The Sophisticated Next Step for High-Income Professionals Who’ve Maxed Their 401(k)s

By Barry Brooksby, Financial Architect & Steve Gibbs, Estate Planning Attorney

Table of Contents

- The Retirement Trap Waiting for 401(k) Maxers

- Why Diversification Isn’t Enough

- The Sophisticated Allocation Framework

- The Ultimate Asset® Foundation: Your 25% Solution

- Uninterrupted Compounding vs. Traditional Withdrawal

- Real Case Study: How Michael Built His Foundation

- Designing Your Financial Architecture

- Implementation Guide for High Earners

- Finding Your Financial Architect

The Retirement Trap Waiting for 401(k) Maxers

If you’re maxing out your 401(k), you’re doing everything right according to conventional wisdom. You’re disciplined, forward-thinking, and building substantial wealth for retirement.

Here’s the brutal reality: Sequence of Returns Risk is the retirement killer that no one talks about until it’s too late.

The 2008 Reality Check

Consider this nightmare scenario that actually happened to millions of responsible savers:

You retire in December 2007 with $1.2 million in your 401(k) after decades of disciplined saving. You’re following the “4% rule” and planning to withdraw $48,000 annually for living expenses.

Then 2008 hits. Your portfolio crashes 40% to $720,000. But you still need that $48,000 to live on.

Even when the market eventually recovered, many of these retirees’ portfolios never caught up. They were forced to drastically reduce their lifestyle or return to work.

“I’ve watched too many successful professionals see their retirement dreams shattered by this exact scenario. They did everything right for 30 years, but one market crash at the wrong time changed everything.” – Steve Gibbs, Estate Planning Attorney

The Distribution Problem

You’ve mastered accumulation, but most high-income professionals have never considered distribution strategy.

Think about it: You’ve diversified your investments across dozens of funds and asset classes. But you have only one way to access your retirement money—sell investments and hope the market cooperates.

Why Traditional Diversification Isn’t Enough

Working with high-net-worth families, I’ve observed a critical blind spot in traditional financial planning. Most professionals focus entirely on asset diversification while completely ignoring withdrawal diversification.

The Single Point of Failure

Your current retirement strategy likely looks like this:

- ✓ Employer 401(k) match maximized

- ✓ Asset allocation properly diversified

- ✓ Contribution limits maximized

- ✓ Rebalancing strategy in place

But when it comes time to access your money, you have exactly one option: liquidate investments from your retirement accounts and hope the market timing works in your favor.

What Sophisticated Investors Do Differently

The ultra-wealthy use a completely different approach. Instead of putting all their eggs in one withdrawal strategy, they create multiple ways to access capital that work independently of market conditions.

“In my 20+ years designing wealth strategies for high earners, I’ve seen the same pattern among the most successful clients: They think like architects, not gamblers. They don’t just build wealth—they engineer withdrawal systems that can weather any economic storm.” – Barry Brooksby, Financial Architect

The Sophisticated Allocation Framework

Here’s the complete framework we recommend for high-income professionals who’ve mastered the basics:

Phase 1: Secure the Free Money ✓

Max your 401(k) employer match

You’re already doing this (never leave free money on the table)

Phase 2: Build Your Foundation

Allocate 25% of your investment capital to The Ultimate Asset® Foundation

- Creates uninterrupted compounding regardless of market conditions

- Provides tax-free access to capital without selling investments

- Eliminates sequence of returns risk for this portion of your wealth

Phase 3: Strategic Deployment

Use your growing foundation as collateral for everything else:

- Fund Roth IRA contributions without cash flow disruption

- Real estate acquisitions with borrowed money while foundation keeps growing

- Business opportunities without liquidating investments

- Market downturns become buying opportunities instead of disasters

The Integration Advantage

This isn’t about whole life versus Wall Street. It’s about asset orchestration—designing a financial ecosystem where each component makes the others work better.

The Ultimate Asset® Foundation: Your 25% Solution

What exactly is The Ultimate Asset®? It’s a properly structured high cash value dividend-paying whole life insurance policy designed specifically for sophisticated investors who demand control over their capital.

Why Banks Stockpile $130 Billion of This Asset

America’s largest banks quietly hold over $130 billion in bank-owned life insurance (BOLI). They’re not investing in these policies for the death benefit—they’re using them as financial engines that provide:

- Guaranteed growth regardless of market conditions

- Tax-free accumulation and access

- Immediate liquidity without selling investments

- Collateral capacity for strategic opportunities

The Four Pillars of The Ultimate Asset® Foundation

1. Uninterrupted Compound Growth

Unlike market investments that can lose decades of progress overnight, your foundation locks in gains every year. Your cash value only moves in one direction—up, providing true uninterrupted compound interest growth.

When the market crashes 40%, your foundation keeps growing. When interest rates fluctuate, your foundation remains stable. When economic uncertainty creates chaos, your foundation provides calm.

2. Tax-Free Access Without Liquidation

Traditional retirement accounts force you to sell investments to access money. The Ultimate Asset® lets you borrow against your cash value while your entire balance continues earning compound interest and dividends.

3. Elimination of Sequence Risk

Because you’re borrowing instead of withdrawing, market timing becomes irrelevant to your income strategy. Early retirement during a bear market? No problem. Your foundation provides income while your other investments recover.

4. Strategic Leverage Platform

Your growing cash value becomes collateral for everything else. Want to buy real estate? Borrow against your foundation. Market crash creating opportunities? Use your foundation. Need to fund a Roth IRA? Your foundation provides the liquidity.

“The most sophisticated clients I work with understand this: You don’t want your money sitting idle ever. The Ultimate Asset® ensures your capital is always working, even when you’re using it for other investments.” – Barry Brooksby

Uninterrupted Compounding vs. Traditional Withdrawal

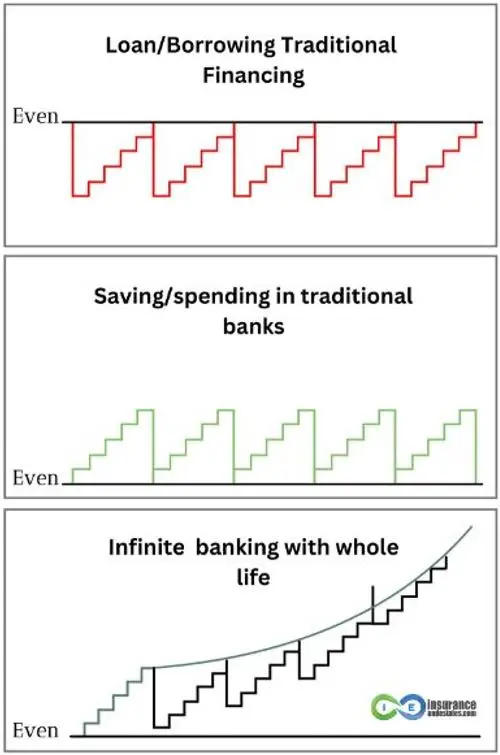

Let me show you the fundamental difference between how traditional retirement accounts work versus The Ultimate Asset® foundation.

The Traditional Method: Forced Liquidation

With traditional retirement accounts:

- You sell investments to access money

- Those sold shares can never recover because they’re no longer in your account

- Market timing becomes critical to your financial survival

- Bad timing can permanently damage your portfolio’s growth potential

The Foundation Method: Uninterrupted Growth

With The Ultimate Asset® foundation:

- You borrow against your cash value

- Your entire balance continues growing as if you never touched it

- Market timing becomes irrelevant to your access strategy

- Your wealth engine never stops building momentum

See how The Ultimate Asset® lets you grow wealth in two places at once, unlike traditional financing methods

The Compound Effect Over Time

This difference compounds dramatically over decades. While traditional retirees are forced to cannibalize their nest egg during bad markets, foundation-based retirees maintain their wealth engine regardless of market conditions.

Real Case Study: How Michael Built His Foundation

Let me share the story of Michael, a 35-year-old software architect earning $280,000 annually. He was already maxing his 401(k) and doing everything “right,” but felt trapped by the traditional retirement model.

Michael’s Situation

- Annual income: $280,000

- Already maxing 401(k) with employer match ($23,000 annually)

- $150,000 in investment accounts

- Available investment capital: ~$100,000 annually after taxes and expenses

- Wanted more control over his capital

- Interested in real estate but didn’t want to liquidate investments

The Foundation Strategy: Beyond the 10% Rule

Most financial advisors tell you to save 10% of your paycheck. Michael was already doing much better—saving over 35% of his income through his 401(k) and investment accounts.

But here’s where sophisticated investors think differently: Instead of spreading all surplus capital across traditional investments, we allocated 25% of Michael’s investment capital directly into The Ultimate Asset® foundation:

- Michael’s annual investment capacity: $100,000

- Ultimate Asset® foundation: $25,000 (25%)

- Traditional investments: $75,000 (75%)

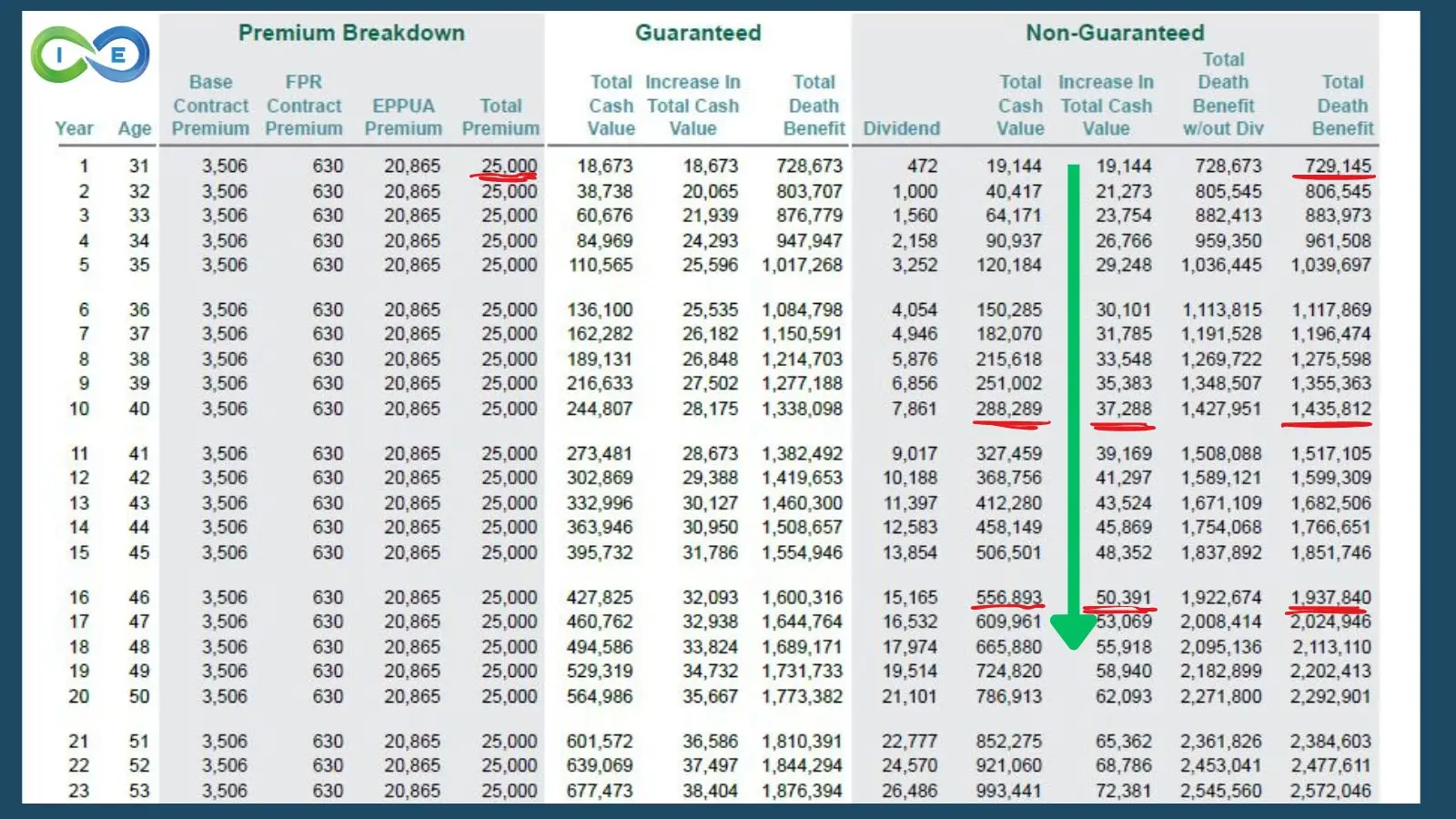

This $25,000 annual commitment to his foundation created the superior performance and strategic flexibility you see in the illustration:

Real Numbers: See how Michael’s foundation grows over time with $25,000 annual premiums

The Results by Year 10

- Total premiums paid: $250,000 (10 years × $25,000)

- Cash value: $288,289

- Annual growth: $37,288 (149% of his premium)

- Death benefit: $1,435,812 tax-free

- Net position: Cash value exceeds total premiums paid by $38,289

But here’s where it gets powerful: In year 8, Michael used $80,000 from his cash value to put a down payment on a rental property. His entire cash value balance continued growing as if he never touched it.

The Real Power: Strategic Access to Capital

Year 8 Real Estate Investment

In year 8, Michael used $80,000 from his cash value to put a down payment on a rental property:

Before the loan:

- Cash value: $215,618 (from illustration)

- Death benefit: $1,275,598

After accessing $80,000:

- Available cash value: $135,618

- Death benefit: Remains $1,275,598

- Key insight: His ENTIRE $215,618 cash value balance continued compounding

“Michael’s strategy is brilliant because it eliminates the either/or dilemma. His foundation keeps building wealth while he deploys capital for opportunities. It’s like having your cake and eating it too.” – Steve Gibbs

The Multiplier Effect

By year 15 (age 50), based on the illustration, Michael had:

- A growing foundation with $506,500 in cash value

- Multiple real estate investments acquired with foundation loans

- A maxed-out 401(k) still growing independently

- $48,400 in annual cash value growth (nearly 2x his premium)

- Complete flexibility for the next opportunity

Designing Your Financial Architecture

Not all whole life policies are created equal. The difference between a properly structured Ultimate Asset® foundation and a traditional policy can mean hundreds of thousands of dollars over your lifetime.

Maximum Early Cash Value

Instead of waiting decades for benefits, proper structure provides significant accessible capital within the first few years. We focus on:

- Paid-up additions riders that accelerate cash value growth

- Minimized base premiums to reduce early costs

- Term riders to optimize the death benefit structure

Premium Flexibility

Your financial situation will change over time. A properly designed foundation accommodates this with flexible premium options between a minimum and maximum range.

For example, in the example illustration we designed a policy for a 35-year-old professional where the minimum annual payment was $3,500 with a maximum of $25,000. That’s tremendous flexibility to adjust as income fluctuates.

Avoiding the MEC Trap

A Modified Endowment Contract (MEC) destroys the tax advantages that make The Ultimate Asset® so powerful. A qualified designer will carefully structure your policy to maximize cash value while staying below MEC thresholds.

Company Selection

We work with multiple top-rated mutual insurance companies, each with their own strengths:

- Dividend history (look for 100+ years of consecutive payments)

- Financial strength (A+ ratings or higher)

- Policy loan features (competitive rates and terms)

- Underwriting efficiency (streamlined approval process)

“Policy design is an art form. Every client’s situation is unique, and the structure should reflect their specific goals and financial circumstances. One-size-fits-all doesn’t work when you’re building a foundation for generational wealth.” – Barry Brooksby

Implementation Guide for High Earners

Ready to build your Ultimate Asset® foundation? Here’s your step-by-step implementation guide:

Step 1: Assess Your Current Position

Calculate your foundation allocation:

- Annual income after 401(k) match

- Current investment surplus

- Minimum viable foundation: $500/month

Step 2: Design Your Foundation

Work with a qualified professional to structure your policy for:

- Maximum early cash value

- Premium flexibility

- Optimal company selection

- MEC avoidance

Step 3: Integration Strategy

Plan how your foundation will integrate with your existing wealth-building:

- Continue maxing 401(k) (don’t stop the free money)

- Redirect investment surplus to foundation building

- Plan strategic uses for your growing cash value

- Maintain emergency funds in traditional accounts initially

Step 4: Deployment Planning

As your foundation grows, plan your strategic deployment:

- Years 1-3: Foundation building phase

- Years 4-7: First strategic deployments

- Years 8+: Full velocity phase with multiple uses

Common Implementation Mistakes to Avoid

- Stopping 401(k) matching to fund the foundation

- Over-funding initially and creating MEC status

- Using traditional policy design instead of optimized structure

- Choosing company based on agent relationship rather than optimal fit

- Not planning integration with existing wealth strategies

Finding Your Financial Architect

The success of your Ultimate Asset® foundation depends heavily on working with the right professional. Not all insurance agents understand this sophisticated approach.

Key Qualifications to Demand

Look for professionals who can demonstrate:

- Policy design expertise with high cash value structures

- Multi-company access (independent, not captive agents)

- Integration experience with comprehensive wealth strategies

- Client track record with professionals in your income range

Red Flags to Avoid

- Agents who push for quick decisions

- One-size-fits-all policy recommendations

- Focus on death benefit rather than cash value optimization

- Inability to explain MEC avoidance strategies

- No examples of policies designed for your situation

The Right Questions to Ask

- “What percentage of your practice focuses on high cash value design?”

- “How many companies can you access for comparison?”

- “Can you show me your typical policy design for someone in my situation?”

- “How do you ensure we avoid MEC status while maximizing cash value?”

- “What’s your process for ongoing policy optimization?”

Ready to Build Your Foundation?

If you’re a high-income professional ready to move beyond traditional retirement planning, we’d love to show you how The Ultimate Asset® foundation can transform your wealth strategy.

Our team specializes in designing optimized foundations for professionals earning $200,000+ who demand more control over their capital.

Includes complete policy design consultation and integration planning

Key Takeaways

- You’ve mastered accumulation – now master distribution

- Sequence of returns risk is the hidden retirement killer

- 25% foundation allocation eliminates withdrawal vulnerability

- Uninterrupted compounding beats forced liquidation

- Asset orchestration creates opportunities traditional planning can’t

- Proper design makes all the difference in results