At I&E, we know whole life insurance. And the thing is, not all whole life policies are the same. Just because you choose a top whole life insurance company does not mean you are getting the best whole life insurance. That is because the best whole life insurance policy is the one that is tailored to your specific needs and designed in such a way to accomplish your goals. There are many ways to design whole life and most life insurance agents have very little knowledge in this area. And there are at least 47 companies offering whole life in the market place. So, with that in mind, let’s talk about the best whole life insurance companies and policies.

Our Current Favorite Whole Life Insurance Companies

While there is no one true “best” whole life insurance company, a few of the carriers listed below are definitely superior to their competitors in a few key areas, namely in the dividend paid, interest on loans, cash value growth, and policy flexibility. Below we will highlight all 16 of our top whole life insurance companies. However, the companies in the immediate list below are clear stand outs presently due to strong policy design options and cash value growth.

Top Picks for 2025

So while we refrain from a true ranking list in order of best to worst whole life insurance companies, we definitely have our current favorites that we recommend to our potential clients.

One last note, we believe it is also important to point out that unlike most life insurance agencies out there, at I&E, we are advocates of a properly designed whole life insurance policy. So, rather than recommend you buy term and invest the difference, we will talk with you on your personal needs and goals to see what the best life insurance policy for you would be.

Maybe it is whole life. Or perhaps convertible term life insurance is more in line with your needs. But the bottom line is, we will take the time to help you make this important decision, rather than give you a “one-size-fits-all” recommendation like so many of our competitors do.

So, with all that said, let’s dive right in…

Table of Contents

- Best Whole Life Criteria

- Best Whole Life Companies

- Whole Life Policy Benefits

- Whole Life Insurance Quotes

- Whole Life Dividends Chart

- Different Ways to Design Whole Life Policies

- Whole Life Policy Loans

- Whole Life Insurance FAQs

Criteria for Determining the Best Whole Life Insurance Company

1. Mutual Company vs Stock Company

According to Kiplinger’s Personal Finance Magazine, when seeking cash value life insurance, “a mutual company is usually your best bet.”(1) The reason that a mutual insurance company is preferred vs a stock company is that the policy holder is a “member” in a mutual company who “participates” in the insurance provider’s investment gains and skill in selecting risk, as opposed to non-participating whole life insurance coverage from a stock company, where there are typically no dividends.

2. Dividend Rate History

One factor we considered in making our list is dividend rate history. We favor companies with a long history of competitive dividend rates.

3. Whole Life Policy Design

Another factor is whole life policy design flexibility, with the appropriate riders, such as paid up additions and term life insurance riders.

4, Top Rated

Also, most of the carriers below are among the top rated life insurance companies. Where applicable, we listed the company’s A.M Best rating, S&P rating, and Comdex ranking. However, a few companies do not have a Comdex ranking, which requires the company be rated by at least 2 of the top 4 rating agencies, A.M. Best, S&P, Moody’s, and Fitch.

5. Customer Satisfaction

We also tried to find out as much as we could about the company’s customer satisfaction score. One problem with most reviews of these companies is that they are heavily biased towards negativity since most people do not post positive reviews.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

Best Whole Life Insurance Companies

The following companies make up our current choices for the top 14 best whole life insurance companies listed in alphabetical order.

Ameritas

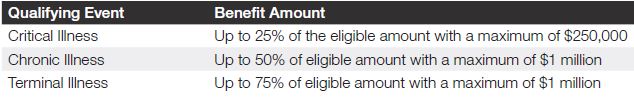

Ameritas offers Care4Life, an Accelerated Death Benefit Rider which provides living benefits if the insured is diagnosed with critical, chronic, or terminally illness.

Financial Strength Ratings for Ameritas:

- A.M. Best rating A

- S&P rating A+

- Comdex ranking 82

Customer Satisfaction Grade: C

- BBB: 1.1 out of 5

- Due to lack of other sources

For more, please visit our Ameritas Life Insurance Company review.

Foresters

Foresters Financial offers its various life insurance products through The Independent Order of Foresters and Foresters Life Insurance and Annuity Company.

The company’s whole life policy is called Advantage Plus II Whole Life Insurance. This is a non-medical whole life policy, with face amounts starting at $25,000.

Financial Strength Ratings for Foresters:

- A.M. Best rating A-

- S&P rating N/A

- Comdex ranking N/A

Customer Satisfaction Grade: A

Trustpilot Reviews: Great – 3.8 (this is quite good for an insurance company)

For more, please visit our Foresters Financial review.

Guardian Life

Guardian offers Core Whole Life which is a level pay policy to age 95, 99, or age 121. Limited pay policies are also available for 10, 15, 20 years and to age 65.

Ratings of Guardian’s Financial Strength:

- A.M. Best rating A++

- S&P rating AA+

- Comdex ranking 99

Customer Satisfaction Grade: A

We would give them an A based on the company’s full page of customer service awards here.

For more, please visit our Guardian Life review.

Lafayette Life

Lafayette Life Insurance Company practices non-direct recognition. Lafayette Life is available in 48 states and the District of Colombia. It currently does not do business in New York or Alaska. Lafayette Life Insurance Company is a member of Western and Southern Financial Group. Lafayette Life was founded in 1905 as a mutual insurance company.

The company offers several different whole life policies, which go by the names Heritage, Contender, Patriot, and Sentinel. The Sentinel offers the highest earliest cash value.

Lafayette Life has strong financial strength ratings, including:

- A.M. Best rating A+

- S&P rating AA-

- Comdex ranking 95

Customer Satisfaction Grade: A

Not much available. BBB has a 3 total reviews. But based on our experience, Lafayette Life has great customer service.

For more, please visit our Lafayette Life review.

MassMutual

MassMutual launched a digital initiative with LifeScore 360 which helps facilitate accelerated underwriting, allowing some clients to bypass having to take a medical exam.

MassMutual offers Whole Life Legacy, that provides options such as 10 pay and 20 pay or to age 65 or 100.

Ratings of MassMutual’s financial strength:

- A.M. Best rating A++

- S&P rating AA+

- Comdex ranking 98

Customer Satisfaction Grade: B

Based on our personal experience, MassMutual has great customer service. Unfortunately, Pissed Consumer website has 61 reviews that are pretty much all negative, which is par for a company of its size, so we lowered its score to a B.

For more, please visit our MassMutual review.

Mutual Trust Life

Mutual Trust Life Insurance, aka MTL Insurance Company, aka Mutual Trust Financial Group, aka “The Whole Life Company”®, was founded in 1904 as a mutual insurance company.

Covenant II is MTL’s premier participating whole life insurance policy, designed for permanent coverage with maximum cash value accumulation and growth.

Mutual Trust Life’s financial strength ratings:

- A.M. Best rating A

- Comdex ranking 78

Customer Satisfaction Grade: B+

The best we could find was Wallet Hub which gives them a score of 4.2 out of 5. Not too shabby.

For more, please visit our Mutual Trust Life review.

New York Life

They rank number 61 on the Forbes 100 list and are A++ rated by A.M. Best.

In 2023, New York Life expects to pay participating policyholders a dividend payout of $2 billion, marking the 169th consecutive year the company has paid policy owners a dividend, dating back to 1854.

New York Life’s impressive financial strength ratings include:

- A.M. Best rating A++

- S&P rating AA+

- Comdex ranking 100

Customer Satisfaction Grade: B

- Consumer Affairs has a score of 1.5 out of 5, with 11% ranking the company from good to great. This is normal with a company as large as NY Life.

- JD Power ranks the company as one of the best for group life insurance.

For more, please visit our New York Life review.

Not sure which whole life policy fits your needs? Book a free 30-minute consultation with I&E to explore the best options for you.

Northwestern Mutual

Founded in 1857, Northwestern Mutual is the highest rated life insurance carrier.

Northwestern Mutual’s has assets of over $265 billion and over $1.8 trillion worth of life insurance in force.

Northwestern Mutual’s financial strength ratings include:

- A.M. Best rating A++

- S&P rating AA+

- Comdex ranking 100

Customer Satisfaction Grade: B+

Consumer Reports gives them a score of 2.0 for 50 reviews, with 24% giving a score of good or great. We also know firsthand that Northwestern Mutual has good customer service, so our cumulative score would be a B+.

For more, please visit our Northwestern Mutual review.

Ohio National

Ohio National offers a unique 10 Pay whole life insurance policy called Prestige Indexed Whole Life. The policy grows cash value through four different Index Accounts and a Fixed Account. The Index Accounts provide a 0% floor to protect capital from poor market performance. It offers guaranteed 20 basis point bonus interest crediting starting in policy year 11. And you can choose between indexed and standard loan options that you can change every 12 months.

Ratings of Ohio National’s Financial Strength include:

- A.M. Best rating A

- S&P rating A-

- Comdex ranking 74

Customer Satisfaction Grade: B-

Wallet Hub gives them a 3.4 out of 5. We did not find any other good sources.

For more, please visit our Ohio National review.

OneAmerica

OneAmerica’s whole life insurance is brought to you buy American United Life, aka AUL, which is a mutual insurance company, that has been in business for over 140 years.

AUL, along with The State Life Insurance Company, are subsidiaries of OneAmerica.

OneAmerica boasts some impressive Financial Strength Ratings:

- A.M. Best rating A+

- S&P rating AA-

- Comdex ranking 95

Customer Satisfaction Grade: N/A

There is not a lot out there in terms of customer service reviews. Indeed and Glass Door gave them a combined score of 3.5 out of 5, but those are from employees. As a result, we have chosen not to give a score.

For more, please visit our OneAmerica review.

Penn Mutual

Penn Mutual’s policy is called Guaranteed Choice Whole Life. The Enhanced Permanent Paid Up Additions Rider (EPPUA) allows the policyholder to catch up on any shortfall from the previous year between EPPUA premiums and annual payment limits.

Penn Mutual’s financial strength ratings include:

- A.M. Best rating A+

- S&P rating A+

- Comdex ranking 93

Customer Satisfaction Grade: A

Having worked first hand with Penn Mutual we can say from experience that they have excellent customer service.

For more, please visit our Penn Mutual review.

Security Mutual Life

The company offers an enhanced paid-up additions rider which allows you to pay additional premium into your policy to purchase additional paid-up life insurance, which increases your death benefit and cash value.

Ratings of Security Mutual’s Financial Strength are:

- A.M. Best rating A-

- S&P rating N/A

- Comdex ranking N/A

Customer Satisfaction Grade: N/A

There is not much information available so we refrained from giving a score.

For more, please visit our Security Mutual Life review.

State Farm

State Farm also offers Final Expense whole life insurance, which is a guaranteed acceptance policy.

State Farm’s financial strength ratings include:

- A.M. Best rating A++

- S&P rating AA

- Comdex ranking 98

Customer Satisfaction Grade: A

Ranked number one for JD Power in 2023.

For more, please visit our State Farm Whole Life Insurance Review.

Thrivent

Once only catering to Lutherans, Thrivent offers membership to all Christians as of 2013. The company boasts strong financial ratings and has over 134 billion in assets under management.

Ratings for Thrivent’s Financial Strength include:

- A.M. Best rating A++

- Comdex ranking 99

Customer Satisfaction Grade: N/A

There is not a lot of third party information available so we refrained from offering a score.

Whole Life Insurance Benefits

The most important aspect to whole life insurance is the guarantees that it offers: guaranteed fixed premiums, guaranteed cash value growth, and guaranteed death benefit protection.

And although not guaranteed, participating whole life insurance focused on cash value growth offers annual life insurance dividend payments.

Guaranteed Fixed Premiums

Whole life insurance rates are fixed for the life of the policy. The primary benefit that fixed insurance quotes provide is stability.

With other types of permanent life insurance, the premiums can fluctuate over the policy’s lifetime.

But with whole life policies, the premiums will remain the same, and you can eventually use your cash value growth and dividend to pay your policy’s premium payment.

Guaranteed Cash Value Growth

Whole life insurance illustrations will provide a guaranteed and non-guaranteed illustration of your projected policy performance.

The typical guaranteed cash value growth is roughly 3%, with the non-guaranteed growth coming at at 5%+ of the best cash value whole life insurance companies.

However, thanks to the death benefit, the actual internal rate of return is much higher, particularly in the early years of the policy.

Guaranteed Death Benefit

Unlike term life insurance that has a definite end date, whole life insurance lasts your entire life.

And with a properly designed policy, your cash value and death benefit will increase each year, so as you age, your death benefit will grow.

The primary advantage to a growing death benefit is that when you do finally pass, your death benefit is close to the largest it has been throughout your lifetime, leaving your beneficiaries with the most income free death benefit possible.

Whole Life Dividends

Dividend payments are unique to whole life insurance policies. Dividends provide a return of premium to policyholders.

You can choose the following dividend options:

- Purchase paid up additions

- Pay Premiums

- Earn interest with the company

- Cash Out

For those of you interested in growing your cash value, paid-up additions allow you to reinvest your dividend into your policy by using the dividend to purchase paid-up life insurance.

The affect of paid-up additions is two fold:

One, it increases your death benefit protection, allowing you to leave more money to your loved ones.

Two, it increases your cash value, allowing you access to more money in your policy to be used via a withdrawal or life insurance loan.

Whole Life Insurance Quotes

You can use the following whole life insurance calculator to get a ballpark of how much a whole life policy may cost. And you can get an idea of how much whole life insurance costs up to $1,000,000 in coverage in the table below.

| Age | $100,000 | $250,000 | $500,000 | $1,000,000 |

|---|---|---|---|---|

| 20 | $83 | $151 | $293 | $580 |

| 25 | $92 | $178 | $348 | $689 |

| 30 | $105 | $216 | $422 | $839 |

| 35 | $121 | $267 | $522 | $1038 |

| 40 | $141 | $326 | $639 | $1273 |

| 45 | $173 | $401 | $789 | $1571 |

| 50 | $214 | $499 | $982 | $1959 |

| 55 | $270 | $629 | $1239 | $2473 |

| 60 | $324 | $802 | $1582 | $3158 |

| Age | $100,000 | $250,000 | $500,000 | $1,000,000 |

|---|---|---|---|---|

| 20 | $56 | $132 | $255 | $504 |

| 25 | $66 | $156 | $304 | $602 |

| 30 | $79 | $188 | $368 | $729 |

| 35 | $96 | $230 | $450 | $894 |

| 40 | $115 | $278 | $544 | $1081 |

| 45 | $143 | $350 | $685 | $1364 |

| 50 | $175 | $429 | $843 | $1681 |

| 55 | $223 | $549 | $1082 | $2158 |

| 60 | $280 | $700 | $1381 | $2756 |

These are sample whole life insurance rates. Please give us a call for tailored whole life insurance quotes designed specifically for you, using your own numbers.

Whole Life Insurance Dividends Chart

| Company | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Ameritas | 5.45 | 5.35 | 5.25 | 5.25 | 5.15 | 5.00 | 5.00 | 5.00 | ? | ? | ? |

| Foresters | 6.32 | 6.70 | 6.65 | 6.75 | 6.60 | 6.40 | 6.23 | 6.23 | 5.58 | ? | ? |

| Guardian | 6.95 | 6.65 | 6.25 | 6.05 | 6.05 | 5.85 | 5.85 | 5.85 | 5.65 | 5.65 | 5.65 |

| MassMutual | 7.00 | 7.00 | 7.10 | 7.10 | 7.10 | 6.70 | 6.40 | 6.40 | 6.20 | 6.00 | 6.00 |

| MetLife | 5.50 | 5.25 | 5.25 | 5.10 | 5.00 | 4.7 | 4.7 | 4.7 | ? | ? | ? |

| Minnesota Life | 6.00 | 4.75 | 5.00 | 5.25 | 5.00 | 5.00 | 5.00 | ? | ? | ? | ? |

| National Life Group | 6.00 | 5.75 | 5.75 | 5.75 | 5.75 | 5.75 | 5.25 | ? | ? | ? | ? |

| New York Life | 5.80 | 5.90 | 6.00 | 6.20 | 6.20 | 6.30 | 6.10 | 6.00 | 6.10 | 5.8 | $1.9 billion |

| Northwestern Mutual | 5.85 | 5.60 | 5.60 | 5.60 | 5.45 | 5.00 | 4.90 | 5.00 | 5.00 | 5.00 | 5.00 |

| Ohio National | 6.15 | 6.00 | 6.00 | 6.00 | 6.00 | 5.75 | 5.40 | 5.40 | 5.2 | 4.7 | ? |

| Penn Mutual | 6.34 | 6.34 | 6.34 | 6.34 | 6.34 | 6.34 | 6.34 | 6.10 | 6.10 | 5.75 | 5.75 |

Different Types of Whole Life Insurance Policies

The two primary types of whole life policies are participating vs non participating policies.

Participating vs Non-Participating

What matters is that participating whole life pays an annual dividend and non-participating policies do not. Ideally, you would want to choose a participating whole life policy, as they tend to provide greater cash value growth long term.

Among participating policies, there are also companies that practice direct recognition vs non-direct recognition.

Direct vs Non-Direct

Economics requires that policy loans, along with other factors in the economic environment, can have a negative impact on the dividend rates offered by a life insurance company.

This impact, when applied to a whole life insurance policy is called a “crediting adjustment” and there are two ways this adjustment is applied.

These two ways are either Direct Recognition, which passes the adjustment only to the policy holders who have outstanding loans and Non-Direct Recognition, which passes the adjustment to ALL of the policy holders, regardless of outstanding loans.

This crediting adjustment for direct recognition companies may result in a decrease (although this is not always the case) in the dividend rate for those who hold policy loans.

Non-direct recognition insurance companies will not show an adjustment to the dividend rates; however, the dividend rates in total may be lower and it is important to consider this factor.

Limited Pay Whole Life Insurance Policies

Whole life companies also offer different ways to design the policy, allowing you to choose from whole life to age 121, whole life to age 65 or limited pay life insurance, allowing you to choose specific periods of time, such as 7-Pay, 10-Pay, 15-Pay and 20-Pay life insurance.

You can choose a limited pay life insurance policy or a policy where premiums are due for your entire life.

A benefit of limited pay policies is that the premiums are no longer due once the limited pay timeline has passed.

But you should be aware that the best cash value whole life insurance policies are not always limited pay policies.

Therefore, if cash value growth is of utmost importance to you, you may want to consider an alternative, such as a policy designed for early cash value growth via paid-up additions that allows you to continue to add money down the road in the form of lifetime premium payments.

Whole Life Insurance Loans vs Withdrawals

You can access your whole life insurance policy’s cash value via a life insurance loan or a withdrawal. Life insurance loans allow you to borrow from the insurance company using your cash value as collateral. Loans are income tax free and provide a great way for you to access your money. Alternatively, withdrawals may be tax free, but only up to your basis in the whole life policy.

Whole Life Insurance FAQs

What is whole life insurance?

Whole life insurance is a permanent policy that provides lifelong coverage, a guaranteed death benefit, and a cash value component that grows over time. It’s designed to offer stability with fixed premiums and can be customized to meet your financial goals.

How does whole life differ from term life insurance?

Whole life covers you for your entire life and builds cash value, while term life covers you for a set period and typically costs less but doesn’t accumulate cash value. Whole life is ideal for long-term needs, while term suits temporary coverage.

Why does the insurance company matter when choosing whole life?

The company’s financial strength, dividend history, and customer service impact policy performance. Top mutual companies like Penn Mutual, MassMutual, and Guardian often pay competitive dividends and offer flexible designs, but even the best company can underperform with a poorly designed policy.

How important is policy design in whole life insurance?

Policy design is critical. A well-designed policy, tailored with riders like paid-up additions, can maximize cash value growth or death benefit, aligning with your goals. A top-tier company with a generic design may not perform as well as a customized policy from a strong insurer.

What are paid-up additions, and why do they matter?

Paid-up additions (PUAs) let you invest additional premiums to buy more coverage, boosting both your cash value and death benefit. PUAs are key for early cash value growth, making them essential for policies designed for wealth-building or flexibility.

How do dividends work, and are they guaranteed?

Dividends are a return of premium from mutual insurers like Lafayette Life or New York Life when they perform well. You can use them to buy PUAs, reduce premiums, or take as cash. They’re not guaranteed, but companies with strong histories, like MassMutual, often pay consistently.

What riders should I consider for my whole life policy?

Riders like paid-up additions, waiver of premium, accelerated death benefit, and long-term care enhance your policy’s flexibility. For example, Guardian offers unique riders for chronic care, while Penn Mutual’s EPPUA rider supports cash value growth.

How can I access my policy’s cash value?

You can borrow against your cash value through tax-free loans (using the policy as collateral) or make withdrawals (tax-free up to your basis). Loans, as offered by companies like Foresters, are often preferred to maintain policy growth.

What’s the difference between direct and non-direct recognition companies?

Direct recognition companies (e.g., Guardian for fixed loans) adjust dividends only for policyholders with loans, while non-direct recognition companies (e.g., MassMutual) spread adjustments across all policyholders. Non-direct recognition may be better if you plan to borrow frequently, but direct recognition may be superior in a rising interest rate environment.

How do I know if a limited pay or standard whole life policy is better?

Limited pay policies (e.g., 10-pay or 20-pay) end premium payments early but may sacrifice long term cash value growth. Standard policies with lifetime premiums, designed with PUAs, often maximize long-term cash value. Discuss your goals with an expert, like those at I&E, to decide.

Conclusion

The “best whole life insurance companies” is an ever changing landscape. Competition helps foster an environment of ever improving whole life cash value growth and performance. If you are interested in finding out more about the best whole life insurance policy for you, based on your unique needs, goals and objectives, our experts are here for you and will provide you with a complimentary strategy session to help you determine if whole life is the best option for you.

Find the Best Whole Life Insurance Policy for Your Goals

Choosing the right whole life insurance company and policy design is crucial for maximizing cash value growth and meeting your financial objectives. Our independent advisory team at I&E offers a personalized analysis to ensure your policy is tailored to your unique needs.

- ✓ Get a customized breakdown of how whole life insurance can work for your specific situation

- ✓ Compare top companies like Penn Mutual, MassMutual, and Guardian to find the best fit

- ✓ Explore policy design options, including paid-up additions and riders, for optimal performance

- ✓ Understand the benefits, risks, and long-term value of your whole life policy

Schedule your complimentary 30-minute whole life insurance consultation today and discover the policy that’s right for you.

No obligation. No pressure. Just expert advice to help you select the best whole life insurance company and policy design for your financial future.

4 comments

Manuel

I’m interested in a life insurance ( IUL) maximizing benefits to me, with a very inexpensive commission to seller of policy,. Also I would like to move any funds I have in a typical bank account or savings account and let it build compound interest. Can you help me?

Insurance&Estates

Hello Manuel, I recommend that you connect with our IUL expert Jason Herring by emailing him to request a call at jason@insuranceandestates.com.

Best, Steve Gibbs, for I&E

KENDRA Gray

WANT TO EST AN INSURANRANCE POLICY

Insurance&Estates

Hello Kendra, if you’d like to request a personal consultation, connect with Barry@insuranceandestates.com.

Best, I&E