If you’re looking for ways to maximize your available cash, while at the same time reducing – or even eliminating – the amount of tax that you’ll have to pay in order to access it, a life insurance policy could provide you with a solution.

While many people think of life insurance coverage only for the death benefit protection it provides, there is actually a long list of other features that you could be eligible for – many during your lifetime – including tax-free access to the accumulated cash value.

But not just any policy will be a good candidate for you to borrow from. So, it is important that you have the right type of coverage in place, and that you take all of the necessary steps to borrow money from it.

Otherwise, your policy could lose some of its tax advantages – or even end up lapsing – leaving your beneficiary(ies) with no death benefit protection in case of the unexpected. Because of that, moving through the policy loan process with a life insurance specialist is a critical part of the process.

Types of Life Insurance You Can Borrow From

Life insurance loans are only available with cash value life insurance policies. These cash value policies are permanent life insurance policies and include whole life and universal life. Because term life insurance policies do not have a cash value component, term life is not a life insurance policy you can borrow money from.

It is important to note, though, that not all cash value life insurance policies are exactly the same. In fact, far from it.

Whole Life Insurance

The accumulated cash value in a whole life insurance policy typically grows at a fixed guaranteed rate that is set by the insurance company. This rate is usually somewhat low – approximately 3% to 4%.

And a participating policy also pays out an annual dividend that may increase the total cash value growth to 5-5.5%, although historically this has been higher.

In addition, while whole life insurance policy dividends are not guaranteed, if your policy is eligible for these, they will continue to be paid, even when you borrow money from your policy. Dividends that are received can also help with increasing the amount of the policy’s cash value.

For more, please check out our article Whole Life Insurance Cash Value Chart

Universal Life Insurance

Universal life insurance policies are generally more flexible than whole life policies. For instance, unlike whole life plans, universal life policy holders may pay higher premium payments than is actually needed to keep the insurance protection in force, and the overage will go into the cash value component. So, based on the way that you fund a universal life insurance policy, there is the potential to accumulate cash value funds faster and higher than you could with a whole life policy.

Indexed Universal Life

An alternate form of universal life – known as indexed universal life insurance, or IUL – generates the return on its cash value, based on the performance of one or more underlying market indexes, such as the S&P 500.

With an IUL policy, if, during a given time period, the underlying index performs well, the cash value is credited with a positive return – oftentimes up to a pre-set maximum, or “cap.” However, if the tracked index(es) performs poorly in a given time frame, the IUL policy’s cash value will not incur a loss. Rather, it is still credited with a “guaranteed floor” rate. (Currently, in 2023, these floor rates may be between 0% and 2%).

Then, when the index performs in the positive again, there are no losses in the cash value to make up for before it starts to grow and build up again. So, this can help to increase the value of the funds in the policy’s cash value component even more.

Cash Value Grows Tax Deferred

As an added plus, the cash value that is in a permanent life insurance policy grows on a tax deferred basis. This means that there is no tax due on the gains until the time of withdrawal…which might not be for many years in the future.

So, if you withdraw funds from your policy’s accrued cash value, there will likely be taxes involved. In addition to that, you could also incur a surrender charge on these withdrawals. Most universal life insurance companies charge early withdrawal or surrender fees if a policy is cancelled within the first few years of purchasing it.

They will also do so if you keep the policy in force, but you access more than the penalty-free withdrawal amount during the “surrender” period. (In many cases, the policy owner is allowed to withdraw up to 10% of the contract value per year. But any amount above that, during the cash surrender period, will be penalized).

Typically, the amount of the cash surrender charge – which is usually stated as a percentage of the withdrawal that you take – will be reduced over time, until it eventually goes away, as the example below suggests.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

Example of a Universal Life Insurance Policy’s Surrender Charge Period

| Year: | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9+ |

| Surrender Charge: | 8% | 7% | 6% | 5% | 4% | 3% | 2% | 1% | 0% |

Having life insurance withdrawals that increase your taxable income can lead to other negative financial consequences, too, such as taxation of your Social Security retirement benefits. Many people are not aware that if they have other substantial income in addition to their Social Security, they could pay tax on up to 85% of these benefits. And the more you owe to Uncle Sam, the less income you will net out and be able to use for your personal needs and wants.

Tax Free Policy Loan

One of the best ways to avoid taxation and penalties on your incoming cash flow – while at the same time having access to funds from your policy’s cash value – is to take a tax free policy loan. This is a type of loan that you can take out against the cash value in your life insurance policy.

Like most other loans, interest will accrue on a life insurance policy loan. But if the outstanding loan balance is not repaid before the insured passes away, money from the death benefit will be used for paying off the outstanding loan balance. The remainder of these funds will then be paid to the beneficiary(ies).

Why Borrow from Your Life Insurance Policy?

Although most people aren’t typically excited about taking on more debt, borrowing money from your life insurance policy is different – and doing so could actually end up saving you money, provided that you go about it the right way.

Life insurance policy loans can offer you a way to obtain cash quickly, often with a low interest rate. So, these loans can be enticing if you have other higher-interest debts that you want to pay off and/or you want to purchase high-ticket items (like real estate) and you do not want to go through the “traditional” lending process.

Unlike applying for a loan from a bank or other lender, there is no credit check involved when you take out a loan from a life insurance company using your cash value as collateral – nor do these types of loans show up on your credit report.

Typically, the interest rate that is associated with a life insurance policy loan is much lower than that of a personal loan or that of a credit card – both of which can be in the double digits and also come with a lengthy list of repayment terms and conditions.

Collateral

One of the biggest benefits to taking a life insurance policy loan is that you are not actually borrowing cash from your own policy. Rather, you’re borrowing money from the life insurance company and simply using your cash value as the loan’s collateral. Therefore, interest will continue to accrue on the entire balance of the cash in your policy.

As an example, if you have $50,000 of cash value in a permanent life insurance policy, and you take a loan for $30,000, you will continue to generate interest on the entire $50,000. This, in turn, can allow you to use the money that you receive for other needs and wants, but without giving up the return on your policy’s cash value funds.

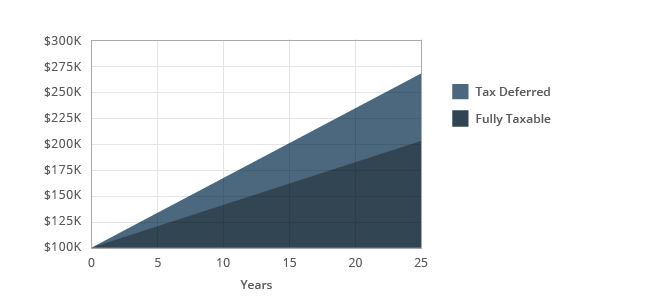

Plus, because cash value earnings accumulate tax deferred, the value of the account can continue to increase exponentially – especially as compared to gains on investments that are fully taxable (with all other factors being equal).

Comparing Tax Deferred Growth vs. Fully Taxable Growth

Steps to Borrowing From A Life Insurance Policy

Because the requirements for life insurance loans can differ from one insurer to another, there is not just one specific way to go about borrowing from a policy. However, in most cases, the process starts with contacting your insurance company and reviewing the details about such loans.

These will typically include the following:

- How much you may borrow (often expressed as a percentage of the cash value)

- The loan’s interest rate

- Repayment terms

- Conditions that could cause the policy to lapse or be cancelled

It is critical that you understand all of the terms and conditions of the policy loan so that you know what to anticipate.

Some life insurance companies allow you to take out a loan simply by filling out an online form. Other companies require you to make a phone call and speak to a company representative. And depending on the amount of the loan, you may be required to complete a life insurance policy loan application.

After that, you will usually be able to access the funds relatively quickly depending on if you had the funds sent to a bank or requested a check by mail.

What to Consider Before You Borrow from Life Insurance

While there are numerous advantages to borrowing from your life insurance policy, there are also some important items to consider before you move forward. Otherwise, you could find that you’ll lose some of the tax-related advantages.

Some of the top considerations before borrowing money from life insurance should include the following:

- Type of life insurance policy you have. Not all life insurance policies can be borrowed against.

- How much you are allowed to borrow from your policy. Many insurance carriers cap the loan amount at 80% or 90% of the cash value.

- The interest rate that the insurance company will charge on the borrowed funds. If the interest rate is in the higher range, and you don’t actively repay the borrowed funds, you may run the risk of the policy lapsing.

- Repayment terms – if any – on the loan. This, too, could make a difference in whether or not the policy remains in force over time – especially if you have trouble making the payments.

- Any other life insurance you have in force. If you have more than just one life insurance policy, it could provide your loved ones with a stronger financial safety net – particularly if the death benefit payout is reduced on the policy you borrowed from.

- The reason(s) you purchased the coverage – and how taking a loan from the policy may impact that.

Pros and Cons of Borrowing from Your Life Insurance Policy

With these factors in mind, you should also make sure that you are aware of both the pros and cons of borrowing from life insurance. For instance, on the benefit side, life insurance you borrow money from can offer a long list of advantages, such as:

- Access to tax free money

- A way to pay off other debts

- Fast and easy access to liquidity – without a credit check or many of the other loan underwriting requirements of traditional lenders

- The ability to continue generating a return on the entire amount of your cash value – even the funds you “borrowed”

- No repayment schedule on paying back the loan

There are also a few items to be mindful of, though, such as:

- A potential reduction of the death benefit on the unpaid loan balance at the time of the insured’s death – as well as the possibility of the policy lapsing if at least a minimum amount of repayment isn’t made

- The requirement that the policy have at least a minimum amount of funds in the cash value before you can borrow against it – which could take some time to build up

- If you do not already have a cash value life insurance policy in force, you (or whoever the insured will be) must first qualify for the life insurance coverage

Going over all of these – as well as any other factors related to your particular situation – should ideally be discussed with a life insurance specialist before you move forward on taking a policy loan.

Advantages and Disadvantages of Borrowing From Life Insurance

| Advantages | Disadvantages |

|---|---|

| Tax free access to cash | Unpaid balance can reduce the death benefit to the beneficiary(ies) |

| Ability to pay off higher interest loans | May require the policy to have a minimum cash value balance before you can borrow against it |

| No additional collateral needed to qualify | Interest build-up could cause the policy to lapse |

| No credit check, employment verification, or other loan underwriting requirements | May only allow a certain percentage of the cash value balance to be borrowed (such as 80% or 90%) |

| Continued growth of your policy's cash value | Must qualify for the life insurance policy (if you do not already have one in force) |

| No repayment schedule |

Getting A Life Insurance Policy You Can Borrow From

Having life insurance that you can borrow from could provide you with a great deal of flexibility. In addition, borrowing money from a cash value life insurance policy offers a strategy for accessing cash on a tax free basis – and these funds could be used for a wide range of needs, such as paying off higher-interest debt or even supplementing your retirement income.

Before taking a loan from your life insurance policy, though, it is recommended that you discuss your options with a life insurance specialist who is also well-versed in how to obtain tax free funds from your policy.

That’s where the experts at Insurance and Estates can help!

At Insurance and Estates, our goal is to assist you with all things related to life insurance. This not only includes making sure that your loved ones have a financial “safety net” in place in case of the unexpected, but also that you are aware of other potential benefits that are associated with this highly flexible financial vehicle – including those that you can use while you’re alive.

So what are you waiting for? Give us a call today and experience the I&E difference!

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept