About Colonial Penn

From its headquarters in Philadelphia, Colonial Penn specializes in marketing life insurance directly to consumers.

When the company was formed in the late 1950s, that meant targeted nationwide radio and TV advertisements, with most business transacted over the phone or through the mail.

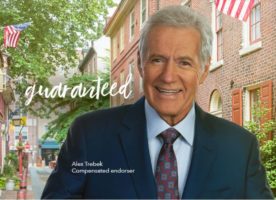

Today, Colonial Penn still has an impressive media presence (just ask Alex Trebek!), but a large chunk of its work is now conducted online.

Since its formation, Colonial Penn has placed an emphasis on the senior market. Indeed, one of the company’s original principals was AARP co-founder Leonard Davis.

Policy options are available for all adults up to age 85, but the retirement-aged demographic remains Colonial Penn’s focal point.

With that in mind, it’s not surprising that Colonial Penn’s guaranteed-acceptance final expense policy is its highest selling product.

Because the company doesn’t use local agents to market its policies, Colonial Penn has to rely on savvy advertising. Over the years, that has translated into a series of well-known celebrity spokespersons, including NFL quarterbacks Joe Theissmann and Roger Staubach, former Tonight Show personality Ed McMahon, and Alex Trebek of Jeopardy fame.

Colonial Penn policies are available in every state but New York. In New York, the life insurance policies are underwritten by Bankers Conseco Life Insurance Company.

In general, Colonial Penn policies come with a quick-and-easy, no medical exam life insurance application process but offer relatively low maximum death benefits.

Colonial Penn Financial Ratings

A.M. Best: A-

Fitch: A-

Moody’s: A3

S&P Global: A-

Comdex Ranking: 63

Colonial Penn’s financial ratings are neither bad, nor spectacular. As national life insurance companies go, Colonial Penn is on the smaller side, but there are no red flags suggesting any heightened risk to policyholders.

Colonial Penn is owned by CNO Financial Group, Inc., an Indiana-based financial services group that also owns insurers Bankers Life and Washington National. Compared to some of the larger players in the insurance industry, CNO is a moderately sized company with a relatively stable financial position. In 2019, CNO reported $4 billion in net revenue with about $290 million in operating income.

Colonial Penn only recently became accredited by the Better Business Bureau. The company currently holds an excellent A+ rating from BBB, though customer reviews on BBB’s website are not particularly encouraging. In all fairness, though, BBB’s sample size is probably too small to extrapolate any overarching conclusions.

Products Offered by Colonial Penn:

- Renewable Term Life Insurance

- Whole Life Insurance

- Final Expense Insurance

- Medicare Supplement Insurance

Life Insurance Policies Offered by Colonial Penn

Renewable Term Life Insurance:

Colonial Penn’s renewable term policy is available to new applicants from age 18 to 75 in every state but New York and Montana.

Policies are simplified-issue, requiring a health-history questionnaire but no exam. Available coverage starts at $10,000 and only goes up to $50,000, which is quite low for term coverage.

Although Colonial Penn’s Renewable Term policies are guaranteed renewable with no additional underwriting through age 90, premiums are only locked in for five years.

Note: Term insurance premiums will increase at every five-year renewal period and you can no longer renew at age 90.

Colonial Penn says that “cash value may be available” with its term policies but doesn’t provide any details as to how that cash value works.

Permanent Whole Life Insurance:

Available with no medical exam for new applicants from age 40 to 75, Colonial Penn’s whole life offering is a fairly standard whole life policy.

Premiums and death benefit amounts are fixed for life.

And policies accumulate cash value (after the first year of coverage), which accrues interest and can be borrowed against.

As with the term policy, death benefit amounts start at $10,000 and only go up to $50,000, so Colonial Penn’s whole life policy will be insufficient for income replacement for many potential insureds.

Guaranteed Acceptance Whole Life:

Guaranteed Acceptance Whole Life:

Colonial Penn’s guaranteed-issue final expense policy is the company’s best seller.

It provides the standard benefits of whole life insurance coverage—fixed premiums and guaranteed-for-life death benefits (as long as premiums are paid).

And, most notably, the application process does not include any medical history screening. If an applicant is between ages 50 and 85 and resides in a state where the policy is available, Colonial Penn will issue coverage.

Guaranteed acceptance burial insurance for seniors is an attractive feature for applicants who have health histories that might leave them otherwise ineligible for life insurance, but it also results in higher premiums for applicants who could qualify for a screened policy.

Coverage limits depend on an individual applicant’s age and gender and are pretty low. Rather than adjusting the premiums required for different coverage levels, Colonial Penn adjusts the amount of coverage provided per “unit” of insurance purchased—with each “unit” costing about $10 per month.

A maximum of twelve units can be purchased per policy.

The result is that a 50-year-old female and 80-year-old male could each purchase the maximum 12 units, pay the same monthly premium, and end up with vastly different death benefits.

Waiting Period

Guaranteed Acceptance is not burial insurance with no waiting period.

Rather, the policy has a two-year waiting period before full coverage takes effect if death is due to natural causes.

If an insured dies during that two-year window, the policy’s death benefit will be equal to all premiums thus far paid into the policy, plus 7% interest.

Colonial Penn Rates

So, how do you determine how much you will pay for your Colonial Penn guaranteed insurance policy?

Well, you have to understand the formula the company uses to determine your overall cost.

You can get a minimum of 1 unit of coverage, and a maximum of up to 12 units of coverage. Each unit costs the same no matter how old you are.

So, if you are a 50 year male, you will pay $119,40 a month for 12 units. And if you are a 80 year old male, you will pay $119.40 a month for 12 units of coverage.

But here is where things get a bit confusing.

Just because you pay the same for the same amount of units, the actual amount of life insurance each unit purchases is different for the 50 year old versus the 80 year old.

For example, 12 units of coverage for a 50 year old will buy him $21,432 worth of coverage.

But, 12 units for a 80 year old will buy him $5,112 worth of coverage.

So, both pay the same amount and both have 12 units of coverage, but the amount of actual life insurance each person has is very different.

We invite you to compare Colonial Penn rates with the following rates from some competitors. We have included rates for guaranteed issue and also level benefit, because you may qualify for these also.

Rates for Males Age 50

| Coverage Amount | $25,000 | $25,000 | $25,000 |

|---|---|---|---|

| Policy Type | Level Benefit | Graded Benefit | Guaranteed Issue |

| 50 | 64.8 | 82.09 | 108.85 |

| 51 | 67.83 | 84.41 | 117.1 |

| 52 | 71.06 | 89.02 | 124.67 |

| 53 | 74.48 | 93.65 | 131.77 |

| 54 | 78.05 | 98.28 | 137.96 |

| 55 | 81.55 | 102.91 | 143.46 |

| 56 | 85.36 | 107.55 | 147.58 |

| 57 | 89.33 | 112.16 | 151.25 |

| 58 | 93.07 | 119.11 | 154.46 |

| 59 | 96.97 | 126.06 | 156.75 |

Rates for Males Age 60

| Coverage Amount | $25,000 | $25,000 | $25,000 |

|---|---|---|---|

| Policy Type | Level Benefit | Graded Benefit | Guaranteed Issue |

| 60 | 101.54 | 132.98 | 158.35 |

| 61 | 106.15 | 139.93 | 170.04 |

| 62 | 111.28 | 146.88 | 181.04 |

| 63 | 117.09 | 156.12 | 191.58 |

| 64 | 123.56 | 165.39 | 201.67 |

| 65 | 130.03 | 176.97 | 211.52 |

| 66 | 137.54 | 188.53 | 220.23 |

| 67 | 144.4 | 200.11 | 227.79 |

| 68 | 152.17 | 213.99 | 234.89 |

| 69 | 159.55 | 230.18 | 241.08 |

Rates for Males Age 70

| Coverage Amount | $25,000 | $25,000 | $25,000 |

|---|---|---|---|

| Policy Type | Level Benefit | Graded Benefit | Guaranteed Issue |

| 70 | 169.94 | 246.58 | 246.58 |

| 71 | 180.33 | 267.26 | 269.04 |

| 72 | 191.72 | 288.64 | 291.04 |

| 73 | 204.11 | 310.64 | 311.67 |

| 74 | 217.56 | 333.74 | 330.92 |

| 75 | 232.07 | 357.39 | 347.42 |

| 76 | 262.79 | 386.1 | 405.85 |

| 77 | 280.53 | 422.84 | 462 |

| 78 | 300.53 | 462.44 | 515.85 |

| 79 | 319 | 501.25 | 567.41 |

Available Life Insurance Riders

The following life insurance riders are also available with Colonial Penn.

Living Insurance (accelerated death benefit):

Accelerated benefits riders are only available for new applicants below age 65 and cannot be purchased with the guaranteed-issue final expense policy.

If purchased, accelerated benefit riders allow acceleration of up to 50% of a policy’s death benefit if the insured is diagnosed with a serious medical condition covered by the rider; or if the insured is diagnosed with less than 12 months to live.

Separate riders are available for Chronic Illness (unable to perform at least two activities of daily living or suffering severe cognitive impairment), Heart Attack & Stroke, and Cancer.

All three versions also cover terminal illnesses.

Accidental Death Benefit:

If purchased, this rider provides a supplemental death benefit if the insured’s death results from a qualifying accident. Supplemental coverage amounts run from $10,000 to $50,000.