By Barry Brooksby, Infinite Banking Practitioner

Twenty-five years ago, I was a young financial advisor, fresh with securities licenses, channeling my clients’ money—and my own—into mutual funds, IRAs, and the stock market. I believed in the system. It’s what everyone did, what big banks and financial advisors preached. Then the calls started rolling in: “Barry, why am I not seeing the returns I expected?” “Barry, my savings are shrinking—what’s happening?” “Barry, I can’t sleep watching my retirement vanish.” These weren’t just clients—they were family, friends, people who trusted me. Their sleepless nights became mine.

When I turned to my mentor, his advice was blunt: “Tell them they’re in it for the long haul.” That answer felt hollow. How could I look people in the eye and ask them to endure financial pain with no clear end? That discomfort sparked a journey that reshaped my understanding of money, leading me to uncover the $130 billion banking secret—a strategy banks use but rarely share. A 2025 Wealth Management survey reveals 72% of Americans feel misled by traditional financial advice, and this guide shows you how to take control with the Infinite Banking Concept.

Table of Contents

- What Banks Hide: The $130 Billion Secret

- Why Traditional Financial Advice Fails

- The Ultimate Asset: High Cash Value Whole Life

- The Money Multiplier Effect

- Case Study: Tripling Wealth with IBC

- Busting Infinite Banking Myths

- Real Results from Real People

- Three-Step Wealth-Building Blueprint

- Designing an IBC Policy: Key Elements

- Is Infinite Banking Right for You?

- Building a Multi-Generational Legacy

- Your Next Step

- Frequently Asked Questions

Key Insight

Banks hold $130 billion in cash value life insurance for secure growth. You can use the same strategy to become your own bank with Infinite Banking.

What Banks Hide: The $130 Billion Secret

Years into my search for better financial solutions, I stumbled across FDIC reports that left me stunned. US Bank: $7.7 billion in cash value life insurance assets. Wells Fargo: $18.3 billion. JP Morgan Chase: $12.4 billion. Collectively, U.S. banks hold over $130 billion in these assets. Yet, when you walk into a bank, they steer you toward stocks, bonds, or mutual funds, never mentioning whole life insurance. Why? They profit from your market investments while using this secure vehicle for their own wealth.

This disconnect hit me hard. Banks weren’t just investing differently—they were keeping a powerful tool from their customers. No posters advertise cash value life insurance at your local branch. Instead, you’re directed to financial advisors pushing volatile, fee-heavy products. This revelation, what I call the “$130 billion banking secret,” became the cornerstone of my mission to empower individuals with the Infinite Banking Concept.

Why Traditional Financial Advice Fails

Imagine an investment pitch: “Put up all your money, take all the risk, pay undisclosed fees, face unknown future taxes, and have no guaranteed outcome.” Would you bite? Yet, that’s the deal with 401(k)s, IRAs, and market-based investments. A 2025 Morningstar study found average 401(k) fees consume 20–30% of long-term returns. Traditional advice has three critical flaws:

- Volatility: Historical data shows 2–3 loss years per decade in markets. Gains of 12–24% can be wiped out by losses of 8–30%, making planning a gamble.

- Hidden Fees: Mutual fund managers trade stocks without your approval, triggering taxes and losses you absorb. These fees often go unnoticed until they erode your wealth.

- Tax Uncertainty: CPAs tout tax savings from 401(k)/IRA contributions, but you’re deferring taxes to an uncertain future. With rising national debt, tax rates are likely to climb, potentially devastating your retirement.

Why leave your financial future to chance when banks have a better way?

Unlock Financial Freedom with Barry’s Book!

Live Rich, Die Rich: Discover how to use high cash value life insurance and the Infinite Banking Concept to build tax-free wealth and secure a lasting legacy.

- ✓ Learn bank-used strategies for guaranteed growth

- ✓ Access tax-free cash for investments and retirement

- ✓ Create a multi-generational financial legacy

Change your financial mindset and empower future generations with Barry Brooksby’s proven insights.

The Ultimate Asset: High Cash Value Whole Life

After extensive research and hands-on experience, I discovered the ultimate financial asset: high cash value whole life insurance structured for the Infinite Banking Concept. Unlike traditional whole life focused on death benefits, these policies prioritize cash value growth, turning your policy into a personal banking system. They address traditional investing’s flaws with four unmatched benefits:

Guaranteed Returns

With mutual insurance companies (owned by policyholders, not shareholders), these policies guarantee annual returns, compounding yearly. For a 38-year-old investing $20,000 annually, the cash value is ~$16,100 in year one (80% of premium) and ~$240,000 by year 10, based on policy illustrations. As time goes on, the cash value growth continues to accelerate and unlike stocks, your money grows every year, with no losses, providing stability for planning.

Liquid Access

Unlike 401(k)s, which restrict access until age 59½ with a 10% penalty, you can tap cash value as soon as 30 days after you start the policy. Edward from Texas shared, “Having liquid cash for emergencies and opportunities changed how I view investments. I don’t fear market crashes anymore.” This flexibility lets you seize opportunities or handle crises without bureaucratic hurdles.

Tax-Free Access

Properly structured, cash value gains are 100% tax-free. A $100,000 policy growing to $500,000 yields a $400,000 tax-free gain—no income or capital gains tax. This tax efficiency, rare in traditional investments, maximizes your wealth.

Growing Death Benefit

A permanent, growing death benefit provides a tax-free legacy, giving you a “permission slip” to enjoy other assets knowing your family is secure. As Galen from New Jersey shared, “We feel as though not only did we gain an asset in our insurance policy, we gained a new family member. We STRONGLY recommend Barry Brooksby for all of your insurance planning needs!

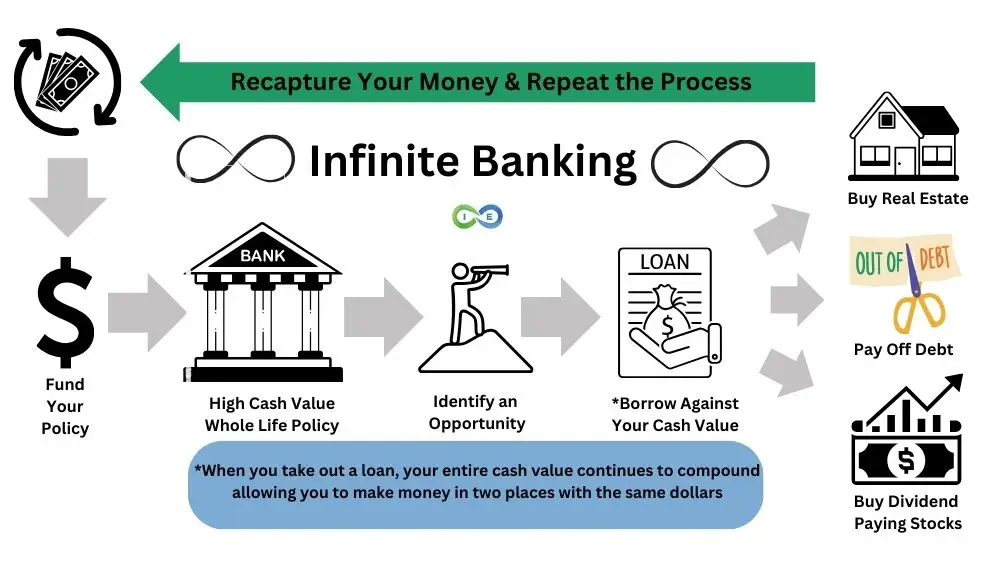

The Money Multiplier Effect

Borrowing against your policy (not withdrawing) creates the Money Multiplier Effect. Your full cash value continues earning interest and dividends, even when borrowed. For example, with $140,000 in cash value, borrowing $50,000 for a rental property leaves the entire $140,000 compounding while the $50,000 generates rental income and appreciation. Your money works in two places at once—inside the policy and in external investments.

Banks use this principle with their $130 billion in life insurance assets, maintaining growth while deploying capital elsewhere. By implementing this approach, you can replicate their playbook, creating multiple income streams without sacrificing security. As Ben from California attests, “Barry is extremely knowledgeable about wealth, finances, and using whole life policies for IBC purposes. He breaks things down into digestible pieces that are easy to understand. I’m using my policy to fund my real estate investments now, and watching my money grow in two places simultaneously has completely transformed my wealth-building strategy.”

Case Study: Tripling Wealth with IBC

Consider John, a 45-year-old real estate investor from Arizona. Frustrated with market volatility, he started an IBC policy with $25,000 annually. By year 5, his cash value was $150,000. He borrowed $50,000 to buy a rental property generating $1,000/month. His $150,000 kept compounding at ~4% annually, while the property appreciated 5% yearly. Over 10 years, John’s policy grew to $220,000, and his property was worth $80,000, tripling his initial investment’s impact. “IBC let me scale my portfolio without losing growth,” John said. This case shows how IBC amplifies wealth across asset classes.

Busting Infinite Banking Myths

Why isn’t IBC mainstream? Misinformation and lack of expertise:

- Myth: Whole Life Is Expensive: Critics like Dave Ramsey cite high-commission traditional policies. My policies allocate 80–90% of premiums to cash value in year one, with lifetime fees 9–10 times lower than managed portfolios.

- Myth: Agents Don’t Understand IBC: Most agents sell death-benefit-focused policies. An IBC specialist designs for cash value growth, using paid-up additions to optimize returns.

Finding a qualified practitioner is key to unlocking IBC’s potential.

Real Results from Real People

Richard from Alabama, after researching IBC, said, “I wish I’d known Barry 20 years ago.” Starting in his 50s, he calculated a policy in his 30s could’ve yielded $800,000 tax-free by now. He set up policies for his children and granddaughter, ensuring their financial future. “They’ll thank me in 20 years,” he noted.

Tamara from Idaho shared, “Barry was awesome, helpful, and caring. He educated us on the best policy, was easy to schedule, and patient throughout.” Claudia from Florida added, “With Barry’s guidance, I made the leap. Infinite Banking is a key tool for securing and leveraging money.” These stories highlight IBC’s transformative power.

Three-Step Wealth-Building Blueprint

To implement IBC, follow this blueprint:

- Consistent Investing: Commit to regular contributions (e.g., $300–500/month). As Robert Kiyosaki says, “pay yourself first.” Even modest amounts build wealth over time.

- Proper Policy Design: Work with an IBC specialist to maximize cash value using paid-up additions and minimal base premiums. Your policy should break even (cash value equals premiums) in 3–7 years, not 15–20.

- Strategic Usage: Use policy loans for real estate, business, or cash-flowing assets. Repay loans with returns, creating a perpetual wealth cycle.

Designing an IBC Policy: Key Elements

A successful IBC policy hinges on design. Key elements include:

- Paid-Up Additions (PUA) Rider: Diverts premiums to cash value, accelerating growth. For a $20,000 annual premium, ~$18,000 goes to cash value in year one.

- Mutual Insurance Companies: Policyholder-owned firms offer dividends, boosting returns (e.g., 4–6% annually).

- Low Base Premium: Minimizes death benefit costs, prioritizing cash value. This contrasts with traditional policies where 50–100% of premiums fund insurance.

A well-designed policy ensures liquidity and growth, aligning with your financial goals.

Infinite Banking vs. Traditional Investments

| Feature | Infinite Banking | 401(k)/IRA |

|---|---|---|

| Market Risk | Guaranteed returns | Full exposure |

| Liquidity | Access within 30 days | Penalties before 59½ |

| Tax Treatment | Tax-free loans/growth | Tax-deferred, taxable withdrawals |

| Legacy | Growing death benefit | Limited, depletable |

Is Infinite Banking Right for You?

IBC suits those seeking control, security, and tax advantages, but it’s not one-size-fits-all. Insurers evaluate health, age, income, and lifestyle (e.g., high-risk activities). Most clients qualify, even with health challenges. A personalized analysis, factoring your financial goals and risk tolerance, determines if IBC aligns with your needs.

Building a Multi-Generational Legacy

IBC is more than wealth—it’s a legacy of financial wisdom. What if your parents had taught you these principles? Your financial life might be transformed. By adopting IBC, you model self-reliance for your children and grandchildren, breaking free from Wall Street’s volatility. Policies for young family members lock in low premiums and decades of growth, as Richard did for his granddaughter, ensuring generational wealth.

Client Perspective

“Barry didn’t just sell me a policy—he brought me into a trusted family of resources. I wish I’d known him 20 years ago.” – Richard, Alabama

Your Next Step

If this resonates, explore your numbers. Discover how a high cash value policy fits your strategy. Claudia from Florida said, “Infinite Banking is a key tool for securing money, leveraging it, and gaining independence.” Contact Barry to Live Rich now and Die Rich later, leaving a legacy for generations. Start today.

Discover if Infinite Banking is Right for You

Before committing to this powerful wealth-building strategy, get a personalized analysis from Barry Brooksby, an experienced Infinite Banking practitioner. He’ll help you understand if IBC aligns with your financial goals and risk tolerance.

- ✓ Receive a tailored breakdown of how IBC would work in your specific situation

- ✓ Compare IBC to traditional investments like 401(k)s and IRAs

- ✓ Understand the tax-free growth and liquidity benefits

- ✓ Get a clear explanation of policy design and long-term potential

Schedule your complimentary 30-minute Infinite Banking consultation with Barry today and take the first step toward becoming your own banker.

No obligation. No pressure. Just expert guidance to help you determine if Infinite Banking is the right fit for your long-term financial strategy.

Frequently Asked Questions

What is the Infinite Banking Concept?

It uses high cash value whole life insurance to create a personal banking system, offering tax-free growth, liquidity, and a death benefit.

Why do banks hold billions in life insurance?

Banks use cash value life insurance for guaranteed growth and liquidity, deploying funds elsewhere while maintaining returns.

Is whole life insurance too expensive?

High cash value policies allocate 80–90% of premiums to cash value, with lower fees than managed portfolios, debunking cost myths.

Who qualifies for an IBC policy?

Insurers assess health, age, income, and lifestyle. Most qualify, even with health issues.

How do policy loans work?

Tax-free loans against cash value let the full value earn interest, creating the Money Multiplier Effect.

Unlock Financial Freedom with Barry’s Book!

Live Rich, Die Rich: Discover how to use high cash value life insurance and the Infinite Banking Concept to build tax-free wealth and secure a lasting legacy.

- ✓ Learn bank-used strategies for guaranteed growth

- ✓ Access tax-free cash for investments and retirement

- ✓ Create a multi-generational financial legacy

Change your financial mindset and empower future generations with Barry Brooksby’s proven insights.