Using life insurance as your own bank means replacing traditional banking functions—saving, borrowing, and earning interest—with a specially designed whole life insurance policy. Instead of depositing money in a bank that pays you 0.5% while lending it out at 7%, you build cash value in a policy you control, borrow against it when you need capital, and your money keeps growing even while you use it.

This isn’t about replacing your investments. It’s about replacing where you park money and how you access capital.

The following 7-step framework shows exactly how to build your own private banking system using whole life insurance and why thousands of families are moving away from traditional banks to take control of their financial lives.

How Does Life Insurance Banking Compare to Traditional Options?

| Traditional Savings Account | HELOC | Whole Life Policy Loans | |

|---|---|---|---|

| Interest earned on your money | 0.5% (taxable) | 0% (equity sits idle) | 4-5% (tax-free) |

| Growth while borrowing | No (money leaves account) | No (equity accessed, not growing) | Yes (cash value keeps compounding) |

| Approval required | N/A | Yes (credit check, appraisal) | No (your money, your decision) |

| Repayment schedule | N/A | Fixed monthly payments | You set the terms |

| Can be called or frozen | Rare, but possible | Yes (banks froze HELOCs in 2008) | No (contractual guarantee) |

| Creditor protection | Limited (FDIC up to $250K) | None (secured by your home) | Yes (varies by state) |

| Death benefit | None | None (debt passes to heirs) | Yes (tax-free to beneficiaries) |

| Best for | Short-term emergency fund | One-time large expense with equity available | Long-term capital access, wealth building, legacy planning |

This comparison shows why we position whole life insurance as a banking alternative, not an investment alternative. The question isn’t “whole life vs. the stock market.” It’s “whole life vs. where you currently park and access capital.”

Banks hold over $200 billion in bank-owned life insurance (BOLI) on their balance sheets. They don’t follow the advice they give retail customers. They buy whole life because the math works for storing and accessing capital.

Is Infinite Banking Right for You?

This strategy isn’t for everyone. Before diving into the framework, here’s who benefits most and who should look elsewhere.

This Strategy Works Well For:

- People with stable income who can commit to consistent premiums

- Business owners and real estate investors who need flexible access to capital

- Those who’ve followed conventional advice and feel stuck on a treadmill

- Long-term thinkers focused on wealth building over decades, not months

- Families who want to create multi-generational financial infrastructure

- Anyone tired of making their bank rich while earning next to nothing on savings

This Strategy Isn’t For:

- People looking for quick returns or short-term gains

- Those without consistent cash flow to fund premiums

- Anyone who struggles with financial discipline or repaying themselves

- People who need every dollar liquid right now with no long-term runway

- Those who believe all debt is bad and all life insurance is a scam

If you’ve done the “right things” financially but still feel like the system is working against you, you’re not imagining it. Banks profit from the spread between what they pay you and what they charge you. Infinite banking puts you on the other side of that equation.

This 7-step blueprint for building your own banking system using whole life insurance will show you how you can achieve financial freedom independent from traditional banks, Wall Street fluctuations, and the typical financial constraints many Americans face today. With over 18 years in financial services and hundreds of policies structured for banking purposes, we’ve seen what works and what doesn’t.

The 7-Step Framework to Creating Your Own Private Banking System:

- Step 1: What type of life insurance works best for personal banking?

- Step 2: Which life insurance riders maximize cash value growth?

- Step 3: How much should you fund your infinite banking policy?

- Step 4: How do you borrow from your life insurance policy?

- Step 5: Why is paying yourself back the key to infinite banking?

- Step 6: How does infinite banking create compounding wealth?

- Step 7: How does infinite banking fit into estate planning?

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

Step 1: What type of life insurance works best for personal banking?

The most effective vehicle we’ve identified for implementing the infinite banking strategy is high cash value whole life insurance from a mutual insurance company. This specific type of dividend-paying whole life policy differs significantly from traditional whole life insurance in its design approach. While conventional policies emphasize death benefits, a policy structured for personal banking prioritizes early cash value accumulation.

These aren’t obscure financial instruments. Companies like Bank of America, Wells Fargo, and JPMorgan collectively hold billions in cash value life insurance. They use it the same way you will: guaranteed growth, tax advantages, and liquidity on demand.

Paid-Up Additions: The Key to Early Cash Value Growth

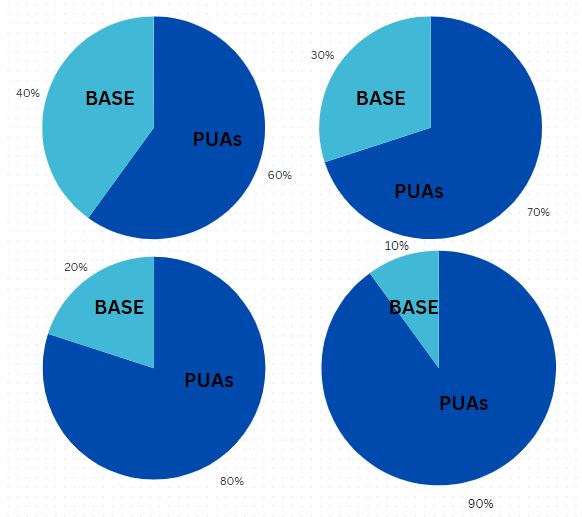

The primary method for achieving rapid cash value growth is designing your policy with a higher proportion of paid-up additions (PUAs) versus base premium. The greater the percentage allocated to paid-up additions, the faster your early cash value grows. Popular whole life policy designs typically feature PUA/Base premium ratios of 60/40, 70/30, 80/20, and sometimes even 90/10 for maximum early cash value accumulation.

We say “typically” because at Insurance and Estates, we’ve helped clients across 50 states implement this strategy, and each situation requires a tailored approach.

Section 7702: Your Tax Advantage Foundation

One of the most compelling benefits of using dividend-paying whole life insurance for your personal banking system comes from the tax advantages provided under IRC section 7702.

Under this code section, neither policy interest accrued nor dividends paid are reported as taxable income. Your cash value grows tax-deferred and can be accessed tax-free through policy loans, creating a powerful tax-advantaged financial tool.

As tax strategist Tom Wheelwright of Rich Dad Advisor fame explains, the tax code is a series of incentives. Thanks to IRC 7702, cash value life insurance represents one such financially strategic incentive.

Many carriers offer quality cash value policies, but our experience shows that selecting from the top dividend-paying whole life insurance companies provides the best foundation for an infinite banking strategy.

Balancing Cash Value and Death Benefit for Optimal Banking Performance

The primary objective of an infinite banking policy is maximizing cash value while minimizing the initial death benefit. This strategic approach ensures that more of your premium payments flow directly into your accessible cash value.

This policy design approach actually reduces commissions for us as agents.

And we’re perfectly comfortable with that approach, as our primary mission is serving our clients’ best interests above our own.

Some clients may desire a substantial death benefit from the beginning. While a “banking policy” isn’t initially designed to provide a large death benefit (though it will grow significantly over your lifetime), you can obtain additional coverage through the strategic life insurance riders we’ll discuss next.

Step 2: Which life insurance riders maximize cash value growth?

A properly designed high cash value whole life insurance policy may include several of these powerful riders to maximize early cash value growth and policy flexibility:

Paid-Up Additions Rider: The Cash Value Accelerator

Paid-up additions are essentially additional insurance coverage that’s fully paid for upon purchase.

The Paid-Up Additions Rider allows you as the policy owner to purchase additional death benefit while simultaneously increasing your policy’s cash value growth rate.

This rider becomes particularly powerful when you direct your annual dividends from participating life insurance companies toward purchasing more paid-up additions, creating an exponential compound growth effect.

Life Insurance Supplement Rider: Strategic Blending

The Life Insurance Supplement Rider (LISR) strategically blends lower-cost term life insurance with permanent life insurance. The term portion gradually decreases as you make payments, eventually leaving you with only permanent coverage.

Additional Life Insurance Rider: Enhanced Premium Capacity

The Additional Life Insurance Rider (ALIR) enables you to make increased premium payments to purchase additional participating paid-up life insurance, enhancing both your policy’s death benefit protection and cash value accumulation potential.

Term Life Rider: Flexible Protection Enhancement

Not to be confused with the LISR mentioned above, the Term Life Rider (or Renewable Term Rider) provides straightforward term life insurance that can be converted to permanent life insurance in the future if you choose. Adding the term rider to your policy allows you to overfund your policy and remain in the IRS guidelines.

This rider is an excellent option for young families implementing infinite banking who need substantial death benefit protection immediately. It offers additional coverage that can be converted to permanent insurance as your financial position strengthens.

Guaranteed Insurability Rider: Future-Proofing Your Coverage

The Guaranteed Insurability Rider (GIR) might not immediately increase your cash value growth, but it provides the valuable guarantee that you can purchase additional insurance in the future without answering health questions or taking medical exams.

This option is particularly valuable when considering life insurance for children, as it guarantees their ability to increase coverage regardless of future health conditions.

Step 3: How much should you fund your infinite banking policy?

With your policy properly structured, it’s time to fund it strategically. The optimal approach is to over-fund your policy to the maximum point possible without triggering modified endowment contract (MEC) status.

The IRS has established guidelines that prevent excessive contributions to life insurance policies to prevent their use as pure tax shelters. While we want to avoid MEC status, we also aim to maximize early cash value accumulation by utilizing the strategic riders mentioned above.

Depending on your situation, you may qualify for backdating your policy to save age, allowing you to contribute more money in the first year than would otherwise be permitted.

The Vital “Capitalization Period”

As time passes, your policy’s cash value will steadily increase. In Nelson Nash’s foundational book, Becoming Your Own Banker©, he recommends dedicating several years to this capitalization phase before major utilization.

The good news? A properly structured insurance policy begins accumulating cash value almost immediately. Depending on your policy design, you should have access to 90% or more of your cash value from day one, providing liquidity while your banking system grows.

Step 4: How do you borrow from your life insurance policy?

Having guided clients through real estate acquisitions, business financing, and major purchases using policy loans, the pattern is clear: those who treat their policy like a bank outperform those who treat it like a savings account.

Important Note: For an authentic banking policy to function optimally, always borrow from the policy rather than withdrawing money.

When you withdraw, you permanently reduce your cash value.

When you borrow from the insurance company using your cash value as collateral, your cash value continues growing inside your policy.

As your policy accumulates substantial cash value, you can leverage that value as collateral through policy loans. The insurance company lends you money secured by your cash value, and you can deploy those funds however you choose.

The key advantage: when you use your cash value as collateral and take out a policy loan, the money in your account continues growing through uninterrupted compound interest.

This means your money works for you in two ways simultaneously – continuing to grow within your policy while also being deployed for various financial objectives.

Strategic Uses for Policy Loans

Acquire Cash-Flowing Assets

Real estate stands out as a premier cash-flowing asset. Real estate investments can generate regular income while offering additional tax advantages. This scenario perfectly showcases the infinite banking concept in action.

At its core, infinite banking involves lending yourself money and systematically recapturing that capital. When you use a policy loan for a real estate down payment, you can then direct the monthly cash flow from that property toward repaying your policy loan with interest.

Pro tip: Don’t shortchange yourself here. Charge yourself the current interest rate that a traditional lender would charge you. Remember you wear two hats, the banker and the investor.

As you use your property’s cash flow to repay your loan with interest, you simultaneously increase your policy’s death benefit and accelerate cash value growth.

This process creates even more opportunities for personal financing in the future, making it one of the most powerful real estate wealth-building strategies available.

Finance Your Business Operations

Another strategic application for policy loans is financing your business operations. Take a policy loan, then lend that money to your business. Your business then repays you with interest for the loan.

This approach allows you to recapture your own interest payments while replenishing your policy. Plus, your business may be eligible to deduct the interest payments, creating an additional financial advantage. A true win-win arrangement!

Self-Finance Major Purchases

Why deplete your savings or finance through traditional banks when purchasing vehicles, funding education, or making other significant investments? Instead, use your banking policy to self-finance these expenses.

This strategy allows you to recapture the interest you would have paid to financial institutions or recover the opportunity cost of paying cash without recouping your capital.

The greatest advantage of personal financing is your position as the banker. You determine the interest rate for repayment and the terms of your loan. However, to maximize the infinite banking strategy’s benefits, consistently repaying your policy loans with interest is highly recommended.

Step 5: Why is paying yourself back the key to infinite banking?

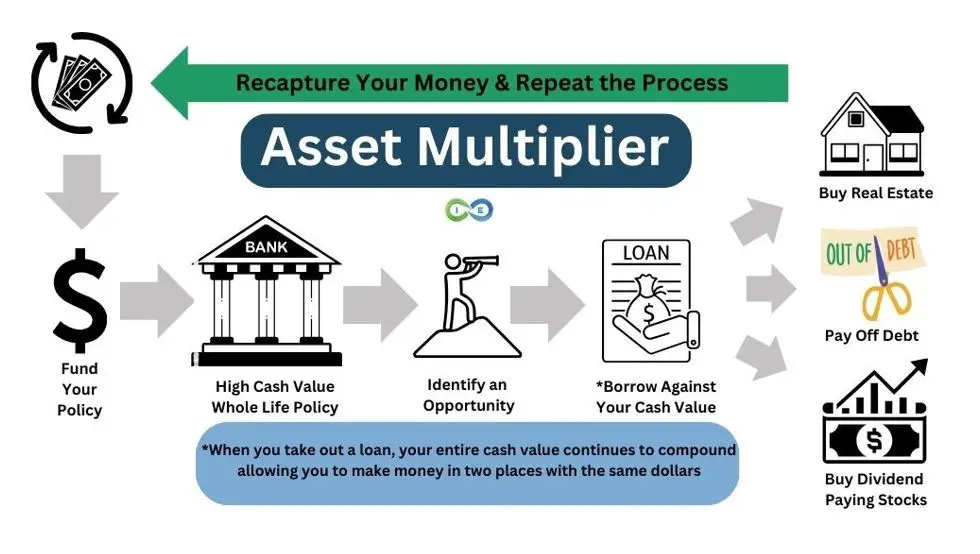

Successfully implementing the infinite banking strategy requires discipline, particularly when it comes to recapturing both principal and interest on your policy loans. We call this process the “asset multiplier blueprint” and the goal is to use your life insurance asset to buy more assets.

In our experience, this step separates successful infinite banking practitioners from those who abandon the strategy. The math only works if you pay yourself back. For those with the discipline to consistently execute this vital step, the growth potential of your banking policy is virtually unlimited.

And that is why this step represents perhaps the most vital component of becoming your own banker. If you fail to repay yourself, you’re essentially “stealing the peas” as Nelson Nash would say.

Loan repayment forms the cornerstone of this financial strategy because it’s the systematic action that generates exceptional long-term returns throughout your lifetime.

As you continue developing your banking policy, you accumulate an increasingly substantial cash reserve that can provide tax-free income through strategic policy loans.

Understanding the Banking Interest Advantage

One primary revenue stream for traditional banks is the interest spread. You deposit funds with a bank, and they pay you interest—currently averaging around 0.5% at most major institutions, while they lend your money out at 7-8%.

Not exactly impressive.

The bank then lends your money at significantly higher rates. Even with a modest 5% lending rate, the bank’s profit margin is over 10 times greater than what they pay you. Would a 1,000% return on your money sound appealing?

Through infinite banking, instead of the bank capturing all these profits, you—as borrower, lender, and banker—keep all the financial benefits traditionally reserved for banks using the fractional reserve system.

What happens to your life insurance policy when you consistently recapture both principal and interest? It experiences compounding growth!

Another significant advantage: life insurance creditor and bankruptcy protection, depending on your state of residence.

If you live in a state with favorable insurance protection laws, your policy’s cash value may be sheltered from creditors, providing additional financial security.

Step 6: How does infinite banking create compounding wealth?

After repaying your policy loan, don’t let your capital sit idle. Repeat the process: borrow, deploy, repay with interest, then borrow again. Each cycle expands your available capital base.

This is where infinite banking separates from conventional financing.

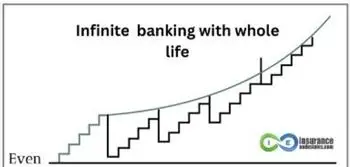

The Stair-Step Effect vs. Starting Over

With a traditional bank loan or HELOC, you deplete your capital to make a purchase. You start at zero (or negative) and spend years climbing back. Once you pay off the loan, you have the asset but no capital. Want to make another move? Start over. Back to zero.

With infinite banking, you never start over. Your cash value keeps growing even while you borrow against it. When you repay the loan with interest, your policy’s value jumps higher than before. The next loan starts from that elevated position, not from zero.

The chart above shows this stair-step pattern. The curved line represents your policy’s guaranteed growth. The stair-steps represent each borrow-repay cycle pushing your capital base higher. Over time, the gap between where you’d be with conventional financing and where you are with infinite banking becomes massive.

This is why the strategy rewards patience and discipline. Early cycles feel modest. But 10, 15, 20 years in, the compounding becomes undeniable.

Why Conventional Financing Keeps You Stuck

Traditional financing traps you in a cycle:

- Save money in a bank earning 0.5%

- Need capital, so you take a loan at 7%

- Spend years paying it off

- Finally debt-free, but your savings are depleted

- Start over from scratch

You’re always climbing out of a hole. The bank profits from the spread. You tread water.

Infinite banking breaks this cycle. Your foundation keeps growing. Each cycle builds momentum. That’s why we call it money momentum: your money consistently works for you instead of you constantly working for money.

This active approach stands in stark contrast to parking your money in government-designed retirement vehicles and putting your financial life on hold. That’s why we consider the 401k plan problematic in certain aspects.

Step 7: How does infinite banking fit into estate planning?

After successfully implementing your infinite banking strategy throughout your lifetime, you’ll have built a substantial estate to transfer to future generations.

Effective estate planning becomes essential for maximizing the legacy you leave to your family.

There are numerous strategies for accomplishing this, both during your lifetime and after your passing. The critical factor is planning proactively so your family can benefit from the full results of your disciplined financial approach.

With a properly structured estate plan, continuously growing cash value, and a guaranteed death benefit passing to your beneficiaries, you’ll be positioned to create a multi-generational financial legacy.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

Frequently Asked Questions About Using Life Insurance as Your Own Bank

How does using life insurance as a bank actually work?

You build cash value in a specially designed whole life insurance policy, then borrow against that cash value when you need capital. The key difference from a traditional bank: your money keeps growing at the same rate even while you’re using it elsewhere. You’re essentially lending to yourself using the insurance company’s money, with your cash value as collateral.

Why would I use whole life insurance instead of a savings account or CD?

Traditional banks pay you around 0.5% on savings while lending your money out at 7% or more. With a properly structured whole life policy, your cash value grows at 4-5% tax-free, you maintain access to your capital through policy loans, and you capture the growth that would otherwise go to the bank. Plus, the growth is tax-deferred and loans are tax-free.

Do I need to be wealthy to start infinite banking?

No. While having more capital allows for faster growth, many people start with a few hundred dollars per month and build their system over time. The concept is about changing where your money flows, not how much you have. That said, you need consistent income to fund premiums, so this works best for people with stable cash flow.

What’s the difference between regular whole life and a policy designed for banking?

Traditional whole life insurance maximizes the death benefit, which means more of your premium goes toward insurance costs. A policy designed for banking does the opposite: it minimizes the death benefit and maximizes early cash value through paid-up additions. This means you have access to more of your money sooner, which is the whole point if you’re using it as a bank.

Does borrowing from my policy hurt my death benefit?

Outstanding loans at death reduce the death benefit paid to your beneficiaries by the loan amount. However, if you follow the infinite banking process and repay loans with interest, you actually increase your death benefit over time. The discipline of repayment is what makes the strategy work long-term.

What happens if I don’t pay back my policy loan?

Unlike bank loans, policy loans have no required payment schedule and you can’t default. However, not repaying defeats the purpose of infinite banking. Unpaid loans accrue interest, reduce your death benefit, and if the loan balance exceeds your cash value, the policy can lapse. The strategy only works if you treat repayment seriously.

Is this the same as investing in the stock market?

No, and that’s a common misconception. Infinite banking doesn’t replace your investments. It replaces your bank. Think of it this way: you still need somewhere to park cash, access capital, and earn interest on reserves. Most people use banks for this. Infinite banking uses a whole life policy instead. Your investment strategy remains separate.

How long before I can start borrowing from my policy?

With a properly designed policy, you typically have access to 90% or more of your cash value from day one. However, most practitioners recommend a dedicated capitalization period of 3-5 years before taking significant loans. This allows your cash value base to grow large enough that loans don’t strain the policy.

Why do banks own billions in life insurance if it’s such a bad investment?

Banks hold over $200 billion in bank-owned life insurance (BOLI) on their balance sheets. They use it for the same reasons you would: guaranteed growth, tax advantages, and liquidity. Banks don’t take their own advice about term insurance and mutual funds. They buy whole life because the math works for storing and accessing capital.

What are the downsides of infinite banking?

It requires discipline and long-term commitment. Early cash value is lower than total premiums paid in the first few years. You need to qualify medically for the policy. And if you surrender the policy early, you’ll likely lose money. This strategy works for people who can commit to it for decades, not those looking for short-term gains.

Want to Go Deeper?

This article covers the mechanics of infinite banking. If you want to understand the economic framework behind why this strategy works, and why it matters more now than ever, read our complete guide to Volume-Based Banking.

Ready to Take Back Control of Your Banking Function?

Schedule your complimentary infinite banking strategy session today and discover how becoming your own banker could transform your approach to building wealth.

42 comments

Jay Roe

Is there a way to roll a 401K into an insurance policy with minimal tax penalty?

Steven Gibbs

Hello Jay,

Great question, there isn’t a way to “roll” a 401(k) into an insurance policy; however, we do have people that want to pay now vs. facing the tax exposure later. This relates to the “pay taxes on the seed vs the harvest” question. This kind of decisions should be carefully considered with an expert and also perhaps discussed with your tax advisor. There are qualified annuities that you could roll over a 401(k) into, however. If you’re interested, our expert Jason Herring is very experienced in helping people with strategic tax moves and you can request a call from him by emailing jason@insuranceandestates.com.

Best, Steve Gibbs for I&E

Steven Gibbs is a licensed insurance agent, and the following agent

license numbers of Steven Gibbs are provided as required by state law:

Resident License; AZ agent #17508301,

Non-resident Licenses: TX agent #2273189, CA agent #0K10610,

LA agent #769583, MA agent #2049963, MN agent #40563357,

UT agent #655544.

Zakee Richardson

How long do I have to wait before I can take a loan out for investments.

Insurance&Estates

Your wait time would depend upon your policy design, premiums, etc. To get a concrete idea, you can have illustrations run for your personal scenario. A great start is to connect and request a call with Barry Brooksby at barry@insuranceandestates.com.

Best, Steve Gibbs, for I&E

Chuck

I have a mature term life insurance policy that went from $60.00 a month for 20 years after that it went to $350.00 a month. During this time I went on disability and due to that fact is was able to keep getting the coverage at no cost to me. I have some cash saved in the bank I want to place it in the life Insurance policy to shield it from any court orders for payment a creditors , Leon’s. I live in Mississippi, hypothetically speaking, thanks

Insurance&Estates

Hi Chuck, thanks for connecting. Unfortunately your situation with the expiration of term coverage is all too common based upon some flawed “advice” out there to cash in whole life policies. That said, if you’re looking for creditor protection a good first stop may be an attorney. If you’d like to pursue a policy go ahead and request a call with one of our experts by emailing Barry at barry@insuranceandestates.com.

Best, Steve Gibbs for I&E

Darrell V. Salu

Working on saving a lump sum. Looking for an investment opportunity. This makes sense but don’t know anything about life insurance . Would like to connect with someone who could explain it to me in lamens terms and how to get started in something like this. Sincerely thank you so much!!!

Insurance&Estates

Hello Darrell, thanks for connecting. A great first step is to watch any of our webinars at insuranceandestates.com/webinars and when you do so, you can access Barry’s calendar to schedule a 1 to 1 call to take next steps.

Best, Steve Gibbs for I&E

Joe

How do you make “buy investment property” sound like it’s just on the shelf at the corner market? I mean when you purchase a property to make money from, it takes a great amount of work to find a property that is selling under the market value. If you expect to turn a monthly profit immediately off a newly purchased property, then you will never buy a property. So how do you just buy income property so easily? With no money to start with or no income other than what you hope to get?

Insurance&Estates

Hello Joe, when we’re speaking about real estate investment, at this point we are directing the message at active real estate investors. Yes, your point is well taken that acquiring real estate takes discipline and expertise. In the future we may be offering some webinars and training to help folks who want to get started.

Best, Steve Gibbs for I&E

Joe

I have no money or insurance policy, and no income. Is it possible to obtain a life insurance policy that i can immediately start living off of, and pay for the policy with those living expenses?

Insurance&Estates

Hello Joe, if have you no money that can be tricky and even “high cash value” policies generally need to mature before they provide enough cash to begin paying expenses from. If you can deposit of lump sum initially, your goal may be possible.

You can with our team of experts by emailing Barry Brooksby at barry@insuranceandestates.com.

Best, Steve Gibbs for I&E

Casey Werner

How do I open a infinite bank account

Insurance&Estates

Hello Casey, a great first step is to request a call from Barry Brooksby, our IBC expert, at barry@insuranceandestates.com.

Best, Steve Gibbs for I&E

Tyde McIntosh

At some point, assuming there is no plan for legacy, can the cash inside the policy be used to create a tax free income?

Insurance&Estates

Hello Tyde, yes this is a strategy often utilized for LIRP (Life Insurance Retirement Planning) where there are planned distributions (via policy loans) beginning at a certain age. To get illustrations to see exactly how this would work, go ahead and request a call be emailing Barry Brooksby at barry@insuranceandestates.com.

Best, Steve Gibbs for I&E

Walter Rauch

I am seventy four years old. I have a old whole life of 15,000. I was thinking of opening up a life insurance policy, and removing it 10,000 at a time from the stocks, every year. What riders would I need to put in place. And would this be a good Idea now at my age?

Insurance&Estates

Hello Walter, your best first step is to connect with one of our IBC experts to have your policy and situation evaluated in detail. You can connect with Barry Brooksby as a first step by e-mailing him at barry@insuranceandestates.com and I will also forward your request to him.

Best, Steve Gibbs for I&E

Eric

This seems like one of those things that is good in theory but not in practice. Why? Allocating to a policy with high fees, opportunity cost between policy returns and market returns, risk of income changing when the person first adopts the strategy so they’re not able to meet policy obligations, risk of cash flowing asset not cash flowing as expected etc. Life insurance always sounds good in a vacuum but life is far from that regardless of net worth.

Insurance&Estates

Hello Eric, I’m just responding to caution our readers. Your commentary is typical of those who peddle market based investments as a one size fits all solution. Interesting that you say “life insurance always sounds good” which is untrue. For some people such as the young without families, it doesn’t. You also seem to take as a given that market based returns are “always” preferable to life insurance policy cash value returns which is also untrue due to inherent risk and inherent lack of predictability. When we counsel folks about permanent whole life options, we do not compare the “return” to a market based investments. However, this is irrelevant for the same reason I don’t hail eating vegetables and ridicule drinking water. As an estate planner, my opinion is that folks need both. That said, I can make a strong case that the 20 year moving average nearly always used to tout Wall Street is a misleading approach. How about the cost for mutual funds? In any event, I suggest you be careful with blanket statements that fail to consider the unique circumstances of every person, as I’m assuming you value the concept of being a trusted advisor. As an estate planner, I’ve observed the power of life insurance for many. For these folks, including myself, whole life insurance rises to the top of one’s most valuable assets.

Best, Steve Gibbs for I&E

Eugene

I’m just learning about the infinite banking potential, but not sure if a whole life policy is out of my budget. It looks like a great way to create security for my family while generating wealth (which also creates security).

Insurance&Estates

Hi Eugene, thank you for you comment and I agree, a powerful safe bucket wealth building vehicle. If you’d like to look more closely it this with our IBC expert Barry Brooksby, go ahead and reach out to him at barry@insuranceandestates.com.

Best, Steve Gibbs, for I&E

Ben

I have a soon to be 8 year old UIL policy, funded with a large single premium. My question is: Can I get one for my wife without triggering MEC?

Insurance&Estates

Hello Ben, thanks for commenting. Jason Herring can help you with IUL question and you can reach him directly at jason@insuranceandestates.com.

Best, I&E

Nicholas A Reed

I have read Nash’s book and maybe I need to go back and look at it again, but I am not sure I understand his examples. He shows a person deposits $5000 a year for the first sevens years for premiums and funding the plan and then takes out a car loan every 4 years and pays that back w/interest but after the 7 years, he shows no premiums being paid. Is that because the dividends are paying the premium along with the interest? I probably need to go back and read it again, but I didn’t understand that.

Thanks

Matthew Hamilton

So the policy illustration you’ve described is most likely a 7 pay policy. So that is to say that the owner would only pay for 7 years. At that time, they want to start taking loans every 4 years. The part that’s murky for me is if when you take a loan, if it opens up the policy for OP or extra repayments, or if you can only put back in what you took out. I’m not sure how your supposed to get extra interest into your policy.

Insurance&Estates

Hello Matthew, I understand your confusion. The short answer is, how much money you can repay to your policy is governed by the MEC limits which are typically calculated by the insurance company annually. So, depending on your policy design and paid up additions contributed each year, you may be able to pay in extra over and above the amount taken as a policy loan. It may be helpful to run some scenarios with our IBC expert Barry Brooksby and you can connect with him at barry@insuranceandestates.com.

Insurance&Estates

Hello Nicholas, thanks for your great questions. Your inquiry was forwarded to Jason Herring today; however, please feel free to connect with him at jason@insuranceandestates.com.

Best, I&E

Chantal

Hi. My son is currently overseas serving in the military. I am very much interested in a whole life policy that allows for the infinite banking strategy for him to set him on the right track for when he is ready to invest. Would he be able to start a policy while he is serving? Thanks.

Insurance&Estates

Hello Chantal, thanks for reading and commenting. We’ve forwarded your comment to Jason Herring, so if he hasn’t reached out yet, feel free to connect with him at jason@insuranceandestates.com.

Best, I&E

WeFactor

Thanks for sharing this article. I want to create my own private banking system. This article will surely help me to create it easily. This article is very good and useful site. I’ll definitely follow what you said here.

Wilson

I also think that the important thing is to plan ahead so that your family can receive the full extent of your disciplined work.I also think that by doing this, we can avoid issues as well. Thanks for sharing this article.

Insurance&Estates

Thanks for commenting and we agree that planning ahead is key.

Best, I&E

Ken Chan

Will this strategy work in other countries? I want to do the same thing here in asia.

Insurance&Estates

Hello Ken, there are some possibilities available for folks in other countries. I suggest you connect with Jason Herring if you haven’t already done so. He is available at jason@insuranceandestates.com.

Best,

Steve Gibbs for I&E

John

Would my life insurance that I have been paying into in the military for 16yrs work the same way? I am wanting to start my own business and need capital to invest to get started.

Insurance&Estates

Hi John, thanks for reading and commenting. I can’t say for sure what possibilities may be available because we have no knowledge of your military policy. for a more detailed discussion, you can contact Jason Herring at jason@insuranceandestates.com.

Best,

Steve Gibbs for I&E

Kevin

If I want to set a policy up to buy a car are there limitations about loan off your policy. Example Could I put 20,000 in today and then loan 17000 tomorrow to pay for a car? Is there a designated time the policy must exist before loaning off of it?

Insurance&Estates

Hi Kevin, great question…the short and general answer is that a policy will need some time to accrue cash value and mature before offering the cash for loan purposes. However, this availability of cash in the policy can be expedited in some cases depending on the strategy. Your example is perhaps a bit ambitious…$20,000 and $17,000 loan tomorrow doesn’t leave much to cover the base and cost of insurance. To put together some actual numbers, I suggest that you follow up with jason@insuranceandestates.com who has substantial expertise in designing IBC policies.

Best, Steve Gibbs for I&E

KIMIO OSAWA

Hi

Your method is working for someone like me living overseas?

I heard many similiar concepts but only people in the US and Canada?

Insurance&Estates

Kimio,

You will need to be in the United States in order to obtain a policy. You can read our article on foreign nationals and non us residents for more information on getting US life insurance as a non resident.

Sincerely,

I&E