Cash Flow Banking: A Powerful Alternative for Wealth Growth and Financial Control

With the constant volatility of the stock market, many investors and retirees are looking for alternative sources for growing and protecting their wealth, as well as for funding large purchases and other investments. One alternative is cash flow banking – a strategy that uses a properly structured whole life insurance policy as an alternative to traditional bank accounts, with a focus on increasing cash flow to regain control of your money.

In addition to providing a guaranteed return, tax advantaged growth, and protection of funds in any type of market or economic environment, though, a cash flow banking strategy using a whole life insurance policy offers some additional enticing features, such as your own banking system where you can quickly and easily access funds for making high-dollar purchases like real estate, as well as a tax-free supplement to your retirement income.

Further, unlike traditional investments, because the cash flow banking strategy uses a whole life insurance chassis, the tax free death benefit can provide an additional financial “safety net” for your loved ones and survivors.

Table of Contents

- What is Cash Flow Banking?

- How Does Cash Flow Banking Work

- Cash Flow Banking vs Traditional Bank Account

- Cash Flow Banking Pros

- Cash Flow Banking Cons

- Pros and Cons of Cash Flow Banking Chart

- Is Cash Flow Banking Right for You?

- Frequently Asked Questions About Cash Flow Banking

What is Cash Flow Banking?

Because the funds in the cash value account grow tax deferred, it can enhance the compound growth accumulation potential. And, when the whole life insurance policy is purchased from a mutual insurance company, you may also receive dividends – which can add to the tax advantaged growth of your cash value.

With the cash flow banking method, you can access the funds from your whole life insurance policy’s cash value account 100% tax free at any time via policy loans, and the money can be used for any purpose. Therefore, cash flow banking can increase your liquidity and give you more control over how you use your money.

There are various other names that cash flow banking may go by, including:

- Infinite banking (or the Infinite Banking Concept – IBC)

- Family banking concept

- Private family banking

- Bank on Yourself

When your whole life insurance policy is structured properly, your cash flow banking account does not have to be reported to the IRS. In fact, a cash flow banking system is completely outside of the government’s and Wall Street’s control. It is also protected from creditors and lawsuits – including bankruptcy – in most states.

How Does Cash Flow Banking Work

With whole life insurance policies the gains in the cash value account are not taxed every year. This differs from personal investments and traditional retirement plans where Uncle Sam “shares” in the profits, in turn, significantly slowing down the growth over time.

Although cash from the whole life insurance policy can be withdrawn, the gains are considered taxable in this case. An alternative is to borrow money from the policy’s cash value, which allows you to access the money tax free, which is a huge focus with cash flow banking.

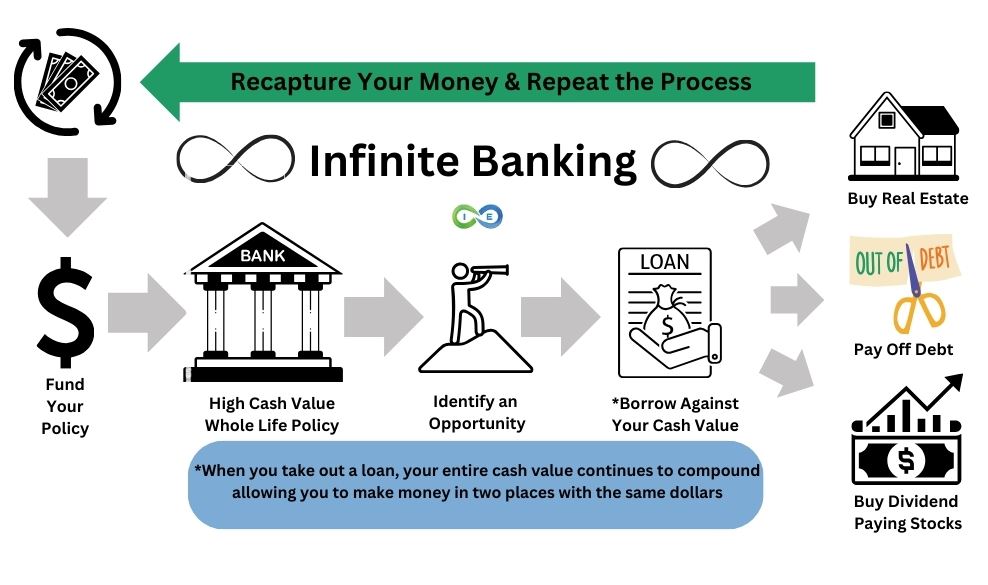

When you access your cash flow banking policy’s cash value through a loan, the full amount of the cash value will continue to generate a guaranteed return plus potential dividends. You entire cash value is still growing with guaranteed interest and dividends because you are actually borrowing from the underlying insurance company and using your cash value as collateral, which allows you to earn compounded returns in your cash flow banking policy and in a potential investment that you borrowed against your policy to obtain.

So, as an example, if your cash flow banking policy’s cash value is $100,000 and you borrow $50,000, a return will continue to be generated on the full $100,000 in your cash value account. Given that, the cash flow banking concept allows you to use the same dollars in two places at once. The cash flow banking process is even further enhanced by using a policy loan to purchase other investments – such as real estate or businesses – to recapitalize your cash flow banking life insurance policy and repeat the process over and over again.

Social Proof

Cash flow banking is not a new concept. In fact, it has been used for more than a century by some of the wealthiest families and largest corporations in the country.

It is possible that you have not heard of cash flow banking – even though it has been used successfully for many years. One of the biggest reasons for this is because since the 1970s, financial advisors have focused primarily on the “Wall Street promise” of building wealth only in the context of the stock market and have advocated for buy term and invest the difference.

Although some of today’s well-known financial entertainers like Dave Ramsey and Suze Orman tell people to steer clear of whole life insurance policies, the Wall Street Journal recently reported that the cash flow banking concept “has become a tax shelter for the rich” and that “it gives the affluent tax advantages far beyond those available to middle income people through a 401(k) or IRA.”

And the good news is that you don’t have to be rich in order to take advantage of the cash flow banking method. Many people get started with an investment as small as just $200 per month. But before you move forward, it is important to understand both the pros and cons of cash flow banking.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

Cash Flow Banking vs Traditional Bank Account

A few key differences stand out when you compare traditional bank savings accounts with cash flow banking life insurance policies. For starters, while the national average yield for savings accounts might hover around 0.58 percent APY, and possibly 4% for a high-yield savings account, with taxes eating into those earnings, a whole life policy not only offers you a guaranteed interest rate of around 3% but could also tack on an extra 2%-4% in dividends, all growing tax-free. This setup could net you 5%-7% tax-free earnings, potentially more if interest rates rise.

With a savings account, the amount you can withdraw is effectively reduced by taxes on your gains, unlike a whole life insurance policy, where the entire surrender value remains accessible for withdrawals. Moreover, whole life insurance lets you borrow against the cash value without needing approval, and you are still earning interest and dividends on your entire cash value account.

Upon your death, while a savings account might offer your beneficiaries a Payable on Death (POD) benefit, a cash flow banking policy delivers a tax-free death benefit, often significantly more substantial than the premiums paid.

The living benefits of whole life insurance, such as chronic illness riders, accelerated death benefits, and creditor protections, offer practical advantages that a traditional savings account can’t match during one’s lifetime. Although no direct costs are associated with maintaining a savings account, the potential for growth and the benefits associated with whole life insurance far outweigh the premiums required to keep the policy active, making it a compelling component of a well-rounded financial strategy.

| Traditional Bank Savings Account | High Cash Value Whole Life Insurance Policy | |

|---|---|---|

| Earnings Rate | The national average yield for savings accounts is 0.58 percent APY as of Dec. 18, 2023 (*Bankrate, December 13, 2023). But actual earnings are less after tax and not guaranteed. | Guaranteed (average) 3% interest. Plus an additional 2%-4% dividends. Tax-free, so net earnings of 5%-7%, which may increase as interest rates increase. |

| Withdrawals and Earnings | Amount available for withdrawals is lower because gains in the account are taxable. | Full amount of cash value is available for withdrawals. |

| Loans | Does not offer loans. Loan would have to be obtained through a bank or other lender. | Loans are available via the cash value, with no approval needed. Plus, the amount borrowed still continues to generate interest and dividends. |

| Loan Repayment | Amount and due date of repayments is determined by the bank or lender. If payments are late or missed, it negatively impacts your credit score. | No required loan payments. Policyholder determines when and how much is paid - or even IF payments are made. |

| Added Benefits Upon Death | Paid on Death (POD) to a beneficiary. | Death benefit is paid to beneficiary income tax free. |

| Living Benefits | None | ~Chronic Illness Rider - With a chronic illness diagnosis or need for long-term care, funds may be accessed from the death benefit. ~Accelerated Death Benefit - Death benefit funds may also be accessed in the event of a terminal illness diagnosis. ~Protection from 3rd party creditors - In most states, whole life insurance is protected from creditors, lawsuits, and bankruptcy. |

| Costs | Potential savings and checking fees. | Premium is required for death benefit. However, premium payments are leveraged for a larger death benefit payout - which is received income tax free by the beneficiary(ies). |

| Creditor Protection | Minimal. | Creditor protection based on individual state laws. |

Cash Flow Banking Pros

As more investors and retirees realize the benefits of using their money while it still continues to generate a guaranteed (and safe) return, many are turning to cash flow banking. That is because cash flow banking can open up a nearly endless list of financial opportunities for you, such as:

- Enhancing your tax advantaged savings (even if you have already “maxed out” the annual contributions to an IRA and/or employer-sponsored retirement plan)

- Paying off existing debt

- Purchasing investment real estate

- Funding a business (as well as the necessary equipment and/or inventory)

- Buying a new car

- Paying college tuition for yourself or a loved one

Some of the key advantages of using the cash flow banking method include:

- Tax-advantaged growth of the cash value

- Guaranteed return

- Leverage

- Non-correlated asset

- Privacy

- Protection from creditors (in most states)

- Improved liquidity and cash flow

- Tax-free access to cash

Tax Advantaged Growth of the Cash Value

A whole life insurance policy’s cash value grows tax deferred, so that there is no tax due on the gains each year – and this, in turn, allows the account value to increase exponentially, as the cash generates a return on the premium contributions, as well as on the previous gains, and on the funds that would have otherwise been paid in taxes.

When dividends are added to the policy’s cash value, these can further enhance the overall growth – especially because dividends are considered a return of premium and are as such received tax-free. So with your guaranteed returns and dividends, all growing in a tax free environment, your policy is growing in true uninterrupted compound interest fashion.

Guaranteed Return

Whole life insurance policies designed for cash flow banking offer several guarantees – including guaranteed cash value accumulation. This is the case, regardless of what happens in the stock market. In addition, the principal and previous gains are also protected from loss.

Some of the other guarantees that whole life insurance also offers include:

- Guaranteed death benefit – which can provide loved ones with a financial “safety net” for replacing income, paying off debt, or taking care of other needs if the insured passes away

- Guaranteed fixed premiums – because the whole life premiums do not increase, it is easy to budget for…and the whole life insurance premium amount will not go up, even as the insured ages or if they contract an adverse health condition in the future.

Leverage

The whole life policy’s death benefit provides a great deal of leverage – particularly because it offers a guaranteed payout to the beneficiaries, even if the insured dies after only one single premium payment has been made. This is not something that is available on “traditional” retirement saving plans like IRAs and 401(k)s.

In addition, life insurance policy beneficiaries receive the death benefit income tax free. Therefore, these recipients will have use of 100% of the proceeds. This is also not the case for retirement plan beneficiaries who must pay taxes (on distributions from traditional IRAs and retirement plans) and are also required to fully liquidate these retirement accounts within just ten years after the account holder’s passing.

To obtain even more leverage with a cash flow banking life insurance plan, you could add a term life insurance rider to the whole life policy for added death benefit protection in the early years. That way, your loved ones will still have a financial safety net while you concentrate on maximizing the cash value growth in the base policy.

Non-Correlated Asset

Whole life insurance is considered a non-correlated asset because it is free from the volatility of the stock market and the housing market. This is important because your money will remain safe and stable, and it will continue to grow year after year, no matter what else is going on in the economy.

In addition to the financial security this offers, it can also provide you with peace of mind and the ability to focus on other things without the constant worry about losing your savings in the next stock market correction.

Privacy

Cash flow banking also offers privacy. With many other asset classes, anyone – including the IRS – can simply do a search and find out what you own. But with life insurance, the policy information is private. Therefore, details about your life insurance holdings do not show up on credit reports or title searches.

As an added bonus, there is also no credit check required before you take a life insurance policy loan. So, this type of borrowing won’t have a negative impact on your credit score, or even show up on your credit report as a “balance” that you have due.

Protection from Creditors

Many U.S. states offer creditor protection for life insurance. Because of that, if you are involved in a lawsuit or other type of financial situation like bankruptcy, the cash value in your policy may be shielded from creditors.

Note: You should consult with an attorney if you have any questions regarding creditor protection of life insurance cash value in your state.

Tax-Free Access to Cash

One of the primary benefits of using the cash flow banking concept is the easy and fast access to funds tax-free via policy loans. This money can be used for any purpose. Although you can withdraw money, it is taxable to the extent of the gains.

But the funds that you access through loans are tax-free – regardless of what the then-current tax rates are. In addition, even though the insurance company charges interest on the borrowed funds, all of your money will still continue to generate a return.

Improved Liquidity and Cash Flow

Using cash flow banking, you can significantly improve your liquidity and cash flow. This, in turn, can provide you with faster access to funds that you need for purchases and investment opportunities.

For instance, while you may own some valuable assets, do they all allow you to access cash from them quickly and easily?

Doing so can be difficult with real estate. In this case, if you want to gain access to equity in your home or an investment property, you must qualify for a home equity line of credit or do a “cash out” refinance. Depending on the situation, you might even have to sell the property.

Multiple Benefits with the Same Dollars

One of the other big advantages to using cash flow banking is the ability to use the same dollars in two places at one. When you take a policy loan, the full amount of your cash value will continue to generate a return. So, your money is growing in your policy and in your investment.

So if you purchase other cash flowing investments – such as investment real estate – the policy loan can be repaid using the rental income. You can then use the rental income to pay back your loan, allowing you to recapitalize your cash flow banking policy and repeat the process over and over again.

Cash Flow Banking Cons

- Qualification criteria

- Cost

- Discipline

- Not diversified

Qualification Criteria

First, you have to qualify for a cash flow banking policy. Just like other types of life insurance, a whole life insurance policy requires that the insured qualify based on age and health criteria. Given that, if you have any existing health issues at the time you apply for a policy, it may be more difficult to qualify.

When searching for the right policy, it can help if you work with a cash flow banking specialist who has access to multiple insurance carriers. That way, if there is a health concern, they can guide you towards the right insurer for your specific situation.

Cost is Prohibitive

For some investors, cash flow banking may be cost prohibitive. Even though there is no set minimum monthly amount of premium (other than enough to keep the policy in force), in order to truly maximize the cash value, it is recommended that you put approximately 10% of your income into the plan (or at minimum, $200 per month).

Oftentimes, though, it is possible to “find” the additional funds that you may need. For example, cancelling unused memberships, cutting back on certain services (such as the premium cable television package), or selling unneeded items can typically free up cash that could be redirected into a cash flow banking policy.

Discipline that is Required

When you borrow against the cash value in your cash flow banking policy, it is critical that you pay it back. Otherwise, it can slow down the growth and hinder the maximization (as well as possible opportunities going forward).

Cash Value is Not Diversified

Another possible drawback of the cash flow banking strategy is that your funds are not diversified – and this goes against what many financial advisors preach. In this case, traditional investing calls for a mix of assets where some that generate gains can help to offset others that may incur losses during a given time period.

However, there are no losses to your principal – or your previous gains – when you use cash flow banking. So, even though you may have “all of your eggs in one basket” when you use this concept, the value of that basket will continue to generate positive guaranteed returns without concern about any type of negative movements.

With that in mind, by using the cash flow banking concept, you in many ways are automatically diversifying in order to maximize your policy – as well as your wealth, your liquidity, and your legacy goals.

Pros and Cons of Cash Flow Banking Chart

| Cash Flow Banking Advantages | Cash Flow Banking Disadvantages |

|---|---|

| Tax-advantaged growth of the cash value | Qualification criteria |

| Guaranteed return | Cost is prohibitive |

| Leverage | Discipline that is required |

| Non-correlated asset | Cash value is not diversified |

| Private | |

| Protection from creditors | |

| Improved liquidity and cash flow | |

| Tax-free access to cash | |

| Multiple benefits with the same dollars |

Frequently Asked Questions About Cash Flow Banking

What is Cash Flow Banking?

Cash Flow Banking is a strategy that uses a properly structured dividend-paying whole life insurance policy to maximize cash value growth, allowing you to access funds tax-free via policy loans for purchases, investments, or retirement income, while providing a tax-free death benefit.

How does Cash Flow Banking differ from a traditional bank account?

Unlike a traditional bank account, which offers low, taxable interest (0.58%-4% APY), Cash Flow Banking provides 5%-7% tax-free growth through guaranteed interest and dividends, tax-free policy loans, creditor protection in most states, and a tax-free death benefit, enhancing liquidity and control.

What are the main benefits of Cash Flow Banking?

Key benefits include tax-deferred cash value growth, guaranteed returns, tax-free policy loans, creditor protection, privacy, and the ability to use funds for investments while earning returns on the full cash value, plus a tax-free death benefit for beneficiaries.

What are the drawbacks of Cash Flow Banking?

Drawbacks include the need to qualify based on health and age, potentially high premium costs (recommended 10% of income or $200/month minimum), the discipline required to repay policy loans, and lack of diversification, though guaranteed returns mitigate risk.

Who should consider Cash Flow Banking?

Cash Flow Banking is ideal for those seeking tax-advantaged wealth growth, financial independence from Wall Street, and liquidity for investments or debt repayment. It suits investors with stable income who can commit to premiums and want a safe, private alternative to traditional savings.

Is Cash Flow Banking Right for You?

Given the pros and cons of cash flow banking, is this strategy right for you?

Before you make a long term commitment to cash flow banking (or to any other financial tool), it is recommended that you first discuss it with a specialist. That’s where Insurance and Estates can help.

At Insurance and Estates, our mission is to assist our clients with safely growing their wealth, while at the same time having the flexibility and control to use their money for other beneficial purposes.

Start Your Cash Flow Banking Journey

Take Control with Cash Flow Banking

Ready to grow your wealth safely and access funds tax-free? Our team at Insurance and Estates offers a personalized consultation to help you set up a Cash Flow Banking strategy tailored to your financial goals.

- ✓ Discover how to maximize cash value with whole life insurance

- ✓ Learn to use tax-free policy loans for investments or purchases

- ✓ Explore guaranteed returns and creditor protection benefits

- ✓ Plan a secure financial future with a tax-free death benefit

Schedule your complimentary 30-minute Cash Flow Banking consultation today to regain control of your money.

No obligation. No pressure. Just expert guidance to help you build wealth with Cash Flow Banking.