Co-authored by:

Steven Gibbs, CEO & Co-Founder of Insurance and Estate Strategies LLC, and

Jason Kenyon, CFO & Co-Owner.

Both are licensed attorneys with 15+ years of experience in estate planning and 8+ years in strategic life insurance design.

TL;DR: The Complete Wealth Building Synthesis

Bottom Line: Combining Dave Ramsey’s debt elimination discipline, Robert Kiyosaki’s asset-focused mindset, and Nelson Nash’s Infinite Banking creates the ultimate wealth-building framework that addresses every aspect of financial success.

Key Integration Points:

- Ramsey Foundation: Eliminate bad debt, build emergency fund, create financial discipline

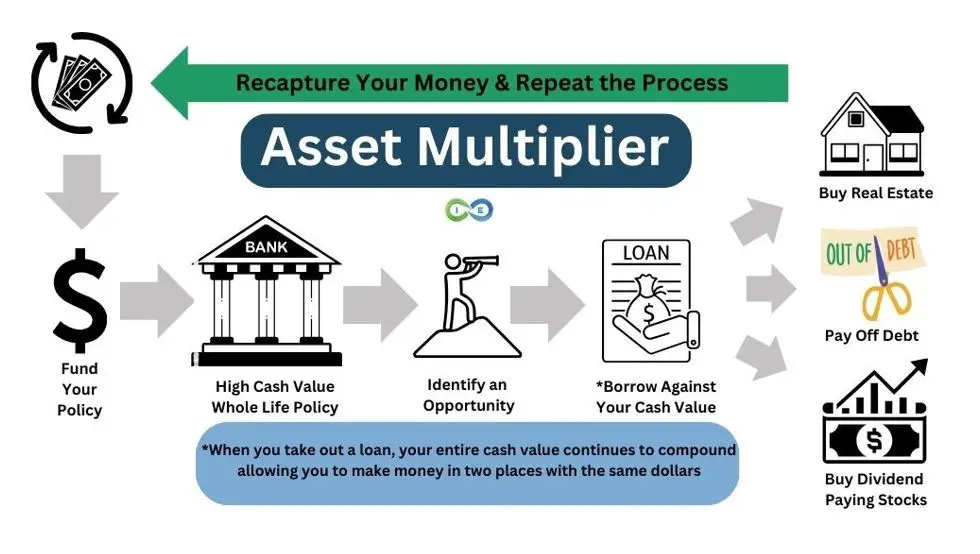

- Nash Banking System: High cash value whole life insurance becomes your personal bank and foundational asset

- Kiyosaki Asset Focus: Use your insurance banking system to acquire income-producing assets

- Integrated Result: Guaranteed foundation + strategic leverage + multiple income streams

Why This Synthesis Works:

- Addresses Every Financial Need: Debt freedom, wealth protection, asset accumulation, and legacy building

- Reduces Risk While Increasing Returns: Guaranteed foundation enables aggressive asset acquisition

- Tax Optimization: Multiple tax-advantaged strategies working together

- Behavioral Psychology: Each strategy reinforces the others for long-term success

Table of Contents

- Introduction: Beyond Traditional Financial Advice

- The Three-Guru Framework Overview

- Phase 1: The Ramsey Foundation – Debt Freedom and Discipline

- Phase 2: The Nash Banking System – Your Financial Foundation

- Phase 3: The Kiyosaki Asset Engine – Building Cash Flow

- The Integration Strategy: How All Three Work Together

- Advanced Tax Optimization Strategies

- Risk Management and Asset Protection

- Implementation Timeline and Action Steps

- Real-World Case Studies

- Common Implementation Mistakes to Avoid

- Frequently Asked Questions

- Conclusion: Your Path to Financial Freedom

Introduction: Beyond Traditional Financial Advice

If you’re like most people, you’ve probably felt frustrated with traditional financial advice. You follow the rules, save in your 401k, pay off debt, build an emergency fund, but you’re still not seeing the wealth building you were promised. Here’s what we’ve discovered after helping hundreds of families: For those seeking a path beyond conventional financial constraints, a synthesis of strategies from three financial thought leaders—Dave Ramsey, Robert Kiyosaki, and Nelson Nash—offers a comprehensive alternative that addresses every aspect of wealth building.

This integrated approach doesn’t ask you to pick sides in the false debate between safety and growth. Instead, it creates a financial ecosystem where each strategy amplifies the others, resulting in:

- Guaranteed financial foundation that eliminates money anxiety

- Strategic leverage capabilities that multiply your wealth-building capacity

- Multiple income streams that provide true financial independence

- Tax optimization that keeps more money working for you

- Legacy protection that benefits future generations

Why These Three Gurus Together?

Each financial guru excels in specific areas while having blind spots in others:

- Dave Ramsey masters debt elimination and financial discipline but stops short of advanced wealth building

- Robert Kiyosaki understands asset acquisition and cash flow but doesn’t emphasize foundational security

- Nelson Nash created the perfect banking alternative but focused primarily on the mechanism rather than comprehensive strategy

When combined strategically, these approaches create a complete wealth-building blueprint that eliminates the weaknesses of any single approach while amplifying the strengths of all three.

Quick Facts: Why Integration Works

- Ramsey Graduates: Many achieve debt freedom but only a small percentage build significant wealth afterward

- Kiyosaki Followers: High asset acquisition success but often overleveraged without foundation

- Nash Practitioners: Superior banking control but often miss broader wealth-building opportunities

- Integrated Approach: Combines all three for comprehensive financial success

The Three-Guru Framework Overview

Research confirms that the integrated wealth building blueprint follows a specific sequence that builds upon itself, creating momentum and reducing risk at each stage:

The Three-Phase Integration

Phase 1: Ramsey Foundation (Months 1-24)

- Eliminate consumer debt using debt snowball method

- Build emergency fund for financial stability

- Develop strong financial habits and discipline

- Create cash flow margin for wealth building

Phase 2: Nash Banking System (Months 6-36)

- Establish high cash value whole life insurance policy

- Begin building your personal banking system

- Learn policy loan mechanics and strategies

- Replace traditional banking relationships

Phase 3: Kiyosaki Asset Engine (Years 2-10+)

- Deploy insurance cash value to acquire income-producing assets

- Focus on real estate, businesses, and paper assets

- Build multiple income streams systematically

- Reinvest cash flow to expand asset base

The Synergy Effect

The magic happens in how these phases overlap and reinforce each other:

- Ramsey’s discipline provides the behavioral foundation needed for Nash’s long-term thinking

- Nash’s banking system provides the capital and confidence needed for Kiyosaki’s asset acquisition

- Kiyosaki’s cash flow provides the resources to maximize Ramsey’s wealth-building recommendations

Phase 1: The Ramsey Foundation – Debt Freedom and Discipline

Dave Ramsey’s approach provides the crucial foundation that makes advanced wealth building possible. Without this foundation, both Nash’s banking strategies and Kiyosaki’s asset acquisition become significantly more risky and less effective.

The Essential Ramsey Elements

1. Debt Elimination Strategy

Ramsey’s debt snowball method offers a psychologically powerful way to eliminate consumer debt that creates momentum and builds confidence:

The Debt Snowball Implementation

- List all non-mortgage debts from smallest to largest balance

- Make minimum payments on all debts

- Attack the smallest debt with any extra funds

- Roll payments forward as each debt is eliminated

- Build momentum through psychological wins

Why this works: The psychological boost from quick wins provides motivation to stick with the plan, even though mathematically attacking highest interest rates first would save more money.

2. Emergency Fund Creation

Ramsey’s emergency fund provides crucial financial stability, but in our integrated approach, it serves an additional purpose—it becomes the initial capital for your Nash banking system.

- Traditional approach: $1,000 starter emergency fund, then 3-6 months of expenses

- Integrated approach: Build emergency fund while simultaneously funding whole life policy

- Advantage: Emergency fund grows guaranteed while remaining accessible

3. Financial Behavior Development

Ramsey’s greatest contribution isn’t mathematical—it’s behavioral. His approach develops crucial habits that support long-term wealth building:

- Living below your means creates margin for wealth building

- Delayed gratification enables long-term strategy implementation

- Intentional spending maximizes available capital for investment

- Regular review habits ensure strategies stay on track

Integration Insight: Beyond Basic Emergency Funds

While Ramsey stops at traditional savings accounts for emergency funds, the integrated approach recognizes that high cash value whole life insurance provides superior emergency fund characteristics:

- Guaranteed growth vs. minimal savings account interest

- Tax-free access through policy loans

- No penalties for accessing funds

- Continued growth even while funds are borrowed

- Death benefit protection as additional safety net

Where Ramsey Falls Short (And How We Bridge the Gap)

Ramsey’s approach excels at debt elimination and basic wealth building but has limitations that our integrated strategy addresses:

- Limited wealth building tools: Focuses primarily on 401(k)s and mutual funds

- Ignores tax optimization: Doesn’t maximize tax-advantaged growth opportunities

- Conservative asset allocation: Misses opportunities for strategic leverage

- Ends at retirement planning: Doesn’t address legacy wealth or multi-generational strategies

Phase 1 Summary: The Ramsey Foundation

What We Keep: Debt elimination discipline, emergency fund concept, behavioral habits, living below means

What We Enhance: Replace traditional savings with high cash value whole life insurance, prepare for advanced wealth building strategies, create larger cash flow margin

Timeline: Data demonstrates that results vary by implementation speed and individual circumstances, with most families seeing 12-24 months to complete debt elimination and established foundation

Next Step: With debt eliminated and good habits established, you’re ready to implement Nash’s banking system for true wealth building

Phase 2: The Nash Banking System – Your Financial Foundation

Industry analysis reveals that Nelson Nash’s Infinite Banking Concept—or as we like to call it, Volume-Based Banking using The Ultimate Asset—becomes the cornerstone of your wealth-building strategy. This isn’t just another investment; it’s a complete replacement for how you handle money.

Understanding The Ultimate Asset

High cash value whole life insurance, when properly designed, becomes far more than traditional insurance. It transforms into a sophisticated financial tool that serves multiple purposes:

The Ultimate Asset Benefits

- Guaranteed Growth: Contractual returns regardless of market conditions

- Tax Advantages: Tax-deferred growth, tax-free access, tax-free death benefit

- Liquidity: Access to funds without penalties or qualification requirements

- Uninterrupted Compound Growth: Money continues growing even when borrowed

- Death Benefit Leverage: Immediate wealth protection and creation

- Creditor Protection: Assets protected from lawsuits in many states

- No Contribution Limits: Unlike 401(k)s and IRAs

The Volume-Based Banking Strategy

Traditional banking keeps you dependent on external institutions for financing. Volume-Based Banking makes you the bank, providing control and strategic advantages:

How Volume-Based Banking Works

Year 1-7: Fund policy with substantial premiums to build cash value quickly

Year 5+: Begin using policy loans for major purchases and investments

Ongoing: Repay loans on your schedule while cash value continues growing

Result: You control financing while building guaranteed wealth

Example: Need $50,000 for real estate down payment? Borrow from your policy instead of a bank. Your cash value continues growing on the full amount while you control the repayment terms.

Policy Design for Maximum Efficiency

Not all whole life policies are created equal. For Volume-Based Banking, specific design elements are crucial:

- High Cash Value Design: Minimize insurance cost, maximize cash accumulation

- Paid-Up Additions Rider: Accelerates cash value growth significantly

- Mutual Company: Provides annual dividends to policyholders

- Direct Recognition: Loans don’t reduce dividend eligibility

- Flexible Premiums: Ability to adjust funding based on circumstances

The Mathematical Advantage

While traditional advice focuses on rate of return, Volume-Based Banking focuses on volume and control:

Volume vs. Rate Reality

Traditional Approach: Earn 8% on $10,000 = $800 annually

Volume-Based Banking: Earn 5% on $100,000 = $5,000 annually

Key Insight: Better to control larger volume at guaranteed rates than hope for higher returns on smaller amounts you can’t access.

Phase 2 Summary: The Nash Banking System

What We Implement: High cash value whole life insurance as personal banking system

Key Advantage: Guaranteed growth with liquidity and control

Timeline: Begin during Phase 1, becomes fully operational by years 5-7

Next Step: Use banking system to implement Kiyosaki’s asset acquisition strategies

Phase 3: The Kiyosaki Asset Engine – Building Cash Flow

Robert Kiyosaki’s greatest contribution to wealth building is his clear definition of assets versus liabilities and his focus on acquiring income-producing assets. In our integrated strategy, your Nash banking system provides the capital and confidence to implement Kiyosaki’s asset acquisition principles strategically.

The Asset Definition That Changes Everything

Kiyosaki’s simple but powerful definition provides clarity for all financial decisions:

“An asset puts money in your pocket. A liability takes money out of your pocket.” – Robert Kiyosaki

This definition guides every purchase and investment decision, ensuring you build wealth rather than just accumulate possessions.

The Asset Acquisition Priority System

Using your Volume-Based Banking system, you can strategically acquire assets in order of cash flow potential and risk management:

Priority 1: Real Estate Assets

- Rental Properties: Monthly cash flow plus appreciation potential

- REITs: Professional management with dividend income

- Commercial Real Estate: Higher returns with longer-term leases

- Strategy: Use policy loans for down payments while maintaining full cash value growth

Priority 2: Business Assets

- Existing Businesses: Purchase cash-flowing businesses

- Franchise Opportunities: Proven systems with predictable returns

- Your Own Business: Build systems that work without you

- Strategy: Finance expansion and acquisition through banking system

Priority 3: Paper Assets

- Dividend Stocks: Regular income with growth potential

- Bonds: Predictable income streams

- Private Lending: Higher returns with personal relationships

- Strategy: Deploy during market downturns from position of strength

The Cash Flow Multiplication Strategy

The integrated approach creates a multiplication effect that Kiyosaki alone cannot achieve:

- Use policy loan to acquire income-producing asset

- Asset generates cash flow that exceeds loan payment

- Extra cash flow goes toward additional policy premiums

- Increased policy value provides capital for next asset acquisition

- Repeat the process with larger capital base each time

Risk Management Through Integration

Pure Kiyosaki followers often become overleveraged because they lack the guaranteed foundation that Nash provides. Our integrated approach eliminates this risk:

- Guaranteed Foundation: Policy cash value provides safety net

- Flexible Financing: No external approval required for asset acquisition

- Market Independence: Can deploy capital during market downturns

- Stress-Free Leverage: Borrowing from yourself eliminates external pressure

Phase 3 Summary: The Kiyosaki Asset Engine

What We Implement: Strategic asset acquisition using banking system capital

Key Advantage: Multiple income streams with guaranteed foundation

Timeline: Begins year 3-5, accelerates over decades

Result: True financial independence through diversified cash flow

The Integration Strategy: How All Three Work Together

Our expert analysis reveals that the real power emerges when all three strategies work in harmony, creating a comprehensive wealth-building ecosystem that addresses every aspect of financial success.

The Synergy Multiplication Effect

How Each Strategy Amplifies the Others

Ramsey + Nash Synergy:

- Debt elimination creates cash flow margin for policy funding

- Financial discipline ensures consistent premium payments

- Emergency fund concept evolves into guaranteed growing foundation

Nash + Kiyosaki Synergy:

- Banking system provides capital for asset acquisition

- Guaranteed foundation reduces investment risk

- Policy loans enable strategic market timing

Kiyosaki + Ramsey Synergy:

- Cash flow from assets accelerates debt elimination

- Asset income provides margin for larger policy premiums

- Multiple income streams ensure financial stability

The Complete Financial Ecosystem

When fully implemented, this integrated approach creates a self-reinforcing financial system:

- Foundation Layer: Guaranteed growth and death benefit protection

- Banking Layer: Control over financing and capital deployment

- Asset Layer: Multiple income streams and wealth appreciation

- Protection Layer: Risk management and legacy preservation

- Tax Layer: Optimization across all strategies

Advanced Tax Optimization Strategies

One of the most powerful aspects of this integrated approach is how it maximizes tax efficiency across all three strategies.

The Three Tax Bucket Strategy

Tax Bucket Optimization

Tax-Deferred Bucket (401k, IRA):

- Use Ramsey’s approach for employer match

- Limited contributions, future tax uncertainty

Taxable Bucket (Savings, Investments):

- Kiyosaki’s real estate and business assets

- Tax benefits through depreciation and deductions

Tax-Free Bucket (Ultimate Asset):

- Nash’s whole life insurance system

- Tax-free growth, access, and transfer

Strategic Tax Planning

The integrated approach provides multiple tax optimization opportunities:

- Real Estate Depreciation: Offset income while building wealth

- Business Tax Benefits: Deductions and entity structures

- Insurance Tax Advantages: Complete tax elimination on growth and access

- Estate Tax Planning: Death benefits pass tax-free to heirs

- 1031 Exchanges: Defer capital gains on real estate

Risk Management and Asset Protection

Comprehensive wealth building requires protection strategies that preserve what you’ve built.

Multi-Layer Protection Strategy

Protection Layers

Layer 1: Insurance Foundation

- Guaranteed cash value provides stability

- Death benefit protects family and legacy

- Creditor protection in many states

Layer 2: Diversification

- Multiple asset classes reduce risk

- Geographic diversification

- Income stream diversification

Layer 3: Legal Protection

- Entity structures for business assets

- Trust strategies for estate planning

- Professional liability coverage

Sequence of Returns Protection

One of the biggest risks to wealth building is poor market timing. The integrated approach provides unique protection:

- Guaranteed Foundation: Policy growth continues regardless of markets

- Strategic Deployment: Buy assets during market downturns

- Income Stability: Multiple streams reduce market dependence

- Flexible Timing: No forced selling during poor markets

Implementation Timeline and Action Steps

Success with this integrated approach requires proper sequencing and realistic timelines.

Year 1-2: Foundation Building

Phase 1 Implementation

Months 1-6:

- Complete debt inventory and create elimination plan

- Build $1,000 starter emergency fund

- Begin whole life insurance policy design process

- Establish basic budget and spending discipline

Months 6-12:

- Execute debt snowball aggressively

- Fund whole life policy with available margin

- Learn Volume-Based Banking principles

- Begin asset education (real estate, business, investing)

Months 12-24:

- Complete consumer debt elimination

- Increase policy funding with debt payment amounts

- Build full emergency fund through policy cash value

- Prepare for asset acquisition phase

Year 3-5: System Development

- Policy Maturation: Cash value becomes substantial enough for strategic use

- First Asset Acquisition: Use policy loan for initial real estate or business investment

- Cash Flow Development: Focus on assets that generate immediate income

- System Refinement: Learn from initial experiences and optimize strategies

Year 5-10: Acceleration Phase

- Multiple Income Streams: Diversify across real estate, business, and paper assets

- Volume Expansion: Increase policy funding with growing income

- Strategic Leverage: Use banking system for larger asset acquisitions

- Tax Optimization: Implement advanced strategies across all buckets

Year 10+: Wealth Acceleration and Legacy

- Financial Independence: Passive income exceeds living expenses

- Generational Planning: Establish trusts and estate structures

- Mentorship and Education: Teach strategies to family members

- Philanthropic Planning: Use wealth for charitable purposes

Success Milestones

- Year 1: Debt freedom and policy establishment

- Year 3: $50,000+ cash value available for deployment

- Year 5: First asset acquisition generating positive cash flow

- Year 7: Multiple income streams established

- Year 10: Financial independence achieved

Real-World Case Studies

Let’s examine how this integrated approach works in practice with real-world scenarios.

Case Study 1: The Young Professional

Background:

- Age: 28, single professional

- Income: $85,000 annually

- Debt: $45,000 student loans, $8,000 credit cards

- Goal: Financial independence by age 45

Implementation:

Years 1-2: Debt elimination using snowball method, simultaneously started $500/month whole life policy

Years 3-4: Increased policy funding to $1,200/month, began real estate education

Year 5: Used $40,000 policy loan for duplex down payment, lived in one unit

Years 6-8: Acquired two more rental properties using policy loans and cash flow

Results at Age 35:

- $180,000 cash value in policy

- Three rental properties generating $2,400/month net income

- $850,000 net worth

- On track for financial independence by age 42

Case Study 2: The Family with Children

Background:

- Ages: 35 and 33, married with two children

- Combined Income: $150,000

- Debt: $280,000 mortgage, $25,000 car loans, $15,000 credit cards

- Goals: Children’s education funding, retirement security

Implementation:

Year 1: Eliminated consumer debt, started $800/month policy on primary earner

Year 2: Added $400/month policy on spouse, increased primary to $1,000/month

Years 3-5: Used policy loans to start consulting business, generated additional $30,000 annually

Years 5-7: Business cash flow funded children’s policies and real estate investments

Results at Ages 45/43:

- $320,000 combined cash value

- Business generating $75,000 annual profit

- Two rental properties plus primary residence

- Children’s education fully funded through policy growth

- $1.2 million net worth

Case Study 3: The Business Owner

Background:

- Age: 42, business owner

- Income: $250,000 (variable)

- Challenges: Irregular income, limited retirement options, tax burden

- Goals: Stable wealth building, tax reduction, business expansion capital

Implementation:

Year 1: Started $2,000/month base policy with flexible premium options

Years 2-3: Used policy loans for business expansion, avoided bank financing

Years 4-6: Increased funding during high-income years, maintained access during lean periods

Years 7-10: Deployed cash value for commercial real estate acquisition

Results at Age 52:

- $650,000 cash value providing business stability

- Expanded business generating 40% more revenue

- Commercial property providing $18,000 annual income

- Significant tax savings through strategic borrowing vs. withdrawal

- $2.1 million net worth with strong cash flow

Common Implementation Mistakes to Avoid

Industry data shows that learning from others’ mistakes can save you years and thousands of dollars. Studies demonstrate these are the most common implementation errors:

Mistake 1: Trying to Do Everything at Once

The Problem:

Attempting to implement all three strategies simultaneously without proper foundation building.

The Solution:

Follow the sequential approach: Ramsey foundation first, Nash banking system second, Kiyosaki assets third.

Mistake 2: Under-Funding the Insurance Policy

- Problem: Buying minimum premium policies that don’t build substantial cash value

- Solution: Work with specialists who understand high cash value design

- Target: Fund policies at 80-90% of Modified Endowment Contract limits

Mistake 3: Ignoring Policy Loan Discipline

- Problem: Borrowing from policies without systematic repayment plans

- Solution: Treat policy loans as seriously as bank loans with structured repayment

- Best Practice: Use asset cash flow to repay loans systematically

Mistake 4: Focusing Only on Rate of Return

- Problem: Comparing whole life returns to stock market returns directly

- Solution: Understand you’re building a banking system, not just an investment

- Perspective: Compare to bank CDs and savings accounts, not market volatility

Mistake 5: Neglecting Asset Education

- Problem: Having capital available but lacking knowledge to deploy it effectively

- Solution: Begin asset education during foundation building phase

- Focus Areas: Real estate analysis, business evaluation, market timing

Frequently Asked Questions

Why should I combine Dave Ramsey, Robert Kiyosaki, and Nelson Nash instead of just picking one?

Here’s what we’ve learned from working with hundreds of families: each guru solves a different piece of the wealth-building puzzle. Ramsey gives you the discipline and foundation, Nash provides the banking system and control, and Kiyosaki shows you how to build assets. When you use all three together, you get the security AND the growth that none of them deliver alone.

How long does it take to see results from this integrated approach?

Results vary by implementation speed and individual circumstances:

- Immediate: Debt elimination momentum and financial discipline

- 6-12 months: Emergency fund replacement through policy cash value

- 2-3 years: Substantial cash value available for strategic deployment

- 5-7 years: Multiple income streams and significant wealth accumulation

- 10+ years: Financial independence and generational wealth building

What if I can’t afford the recommended premium amounts?

Start where you can and build systematically:

- Begin with minimum viable policy during debt elimination

- Increase funding as debt payments are eliminated

- Use asset cash flow to expand policy funding

- Focus on consistency rather than maximum amounts initially

How does this compare to traditional 401(k) and IRA strategies?

The integrated approach complements rather than replaces qualified plans:

- Keep employer 401(k) match – free money is still free money

- Add Volume-Based Banking for liquidity and control

- Use asset strategies for additional income streams

- Result: Diversified approach across all tax buckets

What about market downturns and economic crashes?

The integrated approach actually thrives during economic uncertainty:

- Guaranteed foundation continues growing regardless of markets

- Strategic deployment opportunities increase during crashes

- Multiple income streams provide stability

- No forced selling during poor market conditions

Is this strategy only for high-income individuals?

The strategy scales to different income levels:

- $50,000+ income: Focus on foundation building and basic implementation

- $100,000+ income: Full strategy implementation with multiple assets

- $200,000+ income: Accelerated timeline and advanced strategies

- Key principle: Discipline and consistency matter more than income level

How do I find qualified professionals to help implement this?

Look for professionals who understand all three strategies:

- Insurance specialists who design high cash value policies

- Real estate professionals who work with investors

- Business advisors who understand cash flow analysis

- Tax professionals who optimize across all strategies

Conclusion: Your Path to Financial Freedom

The integration of Dave Ramsey’s debt elimination discipline, Nelson Nash’s Volume-Based Banking system, and Robert Kiyosaki’s asset-focused mindset creates a comprehensive wealth-building blueprint that addresses every aspect of financial success.

The Complete Advantage

This integrated approach provides what no single strategy can deliver:

The Integration Advantage

- Financial Foundation: Guaranteed growth and protection that never disappears

- Strategic Control: Your own banking system for all financing needs

- Multiple Income Streams: Diversified cash flow that provides true independence

- Tax Optimization: Strategies that work across all tax environments

- Risk Management: Protection against market volatility and economic uncertainty

- Legacy Building: Generational wealth that benefits future family members

- Peace of Mind: Confidence that comes from guaranteed foundations

Why This Synthesis Works Where Others Fail

Traditional financial advice forces false choices:

- Safety OR growth

- Liquidity OR returns

- Current income OR future wealth

- Tax benefits OR investment gains

The integrated approach eliminates these false dichotomies by providing all benefits simultaneously through strategic coordination of complementary strategies.

Your Next Steps

Financial freedom isn’t about following someone else’s path exactly—it’s about understanding proven principles and applying them to your unique situation. This integrated approach provides the framework, but your implementation will be personal to your circumstances, goals, and timeline.

The question isn’t whether these strategies work—they’ve been proven by thousands of successful practitioners. The question is whether you’ll take the first step toward building your own comprehensive wealth-building system.

The Choice Before You

You can continue following conventional financial advice that treats symptoms rather than building systems. You can remain dependent on external institutions for your financing needs. You can hope that volatile markets cooperate with your retirement timeline.

Or you can choose to build your own financial ecosystem—one that provides guaranteed foundations, strategic control, and unlimited growth potential.

The choice is yours. The blueprint is here. The only question remaining is: When will you start?

Ready to Build Your Integrated Wealth-Building Blueprint?

Understanding these concepts is just the beginning. The real transformation happens when you apply this integrated approach to your specific financial situation, goals, and timeline.

Our Pro Client Guides specialize in helping individuals and families implement the complete synthesis of Ramsey, Nash, and Kiyosaki strategies. They understand how to coordinate debt elimination, banking system development, and asset acquisition for maximum effectiveness.

What You’ll Discover in Your Strategy Session:

- ✓ Personalized analysis of how these three strategies apply to your situation

- ✓ Custom timeline for implementing each phase based on your current position

- ✓ Specific policy design recommendations for your banking system

- ✓ Asset acquisition strategies that align with your risk tolerance and goals

- ✓ Tax optimization opportunities across all three approaches

- ✓ Clear action steps to begin building your wealth-building blueprint immediately

Don’t let another year pass following conventional advice that keeps you dependent on external institutions and market volatility. Discover how you can combine the best of Ramsey’s discipline, Nash’s banking concepts, and Kiyosaki’s asset focus into your personal wealth-building blueprint.

No obligation. No sales pressure. Just expert guidance to help you determine how to synthesize these proven strategies into your personal path to financial freedom.

Continue Your Financial Education

This integrated approach builds on decades of proven wealth-building principles. Deepen your understanding with these additional resources:

- The Ultimate Asset Analysis: Detailed comparison of Volume-Based Banking vs. traditional strategies

- Real Estate Investment Strategies: How to analyze and acquire income-producing properties

- Business Cash Flow Evaluation: Methods for identifying and purchasing profitable businesses

- Tax Optimization Strategies: Advanced techniques for minimizing taxes across all wealth-building activities

- Estate Planning Integration: How to structure your wealth for multi-generational transfer

True financial education is a lifelong journey. This blueprint provides the foundation, but continued learning ensures you maximize every opportunity along the way.