Note: This article was written with kids in mind so the language is simplified to provide a more enjoyable experience for younger readers.

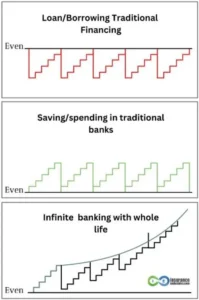

Infinite Banking is a strategy where you use a special life insurance policy to save money, grow it, and borrow from it when needed. It’s like having your own bank because you can take out loans from the money you’ve saved and still keep earning interest on it, just like a bank earns money from the money people deposit. You manage your money, deciding when to put it in, when to take some out via loans, and when to pay it back, all while your money continues to grow uninterrupted in your policy. This way, you can use your money and still make money on those same dollars.

Introducing Kids to Infinite Banking

Imagine you have a magical piggy bank, not like the one where you just save money from your allowance. This piggy bank is magic because it grows more coins over time. The more you put in, the more it grows.

Now, whenever you want to buy something big, like a toy, you can borrow some coins from it instead of breaking the piggy bank open and using all your money. The magic part is that even though you took some coins out to spend, your piggy bank still acts like those coins are there, growing more and more.

Whenever you get money from doing chores or as gifts, you put some back into the piggy bank, replacing the coins you borrowed to borrow again when you need to buy something else big. It’s like having your own bank at home, where you are the boss, deciding when to put in money and take it out.

This way, you can keep using your magic piggy bank to help buy things you need or want without running out of money!

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

Steps to take to start your magic piggy bank:

- Meet with a Savings Coach: First, you and your parents would meet with someone who knows about these special magical piggy banks. This person is like a coach who helps people figure out how to start their banks.

- Plan Your Savings Bank: Your savings coach will help you design your savings bank so it can quickly grow money and allow you to borrow from it when needed. They will discuss how much money to start with and how often you should add more.

- Fill Out a Form: Just like when you join a club or a sports team, you must fill out a form to start your magical piggy bank. This form tells the savings company about you and what you want your bank to do.

- Health Check: Sometimes, the company wants to ensure you’re healthy, so it might ask a doctor for a quick check-up, which helps it decide how to set up your piggy bank.

- Set Up Your Bank: Once you receive approval from the savings company, your piggy bank is ready to go. You can now start putting money into it.

- Watch It Grow: As you add more money, your bank starts to grow money on its own. The more you add, the faster it grows since the growth is a combination of your old money and the new, growing together.

- Use Your Money: You can borrow money from your bank to buy something big. Remember, even though you borrow some money using your piggy bank savings as *collateral, your piggy bank will keep growing based on the entire balance in your savings.

- Pay It Back: After you borrow money, you start putting it back when you can, which keeps your bank full and growing.

- Keep It Going: You keep adding to your bank over time, and it gets bigger and stronger. You can keep using it for everything you need as you grow up, including a car, college, and your first home.

*Collateral: Collateral is something someone holds for value in place of another item. For example, imagine you have a cool toy everyone loves playing with. And suppose you want to borrow some toys from your friend, but your friend wants to ensure you’ll return them. So, you let your friend hold onto your cool toy while you borrow theirs. Your friend’s toys keep your cool toy safe as long as you have them. Your friend returns your cool toy once you return the toys you borrowed.

Infinite Banking for Kids Example

In the video, Denise Boisevert talks about setting up high cash value whole life insurance policies for children and grandchildren as a lasting gift that can financially support them throughout their lives. This includes major expenses like buying a car, paying for college, or even a house down payment. These policies continue to earn interest and offer flexible payment terms, providing financial stability and support over the years.

Pros and Cons of Infinite Banking for Kids

Pros (Good Things)

- Magic Growth Piggy Bank: Just like a magic plant that grows even when you take some leaves off, this special bank grows money all the time, even if you use some of it.

- Always Available: You can borrow money from your bank any time you need it to buy something big, like a new bike or a computer.

- You’re the Boss: You decide how much money to put in, take out, and when to do it.

- Safe and Sound: This bank keeps your money safe from losing value, as the savings company promises to grow your bank continually.

Cons (Not-So-Good Things)

- Costs Money to Start: Setting up your magical piggy bank isn’t free. You need to start putting in a good amount of money, which can be a lot for some people.

- Rules to Follow: You must regularly add money to your bank, or it might stop working. That means you have to be good at saving regularly.

- Takes Time to Fill: When you start your bank, it doesn’t get big immediately. It might take a few years before it has a lot of money, so you must be patient.

- Not Just Anywhere: The rules about how safe your money is in the bank might change depending on where you live. Some places might be better than others.

Conclusion

The Infinite Banking concept is like having a magical jar that helps you save money, watch it grow, and use it when you need it without losing any of its magic growing power. It’s a cool way to be in charge of your own money, like being the boss of a tiny bank!

Next Steps

- Talk with Your Parents: Discuss this idea with your parents to see if it’s something your family can do together.

- Learn More Together: Read a few books about infinite banking or watch some fun videos.

- Meet with a Money Coach: If you and your parents think it’s a good idea, you can meet with a money coach (an insurance agent) who knows about this magical piggy bank.

- Think About Your Money Goals: Start thinking about what you might want to save for—like your first car, college, or a home someday!

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept