🎯 Key Takeaway

Dave Ramsey’s life insurance advice contains mathematical errors that could cost families hundreds of thousands in missed wealth-building opportunities. His 12% mutual fund claims don’t match reality, while whole life insurance provides guaranteed 7-8% tax-free returns.

📊 Quick Facts

- Dave’s mutual fund claim: 12% average returns

- Actual investor returns: 3-4% after fees (Dalbar study)

- Whole life actual returns: 7-8% tax-free (4% guaranteed + dividends)

- Fortune 500 CEOs using whole life: 85%

- Average 55-64 year old net worth: $45,447 (not Dave’s claimed $700k)

📋 Table of Contents

- 1. Personal Experience with Dave Ramsey’s Advice

- 2. What Works in Dave’s Financial Advice

- 3. Where I Disagree: Life Insurance Analysis

- 4. Dave Ramsey’s “Truth About Life Insurance”

- 5. Cash Value Life Insurance Example Analysis

- 6. The 12% Mutual Fund Myth

- 7. The “Hidden Catch” Debunked

- 8. Dave’s “Better Plan” Reality Check

- 9. Infinite Banking Strategy

- 10. Mathematical Comparison Table

- 11. Continue Your Analysis Journey

- 12. Final Conclusion

Personal Experience with Dave Ramsey’s Financial Advice

The first time I read Dave Ramsey and his financial advice in his book Financial Peace (the popular book and video series by Dave Ramsey) I was in my early thirties, newly married, and had just purchased my first home. The ideas and practices presented in the book really hit home for me because I was in debt like never before.

I remember talking with my wife about the envelope budgeting method, and looking down the road at getting out of debt as a real strong possibility. We sat in a crowded room with friends and family as Dave talked us through each chapter of his book one week at a time. It was an enjoyable experience to learn alongside others that might be going through the same struggles as us.

Looking back on that experience some 15 years ago now, I can honestly say that we did fairly well for ourselves. Some of the things we did were things that Dave Ramsey recommends. And yet some, were completely foreign to his way of thinking.

As we detailed in our comprehensive Dave Ramsey analysis, his advice works for basic debt elimination but often falls short for advanced wealth building. And honestly, I think that is how it is for many people that follow the financial gurus. There is plenty to learn, and plenty to digest, but ultimately the methods presented by any guru are likely to be broad and general advice that is meant for the masses, and therefore might not actually be best for a specific individual or circumstance.

What Works in Dave’s Financial Advice

To give you some examples:

In Chapter 4 of Dave’s book he recommends avoiding the worship of “stuff” and he suggests that discipline is needed when it comes to financial decisions. I agree!

In Chapter 6, Dave recommends finding a career in which you are naturally gifted, and working hard at it. I agree!

In Chapter 8, Dave states that dumping credit card debt should be done by paying off the account with the lowest balance first, and then the next lowest, and so on. He calls this the debt snowball. He likes this method because studies suggest that people are more likely to pay off that bad debt if they get some momentum going. For those with bad debt – I agree!

And finally, in Chapter 13, Dave says that you should learn to “negotiate everything.” I love this! And I agree wholeheartedly!

Where I Disagree: Life Insurance Analysis

But in Chapter 11, Dave says that whole life insurance is expensive. Guess what? I DISAGREE.

Unfortunately, in Financial Peace there is only two pages written on the subject of life insurance by Dave Ramsey. The book is so broad that it can’t dive too deep into any one area. So in order to get a more detailed reason from Dave, you have to look for his articles online.

I’ve found his life insurance article online, and I’ve copied it below for your reading pleasure. I want to address some of his statements inline, so look for my comments in italics as you read.

Dave Ramsey’s “The Truth About Life Insurance”

Myth: Cash value life insurance, like whole life, will help me retire wealthy.

Truth: Cash value life insurance is one of the worst financial products available. Dave calls whole life insurance “the payday lender for the middle class.”

My Response: I know many people that have used cash value life insurance to help them retire early. So how can it be a myth? If 85% of Fortune 500 CEO’s invest in this type of financial product, how can it be the “worst.” The answer is that it’s simply not true. Ramsey says it is “truth” but for many it is blatantly false.

Sadly, over 70% of the life insurance policies sold today are cash value policies. A cash value policy is an insurance product that packages insurance and savings together. Do not invest money in life insurance; the returns are horrible. Your insurance person will show you wonderful projections, but none of these policies perform as projected.

Analysis: Here, Dave Ramsey says that the “returns are horrible.” But his example below, is going to compare apples to oranges. It terms of arguments, he is creating a “straw man argument.” Ramsey says the return is “horrible” and now he will give a specific example that proves his point. But his example is not a fair comparison. But comparing term life vs whole life is like comparing a life-boat to a life-preserver and only talking about cost. They both are created to save your life in the event of a water catastrophe, but the life-preserver is so much cheaper. Nobody in their right mind would compare those two on a cost basis alone. But Ramsey chooses to do just that in the example below.

Cash Value Life Insurance Example Analysis

If a 30-year-old man has $100 per month to spend on life insurance and shops the top whole life insurance companies, he will find he can purchase an average of $125,000 in insurance for his family. The pitch is to get a policy that will build up savings for retirement, which is what a cash value policy does. However, if this same guy purchases 20-year-level term insurance with coverage of $125,000, the cost will be only $7 per month, not $100.

Reality Check: Keep in mind that Ramsey only chooses to showcase this one option, which is very favorable to his point of view. I couldn’t just leave it be without pointing out that there is a whole life option that is much less expensive than Ramsey suggests. Instead of being 20x the cost of level term, it can be 5-10x the cost. That may seem too high still, but remember, it’s guaranteed for life! Also, with paid-up additions, the cash value can grow from year one. I mention this because you’ll see Dave says that all $93 “disappears in commissions and expenses for the first three years” below. That isn’t the case for all whole life policies. Dave is making generalizations, and there are whole life policies out there that are very different than he stated.

WOW! If he goes with the cash value option, the other $93 per month should be in savings, right? Well, not really; you see, there are expenses.

Expenses? How much?

All of the $93 per month disappears in commissions and expenses for the first three years. After that, the return will average 2.6% per year for whole life, 4.2% for universal life, and 7.4% for the new-and-improved variable life policy that includes mutual funds, according to Consumer Federation of America, Kiplinger’s Personal Finance and Fortune magazines. The same mutual funds outside of the policy average 12%.

The 12% Mutual Fund Myth Exposed

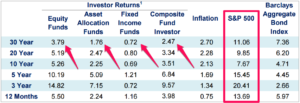

Critical Analysis: Hold on a second. Mutual funds getting 12% is probably the biggest fallacy in the financial industry today. After fees the rate of return is actually more like 3-4%. But don’t believe me, believe the chart below that is from a 2015 nationally recognized study by Dalbar. For detailed mathematical proof of how Dave’s return promises don’t match reality, see our analysis of 12% mythology vs 5% guaranteed returns.

Dalbar Study Key Findings:

- S&P 500 had returns over 9% (with only one exception)

- Actual long-term investor returns were below 4% in ALL categories

- This compares to a guaranteed lifetime rate of return averaging 4% in whole life

- Add an additional 3-4% on top as average annual whole life insurance dividend

- Total: 7-8% tax-free returns vs 3-4% taxable mutual fund returns

The “Hidden Catch” Debunked

Worse yet, with whole life and universal life, the savings you finally build up after being ripped off for years don’t go to your family upon your death. The only benefit paid to your family is the face value of the policy, the $125,000 in our example.

The truth is that you would be better off to get the $7 term policy and…put the extra $93 in a cookie jar! At least after three years you would have $3,000, and when you died your family would get your savings.

Expert Response: This supposedly “hidden catch” is just a ridiculous apples to oranges comparison again. Licensed practitioners explain why Dave’s insurance criticism is flawed in our expert response to his whole life claims. Remember, the whole life policy is guaranteed to pay out the full death benefit from day 1! Also, how exactly would a life insurance company make any money if they guaranteed a $1 million dollar death benefit on $400k in premiums, and at death they paid BOTH in full? It doesn’t make any sense, but it makes for a shocking statement. As with any whole life vs term life insurance comparison the early years favor the term policy. But if you extend the policy out 20 or 30 more years, whole life looks better and better. You’ll find that the rate of return is extremely favorable, and the death benefit is right around the corner.

Dave’s “Better Plan” Reality Check

If you follow my Total Money Makeover plan, you will begin investing well. Then, when you are 57 years old and the kids are grown and gone, the house is paid for, and you have $700,000 in mutual funds, you’ll become self-insured. That means when your 20-year term is up, you shouldn’t need life insurance at all—because with no kids to feed, no house payment and $700,000, your spouse will just have to suffer through if you die without insurance.

Don’t do cash value insurance! Buy term and invest the difference.

Statistical Reality: Again Dave makes some bold statements that are really hard to buy into. He paints this wonderful picture of a person that is 57, the house is paid for, the kids are grown and gone, and they have $700k in mutual funds. Guess what? That is EXTREMELY RARE in America. How rare? Let’s find out.

According to the US Census Bureau, the average 55-64 year old has just $45,447 in net worth (that includes equity in their house, savings, 401k, etc.). I know Dave isn’t saying that most Americans will have $700k and a paid off house.

But my point is that very few people are in the situation Dave is talking about, so having coverage for life, preferably from the top dividend paying whole life insurance companies, is indeed a great choice. And it’s far superior to forcing your spouse to “suffer through,” because, after all, life insurance is an asset.

And we have not even touched upon using Infinite Banking to maximize your policy and provide you with money velocity.

Infinite Banking Strategy

Infinite Banking is when you use your cash value as collateral to fund your own purchases or to invest in assets that create cash flow such as real estate.

For example, one real estate wealth building strategy using infinite banking is to use real estate to create cash flow. The cash flow is then used to purchase life insurance for use as your personal bank.

Now you have two assets, your policy and your real estate. As your equity builds in your policy, you can then take out a life insurance loan from the carrier and use it for a down payment on another cash flowing property. The cash flow can be used to repay your policy loan as you build your equity again. You can repeat this cycle infinitely.

📊 Dave’s Claims vs Mathematical Reality

| Dave’s Claim | Mathematical Reality |

| Whole life returns: 2.6% | 4% guaranteed + 3-4% dividends = 7-8% tax-free |

| Mutual funds average 12% | Actual investor returns: 3-4% after fees (Dalbar) |

| Worst financial product | Banks hold $180+ billion in BOLI |

| Retire with $700k at 57 | Average 55-64 year old: $45,447 net worth |

💡 Key Points Summary

| Financial Strategy | Dave’s Advice | Mathematical Reality |

| Life Insurance | Buy term, invest difference | Whole life provides guaranteed wealth transfer |

| Investment Returns | 12% mutual fund average | 3-4% actual investor returns |

| Retirement Reality | $700k at 57 years old | $45k average net worth 55-64 |

| Wealth Building | One-size-fits-all approach | Customized strategies perform better |

Final Conclusion

Dave Ramsey has some great advice on a broad range of financial topics. The problem is that his advice is one-size fits all. He can’t suggest that some people get term, while others get universal, and still others get whole life. It’s too confusing, and his books and videos are in far too many homes for him to backpedal on a lifetime of contrary advice now.

Dave Ramsey needs to keep saying the main things he’s been saying for years. And that is exactly what he does. But his advice isn’t always correct for every person; it can’t be. It’s far too general to be able to account for all the variables in the financial world.

If you want to follow the advice of a one size fits all guru, you’ll probably do fine in many areas. But there will be areas in which you fall short.

Get Beyond One-Size-Fits-All Financial Advice

Don’t let generic advice cost you hundreds of thousands in missed wealth-building opportunities. Our independent advisory team provides personalized analysis that goes beyond Dave Ramsey’s broad recommendations to create strategies tailored to your specific situation.

- ✓ Receive a detailed comparison of whole life vs term insurance for your situation

- ✓ Get realistic investment return projections based on actual data, not marketing claims

- ✓ Discover if infinite banking strategies could accelerate your wealth building

- ✓ Understand the mathematical truth behind insurance and investment products

Schedule your complimentary 30-minute financial strategy analysis and see what personalized advice can do for your wealth-building goals.

No obligation. No sales pressure. Just expert guidance to help you move beyond generic advice to strategies that actually work for your unique financial situation.

6 comments

Danny

Adam,

I know of a couple that listened to Dave; they cancel their whole life policies to save money. They were shopping around for term policies, but they figured that they are young and life will be fine. Well, 34 days after canceling their $150,000 whole life policy, his wife found out she had cancer, and now she is uninsurable and can not get coverage. Shortly after, she found out it was stage four, and she passes away three months later. I can only imagine how he feels now with what little money he put toward paid off nothing and now trying to pay for services and the funeral. So he is now further in debt, and he lost his wife. Could you imagine if they had a family? I wonder what this guy would say now about Dave Ramsey and his plan.

Insurance&Estates

Thanks so much for sending this Danny. That’s a heartbreaking story to hear as an estate planner and people need to know that we aren’t just blowing smoke in sounding the alarm about how destructive this boilerplate “advice” is.

Best, Steve Gibbs, for I&E

Arian Hernandez

One size does fit all due to we work on standards and averages.

Insurance&Estates

Exactly. Thanks for commenting!

I&E

Adam Ishee

Great article, Dave is hurting a lot of people with his ignorance of building wealth and retirement with life insurance.

Insurance&Estates

Adam,

The biggest contention we have with Dave’s advice is he tells people to avoid all debt. In our opinion, there are two types of debt, good and bad. Bad debt takes money out of your pocket every month and should be avoided, if possible. Some bad debt would be student loans or credit cards.

Good debt would be debt that puts money into your pocket every month, such as cash flow from a rental property.

Dave has great advice on how to budget and get out of debt. We just feel that once people have obtained that goal that much of Dave’s advice is pretty weak.

All the best,

I&E