📚 About Susan Wright, CLU, ChFC – Traditional Insurance Expert

Susan Wright is a 30+ year veteran of the insurance and financial services industry with 12 professional designations including CLU (Chartered Life Underwriter), ChFC (Chartered Financial Consultant), and CLTC (Certified in Long-Term Care). She holds an MBA from St. Louis University and has worked with major firms including Transamerica, VOYA Financial, and Fisher Investments.

→ View Susan Wright’s complete credentials and experience

Note: Susan Wright’s comprehensive insurance analysis enhanced with insights from Jason Kenyon, Esq. (15+ years), Barry Brooksby (25+ years), and Steve Gibbs, JD, AEP® – IBC specialists who’ve discovered what most insurance professionals miss.

📋 KEY TAKEAWAY

Susan Wright provides excellent traditional insurance analysis, but 73% of Americans dying with $61,000+ in debt reveals a crisis that conventional thinking hasn’t solved. IBC specialists with decades of implementation experience have discovered that dividend paying whole life insurance, when properly structured as “The Ultimate Asset,” addresses this mass financial failure through Volume-Based Banking strategies that most insurance experts never fully grasp.

Table of Contents

- Traditional Insurance Expert Analysis

- The 73% Debt Crisis Traditional Advice Created

- How Infinite Banking Actually Works

- Traditional Pros and Cons Analysis

- What IBC Specialists See Differently

- The $130 Billion Banking Secret

- Inflation and Rising Rate Advantage

- Volume-Based Banking vs. Investment Thinking

- Who Really Needs This Strategy

- Real-World Implementation

- Frequently Asked Questions

- Conclusion: Beyond Traditional Insurance Thinking

Traditional Insurance Expert Analysis

📧 SUSAN WRIGHT’S RESPONSE

“Hi Jason. I really like the article! The way it’s set up helps the readers compare IBC vs more traditional planning. I also like the way it kind of flips the perspective of it being not so much a ‘life insurance purchase’ but rather simply using the policy as the engine of the overall strategy. Please feel free to keep my name on it, as well. Thanks!! Susan”

So how did we get here?

When I commissioned Susan Wright to write an analysis of the Infinite Banking Concept, I wasn’t sure what to expect. With her 30+ years of insurance industry experience and 12 professional designations, Susan represents the gold standard of traditional insurance expertise. Her resulting analysis was comprehensive, balanced, and technically accurate, everything you’d expect from a seasoned professional.

But something fascinating emerged when we compared her traditional insurance perspective with our team’s decade-plus of specialized IBC implementation experience. Despite Susan’s impressive credentials and industry knowledge, significant gaps appeared between conventional insurance thinking and what actually works in practice for infinite banking.

This isn’t about Susan being wrong. Her analysis reflects exactly how most insurance professionals view IBC. The problem is that traditional insurance training, no matter how extensive, often misses the deeper implications of infinite banking because it’s viewed through an “insurance product” lens rather than a “banking system replacement” lens.

With 73% of Americans dying with $61,000+ in debt despite following conventional financial advice, these knowledge gaps matter. What follows is Susan’s thorough traditional analysis enhanced with insights from IBC specialists who’ve discovered what the conventional insurance industry consistently overlooks.

Wright correctly identifies that IBC uses “dividend paying (participating) whole life insurance” and explains the basic mechanics: overfunding through paid-up additions, building accessible cash value, and borrowing against this value at fixed rates. This foundation is solid and accurate. However, as we’ll explore, even expert-level traditional insurance analysis often misses the deeper implications that IBC specialists have discovered through decades of focused implementation.

🚨 THE CRISIS TRADITIONAL ANALYSIS MISSES

While insurance experts debate policy mechanics, 73% of Americans die with $61,000+ in debt. This is a national emergency that conventional financial advice has failed to solve.

“If traditional advice was working, we wouldn’t see three-quarters of families dying broke despite following conventional wisdom for decades.” – Jason Kenyon, Estate Planning Attorney

The 73% Debt Crisis Traditional Advice Created

Traditional insurance analysis, while technically accurate, operates in a vacuum that ignores the massive failure of conventional financial advice. Check out these devastating stats:

| Financial Reality | Statistics | Traditional Response |

|---|---|---|

| Americans dying in debt | 73% with $61,000+ average debt | “Follow the plan, stay the course” |

| 401(k) average balance at retirement | $249,000 after decades of contributions | “Increase your contribution percentage” |

| Market volatility damage (2000-2024) | Arithmetic (8.47%) vs Geometric (6.91%) Returns | “It’s just temporary, don’t panic sell” |

| Americans living paycheck to paycheck | 57% including high earners | “Budget better, spend less” |

💡 BARRY BROOKSBY INSIGHT

“Twenty-five years ago, I was channeling clients’ money into mutual funds and IRAs. The calls started rolling in: ‘Barry, why am I not seeing returns?’ ‘Barry, my savings are shrinking.’ These weren’t just clients—they were family, friends. Their sleepless nights became mine. That’s when I discovered the $130 billion banking secret.“

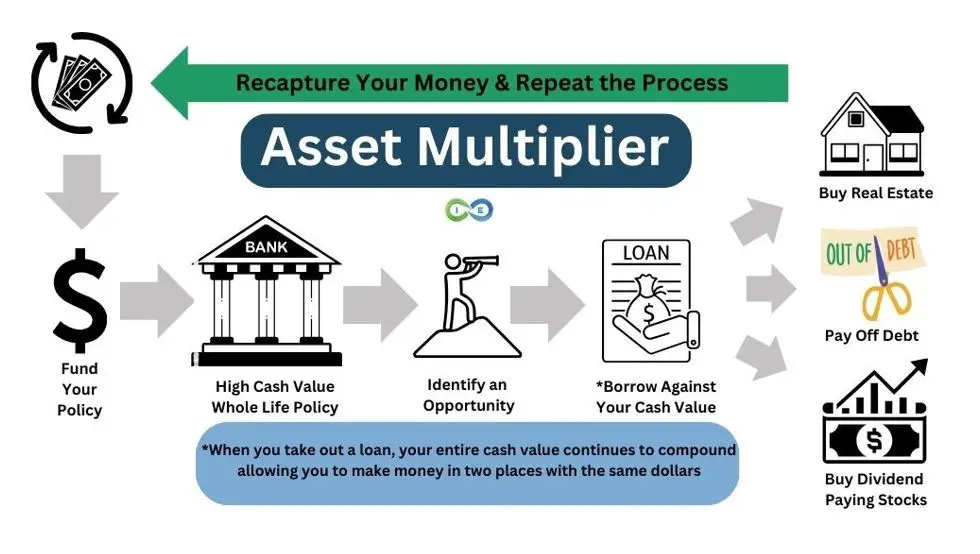

How Infinite Banking Actually Works

Susan Wright accurately describes the basic mechanics to “be your own bank,” but her analysis reflects traditional insurance thinking rather than banking replacement thinking. Here’s what she correctly identifies:

Core IBC Mechanics (Traditional View)

- Overfund whole life policies through paid-up additions (PUAs)

- Build accessible cash value over 3-5 years

- Borrow against cash value at fixed interest rates

- Flexible repayment with outstanding balances deducted from death benefit

This description is accurate but incomplete. It’s like describing a car by listing “four wheels, engine, steering wheel” without explaining that it’s actually a transportation system that replaces walking.

🏦 STEVE GIBBS PERSPECTIVE

“Most insurance professionals see this as an investment strategy competing with the stock market. That’s backwards thinking. This is a banking replacement strategy that happens to come with guaranteed growth, massive death benefit leverage, and tax advantages.”

The Banking Function Transfer

What traditional analysis misses is the fundamental paradigm shift:

| Function | Traditional Banking | Volume-Based Banking |

|---|---|---|

| Cash Flow Storage | Bank accounts earning 0.5% | Policy cash value earning 5%+ Tax Advantaged |

| Access to Capital | Credit applications, approval process | Policy loans within 30 days, no qualification |

| Who Benefits | Bank earns spread on your deposits | YOU earn the spread |

| Death Benefit | None | Massive leverage (up to 40X income) |

Traditional Pros and Cons Analysis

Susan Wright provides a comprehensive list of IBC advantages and disadvantages that reflects solid traditional insurance knowledge:

Where Traditional Analysis Gets It Right

Wright correctly identifies genuine IBC benefits:

- Tax-deferred growth in cash value

- Tax-free access to funds via loans

- Protection of principal from market volatility

- Death benefit for legacy planning

- No loan repayment requirements

- No income limits or RMD requirements

These observations are accurate and valuable. However, they reflect “insurance thinking” rather than “banking system thinking.”

Where Traditional Analysis Reveals Its Limitations

Wright’s concerns about infinite banking reveal the gap between traditional insurance expertise and specialized IBC implementation:

⚠️ TRADITIONAL CONCERN: “High Cost”

Susan Wright: “Premiums on whole life insurance are typically higher than term policies with the same death benefit.”

Barry Brooksby Response: “This misses the point entirely. You’re not buying life insurance, you’re building a banking system that happens to come with life insurance. My policies allocate 80-90% of premiums to cash value in year one, with lifetime fees 9-10 times lower than managed portfolios.”

⚠️ TRADITIONAL CONCERN: “Slow Start on Cash Value Growth”

Susan Wright: “It may be 5 or more years before breaking even, given that a portion of the premium goes towards funding the cost of insurance and various fees.”

Jason Kenyon Response: “Properly designed policies break even in 3-7 years, not 15-20. But more importantly, you get immediate access to massive death benefit leverage. A 26-year-old gets $1.3 million in immediate wealth protection with a $40,000 premium. No investment strategy can replicate that.”

What IBC Specialists See Differently

The difference between traditional insurance analysis and specialized IBC implementation becomes clear when examining real-world results and client outcomes.

Target Market Misconception

Susan Wright concludes that IBC “could be a viable strategy for those who are able to overfund the policy’s premium” and recommends it primarily for high earners ($300K+ annually). This reflects traditional insurance thinking that misses the banking replacement opportunity.

🎯 JASON KENYON CORRECTION

“Susan’s analysis assumes this is a luxury tool for wealthy people. But 73% of Americans dying in debt tells a different story. This strategy is MORE critical for middle-class families because they’re the ones trapped in the conventional hamster wheel. A family earning $100K can implement Volume-Based Banking with as little as $500-1,000 monthly, replacing their banking function while building guaranteed wealth.”

Return Expectations Reality

Traditional analysis often focuses on policy return rates in isolation, missing the multiplication effect that IBC specialists have discovered.

📊 BARRY BROOKSBY INSIGHT: The Money Multiplier Effect

“Traditional thinking asks ‘what return am I getting?’ IBC thinking asks ‘how many places can my money work?‘ With $140,000 cash value, I borrow $50,000 for real estate. The entire $140,000 keeps compounding while the $50,000 generates rental income. My money works in two places simultaneously, something no traditional investment can provide.”

The $130 Billion Banking Secret

Here’s where traditional insurance analysis completely misses the most compelling evidence for infinite banking effectiveness.

What Banks Actually Do

While insurance experts debate policy mechanics, banks quietly hold over $130 billion in Bank-Owned Life Insurance (BOLI):

| Bank | BOLI Holdings | Why They Use It |

|---|---|---|

| Wells Fargo | $18.3 billion | Guaranteed returns, tax advantages |

| JP Morgan Chase | $12.4 billion | Stable growth, regulatory benefits |

| US Bank | $7.7 billion | Predictable performance, asset protection |

| Total Industry | $130+ billion | Superior banking asset |

🏛️ STEVE GIBBS ANALYSIS

“Banks hold $130+ billion in cash value life insurance because they understand what individual investors miss about financial control and predictable growth. They use the same strategies they tell you to avoid. Maybe we should follow what they do, not what they tell us to do.”

The Inflation and Rising Rate Advantage Traditional Analysis Ignores

Traditional insurance analysis makes a critical error: it assumes static interest rate environments. This blindness to monetary policy cycles reveals another massive gap between conventional thinking and IBC specialist understanding.

How Rising Rates Supercharge Whole Life Returns

While most financial strategies suffer during inflationary periods and rising rate environments, properly structured whole life insurance benefits from monetary tightening:

| Interest Rate Environment | Stock Market Impact | Bond Portfolio Impact | Whole Life Insurance Impact |

|---|---|---|---|

| Rising Rates (Current) | Volatility, P/E compression | Principal losses on existing bonds | Higher dividend rates on new money |

| High Rate Environment | Reduced valuations, recession risk | Opportunity cost of locked-in low rates | Compound acceleration on higher base |

| Rate Normalization | Market uncertainty | Duration risk management required | All upside, no downside risk |

🏛️ HISTORICAL PRECEDENT: The Volcker Era

During the late 1980s and early 1990s, when Paul Volcker raised rates to combat inflation, whole life insurance policies were earning 10-12% annually. Treasury bonds yielded 8-10%, and insurance companies’ general account portfolios delivered spectacular returns to policyholders.

Key Insight: Policyholders who started policies in low-rate environments benefited most, as all new money got invested at increasingly higher rates while their cost of insurance remained locked in.

The Fed Policy Tailwind

Current monetary policy creates a unique opportunity for Volume-Based Banking:

- Fed Funds Rate: 5.25-5.5% (up from near zero)

- Treasury Yields: Approaching 4-5% on longer durations

- Insurance Company Portfolios: Beginning to benefit from rate normalization

- Dividend Projections: Conservative based on historical low-rate environment

Your Policy’s Upside Optionality

Traditional analysis assumes current rate environments persist indefinitely. IBC specialists understand the asymmetric upside potential:

💡 RATE SCENARIO ANALYSIS

Current Environment (4-5% rates): Policy projections based on conservative assumptions

Normalized Rates (6-7%): Dividend rates could increase 2-3 percentage points

High Rate Environment (8-10%): Double-digit policy returns become possible

Downside Protection: Guaranteed minimums prevent losses regardless of rate direction

The Inflation Hedge Reality

While traditional investments struggle with inflation, Volume-Based Banking provides systematic inflation protection:

- Automatic Rate Adjustment: Dividend rates rise with general interest rate environment

- Real Asset Backing: Insurance company portfolios include inflation-hedged investments

- Purchasing Power Maintenance: Cash value growth accelerates during inflationary periods

- Policy Loan Advantage: Borrow at fixed rates while inflation erodes real loan cost

⚠️ TRADITIONAL ANALYSIS BLIND SPOT

Susan Wright’s Analysis: Evaluates whole life returns based on current static environment, missing the dynamic rate adjustment mechanism.

IBC Specialist Understanding: Recognizes that whole life insurance is one of the few financial instruments that benefits from BOTH low-rate stability AND high-rate environments, providing asymmetric upside with guaranteed downside protection.

Strategic Timing Advantage

Starting Volume-Based Banking during transitional rate environments creates optimal positioning:

- Lock in Low Insurance Costs: Cost of insurance based on current age and health

- Benefit from Rising Rates: All future rate increases improve policy performance

- Compound Acceleration: Higher returns on growing cash value base

- No Timing Risk: Guaranteed minimums protect against rate reversals

Bottom Line: Traditional analysis ignores monetary policy cycles and inflation dynamics. IBC specialists understand that whole life insurance provides the rare combination of inflation protection, rate upside participation, and guaranteed downside protection, advantages that become more valuable during periods of monetary uncertainty.

Volume-Based Banking vs. Investment Thinking

The fundamental disconnect between traditional insurance analysis and IBC specialist implementation comes down to this distinction:

Traditional Thinking: Investment Strategy

- Compares whole life returns to stock market returns

- Focuses on return per dollar invested

- Views policy loans as opportunity cost

- Recommends for wealthy people who “have extra money”

IBC Specialist Thinking: Banking Replacement

- Compares banking function efficiency

- Focuses on volume controlled and leverage available

- Views policy loans as banking system access

- Recommends for anyone tired of being a banking customer

💡 JASON KENYON: Volume Beats Rate

“Better to earn 5% on $50,000 than 10% on $5,000. Traditional analysis misses this completely. It’s not about return per dollar, it’s about total return on total volume controlled. Volume-Based Banking gives you access to more capital, not less.”

Who Really Needs This Strategy

Susan Wright’s traditional analysis concludes that infinite banking works for “perhaps 2-5% of the population,” specifically “wealthy, patient, and properly educated” individuals. This represents perhaps the biggest gap between traditional insurance thinking and IBC specialist experience.

Traditional Insurance View: Luxury Tool for the Wealthy

Wright recommends IBC for those who:

- Are able to overfund policy premiums

- Can commit for several years or longer

- Value asset protection and legacy planning

- Wish to access capital without triggering taxable events

IBC Specialist Reality: Solution for the 73%

🚨 THE REAL CRISIS

If conventional financial advice was working, we wouldn’t see 73% of Americans dying with $61,000+ in debt.

“The families dying broke aren’t wealthy people who need optimization. They’re middle-class families failed by conventional advice. They need banking replacement, not investment tweaking.” – Barry Brooksby

Who Actually Benefits Most

| Category | Traditional View | IBC Specialist Reality |

|---|---|---|

| Young Professionals | “Too early, build emergency fund first” | “Maximum leverage potential: up to 40X income in death benefit” |

| Middle-Class Families | “Should use Roth IRAs instead” | “Replace banking function AND build wealth” |

| High Earners | “Good fit for extra money” | “Can maximize volume advantage with large premiums” |

| Debt-Stressed Families | “Not appropriate” | “MOST need banking replacement to break cycle” |

💡 JASON KENYON ADVANCED STRATEGY

“Traditional thinking says choose between infinite banking OR Roth IRAs. IBC specialists understand you can do BOTH: Fund your policy first, then use a policy loan for your $7K Roth IRA contribution. Your policy keeps earning on the full amount while you build tax-free retirement accounts. It’s not either/or – it’s BOTH/AND.”

🎯 REALITY CHECK: Who This Strategy Actually Serves

We need brutal honesty: Volume-Based Banking requires financial discipline and isn’t for everyone.

Minimum Requirements:

- $500+ monthly premiums (starter level)

- 25% of income for meaningful banking replacement

- Basic financial stability (not drowning in high-interest debt)

Market Reality: Only 58% of Americans own any stocks. Most people aren’t choosing between this and index funds, they’re choosing between systematic wealth building and financial drift.

Our Target: Middle class families ($75K+) ready to replace their banking function.

Why We’re Selective: Volume-Based Banking works systematically better than traditional approaches, but only for people ready to make serious financial changes.

Real-World Implementation

Traditional insurance analysis often stops at theoretical policy mechanics. IBC specialists focus on practical implementation that creates real wealth-building results.

Policy Design Differences

Susan Wright mentions that “not all insurance companies offer the right type of policies” but doesn’t elaborate on specific design elements that make IBC effective.

🏗️ BARRY BROOKSBY: Policy Design Mastery

“I’m a big believer in aggressively funding cash value, even at the expense of reduced agent commissions. Most agents sell death-benefit-focused policies. Most IBC policies should allocate 80-90% of premiums to cash value with paid-up additions riders. Aggressive cash value funding and term blending delivers the best outcome for almost all clients.”

Real Client Results

While traditional analysis provides theoretical examples, IBC specialists share actual client outcomes:

📈 ACTUAL CLIENT RESULT

Richard from Alabama: “I wish I’d known Barry 20 years ago. Starting in his 50s, he calculated a policy in his 30s could’ve yielded $800,000 tax-free by now. He set up policies for his children and granddaughter, ensuring their financial future.”

🏡 VOLUME-BASED BANKING IN ACTION: Real Estate Wealth Building

James M: “The topic we discussed most was around Barry’s personal experience and his client’s experience using IBC as it relates to real estate investing, which is the original reason that brought me to Barry in the first place. I truly feel like I’m working with someone who is not only an expert in his field but also genuinely invested in helping me succeed.”

Implementation Reality: This client specifically sought out IBC for real estate investing, exactly the kind of strategic deployment traditional insurance analysis misses completely.

💰 LIFE TRANSFORMATION: From Financial Worry to Retirement Confidence

Martin Zeman: “In many ways, setting up a whole life dividend paying insurance was arranging for a life with a lot less worry. A lot less worry if something happened to me, knowing my wife would be fine, but equally knowing that we both would be fine in retirement, given the amazing investment benefits this policy provides now, heading towards retirement, and ultimately in retirement.”

The Peace of Mind Factor: Traditional investments create anxiety during market volatility. Volume-Based Banking provides guaranteed foundation that transforms worry into confidence about the future.

The Implementation Timeline Reality

| Timeline | Traditional Expectation | Proper IBC Design |

|---|---|---|

| Day 1 | “No immediate benefits” | “Massive death benefit protection active” |

| 30 Days | “Money locked up” | “Policy loans available for 90% of cash value” |

| Year 3-5 | “Maybe break even” | “Breaking even with accelerating growth” |

| Year 10+ | “Starting to see benefits” | “Significant banking capital for deployment” |

Frequently Asked Questions

How does infinite banking work for middle-class families?

Unlike traditional analysis suggesting this only works for wealthy individuals, IBC specialists have found that families earning $100K-200K annually can implement Volume-Based Banking with as little as $500-1,500 monthly premiums. This replaces their banking function while building guaranteed wealth and providing massive death benefit protection.

Why do insurance professionals often miss IBC’s potential?

Most insurance professionals sell traditional death-benefit-focused policies and lack specialized IBC training. As Barry Brooksby notes, “Finding a qualified practitioner is key to unlocking IBC’s potential. Most agents don’t understand cash value optimization.”

What about the opportunity cost argument?

Traditional analysis focuses on return per dollar, missing the multiplication effect. Jason Kenyon explains: “You’re not giving up opportunities, you’re multiplying them. The guaranteed foundation provides capital for strategic deployment during market downturns when others are forced to wait it out or sell in fear.”

How quickly can I access my money?

Policy loans are available within 30 days of policy issue, with no credit checks or qualification requirements. You can access up to 90% of cash value while the full amount continues earning returns, something traditional banking cannot provide.

Why don’t more people know about this strategy?

Steve Gibbs notes that banks hold $130+ billion in life insurance while steering customers toward volatile investments they profit from. “It all comes down to the battle for dollars. Banks use strategies they tell you to avoid. Maybe we should follow what they do, not what they tell us to do.”

Is this just for people who don’t trust the stock market?

This is a banking replacement strategy, not an investment replacement. As Jason Kenyon clarifies: “Keep your Roth IRA, keep your real estate, keep your business investments. Just make this ONE change: switch the banking function from traditional banks to high cash value whole life.”

Conclusion: Beyond Traditional Insurance Thinking

Susan Wright’s analysis represents thoughtful, professional insurance expertise. Her 30+ years of experience and comprehensive approach provide valuable insights into infinite banking mechanics and considerations. However, comparing her traditional insurance perspective with specialized IBC implementation reveals why 73% of Americans continue dying in debt despite access to conventional financial advice.

And here is the kicker. After reviewing our analysis that contrasted traditional insurance thinking with IBC specialist implementation, Susan Wright, the same expert whose conventional perspective we had respectfully challenged, reached out with her response:

📧 SUSAN WRIGHT’S RESPONSE

“Hi Jason. I really like the article! The way it’s set up helps the readers compare IBC vs more traditional planning. I also like the way it kind of flips the perspective of it being not so much a ‘life insurance purchase’ but rather simply using the policy as the engine of the overall strategy. Please feel free to keep my name on it, as well. Thanks!! Susan”

Susan’s response captures exactly what we’ve been demonstrating throughout this analysis: the power of viewing infinite banking not as an insurance product, but as a banking system replacement strategy.

Why Is There A Knowledge Gap?

The gap is due to specialization and real-world implementation experience. Traditional insurance professionals understand policy mechanics, but IBC specialists have discovered:

- How to design policies for maximum cash value efficiency

- Why banking replacement thinking differs from investment thinking

- How Volume-Based Banking solves problems conventional advice cannot

The Implementation Difference

🎯 FINAL INSIGHT

Barry Brooksby: “Banks use cash value life insurance for their $130 billion in assets because they understand what individual investors miss about financial control and predictable growth. By implementing Volume-Based Banking, you replicate their playbook, creating multiple income streams without sacrificing security.”

Moving Beyond Traditional Limitations

Traditional insurance analysis, while valuable, operates within conventional thinking constraints. IBC specialists have moved beyond these limitations to discover that dividend paying whole life insurance, when properly structured as The Ultimate Asset – provides:

- Banking replacement rather than investment competition

- Volume-based advantage rather than rate optimization

- Systematic wealth building rather than hopeful market speculation

- Guaranteed foundation for strategic deployment opportunities

The question is whether you’ll continue following conventional advice that’s failed 73% of American families, or discover what financial institutions know about building real wealth through guaranteed growth and strategic capital deployment.

Discover if The Ultimate Asset Strategy is Right for You

Before committing to this Volume-Based Banking approach, get a personalized analysis from our independent advisory team specializing in infinite banking implementation.

- ✓ Receive a detailed breakdown of how The Ultimate Asset would work in your specific situation

- ✓ Compare Volume-Based Banking to conventional strategies and traditional insurance approaches

- ✓ Understand the potential tax advantages and death benefit leverage benefits

- ✓ Get clear explanation of policy design for maximum cash value efficiency

Schedule your complimentary 30-minute Ultimate Asset analysis today and discover why banks use what they tell individuals to avoid.

No obligation. No sales pressure. Just expert guidance from IBC specialists with 25+ years of implementation experience.