The following article examines three different whole life cash value charts to understand how different policy designs affect the outcome of the policy’s long term cash value growth.

Table of Contents

- What is Whole Life Insurance Cash Value?

- The Key Components of Cash Value Whole Life Insurance

- How Cash Value Builds in a Whole Life Insurance Policy

- Whole Life Insurance Cash Value Charts

- All Whole Life Insurance Policies are NOT the Same

- What Other Types of Life Insurance Have Cash Value?

- How to Access Funds from Life Insurance Cash Value

- How to Choose the Right Whole Life Insurance Policy for Your Specific Objectives

What is Whole Life Insurance Cash Value?

Whole life insurance, a type of permanent life insurance, is designed to provide coverage for the entire lifetime of the policyholder. It not only guarantees a death benefit to the beneficiaries upon the policyholder’s death but also includes a savings component known as the cash value. These accumulated funds grow over time at a guaranteed rate set by the insurance company and can be used by the policyholder for various financial needs, such as loans or withdrawals, while still alive. Unlike term life insurance, which only offers coverage for a specified period, whole life insurance remains in effect as long as premiums are paid, offering both a predictable premium structure and a way to build cash value as a financial asset.

Permanent life insurance is an integral part of most financial or retirement plans. Although most people don’t relish the idea of discussing their own mortality, the reality is that if you have people in your life who would struggle financially if you were no longer here, then it is likely that you need life insurance.

While term life insurance provides “basic” death benefit protection, there are other types of cash value life insurance that offer many additional enticing features – benefits that can be enjoyed while the insured is still alive – based on how the permanent life insurance policy is structured.

One of these types of policies is whole life insurance. But not all whole life insurance policies are the same. So, it is important that you have the right type of cash value life insurance plan in place. Otherwise, you could end up unintentionally forfeiting various benefits that you – and those you care about – were counting on.

The Key Components of Cash Value Whole Life Insurance

Cash Value Whole Life is a form of permanent life insurance coverage. This means that the policy will remain in force – for the “whole lifetime” of the insured – as long as the premium is paid. These policies include two primary components. These are the:

- Death benefit

- Cash value

A whole life insurance policy differs from term life insurance, which only offers a death benefit (with no accumulated account value account growth). There are some additional differences between a term policy and whole life policy.

Term Life Insurance

Term life insurance is typically used for “temporary” needs because, as its name implies, it only remains in force for a certain amount of time, or “term,” such as 10 years, 20 years, or 30 years, with some companies offering 40 year term life insurance.

The cost of a term life insurance policy is oftentimes low, especially if the insured is young and in good health at the time of application. However, the term policy does not last the insureds entire lifetime, which can pose a problem down the road if the insured wishes to keep the life insurance after the term expires.

If the insured is still alive after a term life insurance policy has come to the end of its time limit, he or she may have to requalify if they want to renew their coverage. At this point, the new term life insurance premium going forward will usually be higher (and in some cases, much higher) because it will be based on the insured’s then-current age and health condition.

If the insured has contracted a serious health condition, they may even be considered uninsurable – and this could have devastating financial consequences for loved ones who were counting on the death benefit for their future financial support.

Whole Life Insurance

With a whole life insurance policy the coverage will stay in force, and generally, the life insurance premium amount will remain the same for the entire life of the policy – even as the insured ages, as well as if they become seriously ill.

Because of this, owning whole life insurance can be a viable strategy for ensuring that you will have financial protection in place for your survivors, both now and in the future. Plus, the death benefit funds are also received income tax-free to the beneficiary(ies).

Cash Value

Whole life insurance also includes a cash value account. The funds that are in this part of the policy grow tax-deferred, meaning that there is no tax due on the gain unless or until the money is withdrawn.

While whole life insurance is also designed to pay an income tax-free death benefit to beneficiaries, because of the accumulated growth, these flexible financial tools can be used for so much more – such as:

- Generating tax-free retirement income

- Paying off higher-interest debts (such as credit card balances)

- Providing another avenue for tax-advantaged growth (in addition to IRA and/or retirement plan funds)

- Paying the policy’s premium (as versus making these payments out of pocket)

- Making purchases – including “high ticket” items like vehicles – without having to borrow money from a bank or other lender

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

How Cash Value Builds in a Whole Life Insurance Policy

Three Pools

When you make a premium payment on a whole life insurance policy, the insurance company divides your funds into three “pools.” One of these goes towards the death benefit (with the cost being based on the insured’s age, health, and other underwriting factors), another goes for the operating costs of the insurer, and the third goes into the policy’s cash value account.

PUAs

The cash value can be further enhanced through the use of riders, such as the paid up additions rider. A paid up additions rider allows you to purchase additional paid up life insurance, which increases your policy’s available equity.

Guaranteed Rate

Although some other types of permanent life insurance policies provide the opportunity to generate higher returns, the funds that are in a whole life policy’s cash component grow based on a guaranteed rate that is set by the insurer.

This rate is typically around 3-4%. And your principal and your previous gains are also protected from market risk, so there is no need to “make up” for any losses – even if the stock market endures a significant correction.

Dividends

Dividend paying whole life insurance pays out a dividend to participating policyholders annually. The default for dividends is to purchase paid up additions, which grow your cash value and death benefit.

Tax Deferred

The tax-deferred nature of whole life insurance cash value can also help to boost your overall return. That is because the money is generating a true compound interest return on your principal, as well as on prior interest, and on funds that would have otherwise been paid out in taxes each year. Therefore, compared to a fully taxable account, a whole life insurance policy’s accumulated funds can perform substantially better over time as a true compound interest growth account (with all other factors being the same).

Tax-Deferred versus Fully Taxable Account

Although the cash component of a whole life insurance policy will usually grow somewhat slowly in the initial years (due in large part to your premium going to pay the insurer’s expenses), the value can really snowball over time due to true compound growth, particularly given its tax-advantaged nature.

So, with that brief look at what makes whole life insurance so great, let’s take a look at some cash value charts. (Please note, you can click the following link if you are interested in seeing some whole life insurance rates.)

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

Whole Life Insurance Cash Value Charts

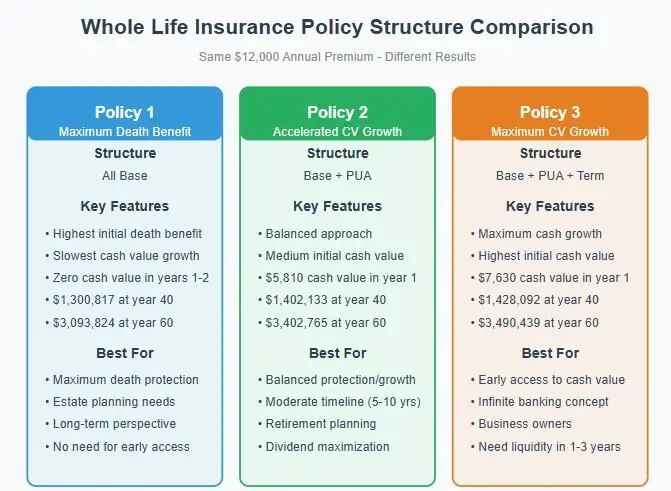

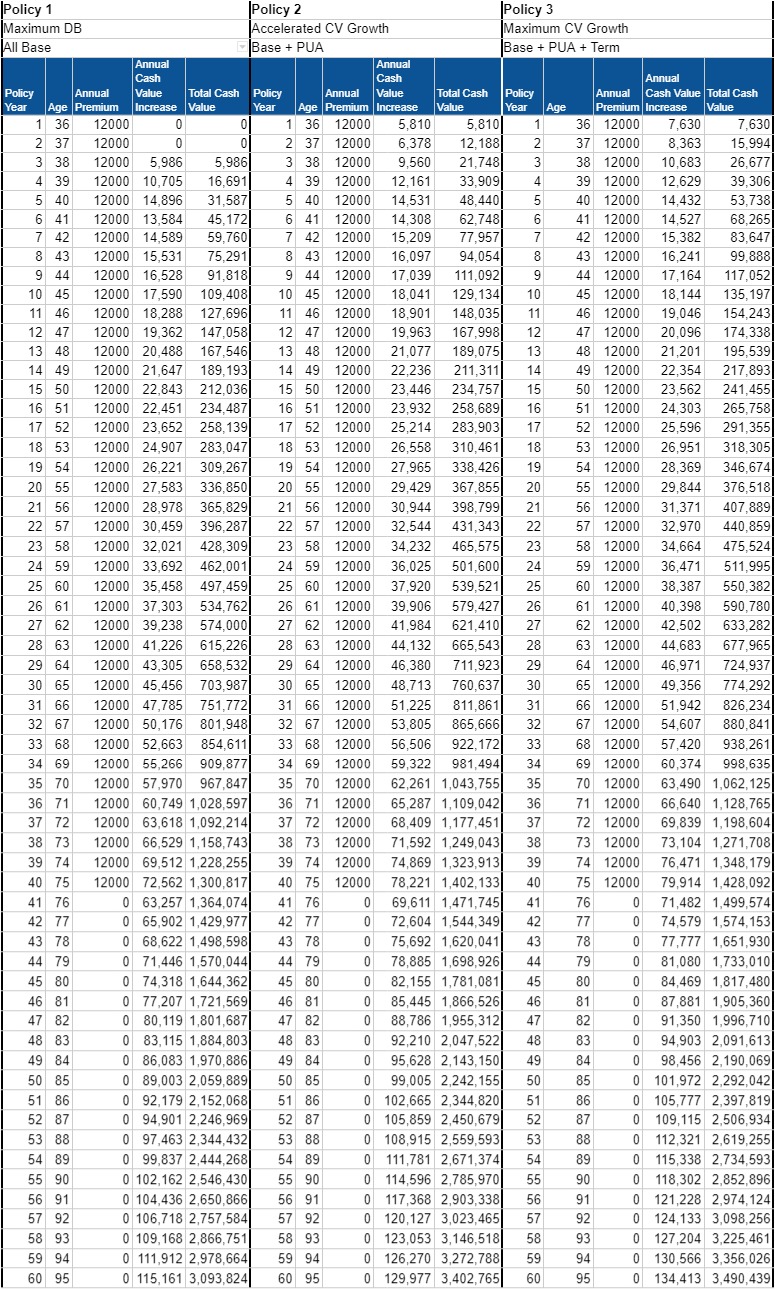

We will be looking at three different whole life insurance cash value charts. Policy one designed for maximum death benefit, policy two is designed for accelerated cash value growth, and policy three is focused on maximum early cash value accumulation.

Comparing Whole Life Policy Structures: Which Design Fits Your Financial Goals?

Here are the 3 different whole life insurance policy designs. This side-by-side comparison illustrates how different policy structures perform over time with the same $12,000 annual premium. Each design offers distinct advantages depending on whether your priority is maximum death benefit protection, balanced growth, or early access to accumulated funds.

This side-by-side comparison illustrates how different whole life insurance policy structures perform over time with the same $12,000 annual premium. Each design offers distinct advantages depending on whether your priority is maximum death benefit protection, balanced growth, or early cash value access.

Examining these whole life insurance charts reveals crucial insights into how your money performs over time. With a standard $12,000 annual premium, notice how Policy 1 directs funds primarily toward death benefit and insurer costs in the early years, resulting in minimal initial policy value. In contrast, Policies 2 and 3 create immediate monetary value through different premium allocations.

As years progress, all policies benefit from tax-deferred growth, compounding your returns without annual taxation. This tax advantage, combined with dividend payments in participating policies, creates substantial long-term value. By year 40, the accumulated cash value becomes self-sustaining, allowing policyholders to stop premium payments while maintaining coverage through the policy’s internal value.

Want to see how different policy structures would perform with your specific situation?

Schedule a complimentary strategy session to get personalized illustrations.

Whole Life Policy Value Chart #1

In this example, the whole life insurance policy is structured solely for the death benefit, so the entire premium payment is all going to the base.

| Policy 1 | ||||

| Maximum DB | ||||

| All Base | ||||

| Policy Year | Age | Annual Premium | Annual Cash Value Increase | Total Cash Value |

|---|---|---|---|---|

| 1 | 36 | 12000 | 0 | 0 |

| 2 | 37 | 12000 | 0 | 0 |

| 3 | 38 | 12000 | 5,986 | 5,986 |

| 4 | 39 | 12000 | 10,705 | 16,691 |

| 5 | 40 | 12000 | 14,896 | 31,587 |

| 6 | 41 | 12000 | 13,584 | 45,172 |

| 7 | 42 | 12000 | 14,589 | 59,760 |

| 8 | 43 | 12000 | 15,531 | 75,291 |

| 9 | 44 | 12000 | 16,528 | 91,818 |

| 10 | 45 | 12000 | 17,590 | 109,408 |

| 11 | 46 | 12000 | 18,288 | 127,696 |

| 12 | 47 | 12000 | 19,362 | 147,058 |

| 13 | 48 | 12000 | 20,488 | 167,546 |

| 14 | 49 | 12000 | 21,647 | 189,193 |

| 15 | 50 | 12000 | 22,843 | 212,036 |

| 16 | 51 | 12000 | 22,451 | 234,487 |

| 17 | 52 | 12000 | 23,652 | 258,139 |

| 18 | 53 | 12000 | 24,907 | 283,047 |

| 19 | 54 | 12000 | 26,221 | 309,267 |

| 20 | 55 | 12000 | 27,583 | 336,850 |

| 21 | 56 | 12000 | 28,978 | 365,829 |

| 22 | 57 | 12000 | 30,459 | 396,287 |

| 23 | 58 | 12000 | 32,021 | 428,309 |

| 24 | 59 | 12000 | 33,692 | 462,001 |

| 25 | 60 | 12000 | 35,458 | 497,459 |

| 26 | 61 | 12000 | 37,303 | 534,762 |

| 27 | 62 | 12000 | 39,238 | 574,000 |

| 28 | 63 | 12000 | 41,226 | 615,226 |

| 29 | 64 | 12000 | 43,305 | 658,532 |

| 30 | 65 | 12000 | 45,456 | 703,987 |

| 31 | 66 | 12000 | 47,785 | 751,772 |

| 32 | 67 | 12000 | 50,176 | 801,948 |

| 33 | 68 | 12000 | 52,663 | 854,611 |

| 34 | 69 | 12000 | 55,266 | 909,877 |

| 35 | 70 | 12000 | 57,970 | 967,847 |

| 36 | 71 | 12000 | 60,749 | 1,028,597 |

| 37 | 72 | 12000 | 63,618 | 1,092,214 |

| 38 | 73 | 12000 | 66,529 | 1,158,743 |

| 39 | 74 | 12000 | 69,512 | 1,228,255 |

| 40 | 75 | 12000 | 72,562 | 1,300,817 |

| 41 | 76 | 0 | 63,257 | 1,364,074 |

| 42 | 77 | 0 | 65,902 | 1,429,977 |

| 43 | 78 | 0 | 68,622 | 1,498,598 |

| 44 | 79 | 0 | 71,446 | 1,570,044 |

| 45 | 80 | 0 | 74,318 | 1,644,362 |

| 46 | 81 | 0 | 77,207 | 1,721,569 |

| 47 | 82 | 0 | 80,119 | 1,801,687 |

| 48 | 83 | 0 | 83,115 | 1,884,803 |

| 49 | 84 | 0 | 86,083 | 1,970,886 |

| 50 | 85 | 0 | 89,003 | 2,059,889 |

| 51 | 86 | 0 | 92,179 | 2,152,068 |

| 52 | 87 | 0 | 94,901 | 2,246,969 |

| 53 | 88 | 0 | 97,463 | 2,344,432 |

| 54 | 89 | 0 | 99,837 | 2,444,268 |

| 55 | 90 | 0 | 102,162 | 2,546,430 |

| 56 | 91 | 0 | 104,436 | 2,650,866 |

| 57 | 92 | 0 | 106,718 | 2,757,584 |

| 58 | 93 | 0 | 109,168 | 2,866,751 |

| 59 | 94 | 0 | 111,912 | 2,978,664 |

| 60 | 95 | 0 | 115,161 | 3,093,824 |

Using Riders to Enhance Whole Life Insurance Cash Value Build-Up

As with many other financial and insurance products, whole life can be “customized” so that the policy more closely fits in with your specific needs. One way to do this is by adding various riders.

Paid Up Additions (PUA)

One rider in particular is the paid up additions, or PUA, rider, which can allow you to have equity in your whole life insurance policy starting in the very first month. This is one of the most powerful components with respect to the accumulation of cash value in a whole life insurance policy.

In essence, a paid up additions rider adds more accumulated value into a participating whole life insurance policy which increases the performance of the policy’s growth component.

In this case, every dollar of premium that is allocated to the paid up additions rider creates a small “paid up” insurance policy that has its own monetary value that is created right away.

With that in mind, a whole life insurance policy that has a substantial portion of its total premium payment going towards paid up additions will often perform much better than those that do not take advantage of PUAs.

Given more of a focus on growing the policy equity (and less on the death benefit coverage), take a look again at the whole life insurance chart above that shows the base plan and compare it with the chart below which shows a policy that includes a PUA rider on it.

As with the base plan, the insured starts the policy at age 36, and pays a premium of $12,000 per year into it between Year 1 and Year 40 (until age 75), for a total input of $480,000 in premiums paid in.

Whole Life Policy Value Chart #2

In this example, the policy is structured so that a portion of the premium payment is going equally to the base and to paid up additions. This design will provide more cash value, with a lower initial death benefit that will grow over time as the cash value in the policy increases.

| Policy 2 | ||||

| Accelerated CV Growth | ||||

| Base + PUA | ||||

| Policy Year | Age | Annual Premium | Annual Cash Value Increase | Total Cash Value |

|---|---|---|---|---|

| 1 | 36 | 12000 | 5,810 | 5,810 |

| 2 | 37 | 12000 | 6,378 | 12,188 |

| 3 | 38 | 12000 | 9,560 | 21,748 |

| 4 | 39 | 12000 | 12,161 | 33,909 |

| 5 | 40 | 12000 | 14,531 | 48,440 |

| 6 | 41 | 12000 | 14,308 | 62,748 |

| 7 | 42 | 12000 | 15,209 | 77,957 |

| 8 | 43 | 12000 | 16,097 | 94,054 |

| 9 | 44 | 12000 | 17,039 | 111,092 |

| 10 | 45 | 12000 | 18,041 | 129,134 |

| 11 | 46 | 12000 | 18,901 | 148,035 |

| 12 | 47 | 12000 | 19,963 | 167,998 |

| 13 | 48 | 12000 | 21,077 | 189,075 |

| 14 | 49 | 12000 | 22,236 | 211,311 |

| 15 | 50 | 12000 | 23,446 | 234,757 |

| 16 | 51 | 12000 | 23,932 | 258,689 |

| 17 | 52 | 12000 | 25,214 | 283,903 |

| 18 | 53 | 12000 | 26,558 | 310,461 |

| 19 | 54 | 12000 | 27,965 | 338,426 |

| 20 | 55 | 12000 | 29,429 | 367,855 |

| 21 | 56 | 12000 | 30,944 | 398,799 |

| 22 | 57 | 12000 | 32,544 | 431,343 |

| 23 | 58 | 12000 | 34,232 | 465,575 |

| 24 | 59 | 12000 | 36,025 | 501,600 |

| 25 | 60 | 12000 | 37,920 | 539,521 |

| 26 | 61 | 12000 | 39,906 | 579,427 |

| 27 | 62 | 12000 | 41,984 | 621,410 |

| 28 | 63 | 12000 | 44,132 | 665,543 |

| 29 | 64 | 12000 | 46,380 | 711,923 |

| 30 | 65 | 12000 | 48,713 | 760,637 |

| 31 | 66 | 12000 | 51,225 | 811,861 |

| 32 | 67 | 12000 | 53,805 | 865,666 |

| 33 | 68 | 12000 | 56,506 | 922,172 |

| 34 | 69 | 12000 | 59,322 | 981,494 |

| 35 | 70 | 12000 | 62,261 | 1,043,755 |

| 36 | 71 | 12000 | 65,287 | 1,109,042 |

| 37 | 72 | 12000 | 68,409 | 1,177,451 |

| 38 | 73 | 12000 | 71,592 | 1,249,043 |

| 39 | 74 | 12000 | 74,869 | 1,323,913 |

| 40 | 75 | 12000 | 78,221 | 1,402,133 |

| 41 | 76 | 0 | 69,611 | 1,471,745 |

| 42 | 77 | 0 | 72,604 | 1,544,349 |

| 43 | 78 | 0 | 75,692 | 1,620,041 |

| 44 | 79 | 0 | 78,885 | 1,698,926 |

| 45 | 80 | 0 | 82,155 | 1,781,081 |

| 46 | 81 | 0 | 85,445 | 1,866,526 |

| 47 | 82 | 0 | 88,786 | 1,955,312 |

| 48 | 83 | 0 | 92,210 | 2,047,522 |

| 49 | 84 | 0 | 95,628 | 2,143,150 |

| 50 | 85 | 0 | 99,005 | 2,242,155 |

| 51 | 86 | 0 | 102,665 | 2,344,820 |

| 52 | 87 | 0 | 105,859 | 2,450,679 |

| 53 | 88 | 0 | 108,915 | 2,559,593 |

| 54 | 89 | 0 | 111,781 | 2,671,374 |

| 55 | 90 | 0 | 114,596 | 2,785,970 |

| 56 | 91 | 0 | 117,368 | 2,903,338 |

| 57 | 92 | 0 | 120,127 | 3,023,465 |

| 58 | 93 | 0 | 123,053 | 3,146,518 |

| 59 | 94 | 0 | 126,270 | 3,272,788 |

| 60 | 95 | 0 | 129,977 | 3,402,765 |

PUA + Term Rider

To maximize the growth in the cash value account even further, yet another alternative could be to add a paid up additions rider, as well as a term rider. In this scenario, you would add term life insurance into the overall mix.

Why would you do that – especially if you already have a whole life insurance policy that provides death benefit protection?

One reason is so that you don’t “overfund” the whole life policy and turn it into a Modified Endowment Contract, or MEC – which could take away the tax advantages of the plan. In its most basic sense, a Modified Endowment Contract is a tax qualification of a life insurance policy whose funding exceeds federal tax law limits.

According to the IRS, if a policy holder places too much money inside of a life insurance policy, it will lose its status as “insurance,” and it instead becomes an investment vehicle – and this can erase its tax-advantaged status, such as allowing the policy value to grow on a tax-deferred basis.

By adding a term rider to your policy, then, the amount of the death benefit is increased, which can help to keep the policy from becoming a Modified Endowment Contract – and allow you to place more money into the paid up additions rider, increasing the accumulated funds even faster.

So, in some instances, it makes sense to include a term rider to your plan. Here again, by paying premiums of $12,000 per year for 40 years, the policy’s monetary value could end up growing to nearly $3.5 million – which represents more than 7 times the premium cost outlay…and this is accomplished with no stock market risk to contend with. As an added “bonus,” the policy will provide an income tax free death benefit to the beneficiary(ies) if the insured passes away.

Whole Life Policy Value Chart #3

In this example we have a policy structured for maximum early cash value growth, by designing the policy with Base+Paid Up Additions+Term Rider. The addition of the term rider allows for more cash to be put into the policy in the early years.

| Policy 3 | ||||

| Maximum CV Growth | ||||

| Base + PUA + Term | ||||

| Policy Year | Age | Annual Premium | Annual Cash Value Increase | Total Cash Value |

|---|---|---|---|---|

| 1 | 36 | 12000 | 7,630 | 7,630 |

| 2 | 37 | 12000 | 8,363 | 15,994 |

| 3 | 38 | 12000 | 10,683 | 26,677 |

| 4 | 39 | 12000 | 12,629 | 39,306 |

| 5 | 40 | 12000 | 14,432 | 53,738 |

| 6 | 41 | 12000 | 14,527 | 68,265 |

| 7 | 42 | 12000 | 15,382 | 83,647 |

| 8 | 43 | 12000 | 16,241 | 99,888 |

| 9 | 44 | 12000 | 17,164 | 117,052 |

| 10 | 45 | 12000 | 18,144 | 135,197 |

| 11 | 46 | 12000 | 19,046 | 154,243 |

| 12 | 47 | 12000 | 20,096 | 174,338 |

| 13 | 48 | 12000 | 21,201 | 195,539 |

| 14 | 49 | 12000 | 22,354 | 217,893 |

| 15 | 50 | 12000 | 23,562 | 241,455 |

| 16 | 51 | 12000 | 24,303 | 265,758 |

| 17 | 52 | 12000 | 25,596 | 291,355 |

| 18 | 53 | 12000 | 26,951 | 318,305 |

| 19 | 54 | 12000 | 28,369 | 346,674 |

| 20 | 55 | 12000 | 29,844 | 376,518 |

| 21 | 56 | 12000 | 31,371 | 407,889 |

| 22 | 57 | 12000 | 32,970 | 440,859 |

| 23 | 58 | 12000 | 34,664 | 475,524 |

| 24 | 59 | 12000 | 36,471 | 511,995 |

| 25 | 60 | 12000 | 38,387 | 550,382 |

| 26 | 61 | 12000 | 40,398 | 590,780 |

| 27 | 62 | 12000 | 42,502 | 633,282 |

| 28 | 63 | 12000 | 44,683 | 677,965 |

| 29 | 64 | 12000 | 46,971 | 724,937 |

| 30 | 65 | 12000 | 49,356 | 774,292 |

| 31 | 66 | 12000 | 51,942 | 826,234 |

| 32 | 67 | 12000 | 54,607 | 880,841 |

| 33 | 68 | 12000 | 57,420 | 938,261 |

| 34 | 69 | 12000 | 60,374 | 998,635 |

| 35 | 70 | 12000 | 63,490 | 1,062,125 |

| 36 | 71 | 12000 | 66,640 | 1,128,765 |

| 37 | 72 | 12000 | 69,839 | 1,198,604 |

| 38 | 73 | 12000 | 73,104 | 1,271,708 |

| 39 | 74 | 12000 | 76,471 | 1,348,179 |

| 40 | 75 | 12000 | 79,914 | 1,428,092 |

| 41 | 76 | 0 | 71,482 | 1,499,574 |

| 42 | 77 | 0 | 74,579 | 1,574,153 |

| 43 | 78 | 0 | 77,777 | 1,651,930 |

| 44 | 79 | 0 | 81,080 | 1,733,010 |

| 45 | 80 | 0 | 84,469 | 1,817,480 |

| 46 | 81 | 0 | 87,881 | 1,905,360 |

| 47 | 82 | 0 | 91,350 | 1,996,710 |

| 48 | 83 | 0 | 94,903 | 2,091,613 |

| 49 | 84 | 0 | 98,456 | 2,190,069 |

| 50 | 85 | 0 | 101,972 | 2,292,042 |

| 51 | 86 | 0 | 105,777 | 2,397,819 |

| 52 | 87 | 0 | 109,115 | 2,506,934 |

| 53 | 88 | 0 | 112,321 | 2,619,255 |

| 54 | 89 | 0 | 115,338 | 2,734,593 |

| 55 | 90 | 0 | 118,302 | 2,852,896 |

| 56 | 91 | 0 | 121,228 | 2,974,124 |

| 57 | 92 | 0 | 124,133 | 3,098,256 |

| 58 | 93 | 0 | 127,204 | 3,225,461 |

| 59 | 94 | 0 | 130,566 | 3,356,026 |

| 60 | 95 | 0 | 134,413 | 3,490,439 |

All Whole Life Insurance Policies are NOT the Same

Even though it is possible to build up a significant amount of cash value in a whole life insurance policy, it is absolutely essential to understand that not all of these policies are exactly the same. In fact, there are certain types of whole life insurance policies that are only offered through specific insurers that can provide this type of performance.

These are known as “participating” whole life policies – and they are provided through mutual life insurance companies.

Mutual life insurance companies are essentially “owned” by their policy holders. Therefore, these individuals have a right to vote on the board of directors. They may also receive dividends on their whole life insurance policies.

The life insurance dividends may be added to the cash value account, which in turn, can add even more to the total value of the account. While the payment of dividends is not guaranteed, there are some mutual insurance carriers that have consistently paid dividends every year to their policy holders for well over 100 years.

A mutual life insurance company differs from a “stock” insurance company in that the latter are owned by stockholders. Therefore, the key objective of stock insurers – like most other publicly traded companies – is to generate a profit for these shareholders, and this may not necessarily benefit the company’s insurance policy holders.

The dividends that are paid out by a mutual life insurance company are in addition to the guaranteed annual policy value increases. Given that – plus the tax-deferred nature of the accumulated growth – it is easy to see how a properly structured whole life insurance policy from a mutual insurer could build significant monetary reserves that could be used for any number of pursuits, such as retirement income or purchasing cash flowing real estate.

What Other Types of Life Insurance Have Cash Value?

The other primary type of life insurance that has a cash value component is universal life insurance. There are three types of universal life policies, guaranteed universal life, indexed universal life and variable universal life.

Guaranteed Universal Life Insurance grows at a fixed rate set by the insurer. Indexed Universal Life grows based on an underlying index, such as the S&P 500. And Variable Universal Life grows based on an investment fund performance, much like a mutual fund.

How to Access Funds from Life Insurance Cash Value

Withdrawal

If you opt to access funds from the cash value account of a whole life insurance policy, there are a couple of ways to go about it. One is to simply take a withdrawal. By doing so, however, you will have to pay tax on any amount of the withdrawal that is considered gain.

Borrow Against Your Cash Value

An alternate option could be to take out a life insurance loan. If you go this route, the money that you access via a loan will be tax-free. In addition, because you are actually taking a loan from the insurance company – and not technically borrowing funds from the policy equity itself – interest will continue to accumulate on the entire amount of your accumulated value.

For instance, if your policy has a monetary value of $80,000 and you borrow $30,000, interest will continue accruing on the entire $80,000. What other bank or lender would allow you to do that?

Although there is typically a small amount of interest that is charged on the outstanding balance of a loan from the policy reserves of a whole life insurance policy, it is generally less than that of a bank, credit card, or other type of personal loan interest.

Plus, the loan balance does not necessarily have to be repaid during your (or the insured’s) lifetime. In this case, if there is still an outstanding loan balance upon your passing, it will be paid off using the policy’s death benefit proceeds. Then, the remainder of the funds will be paid out to your beneficiary(ies).

How to Choose the Right Whole Life Insurance Policy for Your Specific Objectives

There is a long list of reasons why whole life insurance could be a good addition to your overall portfolio – and they go far beyond just the payout of a death benefit for your beneficiaries in the future.

In fact, there are many cases where it makes sense to minimize the death benefit, while at the same time taking steps to maximize the cash value component of the policy.

When putting together a plan, though, it is essential that all of the proper steps are followed.

In addition, not all whole life policies are the same, nor do all insurance carriers offer the best type of plan to use in the wealth accumulation strategy you are looking for.

Work With a Specialist to Design Your Ideal Policy

Because there can be so many parameters to be mindful of, it is recommended that you discuss your goals and needs with a life insurance specialist who can guide you through all of the steps, as well as help you to narrow down which type of policy and life insurance company is best for you. They can also help you to ensure that the policy you go with does not turn into a Modified Endowment Contract and lose the tax advantages that you were counting on.

If you’d like to learn more, simply follow this link to watch our webinar about the High Cash Value Base + PUA + Term designed policy described above.

Ready to See How Whole Life Insurance Could Work for You?

The cash value comparisons above are just examples. Your specific age, health, and financial goals will create a unique scenario for your policy’s performance.

Want to see personalized illustrations using your own numbers?

We offer a complimentary strategy session to design a whole life policy structure aligned with your financial objectives. During this consultation, our specialists will:

- Create custom illustrations based on your age and situation

- Compare different policy structures for your specific needs

- Show you realistic projections for cash value accumulation

- Answer your questions about implementation

At Insurance and Estates, we’re committed to helping you grow and protect your assets, income, and the people you care about through tailored strategies.

Or call us directly at (877) 787-7558 with any questions.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

4 comments

Darryl Elsley

Please advise the Base Sum Insured in example chart provided. Also what amount of Term Insurance is attaching? The charts do not show Sum Insured at all. Table 3 appears to offer the best value, with immediate Cash Value end of year 1. Why offer tables 1 and 2 ?

Please advise Commission Paid in 1st year, and trails that follow. Also companies that offer this Policy selection. My Agency and clients see value . Thank you.

SJG

Hi Darryl, thanks for connecting. This is outside of the scope of a blog comment in my opinion, so the best way to get more concrete feedback is to schedule a zoom call with Barry Brooksby who offers agent training, etc. You can email him at barry@insuranceandestates.com.

Thanks,

Steve Gibbs for I&E

Darryl Elsley

Please provide further information on the Sum Insured using the 3 tables demonstrated.

How much is the Base Sum Insured and what is the Term Sum Insured also.(Not shown)

Am wondering what are the Benefits of Tables 1 and 2, when the Cash Value under Table 3

commences in year 1 and provides a superior Cash return long term.

What is the commission paid 1st year and trails please?

Name of US companies providing this cover please. My Agency is interested. Thank you.

SJG

Hi Darryl, the best way to get more concrete feedback is to schedule a zoom call with Barry Brooksby who offers agent training, etc. You can email him at barry@insuranceandestates.com.

Best, Steve Gibbs for I&E