A key component of financial and retirement planning is safety – and part of keeping your assets protected is ensuring that your loved ones won’t have to struggle financially when you are gone.

One of the best strategies for doing so includes purchasing life insurance. The proceeds from these policies can be used for a wide variety of needs, such as replacing lost income and paying off debts (possibly even including a mortgage balance).

There are many different types of life insurance policies to choose from, though, and not all of them can cover the same needs. But if you want a steady plan that provides protection, tax advantages, and guarantees, whole life insurance could be a viable option.

As with other financial “tools,” there can be both advantages and drawbacks with whole life, depending on the specific objectives you’re trying to attain. So, it is important to consider whole life insurance pros and cons before making a commitment to purchase a policy.

Table of Contents

- What is Whole Life Insurance and How Does It Work?

- The Tax Advantages of Whole Life Insurance

- Term vs. Whole Life Insurance: Key Differences

- Types of Whole Life Insurance Policies

- Additional Features Beyond the Death Benefit

- Accessing Cash Value: Withdrawals vs. Policy Loans

- Whole Life Insurance Cost Breakdown

- The Pros and Cons of Whole Life Insurance

- How Whole Life Compares to Other Financial Vehicles

- Real-World Examples: How Whole Life Works in Practice

- Who Should (and Shouldn’t) Consider Whole Life Insurance

- How to Find the Right Whole Life Insurance Policy

- Frequently Asked Questions

What is Whole Life Insurance and How Does It Work?

Whole life insurance is a type of permanent life insurance that offers death benefit protection, as well as a cash value, or savings, component. Once an insured is approved for whole life insurance, the policy will remain in force for as long as the premium is paid.

If the insured dies while the whole life policy is in force, the death benefit will be paid out to one or more named beneficiaries. Death benefit proceeds are usually free of income taxation to the recipient(s).

Note: Unlike term life insurance that expires after a specified period, whole life insurance provides lifelong coverage with guaranteed death benefits and cash value accumulation, as long as premiums are paid.

The funds that are in the cash value of a whole life insurance policy grow tax deferred. This means that there is no tax due on the gain unless or until it is withdrawn, which in turn, can provide more growth.

This continuous growth makes whole life a great option for anyone looking for a true compound interest account because interest can grow on the premium contributions that you make, as well as on prior interest, and on the funds that would have otherwise been lost to taxation each year.

Whole life insurance policyholders may either withdraw or borrow cash from the policy. However, in the early years of a whole life insurance policy, a surrender – or early withdrawal – charge may be incurred if money is accessed before a certain amount of time has elapsed.

The Tax Advantages of Whole Life Insurance

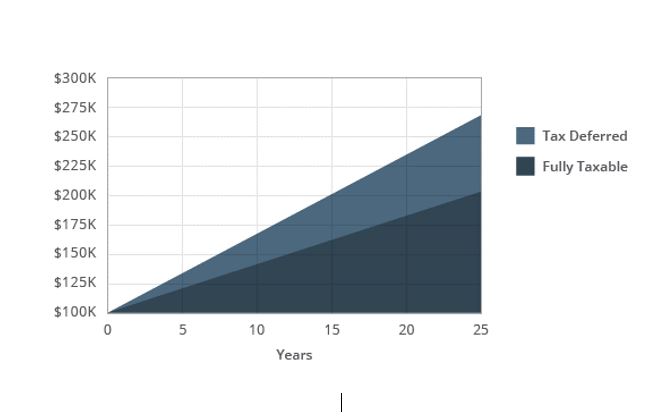

Comparison of Fully Taxable and Tax-Deferred Growth

(With all other factors being equal)

The above chart shows the difference in the growth of an account funded with $100,000 growing over 25 years at 4% in a tax deferred versus a fully taxable account. In 25 years, the tax deferred account would grow to $266,583 versus $208,691 in a taxable account with a 25% tax rate, a difference of $57,892.

Understanding the Full Tax Picture

The tax advantages of whole life insurance extend beyond just tax-deferred growth. Here’s a comprehensive look at the tax implications:

- Tax-Deferred Cash Value Growth: As illustrated above, your cash value grows without annual taxation on the gains.

- Tax-Free Death Benefit: The death benefit paid to your beneficiaries is generally income tax-free.

- Tax-Free Policy Loans: When you borrow against your policy’s cash value, these loans are not considered taxable income.

- Tax-Free Dividend Payments: Dividends received from participating policies are considered a return of premium and not taxable (as long as they don’t exceed the total premiums paid).

Warning: If you surrender a policy with cash value that exceeds the total premiums paid (your basis), you will owe income tax on the gain. Additionally, if your policy becomes a Modified Endowment Contract (MEC) due to overfunding, different tax rules will apply to withdrawals and loans.

Understanding these tax nuances is crucial for maximizing the benefits of your whole life policy while avoiding potential tax pitfalls. Working with both a qualified insurance professional and tax advisor is recommended when implementing whole life insurance as part of your financial strategy.

Term vs. Whole Life Insurance: Key Differences

Although whole life will initially cost more in premium than a term life policy (with all other factors being equal), the amount of the premium is guaranteed not to go up with the whole life option. This differs from term life insurance which offers only death benefit protection – and no cash value build-up – for a set period of time.

Whole life insurance is often purchased for more permanent coverage needs, such as estate planning and/or income replacement for survivors (versus “temporary” needs that someone would choose term life for, like the payoff of a 30-year mortgage balance or college funding for a child or grandchild).

Please see our article which compares whole life vs term life for more.

| Feature | Whole Life Insurance | Term Life Insurance |

|---|---|---|

| Duration | Lifetime coverage | Temporary (10, 20, 30 years) |

| Premium | Higher but fixed for life | Lower initially, increases at renewal |

| Cash Value | Builds cash value over time | No cash value component |

| Flexibility | Can borrow against cash value | No borrowing capabilities |

| Guaranteed Death Benefit | Yes, for life | Yes, but only during term period |

| Ideal Uses | Estate planning, permanent needs, cash value growth | Temporary needs, mortgage protection, children’s education |

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

Types of Whole Life Insurance Policies

Even though whole life insurance is one of many permanent life insurance policy options, this form of coverage can be broken down even further. Some different types of whole life insurance can include the following:

Participating Whole Life Insurance

Some whole life insurance policies pay dividends to their policy holders. These policies – that are referred to as participating, or “par” – are offered via mutual insurance companies. (Mutual insurance companies are owned by their policy holders, as versus stock insurance companies that are owned by their stockholders).

Dividends are considered to be excess profits of the insurer, and as such, they are treated as a non-taxable return of a portion of the premium. Dividends may be received directly in cash, or alternatively they can be added to the policy’s cash value, or even used for buying additional death benefit coverage. While dividends are never guaranteed, there are some mutual insurance companies that have paid dividends consecutively each year for more than a century.

Non-Participating Whole Life Insurance

Contrast a participating policy with non-participating life insurance, or “non-par” whole life insurance policy, the offering insurance carrier assumes all of the future performance risk. This means that if the cost of future claims has been underestimated by the insurer, the company will make up the difference.

The opposite is true, too, in that if the future claims’ cost has been overestimated, the insurer may retain the difference. Non-participating life insurance policies do not pay dividends.

Limited Pay Whole Life Insurance

With a limited pay whole life insurance policy, the coverage can be “paid up” (and require no additional premiums) over a set period of time. For example, a 7-pay policy will require only seven (annual) premium payments after which there would be no more payments due.

Limited pay whole life policies will typically build up cash faster than a straight life policy (i.e., a policy that requires premiums to be paid throughout the lifetime of the policy).

Single Premium Whole Life Insurance

A single premium whole life insurance policy charges just one up-front premium, after which the plan is fully funded. These policies can build up cash value very quickly because of the large premium that is paid in. The amount of the death benefit will depend on the age and health of the insured (at the time of application), as well as the amount of premium that is contributed.

Some single premium whole life insurance policies allow the insured to access the death benefit for paying long-term care and / or other health-related costs. (These withdrawals will generally decrease the amount of death benefit that is ultimately paid out to the beneficiary).

Modified Whole Life Insurance

Modified whole life insurance allows the policy holder to pay less premium than usual for an agreed upon amount of time. Once the time period has elapsed, the policy’s premium payments will increase to an agreed upon amount, which is typically more than usual for that type of policy, as a type of “tradeoff” for the earlier lower cost.

Graded Premium Whole Life Insurance

Graded premium whole life insurance is a type of modified life insurance that provides for annual increases in premiums for a set amount of death benefit during a pre-determined period of time. The purpose of graded premium policies is to make the initial premium payments more affordable.

Intermediate Premium Whole Life Insurance

An intermediate premium whole life insurance policy is like a non-participating whole life policy, except that it offers adjustable premiums. For example, the insurer will charge a “current” premium that is based on its estimate of investment earnings, mortality, and expense costs.

However, if these estimates change over time, the insurer will adjust the premium accordingly – but the cost will never go above the maximum guaranteed premium that is stated in the policy.

Current Assumption Whole Life Insurance

A current assumption whole life policy is a “hybrid” combination of traditional cash value life insurance and universal life. When this type of policy is initially purchased, the death benefit and the premium will be fixed – but only for a certain period of time. At the end of this time period, these items may be recalculated.

Because there are so many different forms of whole life insurance, it is important to work with an insurance specialist who can guide you towards the best option for your specific needs and objectives.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

Other Whole Life Insurance Features Beyond the Death Benefit

While many people think only of the death benefit that is offered with life insurance, whole life policies can provide many additional features, too – and some that can be used while the insured is still alive.

For instance, in addition to the “base” policy, whole life insurance can be further customized to meet specific goals by adding one or more optional policy riders. Some common riders that may be found on whole life insurance include:

- Guaranteed Insurability Rider – A guaranteed insurability rider allows the policy holder to purchase additional death benefit coverage without the need for a medical examination.

- Accidental Death Rider – The accidental death rider pays an additional amount of death benefit if the insured passes away due to an accident. Typically, the insured must die within a certain amount of time (usually within 90 days) after the accident.

- Waiver of Premium Rider – If the insured becomes injured or ill and is unable to work and generate income, the waiver of premium rider allows him or her to stop making premium payments (at least for a period of time) so that the policy will remain in force.

- Family Income Benefit Rider – A family income benefit rider can provide regular monthly income to family members after the insured passes away.

- Accelerated Death Benefit Rider – The accelerated death benefit rider allows the insured to access some – or even all – of the death benefit, penalty-free, while he or she is still alive. This is typically triggered if the insured is diagnosed with a terminal illness or if they must reside in a nursing home for at least a certain period of time (such as 90 or more days).

- Child Term Rider – A child term rider will pay a death benefit if a covered child passes away before they reach a certain age.

- Long-Term Care Rider – With a long-term care rider, monthly payments are made if the insured must receive long-term care services – either in a facility or at home.

Note: These riders can transform a simple life insurance policy into a comprehensive financial tool that addresses multiple concerns including disability, long-term care needs, and guaranteed future insurability. However, each rider adds to the premium cost, so careful selection based on your specific needs is essential.

Accessing Cash from the Whole Life Insurance Cash Value Component

You can typically access cash from a whole life insurance policy in a couple of different ways. These include withdrawals and loans. If you withdraw money from the cash component, you will incur taxes on any amount that is considered gain.

In addition, if the policy is still within its surrender charge period, you could also be subject to an early withdrawal, or “surrender,” penalty, which can reduce the amount of money that you net by even more. With that in mind, taking direct cash value withdrawals should only be considered as a last resort.

Understanding Policy Loans: Benefits and Risks

Another option for accessing cash from a whole life insurance policy is through a loan. Although many people are uncomfortable with borrowing money, a life insurance loan could provide several enticing benefits.

For instance, life insurance loans are not taxable. Therefore, you will be able to use 100% of the funds from the loan. Plus, these loans are actually from the insurance company, using the cash in your policy as collateral (versus borrowing directly from the cash value). Because of that, 100% of your funds will still be generating interest.

As an example, if you have $100,000 of cash value in a whole life insurance policy, and you borrow $50,000, interest will continue to be generated on $100,000. As an added bonus, even though the insurer will charge interest on the loan, if the funds are not fully repaid at the time of the insured’s passing, the remaining balance will be paid off using the death benefit proceeds (with the remainder of the money then going to the beneficiary).

Warning: While policy loans offer significant advantages, they also come with potential pitfalls. Unpaid loan interest can compound over time, potentially causing the total loan balance (principal plus interest) to exceed the cash value. If this happens, the policy may lapse unless additional premiums are paid. A lapsed policy with outstanding loans can trigger taxable income on the gain, potentially creating a significant tax bill without the cash to pay it.

The table below shows how policy loan interest can accumulate if left unpaid:

| Year | Initial Loan | Loan Interest Rate | Outstanding Balance |

|---|---|---|---|

| 1 | $50,000 | 5% | $52,500 |

| 5 | $50,000 | 5% | $63,814 |

| 10 | $50,000 | 5% | $81,445 |

| 15 | $50,000 | 5% | $103,946 |

Careful management of policy loans is essential to preserve both the policy’s cash value and death benefit over the long term.

Whole Life Insurance Cost Breakdown

Understanding the true cost of whole life insurance requires looking beyond just the premium amount. Here’s a breakdown of the various costs associated with whole life policies:

Premium Allocation

During the first several years of a whole life policy, your premium dollars are typically allocated as follows:

- Cost of Insurance: Approximately 30-40% of premiums go toward the actual insurance protection (mortality costs)

- Agent Commissions: Typically 55-90% of first-year premium, dropping to 3-5% in renewal years

- Administrative Fees: Around 10-15% for policy administration, record keeping, and servicing

- Cash Value Contribution: The remainder goes toward building cash value (often minimal in early years)

Surrender Value Schedule

This allocation pattern explains why whole life policies have limited surrender value in the early years. A typical surrender value schedule might look like this:

| Policy Year | Premium Paid (Cumulative) | Available Cash Value | % of Premium Accessible |

|---|---|---|---|

| 1 | $10,000 | $1,000-$2,000 | 10-20% |

| 3 | $30,000 | $15,000-$18,000 | 50-60% |

| 5 | $50,000 | $35,000-$40,000 | 70-80% |

| 10 | $100,000 | $95,000-$105,000 | 95-105% |

| 20 | $200,000 | $240,000-$280,000 | 120-140% |

Note: The longer you hold a whole life policy, the more cost-efficient it becomes. The high upfront costs are eventually offset by policy growth, demonstrating why whole life insurance should be viewed as a long-term commitment rather than a short-term financial solution.

The Pros and Cons of Whole Life Insurance

There is no financial or insurance vehicle that is right for all investors across the board. But overall, there are some universal pros and cons when it comes to owing a whole life insurance policy.

Whole Life Insurance Benefits

Some of the key benefits of having whole life insurance include:

- Premium is locked in for life – Unlike term policies where renewal rates can increase dramatically

- Guaranteed death benefit coverage – Provides lifelong protection that doesn’t expire

- Principal protection on cash value – Your cash value won’t decrease due to market fluctuations

- Cash grows tax deferred – Growth compounds without annual tax drag

- May access cash from the policy – Provides liquidity through withdrawals or loans

- May be protected from creditors – In many states, offers asset protection benefits

- Dividend potential – Participating policies may provide additional growth through dividends

- Estate planning benefits – Bypasses probate and provides tax-free death benefit to heirs

One of the primary reasons why whole life insurance is attractive is because the premium remains the same throughout the entire lifetime of the policy. This can make it easier to budget for over time.

In addition, while the amount of a whole life insurance premium may be higher than that of a comparable term insurance policy initially, over time, the whole life premium will not increase.

The guaranteed death benefit on a whole life insurance policy means that your loved ones will have a known amount of financial protection in place, regardless of what happens in the stock market, with interest rates, or in the overall economy (as long as the policy’s premiums are paid).

And even though the return on the whole life policy’s cash value is typically on the lower end (4-5%), due to its tax-advantaged nature, these funds can increase exponentially over time. In fact, compared to other financial vehicles that could generate more growth, if losses are incurred, the end result with the latter could be a lower account value (in addition to more stress and worry).

Take, for instance, an account that fluctuates between generating a 10% gain and incurring a 10% loss each year for ten years. By the end of the tenth year, the value would be roughly 5% less than the amount you initially contributed. This is because whenever there are losses in the mix, the actual return can be adversely impacted.

| End of Year | Gain or Loss | Value of Account |

|---|---|---|

| 1 | 10% | $1,100.00 |

| 2 | (-10%) | $990.00 |

| 3 | 10% | $1,089.00 |

| 4 | (-10%) | $980.10 |

| 5 | 10% | $1,078.11 |

| 6 | (-10%) | $970.30 |

| 7 | 10% | $1,067.33 |

| 8 | (-10%) | $960.60 |

| 9 | 10% | $1,056.66 |

| 10 | (-10%) | $950.99 |

If, however, you take a lower guaranteed return that is combined with principal protection (i.e., there are no losses in any given year), along with tax deferred growth, the outcome can be very different.

| End of Year | Guaranteed Interest Rate | Value of Account |

|---|---|---|

| 1 | 4% | $1,040.00 |

| 2 | 4% | $1,081.60 |

| 3 | 4% | $1,124.86 |

| 4 | 4% | $1,169.86 |

| 5 | 4% | $1,216.65 |

| 6 | 4% | $1,265.32 |

| 7 | 4% | $1,315.93 |

| 8 | 4% | $1,368.57 |

| 9 | 4% | $1,423.31 |

| 10 | 4% | $1,480.24 |

Funds from the cash value can also be accessed by the policy holder by way of withdrawals and/or loans. The gains on the withdrawals will usually be taxable. But the funds that are accessed as a loan are not taxed, nor will they impact the interest-generating “base” in the policy’s cash value.

Creditor Protection

In some states, cash value life insurance is protected from creditors, including bankruptcy. This protection may include both the death benefit and the funds that are in the cash component. In some cases, the amount of this protection is capped at a pre-set minimum, while in others it can be unlimited.

Items to Consider Regarding Whole Life Insurance Policies

Although whole life insurance can provide numerous benefits – both before and after the insured passes away – there are some items to consider before you make a long-term commitment to purchasing this type of coverage.

- Higher premiums – Significantly more expensive than term insurance for the same death benefit

- Complexity – More difficult to understand than simpler insurance products

- Early liquidity limitations – Limited access to cash value in early years

- Surrender charges – Penalties for early policy termination

- Potentially lower investment returns – Compared to direct market investments

- Inflexible premiums – Payment must be maintained to keep policy in force

- Opportunity cost – Capital could potentially grow faster in alternative investments

- Agent incentives – High commissions may influence sales recommendations

Considerations for Commitment and Eligibility

Whole life insurance requires a long-term financial commitment due to higher premiums and limited early liquidity. Surrender charges may apply in the first several years, and withdrawals could incur taxes or penalties. As long as the premium is current, though, the plan will remain in force – even as the insured ages and regardless of whether they contract a health condition that would otherwise deem them uninsurable.

Applicants must qualify based on age and health at the time of application, so applying early can secure lower premiums and ensure coverage. It’s also important to analyze the opportunity cost – what you might earn if you invested the premium difference between whole life and term insurance in other financial vehicles.

| Strategy | Year 10 | Year 20 | Year 30 | Risk Profile |

|---|---|---|---|---|

| Whole Life Cash Value | $90,000 | $220,000 | $400,000 | Guaranteed+ |

| Term + Index Fund (7% avg) | $102,000 | $275,000 | $565,000 | Market Risk |

| Term + Bonds (4% avg) | $85,000 | $205,000 | $380,000 | Interest Rate Risk |

Warning: This comparison doesn’t account for taxes on alternative investments or the additional benefits of whole life policies (creditor protection, guaranteed death benefit, etc.). Your personal financial situation, risk tolerance, and goals should guide your decision.

| Whole Life Insurance Advantages | Whole Life Insurance Disadvantages |

|---|---|

| The coverage doesn't "expire" (provided that the premium is paid) | Premium is usually higher than term life insurance with the same coverage (at least initially) |

| Premium typically doesn't increase over time | Not 100% of your cash value is liquid during the early years |

| Guaranteed interest rate on cash value | The insured must qualify for the policy |

| Cash value grows tax-deferred | Policies can be more complex than basic term life insurance coverage |

| May pay dividends | Dividends are not guaranteed (or even available) on some policies |

| Principal is protected in any type of market or economic environment | In a traditional whole life policy, lower return on cash value compared to the potential growth on other products |

| May access cash via withdrawals or loans | |

| Death benefit is income tax-free to the beneficiary(ies) | |

| Could add additional riders to "customize" the policy for specific needs | |

| May be protected from creditors |

How Whole Life Compares to Other Financial Vehicles

To make an informed decision about whole life insurance, it’s helpful to see how it compares to other financial strategies. Each vehicle has its place in comprehensive financial planning, with distinct advantages and drawbacks.

| Feature | Whole Life Insurance | 401(k)/IRA | Traditional Savings |

|---|---|---|---|

| Control | Owner-controlled | Employer/government rules | Full control |

| Liquidity | Loans anytime (limited early value) | Penalties before 59½ | Immediate access |

| Tax Treatment | Tax-deferred growth, tax-free loans | Tax-deferred, taxed on withdrawal | After-tax contributions, taxable growth |

| Legacy/Inheritance | Direct, tax-advantaged | Subject to RMDs, taxes | Subject to probate, potentially taxable |

| Market Risk | Low (guaranteed values) | High (market exposure) | Very low (FDIC insured) |

| Growth Potential | Moderate (4-6% long-term) | High (7-10% historical) | Low (0.5-2% typical) |

| Contribution Limits | Flexible (no IRS limits) | Strict annual caps | Unlimited |

Whole Life vs. Universal Life

Whole life insurance is just one type of permanent life insurance. Universal life insurance offers more flexibility but with different guarantees and risks:

| Feature | Whole Life | Universal Life |

|---|---|---|

| Premium Flexibility | Fixed premiums | Adjustable premiums |

| Death Benefit | Fixed and guaranteed | Adjustable, may not be guaranteed |

| Cash Value Growth | Guaranteed plus potential dividends | Based on interest rates, may not be guaranteed |

| Policy Expenses | Built into premium, not transparent | Transparent, deducted from account |

| Policy Management | Simpler, fewer decisions required | More complex, requires regular monitoring |

| Ideal For | Predictability and guarantees | Flexibility and customization |

Within the universal life insurance category, there are several variations including indexed universal life (IUL) and variable universal life (VUL), each with different investment components that affect potential returns and risk levels.

Real-World Examples: How Whole Life Works in Practice

To better understand how whole life insurance functions in real-life scenarios, let’s examine several case studies of policyholders with different needs and circumstances.

Case Study 1: Business Owner’s Estate Planning

Client Profile: Michael, 45, business owner with $2 million company valuation

Challenge: Needs estate liquidity for business succession and potential estate taxes

Solution: $2 million participating whole life policy

Outcome: Michael’s $2 million whole life policy provides immediate estate liquidity upon his death, ensuring his children can either purchase the business from his estate or pay estate taxes without selling the business at a discount. Meanwhile, the policy’s growing cash value serves as an emergency fund for his business and a supplemental retirement asset. After 20 years, the cash value had grown to approximately $1.6 million, which Michael began accessing through policy loans to supplement his retirement income without triggering tax consequences.

Case Study 2: Young Family’s Financial Foundation

Client Profile: Jennifer and David, early 30s, two young children

Challenge: Need insurance protection but also want to build savings

Solution: $500,000 whole life policy with multiple riders

Outcome: The policy provided immediate death benefit protection for the family while building cash value for future needs like college funding. The additional riders (waiver of premium, guaranteed insurability, child term) created a comprehensive safety net. When Jennifer later needed funds for starting a business, she accessed $50,000 from the policy’s cash value through a policy loan, effectively self-financing her business startup with flexible repayment terms. The policy’s growing cash value also became their most stable financial asset during the 2008 financial crisis, maintaining its value while their other investments lost significant value.

Case Study 3: Retirement Planning Enhancement

Client Profile: Robert, 50, high-income professional with maxed-out retirement accounts

Challenge: Needs additional tax-advantaged retirement savings vehicle

Solution: $1 million limited-pay whole life policy (paid up at age 65)

Outcome: After maximizing his 401(k) and IRA contributions, Robert used a 15-pay whole life policy as a supplemental retirement planning tool. By age 65, the policy was fully paid up with no more premiums due, and the cash value had grown to approximately $1.4 million. Robert began taking systematic policy loans to generate tax-free retirement income of about $70,000 annually, complementing his other retirement accounts and Social Security. The approach gave him greater tax control in retirement, keeping him in a lower tax bracket than if he had relied solely on taxable 401(k) withdrawals.

Note: These case studies demonstrate how whole life insurance can serve multiple purposes simultaneously: death benefit protection, tax-advantaged savings, and financial flexibility. The key in each scenario was matching the policy design to the specific needs and objectives of the policyholder.

Who Should (and Shouldn’t) Consider Whole Life Insurance

Whole life insurance isn’t suitable for everyone. Understanding who should and shouldn’t consider this financial tool can help you make a more informed decision based on your personal circumstances.

Whole Life Insurance May Be Appropriate For:

- High-Income Professionals who have maxed out tax-advantaged retirement accounts and seek additional tax-favored saving opportunities

- Business Owners looking for additional retirement planning options, business succession funding, or key person protection

- Individuals with Permanent Insurance Needs who want lifelong coverage regardless of future health changes

- Estate Planning Situations where life insurance proceeds can provide liquidity for taxes or equalization among heirs

- Individuals with Special-Needs Dependents who require permanent financial protection

- Conservative Investors who prioritize guaranteed growth and principal protection over higher returns with risk

- Those Seeking Asset Protection in states where life insurance enjoys strong creditor protection

- Individuals Who Want Tax-Free Income in Retirement to complement taxable retirement account withdrawals

Whole Life Insurance May Not Be Suitable For:

- Young Families on Tight Budgets who may be better served by more affordable term insurance

- Individuals Behind on Retirement Savings who should prioritize maximizing 401(k)/IRA contributions

- Those with Short-Term Financial Goals due to the long-term nature of whole life policies

- Individuals Seeking Primarily Investment Growth who might achieve better returns elsewhere

- Those with Temporary Insurance Needs (such as income replacement during working years only)

- People with Unstable Income who may struggle with the required premium commitment

- Those with Limited Cash Flow who would be stretching financially to afford premiums

- Individuals Nearing Retirement without adequate liquid savings who may not benefit from the long-term nature of whole life

Warning: The decision to purchase whole life insurance should be part of a comprehensive financial planning process that considers your individual goals, resources, time horizon, and risk tolerance. What works well for one person may be entirely inappropriate for another, even with similar financial profiles.

How to Find the Right Whole Life Insurance Policy

There are many “moving parts” involved when shopping for whole life insurance. In addition, while these policies are often structured similarly, they can also offer different features. So, it can help to have a “guide” with you who can help sort out which option(s) may be right for you and your specific needs.

Steps to Finding the Right Whole Life Policy

- Clarify Your Financial Goals – Determine exactly what you want the policy to accomplish (death benefit protection, cash accumulation, tax advantages, etc.)

- Work with a Specialist – Seek an independent agent who specializes in permanent life insurance and works with multiple carriers

- Compare Insurance Carriers – Look at financial strength ratings (A.M. Best, Moody’s, S&P) and dividend histories for participating policies

- Request Multiple Illustrations – Get detailed projections from several companies to compare guarantees, dividends, and cash value growth

- Review Policy Design Options – Consider riders, premium structures (limited pay vs. lifetime), and balance between death benefit and cash value focus

- Understand the Costs – Get transparency on commissions, fees, and surrender charges

- Consider Your Health Status – Some companies have more favorable underwriting for specific health conditions

A life insurance specialist could also assist with picking insurance carriers that may be more apt to approve you for coverage if you have certain health issues and/or you are seeking certain add-ons to the policy.

Frequently Asked Questions About Whole Life Insurance

Is whole life insurance a good investment?

Whole life insurance is best viewed as a unique financial tool rather than strictly an investment. It combines permanent life insurance protection with tax-advantaged cash value growth and offers benefits like tax-free loans and creditor protection that most investments don’t provide. However, the returns on cash value generally range from 4-6% long-term, which is typically lower than what stock market investments might achieve over similar time periods. The greatest value comes when utilizing all aspects of the policy – protection, cash value growth, tax advantages, and policy loans – rather than focusing solely on rate of return.

How long does it take for a whole life policy to build cash value?

Cash value begins building from the first premium payment, but the rate of growth follows a curve. In the early years (typically years 1-5), cash value growth is slower as more of your premium goes toward policy expenses and commissions. Growth accelerates in the middle years (years 6-15) as more of each premium is allocated to cash value. The most substantial growth typically occurs in later years (15+) when the compounding effect becomes more significant. Well-designed policies may provide access to 70-80% of premiums paid by year 5 and 100% by years 8-10. Policy design significantly impacts this timeline – policies structured for maximum cash value (with paid-up additions riders) build value faster than those optimized for death benefit.

What happens if I stop paying premiums on my whole life policy?

If you stop paying premiums on a whole life policy, you have several options. First, if you have enough cash value, you can use automatic premium loans where the insurance company loans you the premium amount using your cash value as collateral. Second, you can convert to a reduced paid-up policy where your coverage continues with a lower death benefit and no future premiums required. Third, you can surrender the policy and receive the cash surrender value (potentially triggering taxes on gains). Fourth, you can convert to extended term insurance, which provides the full death benefit for a limited time period. The availability of these options depends on how long you’ve had the policy and how much cash value has accumulated.

How do dividends work in a participating whole life policy?

Dividends in participating whole life policies represent a return of excess premium to policyholders when the insurance company’s actual experience is more favorable than its conservative projections for mortality, investment returns, and operating expenses. While never guaranteed, top mutual companies have consistently paid dividends for over 100 years, even through world wars and the Great Depression. Policyholders can choose to receive dividends in cash, use them to reduce premiums, purchase paid-up additions (mini policies that increase both death benefit and cash value), accumulate at interest, or repay policy loans. Dividends are considered a return of premium for tax purposes and are therefore not taxable income (unless they exceed the total premiums paid into the policy).

Can I use my whole life insurance cash value for retirement income?

Yes, whole life insurance cash value can be effectively used as a retirement income source through policy loans. This approach offers several advantages: the income is tax-free (as policy loans aren’t considered taxable income), doesn’t count as income for Social Security benefit taxation purposes, has no government-mandated withdrawal requirements like RMDs, and is flexible (you can vary the amount based on needs). The strategy typically involves taking systematic policy loans beginning at retirement. These loans reduce the death benefit if not repaid, but the remaining death benefit can still provide a legacy for heirs. This strategy works best when the policy has been in force for 15+ years before beginning withdrawals and is most suitable as a complement to other retirement income sources rather than the sole income source.

Should You Add a Whole Life Insurance Policy to Your Financial Plan?

While whole life insurance isn’t suitable for everyone, it could be a good fit if you want to:

- Ensure that the coverage will remain in force, even if you become ill or injured (i.e., if you are rendered uninsurable) in the future

- Build up tax-deferred cash value that can be used for paying off higher-interest debt, replacing lost income, taking a vacation, buying real estate, or supplementing future retirement income

- Add to your tax-advantaged savings – even if you have “maxed out” the annual contribution to other qualified savings options such as an IRA (Individual Retirement Account) and / or employer-sponsored retirement plan

- Be assured that your premium will not increase over time

- Plan ahead for an unknown time period

- Fund business succession needs, such as a key person life insurance strategy

Conclusion: Balancing Whole Life Insurance Pros and Cons for Your Situation

Whole life insurance represents a unique combination of permanent life insurance protection, tax-advantaged cash value growth, and financial flexibility not found in most other financial products. While its higher premiums and complexity make it inappropriate for some, those who understand its mechanics and align it with appropriate long-term goals may find it a valuable component of their financial strategy.

The key to success with whole life insurance is twofold: proper policy design and appropriate expectations. A well-designed policy from a financially strong company, structured to meet your specific objectives, can serve multiple purposes simultaneously – providing death benefit protection, tax-advantaged growth, and financial flexibility through policy loans.

However, whole life should rarely be your only financial strategy. It works best as part of a comprehensive plan that may include qualified retirement accounts, other investments, and term insurance where appropriate. The goal is not to choose between whole life and other financial strategies, but rather to determine how they can work together to achieve your unique goals.

At Insurance and Estates, our primary focus is on helping our clients protect what they have worked for and ensuring that their loved ones won’t suffer financially in the event of the unexpected.

So, if you would like to chat with one of our life insurance specialists about adding more flexibility and protection to your financial plan, feel free to reach out to Insurance & Estates by calling (877) 787-7558 or by sending us an email through our online contact form at info@insuranceandestates.com. We look forward to assisting you.

Explore Whole Life Insurance for Your Financial Future

Not sure if whole life insurance fits your financial goals? Our expert team at Insurance and Estates offers a personalized consultation to help you determine if whole life’s guarantees, tax advantages, and flexibility are right for you.

- ✓ Receive a customized analysis of how whole life can meet your specific needs

- ✓ Compare whole life to term, universal life, and other financial strategies

- ✓ Understand tax-deferred growth, policy loans, and dividend potential

- ✓ Get clear insights on costs, riders, and long-term benefits

Schedule your complimentary 30-minute whole life insurance consultation today to build a secure, tax-advantaged financial plan.

No obligation. No sales pressure. Just expert guidance to help you decide if whole life insurance is the right tool for your long-term financial strategy.