with your income and help you understand if VBB aligns with your financial goals.

- ✓ Calculate your optimal volume capacity based on income and goals

- ✓ See actual policy illustrations showing guaranteed growth and borrowing capacity

- ✓ Understand how to integrate VBB with your existing financial strategies

- ✓ Learn the strategic deployment options for maximum advantage

- ✓ Ongoing lifetime coaching to optimize your banking system

- ✓ Expert guidance as your financial situation evolves

Schedule your complimentary 30-minute Volume-Based Banking analysis and discover if this strategy can replace your traditional banking relationships.

No obligation. No sales pressure. Just expert guidance to help you determine if Volume-Based Banking can provide the banking alternative you’ve been seeking.