The following article covers all things related to life insurance proceeds. The following topics will be covered.

- What Happens to Unclaimed Life Insurance Proceeds?

- Where Do Unclaimed Life Insurance Proceeds Go?

- How to Learn About and Access Unclaimed Life Insurance Funds

- The Model Unclaimed Life Insurance Benefits Act

- The Best Life Insurance for Long-Term Needs of Your Survivors

- Tax Deferred versus Fully Taxable Growth

- How to Keep Your Life Insurance Policy’s Benefits from Going Unclaimed

- The Process of Filing a Life Insurance Policy Claim

- How to Ensure that Your Survivors Receive the Death Benefit Funds They Need

- Do You Need More Information on Setting Up a Life Insurance Safety Net?

What Happens to Unclaimed Life Insurance Proceeds?

While many people obtain life insurance to protect their loved ones from financial hardship in case of the unexpected, if survivors don’t know about the policy, the death benefit proceeds could go unclaimed.

It is estimated that approximately 1 in 7 individuals and businesses have unclaimed property or assets that are due to them – much of which includes life insurance proceeds. In fact, every year in the United States, tens of millions of dollars in life insurance benefits go unclaimed. This, in turn, can leave loved ones without the financial safety net that they were entitled to.

Life insurance death benefit funds are often used by individuals and families for paying off debt (including estate taxes and home mortgages) and/or replacing lost income, as well as by businesses for funding a buy sell agreement or keeping the company afloat while a new owner or key employee can be found.

Because of that, it is essential to determine whether or not you are entitled to life insurance proceeds – and if so, what methods are available to find these funds if they have gone unclaimed.

The good news is that there are several options available for finding unclaimed life insurance benefits. Doing so could require some digging, though, so it is helpful if you know what can happen to unclaimed insurance proceeds, and where to start your search for them.

Where Do Unclaimed Life Insurance Proceeds Go?

There are many reasons why life insurance proceeds could go unclaimed. For example, the policy owner and the insurance company may have lost track of one another. In this case, because the primary mode of contact may be via “snail mail,” if the policy owner has moved, it is imperative to provide the insurer with a forwarding address. (And to then officially file a change of address form, because the U.S. Postal Service will only forward first class mail for one year).

Another reason why life insurance policy proceeds may go unclaimed is because the insurer does not know that the insured has passed away. Life insurance companies usually do not know when an insured has died until they are informed of his or her passing – which is typically done by the policy’s beneficiary.

Even if the premium payments have stopped being made on a policy, an insurer may still not know of the insured’s death. This is because some life insurance policies include methods of paying the premium via an automatic premium loan or other similar feature.

Likewise, many life insurance policies are in a stage when premiums are not due from the policy holder. These can include paid up policies, as well as single premium plans where the policy is completely paid up with just a single lump sum payment.

In addition, if an insured is still living but has forgotten that he or she owns a life insurance policy – or if they are unable to pay the premium due to a job loss or other financial difficulty – some carriers have methods in place for keeping policies in force.

For example, there are some life insurance policies that include a mechanism for ensuring that a premium payment on a permanent policy isn’t missed. In these instances, the insurer pays the premium out of money that has accumulated in the cash value component of the policy.

Although these premium payments will cease after the insured passes away, as long as the policy was in force at the time of the insured’s death, the beneficiary(ies) is entitled to the proceeds.

The insurance company may also be unable to find a policy’s beneficiary(ies). This, too, is another reason why proceeds from a life insurance policy could go unclaimed – and in some cases are never paid out. Therefore, it is important to provide detailed contact information about each beneficiary to the insurance company.

Likewise, beneficiaries may not know that they have been named on the policy as a recipient of the proceeds – or even that a life insurance policy exists at all. With that in mind, policy owners should ideally let individuals and/or organizations know that they are listed as beneficiaries. In addition, it can help to provide these beneficiaries with the name and contact information of the insurer, as well as the policy number(s).

In still other instances, a life insurance company may no longer exist, or the insurer’s assets (including its policy payout obligations) have been taken on by another insurance carrier. Typically, insurance companies will notify their policy holders of any such changes. So, it is important that this information be kept on file.

Some of the best places to start if you are looking for evidence of a life insurance policy include:

- Searching the insured’s physical and/or online files about the coverage – including their safe deposit box and other storage spaces

- Asking the insured’s financial advisor(s)

- Checking with the insured’s bank(s)

- Inquiring at the insured’s employer (in the case of group life insurance coverage)

If a policy is found, the insurance company should be notified right away, and an official claim should then be filed if the insured is deceased.

There is usually no deadline for filing a life insurance claim for the death benefit proceeds. It is important to keep in mind, though, that insurance companies do not keep unclaimed life insurance policies in their possession indefinitely. So, if the policy is no longer on the insurer’s books, the beneficiaries will have to look elsewhere for it.

Escheat

For instance, after a certain amount of time has passed (typically three to five years, depending on the state), the insurer may no longer hold the policy. Oftentimes, unclaimed life insurance proceeds are turned over to the state in which the insured is last known to have resided. (Not all states follow the same rules, though, so looking up the rules in the insured’s state of residence can help to give you direction). This process of transferring property to the state is known as “escheat.”

In the case of life insurance proceeds, after an unclaimed death benefit has been transferred to a state, that state must make a last-ditch effort to find the beneficiary(ies) before the funds are officially turned over to the state’s treasurer.

Insurers may also have other methods in place for paying out unclaimed life insurance proceeds. For instance, typically, people do not live to the age of 120. So, if a policy’s beneficiary(ies) has not claimed benefits by the time an insured would have turned 120 years of age, the insurance company will assume that the insured is deceased on what would have been their 120th birthday. At that time, the proceeds are distributed to any of the living beneficiaries that are named on the policy.

It is important to note that only beneficiaries may claim the death benefit of a life insurance policy. Therefore, if none of a policy’s beneficiaries are still alive (both the primary and contingent beneficiaries), the death benefit proceeds will usually have to go through the process of probate. If so, it could take an additional year or more for the recipient who is next in line to receive the funds. That is why it is best to avoid probate whenever possible.

How to Learn About and Access Unclaimed Life Insurance Funds

Fortunately, technological advances over the past couple of decades have reduced the likelihood of not knowing about life insurance coverage. So, what used to require days, weeks (or longer) for calling a list of insurance carriers can now typically be done with a quick online search.

Although life insurance policies are usually not considered to be public records, information about a policy may be found on websites and/or databases that aggregate records of unclaimed property in each state.

Some life insurance carriers have also started using the Social Security Administration’s (SSA) Death Master File, or DMF. This is a data source that includes nearly 100 million records of deceased individuals – created from internal Social Security records of those who possessed Social Security numbers – that were reported to the SSA.

Survivors may also access information from the Insurance Information Institute (III), as well as the American Council of Life Insurers (ACLI), the National Association of Insurance Commissioners (NAIC), and the websites of their individual state insurance departments.

NAIC

For instance, the NAIC’s policy locator service can assist with finding life insurance policies for a deceased loved one. In order to use this source, though, you will need information from the insured’s death certificate, as well as his or her Social Security number, legal first and last name, date of birth, and the date of their death.

When the NAIC receives a request to locate a life insurance policy, it will:

- Give participating insurance companies that have policy information access to respond to you, and

- Provide participating insurers access to search their records in order to determine whether or not it has a policy in the name of the deceased

Also, the National Association of Insurance Commissioners (NAIC) provides contact information for all of the state insurance departments in the U.S. This information may be found by going to the NAIC’s website here.

If an insurance company has been sold or has merged with another company, the state insurance department will typically also have this information on file, as well as the contact details for the current carrier.

NAUPA

Another possible option for learning about unclaimed life insurance policy proceeds is to go to the website for the National Association of Unclaimed Property Administrators (NAUPA). This organization offers education, software, and other resources for finding and reporting unclaimed property and assets.

When assets – such as life insurance death benefit proceeds – have had no activity for a certain amount of time, they will transition to “unclaimed property.” This is typically done by the company or financial institution that is holding those assets.

The time in which no activity or contact has been made for an asset is referred to as the “dormancy period.” Once this period has been reached – and no “owner” of the asset or property has been located – the assets are turned over to the state for safekeeping.

When this occurs, individuals – such as life insurance policy beneficiaries – must go through the process of reclaiming the assets. Each individual state is responsible for managing the process, and for ultimately returning the assets to their owners.

In other cases, a life insurance company may have gone bankrupt. If this occurs, the state guaranty association will step in. Similar to how the FDIC (Federal Deposit Insurance Corporation) protects bank customers if a bank becomes insolvent, state guaranty associations will pay up to a certain amount of benefits if an insurer goes under and becomes insolvent.

So, if an insurance carrier lacks funds to pay its debts and other obligations, the state insurance commissioner acts as the estate administrator. While the amount of coverage through the guaranty association can differ from state to state, most states offer up to the amounts that are specified in the National Association of Insurance Commissioners’ Life and Health Insurance Guaranty Association Model Law.

These amounts are:

- $300,000 in life insurance death benefits

- $100,000 in net cash surrender or withdrawal values for life insurance

- $300,000 in disability income insurance benefits

- $300,000 in long-term care insurance benefits

- $500,000 in medical, hospital, and surgical policy benefits

- $250,000 in the present value of annuity benefits (which includes cash surrender and withdrawal values – payees of structured settlement annuities are also entitled to $150,000 of coverage)

- $100,000 for coverages not defined as disability insurance, health benefit plans, or long-term care insurance

It is important to note that most states impose an overall “cap” of $300,000 in total benefits for any individual with one or multiple policies with an insolvent insurance company.

There may be some instances when, despite all of the best efforts, finding a life insurance policy when a loved one passes away can seem impossible. If you wish to continue your search, though, there are private companies and paid services available that may be able to help.

Some of these companies will send out correspondence (such as emails, faxes, and letters) to all life insurance companies on your behalf. Others may perform an investigative search and are paid, based on a percentage of any assets that are recovered – if any.

MIB

One of the paid options for finding unclaimed life insurance proceeds is the Medical Information Bureau – now known simply as the MIB. This organization is similar to a credit reporting agency that helps insurance companies mitigate their risk by protecting them against policy holder fraud.

The MIB’s Policy Locator Service, or PLS, may provide evidence of life insurance applications on a decedent that were taken by one of the entity’s 430 member companies. (This includes both U.S. and Canadian member life insurers). In addition to an application for locator services and payment, the MIB also requires that an original death certificate be submitted before it will begin a search.

It is important to understand, though, that even with extensive databases like the MIB has, there can be some limitations in the search for unclaimed life insurance proceeds. For instance, while the MIB provides search results for life insurance applications, it does not indicate whether any life insurance was ever issued and/or is actually in force at the time of the insured’s passing.

In addition, the MIB’s Policy Locator Service only covers life insurance applications that were underwritten and taken at member companies between January 1st, 1996, and the present time.

Further, the following types of life insurance are not covered in the MIB’s search services:

- Lower face amounts ($100,000 and below)

- Employer-based policies (or other group coverage) that are not individually underwritten

- Life insurance that is issued by the military

If a life insurance application is found in the MIB’s database, information about beneficiaries is usually not included in the search, either.

The Model Unclaimed Life Insurance Benefits Act

When searching for death benefit proceeds that you may be entitled to, it can help to be familiar with the Model Unclaimed Life Insurance Benefits Act. This legislation – which is also known as the National Council of Insurance legislators (NCOIL) Model Act – actually standardizes the process of handling unclaimed life insurance policies. This can help with reducing the number of outstanding life insurance claims.

This Act was initially adopted by the National Council of Insurance Legislators in 2011. It was updated in 2014, and then readopted by the NCOIL Executive Committee in 2019. The model act requires insurance companies to periodically search the Social Security Administration’s Death Master File, or DMF, in order to determine if an individual has passed away.

Such checks can help insurance companies with identifying policy holders who are deceased. They can also help with finding policies that have unclaimed benefits, and then paying out the funds to the beneficiary(ies) that are named on them. If there is a “match,” the death benefit proceeds should be paid out to beneficiaries within 90 days.

Many individual U.S. states have adopted their own versions of the Model Unclaimed Life Insurance Benefits Act. Likewise, most major life insurance carriers follow the recommendations that are outlined in the Act – even in states that have not enacted the legislation.

The Best Life Insurance for Long-Term Needs of Your Survivors

If you are the beneficiary of a life insurance policy, it is possible that your financial needs have changed over time. Because of that, the amount of the proceeds you are slated to receive may or may not be enough to pay off the insured’s debts, replace lost income, and/or cover other financial needs that you may have.

Likewise, if you have life insurance coverage on yourself – or you if plan to purchase a policy soon – it is important to consider your beneficiaries’ short- and longer-term needs for the proceeds, because this can make a big difference in how they fare financially going forward.

Term vs Permanent

There are different categories of life insurance coverage available. These are term and permanent. Term life insurance provides coverage for a pre-set amount of time, such as 5, 10, or 20 years. After this time has elapsed, the policy will typically expire – unless it has been “converted” to a permanent type of coverage.

Term life insurance can oftentimes initially sound very appealing. One reason for this is because, since term insurance provides only death benefit protection – without any cash value – the cost can be low. This is particularly true if the insured is young and/or in good health at the time of application.

However, if the insured wishes to renew or continue coverage after a term life insurance policy has expired, the new coverage will be based on their then-current age and health condition. So, the cost of the updated policy could be much more expensive. And in some instances, if the insured has contracted serious health issues, they could be deemed uninsurable.

Therefore, when it comes to protecting loved ones for the longer term, permanent life insurance is often the better option. Permanent life insurance provides both death benefit protection and cash value.

Unlike term policies, permanent life insurance will typically remain in force as long as the premium is paid. This is the case, even as the insured ages and regardless of whether they contract serious health issues that could otherwise make them uninsurable.

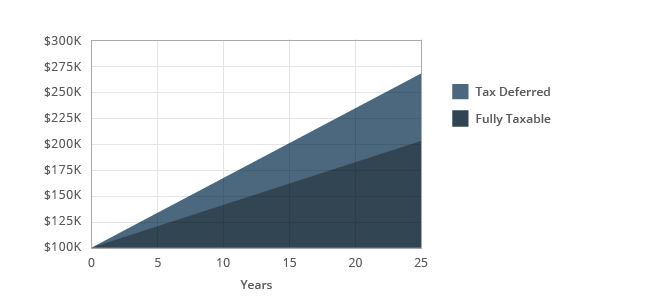

In addition, the cash value in a permanent life insurance policy is allowed to grow on a tax deferred basis. This means that there is no tax due on the gain until the time of withdrawal. So, even with a conservative rate of return, these funds have the ability to grow and compound exponentially over time.

Tax Deferred versus Fully Taxable Growth

Because permanent life insurance policies don’t have a “time limit” like term policies do, you and your loved ones won’t have to worry about the coverage “expiring” after a certain period of time. This, in turn, can provide more peace of mind, knowing that funds will be available in case of the unexpected – both now and in the future.

Plus, permanent life insurance can also be used while the insured is still alive. For instance, the funds from the cash value could be accessed penalty-free for a long list of needs and wants, such as:

- Payment for various healthcare and/or long-term care needs

- Supplementing retirement income

- Purchasing high ticket items like a home or a car

It may also be possible to access money from the policy’s cash value component without having to pay taxes on it. As an example, when funds are withdrawn, the amount of the withdrawal that is considered gain will be taxed as ordinary income in the year it was received.

But, you can take out a life insurance loan which allows you to borrow funds through the policy instead, that way the money can be received tax free. Although many people may not like the idea of “borrowing,” doing so through a cash value life insurance policy can come with a number of other advantages, too.

One of these benefits is that interest will continue to accrue on the amount that was “borrowed.” This is because the loan actually comes from the insurance company, and the policy’s cash value is used simply as collateral. There are no other financial tools that allow you to borrow a certain amount of money while at the same time still receiving a return on the collateral!

In addition, even though the insurance company will usually charge interest on the borrowed funds, if the return that is generated is the same – or possibly even more – than the amount of this interest being charged, the policy holder could obtain an interest-free and cost-free loan.

For instance, if the insurer charges 2% interest on the loan – which is possible, as life insurance policy loans oftentimes charge a lower interest rate than more “traditional” loans from banks and other lenders – and the funds in the policy’s cash value are also earning a 2% rate of interest, then the policy holder could secure a no-cost distribution.

As an added bonus, if the amount of the loan has not been fully repaid at the time the insured dies, the remaining balance can be paid off using funds from the death benefit (and the remainder of the death benefit will then be paid out to the beneficiary).

That being said, it is important to keep in mind that, while loans from the policy’s cash value are not necessarily required to be fully repaid during the insured’s lifetime, if there isn’t at least a certain amount of money in the cash component when the insured dies, then it is possible that the taxes that were avoided could come due.

Therefore, it is highly recommended that policy holders seek the guidance of life insurance professionals who are well-versed in properly setting up these types of plans before moving forward.

It is also important that you determine the right amount of death benefit coverage on a policy that you are purchasing. While there are several “rules of thumb” that you could use, such as ten times your annual salary, there is no single “right answer” for everyone across the board – primarily because everyone’s need for life insurance can differ.

For example, some people may only aim to cover the cost of their burial and other final expenses, while others might want to provide money for a child or grandchild’s college education, a large donation to a favorite charity, and/or replacement of lost income so that their loved ones don’t have to drastically change their lifestyle in the future.

With that in mind, some of the key items to consider when determining the right amount of life insurance coverage can include:

- Amount of any outstanding debts (including vehicle loans and home mortgage)

- Future education costs for children

- Amount of income to replace until children turn age 18

- Possible uninsured medical expenses

- Cost of a funeral, burial, and other final expenses

- Number of years until retirement

- Amount of savings and investments

- Any other life insurance coverage in force

How to Keep Your Life Insurance Policy’s Benefits from Going Unclaimed

If you own life insurance coverage, there are several steps that you can take to help with better ensuring that these benefits won’t go unclaimed by your beneficiaries. These can include the following:

Keeping your account(s) active.

One of the best ways to prevent your life insurance proceeds from going unclaimed by your beneficiaries is to maintain activity on all of your policies. This could include making regular premium payments, or even just staying in contact with your agent and/or the insurance company.

Maintaining updated contact information.

Keeping your contact information updated is also essential. This not only includes information about your physical mailing address, but also your email address and phone number.

Holding on to your policy records.

Keeping your policy records in a safe place is another way to help your beneficiary(ies) with claiming the proceeds when the time comes. You can do this with physical files, as well as having records that are digitally stored on your computer or in the cloud.

Sharing information with your beneficiary(ies).

Sharing policy details with your beneficiary(ies) is another way to assist them in the process of claiming your life insurance proceeds. Some of the most important of these include the name of the insurance company, your policy number, and contact information of the insurance agent or financial advisor who sold you the policy. If you are covered by a group life insurance plan through your employer, providing the contact information of the HR department to your beneficiary(ies) can also be beneficial.

The Process of Filing a Life Insurance Policy Claim

After an insured has passed away – and information about his or her life insurance policy is known – it will be necessary to file a claim with the insurer in order to access the death benefit proceeds.

Typically, you can contact the policy holder’s insurance agent or the insurance carrier directly to get the filing process started. The insurer will need the insured’s name, along with the life insurance policy number, in order to process the claim.

In addition, proof of the insured’s death is also required when you file a life insurance claim. Therefore, the insurance company will need a copy of the insured’s death certificate. This can be ordered through the funeral home that is handling the insured’s final arrangements.

Other information that could also be required by the insurance company include a(n):

- Autopsy report

- Coroner’s report

- Medical examiner’s report

- Policy report

- Toxicology report

In the past, this information could all be mailed to the insurance company. Today, however, more insurers are allowing life insurance claims to be filed online via the company’s website.

Many insurance carriers will give life insurance policy beneficiaries several options for receiving the death benefit proceeds. The most common of these is the payout of just one single lump sum.

Beneficiaries don’t typically have to claim the receipt of life insurance proceeds on their income tax return. However, in some cases, the amount of the proceeds may be included in the overall value of the policy owner’s estate for estate tax purposes.

Other possible alternatives for receiving life insurance proceeds may include the following:

- Specific income payout

- Life income payout

- Interest income payout

Specific Income Payout Option

With the specific income life insurance policy payout, the insurer will pay both principal and interest to the beneficiary(ies) for a pre-determined period of time, such as 10 or 20 years. While the principal isn’t taxable to the beneficiary as income, the portion of the payment that is considered interest usually will be.

Life Income Payout Option

If a life insurance policy beneficiary chooses to take a life income payout, the insurance company will continue making payments for the remainder of his or her lifetime – regardless of how long that may be – like a lifetime annuity.

The amount of each payment will depend on several factors, such as:

- The death benefit amount

- The age and gender of the beneficiary / recipient

Similar to the specific income payout method, the portion of each payment that is considered principal is not taxable to the recipient as income, but the amount that is interest will be taxable at the beneficiary’s ordinary income tax rate.

Interest Income Payout Option

If the interest income payout is chosen, the insurance carrier will hold the proceeds and then pay the beneficiary interest on them. With this option, the interest payments will typically be taxable to the recipient.

Generally, the amount of the death benefit (i.e., the original principal) will remain intact at the insurance company. These funds can then be paid out to a secondary beneficiary following the original beneficiary / recipient’s passing.

Depending on the insurance company, it is possible that a life insurance policy beneficiary could receive the death benefit proceeds (or start to receive their payouts) within just a few days of filing the initial claim.

How to Ensure that Your Survivors Receive the Death Benefit Funds They Need

Because many people purchase life insurance to prevent their loved ones from enduring financial hardship upon the insured’s passing, it is important that you communicate with your family members so that they know where to locate your policy(ies).

For example, let your primary beneficiary(ies), as well as your contingent beneficiary(ies) know about the existence of the coverage. If one or more of the policy beneficiaries is a minor, then you should inform the executor of your estate about the coverage.

When doing so, it is crucial that you include the following information:

- Name of the insurance company

- The policy number(s)

- The intended use of the proceeds (such as debt payoff, income replacement, college funding needs, charitable donation, etc.)

It can also help if you have copies of important documents – including your life insurance policy(ies) – located in physical file cabinets or a safe deposit box, as well as digitally.

Do You Need More Information on Setting Up a Life Insurance Safety Net?

Life insurance is an extremely important and flexible tool, and it can play a key role in your overall financial plan. But if you (or your beneficiaries) don’t know that a policy exists – or how to access the proceeds – it could drastically change the financial future of the recipient(s).

At Insurance and Estates, we’ll help you secure the right type and amount of life insurance protection. We will also assist your loved ones so that they aren’t left in the dark when the time comes to file a claim or to access important information.

Our experienced team specializes in building the best plan for your specific coverage needs – because when it comes to the financial protection of your loved ones, a cookie-cutter solution just won’t do.

So, if you would like more information on how our process works, we invite you to contact us with any questions that you may have. You can reach Insurance and Estates directly by calling (877) 787-7558.

Or, you can send us an email by going to our secure online contact form at https://www.insuranceandestates.com/contact/. We look forward to talking with you and helping to keep yourself and your loved ones financially secure, even if the unexpected occurs.

Sources

Fact Sheet: Unclaimed life insurance policies. Insurance Information Institute. https://www.iii.org/article/fact-sheet-unclaimed-life-insurance-policies

Unclaimed life insurance benefits. Insurance Information Institute. https://iii.org/article/unclaimed-life-insurance-benefits

Social Security Death Master File (DMF). https://fiscal.treasury.gov/files/dnp/20170804QRCDMF_FINALv2.pdf

Insurance Departments. National Association of Insurance Commissioners (NAIC). https://content.naic.org/state-insurance-departments

Policy Locator Service. National Association of Insurance Commissioners (NAIC). https://eapps.naic.org/life-policy-locator/#/welcome

National Association of Unclaimed Property Administrators (NAUPA). https://unclaimed.org

Missing Money. https://missingmoney.com

Locating the Company that Services your Life Insurance Policy. National Association of Insurance Commissioners (NAIC). https://content.naic.org/consumer_life_co_locator.htm

How do I file a life insurance claim? Insurance Information Institute. https://www.iii.org/article/how-do-i-file-life-insurance-claim

Insurance Guaranty Association Definition. By Daniel Liberto. Updated March 31, 2023. Investopedia. https://www.investopedia.com/terms/i/insurance-guaranty-association.asp

Policy Locator Service. MIB. https://www.mib.com/fee_based_services.html and https://mib.com/pls.html

The Unclaimed Life Insurance Benefits Act: What you should know. By Rebecca Shoenthal and Tory Crowley. Updated June 8, 2023. Policygenius. https://www.policygenius.com/life-insurance/unclaimed-life-insurance-act/

Model Unclaimed Life Insurance Benefits Act. National Council of Insurance Legislators (NCOIL). https://ncoil.org/wp-content/uploads/2019/03/Unclaimed-Property-Model-2019-Readoption.pdf