📖 Estimated Reading Time: 12 minutes

TL;DR: Why 73% of Americans Die With Debt

The system isn’t broken—it’s working exactly as designed. Here’s what’s really happening:

✓ The Reality:

- 73% die with debt regardless of financial behavior

- System extracts wealth from savers through inflation and interest

- Borrowers win, savers lose in fiat currency systems

✓ The Exit Strategy:

- Position yourself on the winning side of monetary expansion

- Access capital before inflation devalues it

- Build institutional-level financial infrastructure

You sensed something was off. You were right. There’s a better way, and you’re in the right place to learn it.

Table of Contents

The Statistic Nobody Wants to Talk About

You did everything right.

You budgeted. You saved. You invested in your 401k. Maybe you even paid off debt. You followed the rules, worked hard, and made smart decisions with your money.

And yet, if you’re like most Americans, you’ll die with debt anyway.

According to a comprehensive study by Experian, 73% of Americans die with outstanding debt. The average balance at death is over sixty thousand dollars. Credit card balances lead the way, followed by mortgages, auto loans, and personal debt.

Think about that for a moment. You’re here reading this because you’re NOT in the reckless spending camp. You’ve been trying to do it right. Yet the statistic shows that even people like you—the savers, the planners, the responsible ones—often can’t escape the trap. That should tell you something about the system itself.

The Experian Study

Experian analyzed their FileOne database tracking over 220 million consumers. The findings revealed that those who died with debt, 68% had credit card balances, 37% had mortgage debt, and 25% had auto loans. This isn’t a story about reckless spending but rather it’s a story about a system designed to keep people perpetually indebted. See ABC News.

This Isn’t Your Fault—But It Is By Design

Here’s what nobody tells you: the financial system isn’t failing. It’s succeeding brilliantly—just not for you.

The system is designed to extract wealth from the middle class through a combination of inflation, taxation, and interest payments. But nothing is broken. It’s operating exactly as intended, rewarding those who understand the rules while quietly draining everyone else.

You may have sensed this. That nagging feeling that something doesn’t add up. That watching your paycheck disappear into bills and expenses while the finish line keeps moving further away. That frustration of doing everything “right” and still feeling trapped.

You weren’t imagining it. The system is rigged—but not in the way most people think.

The Wealth Extraction System Explained

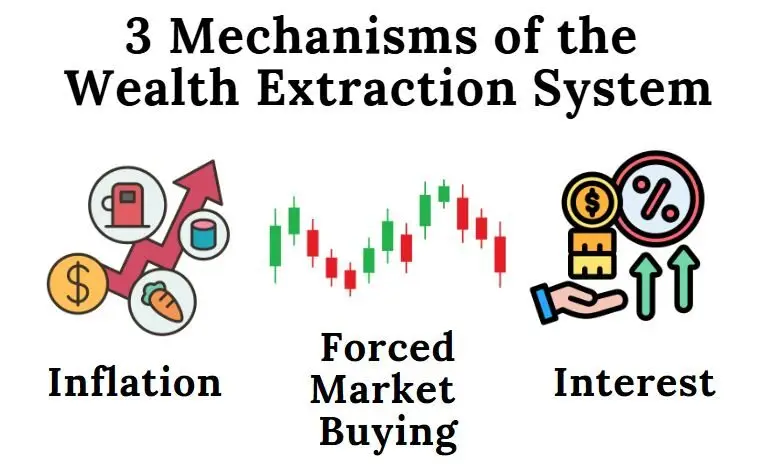

The wealth extraction system operates on three core mechanisms that most people never recognize:

First, inflation systematically devalues your savings. Every dollar you save loses purchasing power year after year. The government reports inflation at three or four percent, but your grocery bill, healthcare costs, and housing expenses tell a different story. Your savings account earning point-five percent isn’t keeping pace. Your money is actively losing value while sitting “safely” in the bank.

Second, interest payments drain your cash flow. Mortgages, car loans, credit cards, student loans—each one extracts monthly payments that could have built wealth. Over a thirty-year mortgage, you’ll pay nearly as much in interest as you borrowed in principal. That’s wealth transfer from your family to financial institutions, plain and simple.

Third, conventional savings vehicles favor the wealthy over wage earners. 401k plans force you to buy markets at any price, whether valuations are reasonable or insane. You’re a forced buyer when institutions are selling. When markets crash and you should be buying, you’re often too scared or cash-strapped to deploy capital.

The system isn’t broken. It’s working perfectly—extracting wealth from savers and wage earners, transferring it to those who control capital and understand how money actually works.

The Math Nobody Shows You

A $300,000 mortgage at 6% over 30 years costs you $347,000 in interest alone. That’s $347,000 you transferred to a bank—money that could have built generational wealth for your family. Multiply this across car loans, credit cards, and other debt, and you see why 73% never escape.

Why Borrowers Win and Savers Lose

Here’s the part that changes everything once you understand it: in a fiat currency system with continuous monetary expansion, borrowers win and savers lose.

This concept is called the Cantillon Effect, named after an eighteenth-century economist who first identified how new money flows through an economy. When central banks create new currency, it doesn’t reach everyone simultaneously. It flows to those closest to the money creation first—banks, corporations, well-connected borrowers. See Mises.Org for more.

These “front row” recipients use the new money to buy assets before prices rise. By the time that money reaches wage earners through paychecks, inflation has already devalued it. Workers buy the same assets wealthy investors purchased months earlier, now twenty or thirty percent more expensive.

This is why you feel like you’re running faster just to stay in place. You are. The monetary expansion benefits those who borrow and buy assets first. It punishes those who save and wait.

The conventional advice to save money and avoid debt made sense in a gold standard economy. In our current monetary system, it’s a recipe for wealth destruction. You’re positioned on the wrong side of monetary expansion, fighting against mathematical inevitability.

But here’s the good news: once you understand the game, you can change your position.

What Institutions Do vs. What They Tell You

Want to know the most revealing fact about whole life insurance? Banks and corporations own over two hundred billion dollars of it.

Read that again. The same institutions that tell you to avoid whole life insurance hold more than $200 billion in Bank-Owned Life Insurance on their balance sheets.

Why? Because it works. Because it provides guaranteed growth, tax advantages, liquidity, and asset protection. Because sophisticated financial institutions understand that controlling capital infrastructure beats chasing speculative returns.

Banks don’t gamble their core assets in the stock market. They build financial infrastructure that guarantees growth, provides liquidity, and captures value on every dollar flowing through their system.

Then they turn around and tell retail customers to buy term insurance and invest the difference in market speculation.

This is institutional-level wealth building versus retail-level consumption. One approach builds generational wealth. The other keeps you on the hamster wheel until you die—with debt.

The Institutional Advantage

Major banks use dividend-paying whole life insurance as a core asset because it provides guaranteed annual increases, tax-deferred growth, complete liquidity without forced selling, and positive correlation with rising interest rates. They’re not buying it for death benefit—they’re using it as financial infrastructure that captures value on capital flow.

The wealthy have used these strategies for over a century. The Rockefellers, the Carnegies, the Disney family—they built banking systems within their family structures. Not because they were geniuses, but because they understood that controlling capital infrastructure creates more wealth than chasing returns.

This isn’t secret knowledge but it is knowledge most people never hear about because conventional financial advice steers them toward products that benefit institutions, not families.

The Alternative Path Forward

So what’s the alternative? How do you position yourself on the winning side of monetary expansion?

You build your own banking system.

This concept is called Volume-Based Banking, and it’s built on three fundamental principles:

Volume: Maximize total capital under your control, not rate of return. Better to control two hundred thousand dollars at five percent guaranteed than twenty thousand at twelve percent speculative. Volume creates borrowing capacity and financial flexibility that dwarfs traditional approaches.

Velocity: Your money works in two places simultaneously. Cash value continues earning dividends even while borrowed against. Deploy borrowed funds to productive investments. Each dollar works harder because it’s working twice. This is the institutional advantage made accessible.

Value Creation: Deploy capital only to productive opportunities aligned with your expertise. Unlike 401k plans that force you to buy markets at any price, you maintain strategic optionality. Your policy keeps earning whether you deploy capital or not. You’re never a forced buyer at market peaks.

This isn’t about replacing investments. It’s about building financial infrastructure that captures value on cash flow, positions you in the “front row” for capital access, and enables strategic deployment rather than forced buying.

The system will continue extracting wealth from those who don’t understand it. Inflation will keep devaluing savings. Interest payments will keep draining cash flow. Conventional advice will keep producing the same results—seventy-three percent dying with debt.

Or you can build a different system. One that works for your family instead of against it.

Your Next Steps

You’re here because you sensed something was off. The system isn’t working for you despite doing everything “right.” That instinct was correct.

Understanding the problem is the first step. Building the solution is the second.

The wealth extraction system will continue operating whether you participate or not. The Cantillon Effect will keep benefiting those closest to capital creation. Institutional hypocrisy will keep steering retail investors toward products that benefit institutions.

But now you see it. You understand why seventy-three percent die with debt despite following conventional advice. You recognize that the system is designed to extract wealth from savers and wage earners.

The question is: what are you going to do about it?

You can keep following conventional advice and hope for different results. Or you can learn what institutions actually do with their money and why they don’t want you to know.

The exit exists. The alternative path is real. And you’re already taking the first step by reading this.

Ready to Learn What Institutions Actually Do?

We’ve compiled everything you need to understand how to become your own bank and position yourself on the winning side of monetary expansion.

Download our free Self Banking Blueprint and discover:

- ✓ How to build financial infrastructure that captures value on cash flow

- ✓ The three pillars wealthy families use to build generational wealth

- ✓ Why borrowers win and savers lose in fiat currency systems

- ✓ Specific implementation strategies to escape the extraction system

- ✓ How to access capital before inflation devalues it

This isn’t about getting rich quick. It’s about understanding how money actually works and positioning yourself accordingly.

The system will keep extracting wealth from those who don’t understand it. Learn the alternative and start positioning yourself today.

Frequently Asked Questions

Why do 73% of Americans die with debt?

The financial system is designed to extract wealth from savers through inflation, interest payments, and forced buying in qualified retirement plans. Conventional advice positions people on the losing side of monetary expansion, where their savings lose purchasing power while debt payments drain cash flow. The seventy-three percent statistic reflects a system working as designed, not individual failure.

Is this really the government’s fault?

This isn’t about blame—it’s about understanding monetary mechanics. Fiat currency systems with continuous expansion mathematically benefit borrowers and asset owners over savers and wage earners. This is the Cantillon Effect in action. Whether intentional or not, the system produces predictable outcomes. Understanding this allows you to change your position rather than fighting against mathematical inevitability.

What is the Cantillon Effect?

The Cantillon Effect explains how new money flows through an economy. When central banks create currency, it reaches banks, corporations, and connected borrowers first—the “front row.” These recipients buy assets before prices rise. By the time money reaches workers through wages, inflation has devalued it. Front-row participants benefit from monetary expansion while back-row recipients suffer from inflation. Position matters more than income.

Why do banks own $200 billion in whole life insurance?

Banks use Bank-Owned Life Insurance because it provides guaranteed growth, tax advantages, complete liquidity, and asset protection. They’re not buying it for death benefit speculation—they’re using it as core financial infrastructure. Banks understand that controlling capital infrastructure beats chasing speculative returns. Then they tell retail customers to avoid the same strategies they use themselves.

Isn’t whole life insurance too expensive?

This question misunderstands what you’re buying. Properly structured whole life insurance isn’t an expense—it’s asset acquisition. You’re building financial infrastructure that provides guaranteed growth, tax advantages, liquidity, death benefit protection, and strategic borrowing capacity. Compare this to paying bank interest on loans, losing purchasing power to inflation, and forced buying in retirement accounts. The question isn’t whether whole life costs money. The question is what you’re getting for those dollars.

Can’t I just invest in index funds and do better?

Investing in index funds is important—but it’s not a replacement for financial infrastructure. Volume-Based Banking doesn’t compete with stock market returns. It captures value on cash flow that would otherwise earn zero percent in checking accounts or lose purchasing power to inflation. You do both—build infrastructure and invest in growth assets. Institutions don’t choose between banking systems and investments. They use both strategically.

How do I actually implement this strategy?

Implementation requires three components: properly designed whole life insurance that maximizes cash value growth, understanding how to borrow strategically against cash value, and deploying borrowed capital to productive investments aligned with your expertise. The process starts with education—understanding why this works and how institutions use it. Then you work with specialists who design policies for cash value accumulation rather than death benefit maximization. Most traditional insurance agents don’t understand this approach.

What if I already have significant debt?

Current debt doesn’t disqualify you—it actually validates why you need this strategy. The goal isn’t to avoid all debt. The goal is to position yourself on the winning side of monetary expansion. Understanding good debt versus bad debt matters more than being debt-free. Productive debt that buys appreciating assets works in your favor. Consumption debt drains wealth. The strategy is about redirecting cash flow toward wealth building rather than wealth extraction.

Is this legal and legitimate?

Completely. This is exactly what banks, corporations, and wealthy families have done for over a century. The strategy uses standard permanent life insurance products from highly-rated mutual insurance companies. There’s nothing exotic or questionable about it. The only unusual aspect is that most people have never been shown how institutions actually use these vehicles versus how they’re marketed to retail consumers.

How much money do I need to start?

Implementation scales with income and discipline. Minimum entry typically starts around five hundred to one thousand dollars monthly, but the principles work at any level with positive cash flow. Wealthy families deploy millions. Middle-class families start with thousands. The mathematical advantages remain consistent—you’re building infrastructure, accessing capital before inflation hits, and positioning for strategic deployment rather than forced buying.

What’s the catch?

There’s no catch—just trade-offs and discipline requirements. Early years build foundation rather than immediately accessible cash value. You need positive cash flow and consistent premium payments. The system requires monitoring loan-to-value ratios and maintaining discipline around strategic deployment. This isn’t passive. It’s active wealth building using institutional strategies. The “catch” is that it requires understanding, commitment, and implementation rather than hoping conventional advice produces different results than it has for seventy-three percent of Americans.