“For I know the plans I have for you” declares the LORD, “plans to prosper you and not to harm you, plans to give you hope and a future.” Jeremiah 29:11

Over the past decade, there has certainly been a trend for many financial advisors and most life insurance agents to become cheerleaders for the idea that term life insurance policies are the “be all end all” option when it comes to helping their clients secure their families financial security.

Unfortunately…what this “one size fits all” approach fails to take into consideration is that not everyone’s financial needs are the same, and there are a lot of reasons why one might want to consider purchasing a whole life insurance policy that has nothing to do with the ultimate death benefit that these “types” of life insurance policies will ultimately provide to their owners.

And this is where reading a book like Becoming Your Own Banker by Nelson Nash can not only educate one on the value of what a high cash value whole life insurance policy can mean to ones own financial security, it can also “change” how one approaches their personal finances forever!

In the book, Nelson Nash provides a detailed description of how the use of dividend-paying cash value whole life insurance can be used as a means of building up funds that can the be used to finance expenditures thus “cutting out” the “banker” as the middleman in ones own personal finances thus allowing one to become their own “banker”.

Nash’s key insight is that by taking advantage of the tax-deferred buildup of funds in a life insurance policy in conjunction with policy loans and dividends, you can finance many of your purchases, reaping greater financial rewards in the long run than would be the case if you took out loans from a bank or finance company.

In this infinite banking concept review, we’ll take a comprehensive look at the points Nash makes in the book, along with links to many other helpful articles on our site to give you an in-depth understanding of this powerful financial strategy.

How Nash Developed the Infinite Banking Concept

Nash trained as a forester and worked in that field after graduating from the University of Georgia. In the book he states that much of the core portion of the infinite banking concept (IBC) was derived from his study of forest finance – where compound interest over long periods of time, in the form of growth of forestry assets, occurs with no taxation on that growth. The downside of this type of growth, Nash mentions, is that you don’t see a result from your investment for a long time.

Nash also sold life insurance for many years with The Equitable Life Assurance Society of the U.S. and with The Guardian. His knowledge of the ins and outs of dividend-paying whole life insurance forms another pillar of the Infinite Banking Concept.

The Final Piece of the Puzzle

The final piece of the puzzle in terms of deriving the inspiration to create the infinite banking concept came from his experience as a real estate investor. Timber, in conjunction with the land the trees grow on, can be considered a form of real estate, Nash states, similar to an apartment or office building.

The key message being delivered about investing in real estate, Nash soon found, was not about the property per se but about the leverage an investor could use to juice their returns from investing in real estate.

After all, if you are faced with paying interest whether you borrow money or use your own money. If you use your own money, you miss out on the interest you would otherwise be receiving on the money. By borrowing the money, you only gave up the interest you paid between the time you bought the property and when you sold it at a profit.

Paying 23% Interest

Nash followed this strategy profitably in the late 1970s but found himself in trouble when the early 1980s rolled around and he was faced with paying 23% interest, which he had not budgeted for, on $500,000 worth of property. Selling the property at a massive loss was not his preferred solution, so he had to look for some way to find the cash to pay the interest owed on the loan. The pressure of dealing with this financial crisis, along with other challenges he faced at the time in his personal life, led Nash to come up with the infinite banking concept.

What he realized was that he could escape the financial disaster that was staring him in the face by borrowing against the cash value in his whole life insurance policy via policy loans, at rates far below the 23% he was paying on his real estate property. Typically, the only restriction on the amount you can access in this way is the amount of cash you have built up in a policy. At this point, it became clear to Nash that he needed to boost the life insurance premiums he was paying significantly.

How could he do this while staring a $500,000 loan at 23% interest in the face? Nash found that by revising his spending patterns he was able to free up more cash to contribute to his insurance policies. The idea of contributing to dividend-paying whole life insurance as a means of being your own banker was contrary to what was being taught by the “experts” at the time. But analysis of the benefits of building up cash value in a tax-deferred vehicle with an attached death benefit convinced Nash that his insight into the potential of the infinite banking concept was valid.

How Infinite Banking Works

To illustrate the process of infinite banking as he defines it, Nash uses the example of running a family business such as a retail store where you and your family both consume its products and sell them to others.

“Don’t Steal the Peas”

In the long run, he asserts, the stores which do best are those where the owners don’t take the goods out the back door of the store without paying retail prices for them. In the same way, when taking out a loan from your whole life policy, he advises making payments that reflect current market interest rates, regardless of whatever rate the insurance company may charge, as a means of continuing to strengthen your financial position.

If you are running a business, a portion of your profits, of course, go to the IRS. Nash asks you to imagine running a business in which your profits grow tax free. This, he states, would make it even less desirable to take the goods out the back door and avoid paying retail prices for them. While tax-favored growth of profits may not apply for the average family-run business, it does apply to earnings on cash value life insurance.

$.345

Next, Nash focuses on the tremendous amount of interest the average consumer pays in financing purchases large and small, whether a car, house, or incidental items charged to a credit card. He claims that 95% of trade-in cars are not paid for, meaning that for cars traded-in after 30 months 21% of each dollar paid is interest on the car loan. The case is worse, according to Nash, for individuals taking out home mortgages that they refinance frequently. In the example he cites, 86% of every payment made is dedicated to paying financing costs. When other financing costs are considered, Nash estimates that the average All-American consumer spends $.345 of every disposable dollar they have in interest.

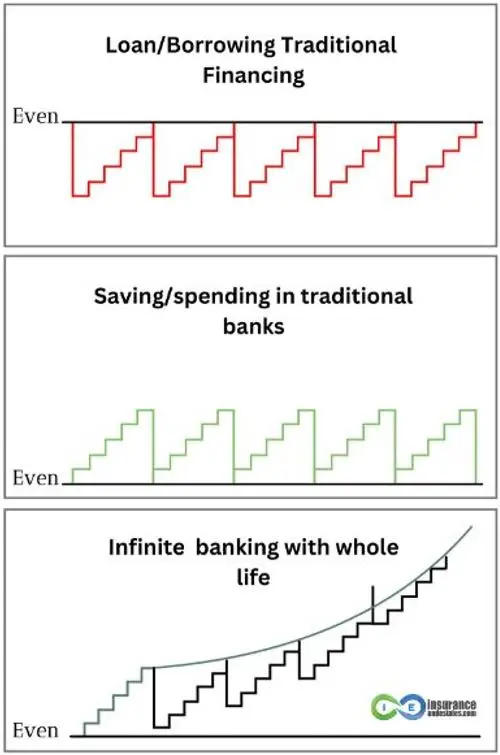

By gaining control of the “the financial environment in which you operate” using infinite banking, the book claims that you can cut down on the interest you pay to others by financing many of your own expenditures. According to Nash, learning how to gain this control is “the most profitable thing that you can do over a lifetime.”

Gaining control of your finances and becoming your own banker is “the most profitable thing that you can do over a lifetime.”

To gain the power to charge others interest as a bank requires a significant investment of time and money. The infinite banking concept also requires time to build up funds in the cash value portion of your policy, but because the structure of dividend-paying whole life insurance already allows you to use such policies to build your own banking system, much less investment is required than would be the case if you were trying to start up a bank. Thus, Nash believe using infinite banking is a much easier method for achieving a similar result to operating your own bank.

Infinite Banking by Other Names

The concept is so popular that it has taken on many different names. Many organizations have taken the infinite banking concept and renamed it, such as Be your own bank, Bank on yourself, Cash flow banking, Perpetual wealth strategy, Cashflow tactics, The and asset, Wealth maximization account, Cashflow hacking, and the list goes on.

All of these different names are describing the same thing, using high cash value life insurance as a wealth storage account, to buy other cash flowing assets, and turn you into the banker, and your policy as your bank. Your policy provides ever increasing cash value and death benefit, as you use the cash value in your policy as a conduit to true compound interest wealth building, while simultaneously using the same dollars to invest in cash flowing assets such as your business, real estate, dividend paying stocks, etc.

First Principle: You Finance Everything

The book teaches that the first principle to understand when learning how infinite banking operates is that everything a person buys is financed, either by borrowing from a lender or by using your own money, thereby foregoing the interest you would have otherwise received on the funds. This concept is also known as the opportunity cost of money.

EVA: Economic Value Added

In this regard, Nash mentions economic value added (EVA), which refers to the earnings on a sum of capital above and beyond the cost of that capital.

In the case of Economic Value Added, EVA, Nash reports that many large corporations produced tremendous success by adopting EVA, which centers on the idea that use of your own funds has a cost of capital.

By removing the need to pay interest to others and directing that same amount of interest to a life insurance policy under your control which features tax-deferred growth, he says, you can improve your financial situation.

Similar to EVA, for this type of system to work, Nash states, “the Infinite Banking Concept must become a way of life. You must use it or lose it!”

Dividends

Life insurance is a product that has been around for over 200 years. In addition to the ability to earn tax-deferred interest, life insurance dividends generated by policies from participating life companies are also free from current taxation, as they are considered to be a form of return of principal.

Need for Finance

Nash next discusses the idea that if you are paying out more than 35% of every dollar you make in after-tax income in interest, your need for finance is likely to be greater than your need for life insurance over the course of your working years. By using dividend-paying whole life insurance to address your life insurance needs, Nash’s book claims that you will then automatically be able to build up more life insurance while regaining the totality of the interest you would otherwise be paying to someone else.

This program, however, almost never occurs, according to Nash, because of the bias against using life insurance as a place to store money. Thus, instead of paying the insurance company an amount which encompasses the funds needed to keep the insurance in force plus the sums needed to build up enough cash to finance a car payment and other financial needs, these funds are paid separately in the form of car payments, credit card payments, etc. You would be better off, Nash states, by paying these sums to the insurance company and cutting out the middleman.

The key, he believes, is that you should make sure you are paying into the insurance policy the same amount you would otherwise be paying to the car finance company, thereby earning what the finance company would have earned for your own benefit. Ideally, you will contribute even more than that amount to increase the amount of cash in the account that you can use for other purposes.

You the Borrower; You the Lender

This is the core of Nash’s system, setting aside funds in your dividend-paying whole life insurance that you would otherwise pay directly to financial organizations to finance expenditures so that you can finance the expenditures yourself, as a result capturing for your benefit the interest you would otherwise be paying to others.

This is the core of Nash’s system, setting aside funds in your dividend-paying whole life insurance that you would otherwise pay directly to financial organizations to finance expenditures so that you can finance the expenditures yourself, as a result capturing for your benefit the interest you would otherwise be paying to others.

To fully understand the infinite banking concept, Nash states, more explanation is needed. It generally requires four years or so of premium contributions to generate enough cash value to begin financing purchases. To be able to finance a car is likely to require somewhat more than four years. Given that many college business professors, according to Nash, teach that corporations invest with the idea that it will require at least seven years to turn a profit on a new investment, he suggests capitalizing each life insurance policy bought using the infinite banking concept for no less than seven years so that dividends from the policy are enough to pay all remaining policy premiums.

Ideally, Nash states in the book, those using infinite banking will utilize a number of insurance policies, rather than just one, to get the most out of the system. To maximize its potential, after purchasing the maximum amount of life insurance a company will issue on your life, Nash suggests purchasing insurance on the lives of others, such as life insurance on your kids, of whom you have an insurable interest.

Becoming Your Own Banker

He estimates it will require approximately 20 to 25 years for the average individual to fully assemble a banking system that can handle all of their financing needs using life insurance. However, once such a system has been built, Nash states, it can be passed down to future generations, assuming they have the discipline not to “go out the back door of the grocery store,” i.e. steal from yourself, and continue to adequately fund the policies.

Nelson Nash points out that life insurance contracts are owned, not by the insurance company, but by the policy owner, who is first in line when it comes to having the right to access all of the cash in the policy if they choose to do so. Tax-deferred dividends received in a policy can be used to purchase additional paid-up insurance, resulting in consistently compounding returns on a continually increasing base.

Your Banking System

People always talk about return on investment and compare whole life insurance with the stock market, but what Nash is saying is that you put your entire income into a policy so that the volume of your return exceeds what you could ever make in the stock market. Because we’re not talking about return we’re talking about volume. The banking system tells you to save 10% of your income in a tax deferred account. Nash is telling you to put your entire income in a tax free account. The difference is astronomical.

Developing the Discipline to Use Infinite Banking

In addition to covering the technical details of setting up a personal banking system via high cash value whole life insurance, Nelson Nash also writes about the human behavior-related issues that must be overcome to successfully create such a system.

Parkinson’s Law

In this regard, he cites Parkinson’s Law, which goes as follows: “expenses rise to equal income.” In Nash’s opinion, allowing your expenses to consume all of your income is no way to manage your finances. He feels so strongly about this that he writes that if you do so, if you can’t overcome the urge to spend every penny you make, “you are destined to become a slave!”

“Expenses rise to equal income.”

While Nash uses histrionic language to make his point, he is right on the mark here in stressing the importance of moderating spending when it comes to building up your savings. Whether an individual uses the infinite banking concept or any other method to save money, keeping your expenses in line is essential.

Government Sponsored Retirement Plans

For those who are able to save some of their income, Nash is skeptical of the vehicle many Americans use to invest such sums – government-sponsored retirement plans, such as the much aligned 401k plan.

Because government does not produce things itself, he sees it as a parasite which extracts resources from the productive parts of society. At the same time, if governments raise taxes too high, it can hurt economic production.

Thus, Nash says, they resort to setting up retirement plans like 401(k)s, IRAs, and the like to reduce the impact of the taxes they have passed. However, he warns, the government can change the rules regarding these plans if they like.

Therefore, Nash feels that the superior choice is the “magnificent idea” of dividend-paying whole life insurance, which has been in existence for more than 200 years. In his view, it has the advantage of not being a government-sponsored program and being private property.

Arrival Syndrome

When it comes to factors that prevent people from achieving their financial goals, Nash cites what he calls “The Arrival Syndrome” as probably limiting “the achievements of mankind more than anything else.”

This syndrome revolves around the sense of complacency often exhibited by individuals or companies who have achieved some level of success, which thereby prevents them from continuing to improve and adapt. They fall into a comfort zone that prevents them taking the steps necessary to adapt to new developments.

Willie Sutton’s Law

Nash also mentions Willie Sutton’s law, which refers to the famous bank robber who said he robbed banks because “that’s where the money was.” In this regard, dividend-paying whole life can become like a bank only if you design it properly and fund it as necessary.

The Golden Rule

Nash also cites the Golden Rule, as in he or she who has the gold makes the rules, to make the point that if you save up enough money using the infinite banking concept you, rather than the bank or a finance company, control your financial destiny.

These ideas, along with the idea of Use It or Lose It, and the idea that your own capital has a financial cost similar to funds borrowed from the banks, make up what Nash calls the Infinite Banking Concept Basic Understandings. All of these understandings are based on the idea that success is dependent upon being able to overcome human nature.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

Designing an Infinite Banking Plan

When it comes to designing an infinite banking policy, Nash suggests studying mortality tables to see where the majority of the dying occurs. He cites statistics which show that if you take 900 people who are living at age 45, 75% of them will not die until they have passed age 65.

With increasing lifespans, these numbers may be even more tilted toward deaths occurring after age 65 in the decades since Nash wrote the book. He points out that when people discuss the “need” for life insurance, they typically focus on the time between age 21 and 65, even though comparatively few people die within this age range.

Nash points out that life insurance started out as term life insurance, with insured individuals paying higher and higher premiums as they aged and became more likely to die, until they reached the point at which they could no longer afford to buy insurance at all. Thus, whole life insurance was created, beginning with the insured’s current age and extending all the way to age 100. From Nash’s perspective, this type of whole life insurance policy had more to do with banking than anything else, making it equivalent, in his view, to “a banking system with a death benefit thrown in for good measure.”

Dividend Paying Whole Life Insurance is a “a banking system with a death benefit thrown in for good measure.”

This misunderstanding, or misclassification, as Nash sees it, was key to his discovery of the infinite banking concept. In building an infinite banking policy, Nash recommends that shorter payment periods on life insurance policies are better. However, he doesn’t see a need to pay so much of a policy upfront that it is classified as a MEC (modified endowment contract), thereby losing certain tax advantages granted to life insurance policies.

PUAs

Instead, Nash suggests utilizing a number of policies to create a comprehensive IBC system, using as a base policy a policy that has standard premium payments over the course of an individual’s life, and then adding a rider that allows Paid-Up Additions (PUA) to the policy.

You can then vary how much is allocated to the new policies in relation to the base policy, with the MEC cut-off line at one end and the base policy at the other end. The objective, according to Nash, is to get close to the MEC line without crossing it, reducing the amount of immediate death benefit while emphasizing the banking aspects of the system by creating greater cash value.

“Infinite” Policy

An added advantage of this approach, Nash says, is that it is likely to end up generating greater death benefit at the time death is most likely to occur than would be the case with other plans. Using this strategy, the base policy generates dividends, as will the PUA rider, which can be put to use to buy further Paid-Up insurance, enhancing the “infinite” aspect of the system.

Such an approach can also be called “overfunding life insurance”, with a goal of getting the maximum amount of money possible into the policy with the least insurance attached to it.

Essentially, the goal for the purpose of infinite banking is to acquire the policy which is highest in cost without being designated a MEC; in other words, minimizing the death benefit of a policy while seeking to maximize its cash value.

A properly designed Infinite Banking policy maximizes cash value growth and minimizes the initial death benefit.

Once you have adequately capitalized your infinite banking system, Nash says, you can then access the funds within the system and pay back interest to yourself, rather than to a finance organization. While it takes time to build up sufficient capital in the system, Nash reminds his readers that the same would apply if they were starting up a business or a bank of their own.

Reviewers Note: Properly designed life insurance for infinite banking may have cash available to borrow against starting in month one. However, it will typically take about 5 years before the policy begins earning interest and dividends greater than your initial contribution.

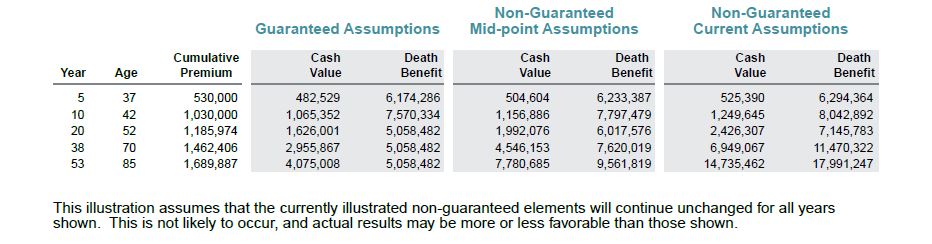

Infinite Banking Policy Example

The following illustration numbers are based on a 32 year old male putting $100,000 into a policy annually for 10 years until age 42, and then $15,165 until the age of 100. At age 70, the cumulative premiums paid into the policy are $1,462,406, with the cash value ranging from $4.5 million to $6.9 million and a death benefit of $7.6 million to $11.4 million.

Reviewers Note: the non-guaranteed portion above assumes dividends will be paid out at the current scale or better over the policy’s lifetime. Dividends are not guaranteed but most mutual insurance companies we work with have consistently paid dividends every year for over 100 years.

Infinite Banking Illustration

To illustrate the power of the infinite banking concept, Nash outlines a number of different scenarios for acquiring the funding to purchase or lease a series of cars over a 44-year period. According to Nash’s calculations, using dividend-paying whole life insurance to take advantage of the guaranteed return plus the potential for dividends offered by these policies proves to be the most effective use of capital as compared to other methods.

Infinite Banking included, these methods are as follows:

- Leasing a car each year over 44 years: This method is the most expensive of all, according to Nash, given the high fees involved

- Borrowing the money from a bank or finance company: In this method, interest is paid to the bank and thus benefits the bank and not you.

- Paying cash for a new car every four years (by setting aside enough money in savings to be able to afford a car): This is similar to the “sinking fund” method but does not take full advantage of the possibility of earning interest and potentially dividends on your funds over time.

- Investing money in bank CDs over seven years to build up enough money to purchase a car: While this does earn interest, you are using someone else’s bank to do so, therefore the dividends earned by the bank accrue to the bank’s shareholders, and not to you.

- Using dividend-paying whole life: In this scenario, you can benefit from the strong dividend-paying ability of life insurance companies, some of whom have paid dividends yearly for more than 150 years. Nash’s illustration of this method in the book shows the withdrawal of dividends, rather than taking a policy loan, to generate funds to purchase a car. However, Nash says that his preferred method would be to use policy loans, because of the compounding power generated by using dividends to buy further Paid-Up insurance. If you use loans, you don’t restrict the policy’s ability to grow via interest accrued on your existing cash value and dividends.

Delayed Gratification

Nash explains that buying a life insurance policy is similar to starting a business – which generally involves a delay before profitability kicks in.

Because you, and not the life insurance company, are the owner of the policy, you have full control over how the capital built up in the policy is used.

Thus, Nash dismisses claims that life insurance is a poor method of accumulating wealth due to the fact that it takes time to build up equity in your policy. In the long run, Nash says, the retirement income that is generated by the IBC method can far outstrip that generated using alternative methods. This, he writes, is “the real power of the life insurance method.”

By Nash’s calculations, the IBC system outlined in method 5 continues to pay retirement income from dividends until the cost basis is recovered and thereafter from policy loans for many years longer than would be the case using the CD method described in method 4, which runs out of funds after a few years of paying retirement income.

At the same time, it leverages to you a significant death benefit to your heirs when you pass away. By capturing the interest that an individual would normally pay to someone else and the dividends generating by controlling the lending process, the IBC method, according to Nash, enables a policy owner to significantly improve their financial position over the long-term.

TWO RULES

Nash says that only two rules apply to the use of the Infinite Banking Concept:

- You shouldn’t hesitate to capitalize the concept by putting as much capital as possible into it, as the more money within the system, the more that can be regained as tax-free “passive income.”

- You should always be prepared to pay back any policy loans you take from the system.

Nash says that the idea that premiums should match income may sound strange, but the fact that all of an individual’s income flows through someone else’s bank now means that doing this is just taking control of your own finances.

Paying a significant portion of every dollar in interest into a banking system that is not your own is not productive, in his opinion. He sees no reason that a person must stop at financing just one car using infinite banking. In fact, Nash shows how, with significant capitalization, the system can be used to finance multiple cars, and even be extended into the realms of equipment leasing, a home mortgage, and self-insurance.

Reviewers Note: We also recommend using infinite banking for entrepreneurs and business owners

While Nash’s infinite banking system is by no means a recipe to get rich quick, the calculations he uses shows that it can be a powerful means of structuring your finances to benefit from the ability of dividend-paying life insurance to:

- Provide a source of financing for major purchases

- Serve as a vehicle for setting aside funds to use in retirement

- Provide a death benefit for your beneficiaries

Capitalizing an Infinite Banking System

The infinite banking concept enables the use of properly designed high cash value whole life insurance to set up a system that has all the hallmarks of a banking system, according to Nelson Nash.

The steps needed to get into the business of banking using life insurance include:

- Choose a high-quality dividend-paying life insurance company to purchase a policy from; preferably offered by a Mutual Insurance Company

- Capitalize this policy over a period of at least four years, and ideally longer to make the system more profitable

Start Your Own Business

Nash stresses that no licenses are needed nor are customers required for you to operate this “business.” You don’t have to hire any engineers or salespeople. All the hard work of starting up the business has already been done by the insurance company. No other start-up business comes with such advantages, as far as Nash is concerned.

The key to getting started in the capitalization phase, according to Nash, is having the desire to overcome Parkinson’s Law and cut back on your spending to set aside money for this purpose. He recommends finding a life insurance agent who is well-versed in the infinite banking concept as well as discussing the process with other individuals who are familiar with the infinite banking concept.

Don’t Wait

Above all, Nash says, you should get started as soon as possible. By waiting to start the capitalization process, you make it harder to amass the sums needed to reach your financial objectives. In discussing ways to find the funds to add to your dividend-paying whole life policy,

“I Can Get a Greater Return on Investment Elsewhere”

Nash brings up the objection often voiced by those who hear about infinite banking for the first time, namely, that they could get a greater rate of return by investing elsewhere. However, Nash says, this misses the point that the infinite banking concept is not focused on the yield of an investment, but rather how you finance anything that you purchase. Nash states that “It is always better to finance it through your banking system than out of your pocket.”

Reviewers Note: A comparison of infinite banking versus stock market returns

College Degree

Nash also digs into the numbers behind financing a college education in the book, explaining that given the doubtful value of a college degree, or at least some college degrees, a person would be better off investing the sums spent paying for college in a dividend-paying whole life insurance policy.

The total income generated by such a policy, in his estimation, would likely be greater than the value created by a college degree. While Nash states that he is not against higher education, he worries that students attending such institutions may be exposed to a professor who teaches them that whole life insurance is not a good place to put money.

Infinite Banking Review Conclusion

In conclusion, Nash points out that when you are paid for work at your place of employment, that money is typically placed into somebody else’s bank. However, if you owned your own bank, Nash asks, wouldn’t you want to do all your business with that bank?

It then follows, he states, that, ultimately, your annual life insurance premiums paid per year should be equal to your annual income. While this is impractical in the short term, over 20 years it can be achieved by the average individual. If this lesson is passed on to successive generations, Nash believes, a perpetual banking system can come into being.

Whether or not a person plans to use the infinite banking concept outlined by Nash, in part or in full, this book does an excellent job of explaining how it works and why you might want to consider using it.

Becoming Your Own Banker offers a clear description of how to adopt such a system that details both the technical and behavioral steps a person would need to take to put the IBC to work on their behalf.

The main problem…

Most folks will find once they have become “introduced” to many of the concepts that Nash talks about in his book is that it seems like most financial advisors and certainly most insurance agents working for the larger “nationwide” insurance brokerages aren’t going to have much experience helping folks implement these ideas.

And they may be inclined to “automatically” assume that purchasing a dividend-paying cash value whole life insurance policy is a terrible idea because they don’t fully understand the concept of using a whole life insurance policy for the purposes of strategic self banking.

The good news is…

That here at I&E we understand that for a lot of folks, the ideas presented in R. Nelson Nash’s book Becoming Your Own Banker, can and often will make a lot of sense. If you’re thinking that you’d like to learn a little bit more about how becoming your own banker might work for you, and you’d like to speak with someone who will be able to break it down for you in a language that is easily understandable like Nash uses, feel free to give us a call or visit our Pro Client Guide page, we’d love to be given an opportunity to show you how infinite banking would work for you, using your own numbers.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

5 comments

Francisco Martinez

I’m interested in getting started on my own IBC and getting information on getting started.

Insurance&Estates

Hello Francisco, I passed your request to our resident IBC expert Barry Brooksby, and he will be reaching out to you if he hasn’t already.

Best, Steve Gibbs for I&E

Rico

Nice article on the banking concept. It’ll help newbies very much. It’s good to see someone put forth recommendations on this. As you point out, there are plenty of important tricks & strategies to apply. Great selection! Thanks for the information, it was very useful! I would like to be here again to find another masterpiece article.

Peter Scott

I’ve read Nash’s book and want to like the concept of IBC. I would be a complete fan except for one detail. When I borrow from the cash value of my whole life insurance policy, I am paying interest on the loan TO THE INSURANCE COMPANY. In other words, I am not “paying myself” the interest on the loan. The interest is paid to the insurance company itself and is not credited to me or my policy in any way. The interest rate quoted in my policy (obtained in 1987) is 8%. If I were to finance a car, for example, surely I could obtain a loan for less than 8% in our current low-interest rate environment. So what advantage do I have in following IBC rules and financing major purchases with policy loans? I hope I have my facts right, but please set me straight if not. Thanks!

Insurance&Estates

Hi Peter, thanks for reading and your comment. You’re observation is correct insofar as a policy loan (taken from the insurance company) is a loan secured by your cash value and the insurance company will charge a rate of interest. I tend to equate a policy loan with a home equity loan, yet one that is much more readily available, totally liquid with no external credit application and no time lag when applying (usually approved within a day or 2). So the ability to take a policy loan in itself an incredibly useful tool. This is something that arguably should’ve been clarified in Nash’s book and is a question that is commonly addressed by current proponents of this strategy.

As far as the benefits, while you pay interest on a policy loan, it is generally lower than what is available from a bank with the exception of auto loans (although when you really look at auto finance this is debatable). The background to all of this; however, is that even if you use cash, there is always a cost of capital due to lost opportunity costs. With policy loans, the loan proceeds are still invested and receiving a guaranteed return plus dividends, and potentially the full amount depending on the policy and company. So, the goal is often to create a financial arbitrage (0 cost of capital or a small gain) AND using the loan proceeds for higher rate of return investments such as real estate. There are companies that offer lower rates currently (than what your company is quoting) and some even a “margin lock” after a period of time so that even if interest rates rise, the are locked so as to not exceed dividend rates.

There is a lot more to consider when analyzing this strategy, and the logic tends to fly against common conventional thinking until the light bulb goes on. So your question is well taken. If you’d like to look at some other policy options, feel free to reach out to Jason Herring at jason@insuranceandestates.com.

Best, Steve Gibbs for I&E.