📖 Estimated Reading Time: 21 minutes

Table of Contents

Most people spend their entire lives making banks rich while staying financially dependent on institutions that profit from their money. Meanwhile, the wealthy operate differently – they position themselves in the “front row” for capital access, borrowing before inflation devalues currency and deploying that capital to appreciating assets.

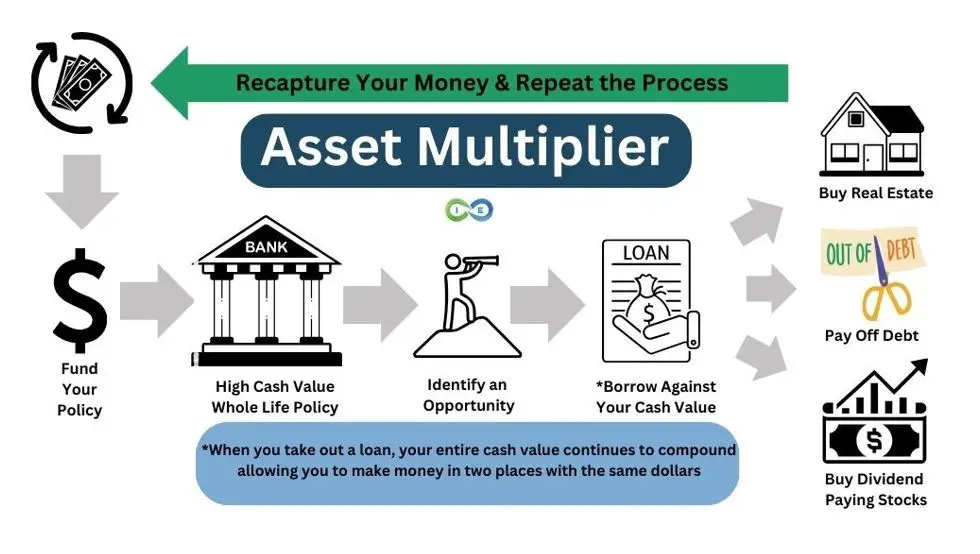

Volume-Based Banking (VBB) offers a different approach: become your own bank by channeling as much of your income as possible through a properly designed whole life insurance policy—what we call The Ultimate Asset®—instead of traditional bank accounts. But VBB isn’t just about replacing your savings account – it’s a complete financial philosophy built on three fundamental pillars that position you like wealthy institutions rather than perpetual borrowers.

This is an evolution of the traditional Infinite Banking Concept. While Infinite Banking focused on replacing car loans and major purchases with policy loans, Volume-Based Banking focuses on running 100% of your lifetime cash flow through your system and deploying borrowed capital to productive investments. The goal isn’t just to recapture interest – it’s to position yourself on the winning side of monetary expansion.

What Is Volume-Based Banking?

Volume-Based Banking (VBB) replaces your traditional banking relationships with a properly structured whole life insurance policy, which we coined The Ultimate Asset®. Your Ultimate Asset functions as your personal banking system, where you become the banker. And unlike conventional saving strategies or even traditional infinite banking approaches, The Ultimate Asset® using volume-based banking operates on a distinct framework: The Three Pillars of Volume, Velocity, and Value Creation.

Instead of storing money in savings accounts earning minimal returns and borrowing from external lenders at high rates, you build cash value in your policy and borrow from yourself. Your cash value continues earning guaranteed returns plus dividends even while borrowed against – creating a unique advantage where your money works in two places simultaneously.

The key insight: Traditional banks operate in the “front row” of the financial system. They access capital from the Federal Reserve before inflation hits, then lend it to you after prices have risen. When you become your own bank, you’re positioning yourself in that same front row – accessing capital before inflation devalues it, then deploying it to assets that appreciate with monetary expansion.

How VBB Differs from Traditional Infinite Banking

Many people are familiar with the Infinite Banking Concept popularized by Nelson Nash. VBB is an evolution of that foundation:

Traditional Infinite Banking Concept:

- Replace auto loans and major purchases with policy loans

- Recapture interest you’d pay to banks and car companies

- Emphasis on personal consumption financing

- Typically 10-15% of income into one or two policies

Volume-Based Banking:

- Run 100% of lifetime cash flow through your system over time

- Deploy borrowed capital to productive investments and assets

- Emphasis on wealth building through volume control and strategic deployment

- Scale from 25% to 50% to 100% of income through multiple policies

- Position yourself in the “front row” for capital access like institutions

Nash proved the vehicle. He showed that whole life insurance could replace traditional banking for consumer financing. But Nash was solving a 1990s problem: how to stop paying interest to banks.

VBB solves a different problem: how to position yourself on the winning side of continuous monetary expansion. The distinction isn’t the policy—it’s the framework.

IBC asks “How do I recapture interest?” VBB asks “How do I access capital like institutions do?”

| Infinite Banking (Nash) | Volume-Based Banking | |

|---|---|---|

| Primary Goal | Recapture interest paid to banks | Reposition in monetary system |

| Mental Model | Household financial efficiency | Institutional capital access |

| Core Question | “How do I stop losing money to banks?” | “How do I operate like a bank?” |

| Scale Target | 10-15% of income, 1-2 policies | 25% → 100% of lifetime cash flow |

| Deployment Focus | Replace consumer financing | Productive assets with velocity advantage |

| Economic Framework | Implicit (compound interest) | Explicit (Cantillon Effect positioning) |

| Audience | Business owners seeking debt freedom | Families building generational infrastructure |

| Endgame | Debt freedom with legacy benefit | Multi-generational banking system |

The Three Pillars of Volume-Based Banking

When properly structured whole life insurance—The Ultimate Asset®—operates through Volume-Based Banking principles, it rests on three fundamental pillars. But these aren’t equal pillars holding up a roof, they’re sequential. Volume is the foundation. Velocity and Value Creation are what Volume enables.

Pillar #1: Volume – Control Capital, Not Just Returns

This is where VBB fundamentally departs from both conventional financial advice and traditional Infinite Banking.

Traditional financial advice says: “Save 10-15% of your income and get the highest return possible on that money.”

Traditional Infinite Banking says: “Capture enough to replace your car loans and major purchases.”

VBB says: “Capture the maximum volume of your lifetime cash flow in a system that positions you in the front row of monetary expansion.”

Here’s why volume matters more than rate of return:

Over a 30-year career, someone earning $150,000 annually will move $4.5 million through their financial life. That’s $4.5 million in total cash flow—money that comes in, sits briefly, and flows out to expenses, taxes, purchases, and investments.

Where does that money sit between arrival and departure? For most people: checking accounts earning 0%. Savings accounts earning 0.5%. Maybe a money market at 4% for a few months before deployment.

That’s $4.5 million getting zero front-row positioning advantage. The money arrives already devalued by inflation, sits in accounts that lose purchasing power, then deploys to assets at whatever price the market demands that day.

Now consider what changes when you systematically route that cash flow through properly structured whole life insurance:

At 25% capture: $37,500 annually flowing through your system. Over 30 years, that’s $1.125 million in volume earning guaranteed growth plus dividends, accessible via policy loans, building death benefit protection. You’ve repositioned over a million dollars from back-row to front-row.

At 50% capture: $75,000 annually. $2.25 million over a career. Your banking infrastructure now rivals what small businesses maintain in commercial credit lines—except yours has no approval process, no credit checks, no call provisions, and your collateral (death benefit) grows rather than depreciates.

At 100% capture: Every dollar flows through your system before deploying elsewhere. You’ve achieved what banks do: position yourself at the point of capital access rather than the end of the inflation chain.

The math is simple but counterintuitive:

$50,000 at 12% speculative return = $6,000 (if markets cooperate)

$500,000 at 5% guaranteed return = $25,000 (regardless of markets)

Traditional advice chases the 12%. VBB captures the $500,000.

Which approach actually builds generational wealth? The one that works when markets crash, when you lose your job, when opportunities arise at inconvenient times, when you need capital and can’t wait for recovery.

The volume strategy:

- Start with 25% of gross income flowing through your system

- Add policies as cash value matures, pushing toward 50%

- Ultimate goal: 100% of cash flow running through your banking infrastructure before deploying to any other use

This isn’t about replacing your car loan. This is about repositioning your entire financial life from the back row to the front row of the monetary system, the same position banks occupy when they access Fed funds before lending to you at marked-up rates.

Volume is the foundation. Without it, the next two pillars can’t operate at scale.

Pillar #2: Velocity – Money Working in Two Places Simultaneously

Volume creates the capital base. Velocity multiplies what that base produces.

This is the mechanical advantage that makes whole life insurance unique: when you borrow against your policy, your full cash value continues earning guaranteed interest and dividends as if you never borrowed.

The insurance company loans you their money, using your death benefit as collateral. Your cash value remains intact, compounding uninterrupted. You now have capital deployed in two places simultaneously.

Example:

Your $200,000 cash value continues earning guaranteed interest and dividends on the full $200,000—even while you borrow $100,000 against it. Yes, you pay interest on the loan. But as you pay down that loan—whether from rental income, business cash flow, or regular earnings—your policy never missed a beat. The full cash value kept compounding. The death benefit kept growing.

This is what makes velocity different from leverage. Traditional leverage puts your asset at risk. VBB velocity means your foundation keeps building while borrowed capital works elsewhere. Your death benefit grows regardless. Your cash value compounds regardless. The loan is a temporary draw against permanent infrastructure. This fundamentally changes the mathematics of wealth accumulation.

And here’s what matters: velocity without volume is limited. $50,000 working in two places is useful. $500,000 working in two places is transformational. That’s why volume comes first.

Pillar #3: Value Creation – Strategic Optionality and Investor DNA

Volume positions you in the front row. Velocity multiplies your returns. Value Creation determines when and where you deploy.

Unlike 401(k)s that force you to buy markets at any price through automatic contributions, VBB gives you strategic optionality. Your policy keeps earning guaranteed returns whether you deploy capital or not. You’re never a forced buyer.

When markets are overvalued: Your cash value grows 5%+ guaranteed while you wait. No pressure to buy at peaks. No anxiety about sitting in cash. Your foundation compounds regardless.

When markets crash: You deploy policy loans to quality assets at genuinely discounted prices. Your full cash value keeps earning while you buy what others are panic-selling. This is front-row capital access during crisis—exactly when it matters most.

When opportunities align with your expertise: Real estate professionals deploy to properties. Business owners fund expansion. Value investors buy beaten-down stocks. You deploy according to your investor DNA, not according to an automatic contribution schedule.

The key insight: Value Creation is only possible because Volume and Velocity created the foundation. Without substantial capital positioned in the front row, you have no strategic optionality. You’re just another forced buyer hoping markets cooperate with your timeline.

The three pillars work together:

Volume positions you in the front row of monetary expansion—capturing the first mover advantage at scale.

Velocity multiplies your returns by keeping capital working in multiple places simultaneously.

Value Creation ensures deployed capital flows to productive opportunities aligned with your expertise and timing.

This is what distinguishes VBB from both conventional financial advice (which ignores positioning entirely) and traditional Infinite Banking (which focuses on debt replacement rather than monetary repositioning). You’re not just recapturing interest. You’re restructuring where you sit in the financial system.

Traditional Banks vs. Your Banking System

The advantages of Volume-Based Banking become clear when compared directly to traditional banking relationships. But the comparison reveals more than just better rates – it reveals a fundamental difference in positioning within the financial system.

The “Front Row” Access in Banking: Traditional banks receive newly created money from the Federal Reserve first. They’re in the “front row” – accessing capital before inflation drives up prices. By the time that money reaches you through wages, inflation has already reduced its purchasing power. Meanwhile, banks lend that money back to you at higher rates.

With VBB, The Ultimate Asset® positions you in that same front row. You access capital through policy loans before inflation fully devalues currency, then deploy it to appreciating assets. You’re borrowing today’s cheaper dollars to buy assets that rise with inflation – the same strategy banks and wealthy institutions use.

| Traditional Bank Savings Account | High Cash Value Whole Life Insurance Policy | |

|---|---|---|

| Earnings Rate | The national average yield for savings accounts is 0.58 percent APY as of August 2025 (Bankrate). But actual earnings are less after tax and not guaranteed. | Guaranteed (average) 3-4% interest. Plus an additional 2%-3% dividends. Tax-free, so net earnings of 5%+ which may increase as interest rates increase. |

| Withdrawals and Earnings | Amount available for withdrawals is lower because gains in the account are taxable. | Full amount of cash value is available for withdrawals. |

| Loans | Does not offer loans. | Loans are available via the cash value, with no approval needed. Plus, the amount borrowed still continues to generate interest and dividends. |

| Loan Repayment | Amount and due date of repayments is determined by the bank or lender. If payments are late or missed, it negatively impacts your credit score. | No required loan payments. Policyholder determines when and how much is paid – or even if payments are made. |

| Added Benefits Upon Death | Paid on Death (POD) to a beneficiary. | Death benefit is paid to beneficiary income tax free. |

| Living Benefits | None | -Chronic Illness Rider – With a chronic illness diagnosis or need for long-term care, funds may be accessed from the death benefit. -Accelerated Death Benefit – Death benefit funds may also be accessed in the event of a terminal illness diagnosis. |

| Costs | Potential savings and checking fees. | Premium is required for death benefit. However, premium payments are leveraged for a larger death benefit payout – which is received income tax free by the beneficiary(ies). |

| Creditor Protection | Minimal. | Creditor protection based on individual state laws. |

The comparison reveals why properly designed whole life insurance functions as a superior banking alternative. You earn higher guaranteed returns, maintain complete control over borrowing, and build substantial death benefit protection.

But the deeper insight isn’t just better rates or tax advantages. It’s positioning. Traditional banking keeps you in the back row—earning minimal returns, borrowing at high rates, buying assets after inflation has already hit. VBB moves you to the front row—the same position banks occupy when they access capital before lending it to you at marked-up rates.

This is why Volume matters most. The more capital you route through your system, the more you’ve repositioned from back-row to front-row. It’s not about beating the market on returns. It’s about changing where you sit in the financial system.

The Economic Foundation: Why VBB Works

Volume-Based Banking isn’t just a mechanical strategy – it’s grounded in fundamental economic principles that explain why borrowers systematically accumulate wealth in fiat currency systems while savers fall behind. Understanding this foundation transforms VBB from a tactic into a philosophy.

The Cantillon Effect: Front Row Capital Access

Named after 18th-century economist Richard Cantillon, the Cantillon Effect explains why the wealth gap keeps widening despite everyone working harder.

How New Money Flows Through the Economy:

- Government and Federal Reserve create new money

- Money flows to banks, large corporations, and connected borrowers FIRST

- These “front row” recipients buy assets before prices rise

- By the time money reaches workers through wages, inflation has already hit

- Workers buy the same assets the wealthy purchased months ago, now 20-30% more expensive

Your Ultimate Asset® Position: When you borrow against your policy, you’re accessing capital BEFORE inflation devalues it – just like banks and wealthy investors do. You’re positioned in the “front row,” not the back.

The Strategic Advantage:

- You borrow today’s dollars to buy productive assets

- Your tenants, customers, or investment returns pay you back with tomorrow’s inflated dollars

- Your loan payment stays fixed while your income rises with inflation

- Debt gets cheaper in real terms while assets appreciate

This isn’t speculation – it’s positioning yourself on the winning side of continuous monetary expansion. The wealthy understand this instinctively. VBB makes it systematic and accessible. This is the economic foundation for Pillar #1 (Volume). The more of your lifetime cash flow you route through your system, the more capital you’ve repositioned from back-row to front-row.

Volume isn’t about earning a higher rate—it’s about capturing the Cantillon advantage on maximum capital. That’s why VBB targets 25% → 50% → 100% of income over time, not the 10-15% typical of traditional Infinite Banking.

Austrian Economics: Why Borrowers Win in Fiat Systems

In a sound money system backed by gold, savers win and borrowers lose. In a fiat currency system with continuous monetary expansion, the opposite proves true mathematically.

The Inflation Reality: The dollar loses 3%+ purchasing power annually through inflation (often more). Your loan balance doesn’t increase – it stays fixed at the original amount. Meanwhile, assets purchased with borrowed money appreciate with inflation. The result: your debt burden decreases in real terms while asset values grow.

The Leverage Multiplier Example:

- Buy $100,000 property with 20% down ($20,000 of your capital)

- 3% annual inflation on $100,000 asset = $3,000 appreciation

- Your $20,000 investment gained $3,000 = 15% return

- Meanwhile, your $80,000 loan balance stayed flat while the asset inflated

Now imagine deploying this principle systematically across your entire financial life through policy loans. This is how institutional wealth operates. VBB enables you to harness this dynamic with guaranteed liquidity, no credit checks, and no forced liquidation during market downturns.

Werner’s Credit Theory: Productive vs. Speculative Deployment

Economist Richard Werner’s empirical research proved that not all credit creation produces the same outcomes:

Three Types of Credit Deployment:

- Productive Investment Credit – Creates real economic growth without inflation. Examples: business equipment that increases productivity, rental properties that house people, skills development that increases earning capacity.

- Consumption Credit – Creates inflation without growth. Examples: consumer goods, vacations, lifestyle spending that produces no future returns.

- Speculative Credit – Creates asset bubbles followed by crashes. Examples: buying overpriced stocks at market peaks, bidding up real estate beyond fundamentals, forced buying through automatic 401(k) contributions regardless of valuation.

VBB Strategy Alignment: Your policy loans should flow primarily to Type 1 (productive investment) – assets that generate cash flow, build skills, or create real economic value. This is Pillar #3 (Value Creation) in action. Deploy capital to opportunities aligned with your investor DNA, not consumption or forced speculation.

When you have patient capital that keeps earning whether deployed or not, you can wait for truly productive opportunities rather than being a forced buyer at any price. This is how sustainable wealth gets built – through productive deployment, not consumption or speculation.

How VBB Works: The Mechanics

Understanding the Three Pillars provides the “why” behind Volume-Based Banking. Now let’s examine the “how” – the mechanical implementation that makes the philosophy operational.

Policy Design: The 90/10 or 80/20 Structure

This isn’t traditional whole life insurance sold by typical agents. The design specifications matter enormously for VBB implementation:

Optimal Structure:

- 90% or 80% of premium goes to Paid-Up Additions (PUA) rider – maximizes cash value accumulation from day one

- 10% or 20% goes to base policy – this portion represents the minimum required premium

- Base premium keeps the policy in force; PUA rider builds accessible cash value rapidly

This design prioritizes Pillar #1 (Volume) by front-loading cash value accumulation. Traditional whole life policies emphasize death benefit; VBB-optimized policies emphasize cash value growth while maintaining substantial death benefit protection.

Why This Design Works:

- Years 1-4: Building banking infrastructure foundation (similar to business startup costs)

- Years 4-7: Reach break-even where cash value equals total premiums paid

- Years 7+: Accelerating growth with substantial borrowing capacity

How Policy Loans Enable Pillar #2 (Velocity)

The unique feature that makes velocity possible: policy loans are collateralized by your death benefit, not your cash value. This means your full cash value continues earning guaranteed interest and dividends even while you have an outstanding loan.

The Velocity Mechanics:

- Cash value grows to $100,000 earning 5% annually

- You take a $50,000 policy loan (insurance company’s money)

- Your $100,000 continues earning as if never borrowed

- You deploy the $50,000 to productive investments earning returns

- Money works simultaneously in two places

Loan Terms:

- Typically 5-8% simple interest (not compound)

- No required repayment schedule

- No credit checks or approval processes

- Access funds within days

- Borrow up to 90-95% of cash value

Managing Loan Balance: The key discipline is maintaining loan balance below total cash value. Above 90% becomes dangerous territory for policy sustainability. Your death benefit eventually pays off all loans, but proper management ensures the policy remains strong throughout your lifetime.

The Cash Flow Mechanism

VBB operates as financial infrastructure through which your cash flow passes:

- Income flows into policy as premium (starting at 25% of gross income)

- Cash value grows with guaranteed interest plus dividends

- Immediate death benefit exists from day one

- Borrow from policy for expenses, investments, opportunities

- Deploy borrowed funds to productive investments aligned with your expertise (Pillar #3)

- Service loans from cash flow or investment returns (or don’t – flexible repayment)

- Maintain strategic optionality – deploy when opportunities present themselves

This creates a closed-loop system where you capture the volume efficiency on your entire cash flow while maintaining front-row access to borrowed capital for strategic deployment.

Strategic Deployment: Creating Value Through Productive Investment

Having access to capital means nothing without wisdom in deployment. This is where Pillar #3 (Value Creation) transforms VBB from banking infrastructure into wealth-building philosophy.

The Investor DNA Concept

Everyone has natural strengths, expertise, and opportunities unique to their situation. Strategic deployment means aligning capital with your specific investor DNA rather than forced buying through automatic contributions.

Examples of Investor DNA Alignment:

- Real estate professional: Deploy to rental properties where expertise creates advantage

- Business owner: Fund equipment, inventory, expansion when ROI is clear

- Index fund investor: Buy during market crashes when others panic sell

- Private lending expertise: Deploy to family financing, hard money lending, or peer-to-peer opportunities where you understand the borrower and collateral

The advantage: Your policy keeps earning whether you deploy capital or not. No opportunity loss from waiting. No forced buying at market tops. This is patient capital – exactly how wealthy families operate.

Productive vs. Speculative Deployment

Werner’s credit theory provides the framework for wise deployment:

Productive Deployment (Priority):

- Rental real estate generating cash flow

- Business opportunities with clear ROI

- Index funds purchased during market corrections

- Private lending

- Any asset generating returns or building real value

Speculative Deployment (Caution):

- Buying overpriced markets at peaks

- Chasing momentum stocks or crypto

- Speculation without expertise

- Forced buying regardless of valuation

Consumption Deployment (Minimize):

- Lifestyle purchases that produce no returns

- Depreciating assets

- Consumption that could be deferred

Traditional 401(k)s force you into speculative deployment – automatic contributions buy markets at any price. VBB gives you strategic optionality to wait for productive opportunities aligned with your expertise.

Deployment Examples Across Investment Types

- Borrow $100,000 against policy for rental property down payment

- Property generates cash flow while your full cash value continues earning guaranteed interest and dividends

- Yes, you pay loan interest, but as you pay down the loan from rental income, your policy never missed a beat

- Your death benefit kept growing throughout

- Tenant pays principal, you control appreciating asset with fixed debt

Market Corrections:

- Market crashes 30% – others forced to keep buying or sell

- You deploy $50,000 policy loan to buy quality index funds at discount

- Your cash value continues earning while you buy assets cheaply

- When market recovers, you’ve deployed at optimal prices

- This is front-row capital access during crisis

Business Opportunities:

- Equipment purchase with 40% ROI potential

- Borrow $25,000 from policy instead of bank loan

- Cash value keeps earning while equipment generates returns

- No bank approval, no credit impact, no forced repayment schedule

- Flexibility to repay from business cash flow at your pace

The common thread: Deploy to productive investments where you have expertise or clear advantage. Maintain patience when valuations are extreme. Use your front-row capital access during opportunities that align with your investor DNA.

Implementation for Any Income Level

Volume-Based Banking scales to any positive cash flow situation. The key is starting with appropriate volume for your current income and scaling systematically over time – embodying Pillar #1 (Volume) through progressive expansion.

Income Level: $80,000-$100,000

Starting Position (Year 1):

- Begin with single policy capturing 25% of gross income

- Annual premium: $20,000-$25,000

- Initial cash value: $16,000-$20,000 (80% of first-year premium with optimized design)

- Death benefit: $300,000-$400,000

5-Year Position:

- Cash value: $110,000-$130,000

- Available borrowing capacity: $100,000+

- Death benefit: $350,000-$450,000

- System now generating $5,500+ annually through guaranteed growth plus dividends

Strategic Deployment Examples:

- Fund Roth IRA contributions ($7,000 annually) via policy loan while cash value continues growing

- Emergency fund replacement – no lost opportunity cost on idle cash

- Buy index funds during market corrections with front-row capital access

Income Level: $150,000-$200,000

Starting Position (Year 1):

- Single policy at $37,500-$50,000 annual premium (25% of gross)

- Alternative: Two policies totaling this amount for diversification

- Initial cash value: $30,000-$40,000

- Death benefit: $600,000-$800,000

5-Year Position:

- Cash value: $200,000-$250,000

- Borrowing capacity: $180,000-$225,000

- Death benefit: $700,000-$900,000

- Annual growth: $10,000-$12,500 guaranteed plus dividends

Strategic Deployment Examples:

- Real estate down payments – borrow $50,000 for rental property while cash value continues earning

- Business investments with clear ROI

- Aggressive index fund buying during market crashes (embodying Pillar #3 strategic optionality)

- Fund children’s education without disrupting investment timeline

Scaling Strategy: After year 5-7 when original policy is mature, add second policy to push toward 50% of income through the system. This progressive volume expansion is the path toward running 100% of cash flow through your banking infrastructure.

Income Level: $250,000+

Starting Position (Year 1):

- Multiple policies totaling $62,500+ annually (25% of gross)

- Typical structure: 2-3 policies across different companies

- Initial cash value: $50,000-$70,000

- Combined death benefit: $1,000,000-$1,500,000

5-Year Position:

- Cash value: $350,000-$400,000

- Borrowing capacity: $315,000-$360,000

- Death benefit: $1,200,000-$1,700,000

- Annual growth: $17,500-$20,000+ guaranteed plus dividends

10-Year Vision (Scaling to 50%+ of income):

- Cash value: $1,000,000+

- Borrowing capacity: $900,000+

- Death benefit: $2,500,000-$4,000,000

- System operating as full-scale family bank with institutional-level capital access

Strategic Deployment Examples:

- Commercial real estate opportunities requiring $200,000+ down payments

- Private business investments and partnerships

- Aggressive market deployment during corrections with substantial capital

- Legacy wealth transfer with massive death benefit leverage

- Multi-generational banking system serving family’s financial needs

At this level, VBB positions you exactly like wealthy families who have used dividend-paying whole life insurance as banking infrastructure for over 100 years. You’re operating with front-row capital access, velocity advantages, and strategic optionality previously available only to institutional capital.

The Progressive Volume Strategy

Regardless of starting income level, the progression follows the same pattern:

Year 1-4: Build foundation with 25% of income, focus on understanding the system

Year 5-10: Add policies to push toward 50% of income through the system

Year 10+: Continue scaling toward 100% of cash flow eventually running through your banking infrastructure

This is Pillar #1 (Volume) in action – systematically capturing more of your lifetime cash flow in tax-advantaged infrastructure with guaranteed growth, death benefit protection, and strategic borrowing capacity.

Frequently Asked Questions

How is Volume-Based Banking different from just saving money in a bank account?

Traditional bank accounts earn minimal interest (0.58% average) with no tax advantages and require external loans for major purchases. VBB earns 5%+ tax-advantaged returns while providing loans from your own system.

But the deeper difference: VBB positions you in the “front row” for capital access through the Cantillon Effect. Banks get newly created money from the Federal Reserve before inflation hits. When you borrow from your policy, you’re accessing capital before inflation devalues it – just like banks do. You then deploy that capital to productive assets that appreciate with monetary expansion.

Additionally, your money works in two places simultaneously (Pillar #2: Velocity) – cash value continues earning while borrowed funds generate additional returns. This creates combined growth impossible with traditional banking where withdrawals stop earning.

Traditional banking positions you as a back-row participant paying for institutional profits. VBB positions you as a front-row participant capturing institutional advantages.

How is VBB different from traditional Infinite Banking?

Traditional Infinite Banking Concept (IBC) focuses on replacing car loans and major purchases with policy loans – recapturing interest you’d pay to banks and car companies. It’s typically implemented with one or two policies capturing 10-15% of income.

Volume-Based Banking evolution:

- Pillar #1 (Volume): Scale from 25% to 50% to 100% of income through multiple policies – maximizing total capital under your control

- Pillar #2 (Velocity): Deploy borrowed capital to productive investments that generate returns while cash value continues growing

- Pillar #3 (Value Creation): Focus on strategic deployment to productive opportunities aligned with your investor DNA, not consumption or forced buying

- Economic foundation: Grounded in Cantillon Effect (front-row capital access), Werner’s credit theory (productive vs. speculative deployment), and Austrian economics (why borrowers win in fiat systems)

Nash proved the concept. VBB proves the scale – transforming infinite banking from a tactic for recapturing interest into a complete financial philosophy with economic theory foundation.

What happens if I need my money immediately?

Policy loans are typically available within 30 days with no credit checks, approval processes, or qualification requirements. You can access up to 90% of your cash value while your full balance continues earning returns. This provides superior liquidity compared to many traditional savings vehicles.

But VBB eliminates the traditional “emergency fund” concept entirely. Rather than holding $20,000 in a bank account earning nothing while waiting for emergencies, that $20,000 sits in your policy earning 5%+ tax-advantaged returns. When emergency strikes, you borrow from yourself within days. No opportunity cost from holding idle cash.

This is Pillar #2 (Velocity) in action – your emergency fund keeps working even when you need to access it.

How much should I put into Volume-Based Banking?

Start with 25% of gross income and scale up over time. Most people begin conservatively with one policy, experience the advantages, then progressively add policies to capture more volume.

The goal isn’t a specific percentage, but maximizing total volume under your control (Pillar #1). Wealthy families who have used this strategy for over 100 years often run the majority of their cash flow through whole life infrastructure.

Insurance company limits typically cap single-policy contributions at 20-25% of income. To exceed this, you add policies across multiple top-rated companies. The vision: eventually running 100% of lifetime cash flow through your banking system.

Better to control $200,000 at 5% guaranteed than $20,000 at 12% speculative. Volume creates borrowing capacity that dwarfs traditional banking access.

What about opportunity cost?

The opportunity cost question assumes single-use capital—that money deployed to one purpose cannot simultaneously serve another purpose.

Pillar #2 (Velocity) eliminates opportunity cost by making your capital dual-use. Your $50,000 cash value continues earning guaranteed interest and dividends even while that same $50,000 (via policy loan) deploys to a rental property or other productive investment. Yes, you pay loan interest. But as you pay down that loan, your full cash value kept compounding the entire time. Your death benefit kept growing. The loan is temporary; the infrastructure is permanent.

Additionally, Pillar #3 (Value Creation) means you’re never forced to deploy. Your policy keeps earning whether you use borrowed capital or not. Traditional 401(k)s force you to buy markets at any price through automatic contributions. VBB gives you patient capital that keeps earning while you wait for productive opportunities aligned with your expertise.

The real opportunity cost: leaving your cash flow sitting in bank accounts earning nothing or minimal taxable interest while being forced to borrow externally at high rates for opportunities. VBB captures volume efficiency on your entire cash flow while providing front-row capital access for strategic deployment.

What about my 401(k) and other investments?

Volume-Based Banking enhances rather than replaces investment strategies. VBB is banking infrastructure, not investment replacement.

How VBB complements investing:

- Use policy loans to fund Roth IRA contributions while cash value continues growing

- Buy stocks during market downturns when others are selling (front-row capital access)

- Make real estate investments without disrupting investment timeline

- Maintain strategic optionality – deploy when opportunities present themselves (Pillar #3)

The difference: 401(k)s force you to buy markets at any price through automatic contributions. VBB gives you patient capital earning guaranteed returns that you can deploy aggressively during market crashes when assets are cheap.

Think of The Ultimate Asset® as the foundation – guaranteed, liquid, tax-advantaged banking infrastructure. Then build aggressive investment strategies on top of that foundation using borrowed capital that costs you nothing in opportunity cost because your cash value never stops earning.

What are the risks of the Volume-Based Banking strategy?

The primary risk involves over-borrowing relative to cash value growth. If total loan balance exceeds cash value for extended periods, the policy can lapse.

Risk Management:

- Maintain loan balance below 90% of cash value

- Insurance companies limit borrowing to prevent problems

- Service loans from cash flow or investment returns

- Conservative management eliminates most risks

Unlike market-based strategies, you cannot lose principal to volatility. Your growth is contractually guaranteed. The death benefit provides massive leverage – even poor policy management still delivers death benefit to beneficiaries.

What about dividend risk? Mutual life insurance companies have paid dividends continuously for 100+ years including through Great Depression, 2008 financial crisis, and COVID. This is their entire business model. Work only with A+ rated companies with century-long operating histories.

The real risk: leaving your cash flow in conventional banking infrastructure that captures zero growth while forcing you to borrow externally at high rates and positioning you in the “back row” during monetary expansion. That’s guaranteed wealth destruction over time.

How long does it take to see results?

Cash value begins accumulating immediately, with meaningful borrowing capacity typically available within 2-3 years. The strategy’s power accelerates over time as your banking system grows.

Timeline Expectations:

- Years 1-4: Building infrastructure (similar to business startup costs)

- Years 4-7: Reach break-even where cash value equals total premiums paid

- Years 7+: Accelerating growth with substantial borrowing capacity

- Years 10+: Full-scale family banking system with institutional advantages

Most practitioners see significant advantages within 5-7 years of consistent implementation. But the real power emerges over 20-30 years as the Three Pillars compound:

- Pillar #1 (Volume): Millions in total cash flow captured at guaranteed rates

- Pillar #2 (Velocity): Decades of dual-use capital creating combined returns

- Pillar #3 (Value Creation): Strategic deployment to productive opportunities over entire career

This is generational wealth infrastructure, not get-rich-quick speculation.

Can I do this with term life insurance?

No. Term insurance provides temporary death benefit protection but builds no cash value. Volume-Based Banking requires permanent whole life insurance with cash value accumulation and borrowing capabilities. The cash value is what creates your banking system and enables the Three Pillars:

- Volume (cash value captures growth on your cash flow)

- Velocity (cash value continues earning while borrowed against)

- Value Creation (cash value provides borrowing capacity for strategic deployment)

Without cash value, there is no banking system, no velocity advantage, no front-row capital access, and no strategic optionality. Term insurance serves a different purpose entirely.

What if the insurance company fails?

Work only with A+ rated companies with century-long operating histories and consistent dividend payments. These companies have survived multiple economic crises, wars, and market crashes. Additionally, state guarantee associations provide policyholder protection, though failure of highly-rated companies is extremely rare.

The companies we work with have been paying dividends continuously since the 1800s. They operated successfully through:

- World War I and World War II

- The Great Depression

- 1970s stagflation

- 1987 stock market crash

- 2008 financial crisis

- 2020 COVID pandemic

These mutual companies are owned by policyholders, not stockholders. They have no incentive to take excessive risks or prioritize short-term stock prices over long-term policyholder value.

The real question: What happens when your bank fails or your checking account earns nothing while inflation destroys purchasing power? That risk is guaranteed and happening continuously. VBB protects against that certainty.

What if inflation drops or the Fed tightens? Does this still work?

The front-row positioning advantage exists in any fiat system with fractional reserve banking. Even in deflationary periods, guaranteed growth plus the velocity advantage outperforms savings accounts earning nothing. Your cash value never goes backward—it compounds regardless of monetary policy direction.

But the real question: do you believe governments will stop expanding money supply? History suggests otherwise. Every major economy has expanded money supply continuously for decades. Central banks have tools to tighten temporarily, but the long-term trajectory of fiat currency systems is expansion. VBB positions you to benefit from that mathematical certainty while providing guaranteed growth even during temporary tightening.

The wealthy don’t try to time monetary policy. They position themselves to benefit regardless of short-term Fed decisions. That’s what VBB infrastructure provides—a system that works whether inflation runs hot or the Fed tightens for a cycle.

Getting Started with Volume-Based Banking

The Cantillon Effect will continue concentrating wealth among those with “front row” access to capital before inflation hits. The wealthy understand this instinctively – banks, corporations, and wealthy families position themselves to borrow before currency devaluation and deploy to appreciating assets.

The only question: Are you positioned in the front row or the back row?

Traditional banking positions you in the back row – earning minimal returns while being forced to borrow externally at high rates after inflation has already reduced purchasing power. Volume-Based Banking positions you in the front row alongside institutions – accessing capital before inflation devalues it, deploying to productive investments that appreciate with monetary expansion, and capturing volume efficiency on your entire cash flow.

The Three Pillars provide the framework:

- Pillar #1 (Volume): Control massive capital at guaranteed rates rather than chasing high returns on limited amounts

- Pillar #2 (Velocity): Money working in two places simultaneously – cash value earning while borrowed capital generates additional returns

- Pillar #3 (Value Creation): Strategic optionality to deploy only to productive opportunities aligned with your investor DNA

This isn’t speculation about what might work. The Ultimate Asset® is the proven strategy wealthy families have used for over 100 years – now accessible to anyone with positive cash flow and discipline.

Ready to Position Yourself in the Front Row?

Before implementing Volume-Based Banking, get a personalized analysis from our banking alternative specialists. We’ll show you exactly how the Three Pillars would work with your specific income and help you understand if VBB aligns with your financial philosophy.

- ✓ Calculate your optimal volume capacity based on income and goals (Pillar #1)

- ✓ See actual policy illustrations showing guaranteed growth and borrowing capacity

- ✓ Understand how velocity creates dual-use capital advantages (Pillar #2)

- ✓ Learn strategic deployment options for your investor DNA (Pillar #3)

- ✓ Discover how VBB positions you for front-row capital access

- ✓ Ongoing lifetime coaching to optimize your banking system as it scales

Schedule your complimentary 30-minute Volume-Based Banking analysis and discover if this strategy can position you in the front row alongside institutional capital.

No obligation. No sales pressure. Just expert guidance to help you determine if Volume-Based Banking can provide the front-row positioning and Three Pillars advantages you’ve been seeking.