What is a Qualified Retirement Plan?

Technically speaking, a Qualified Retirement Plan is any plan that satisfies the requirements laid out in section 401(a) of the Internal Revenue Code (IRC). A qualified plan is typically referred to as a “tax-deferred” plan, in that it allows the participant to contribute to the plan with pre-tax dollars. The plan money grows tax-deferred (taxes are not paid on the growth each year) until retirement age.

In retirement, the plan money is withdrawn and taxed at the then current tax rate of the individual. The most common types of qualified retirement plans are 401(k), defined benefit plans, and profit-sharing plans. The plans must be established by a business and are required to meet all the conditions set forth by the Employee Retirement Income Security Act (ERISA).

If you’ve read some of our other articles on 401(k) plans, or even if you just happen to notice our domain name – insuranceandestates.com – it may seem odd that we are highlighting a qualified plan. But one size shoe does not fit everyone, and neither does one size retirement plan.

For the small business owner, or for the serial entrepreneur, the qualified retirement plan offers some distinct advantages over the IRA. In this article we’ll be discussing the benefits of the qualified plans, but first we want to showcase the fact that some of these plans can invest in life insurance.

Advantages of including Life Insurance in a Qualified Plan

There are a handful of reasons why it’s beneficial to invest in life insurance with a qualified plan – let’s take a look at them.

- You can pay your life insurance premiums with pre-tax dollars

- In the event of the premature death of a participant, the plan is fully funded (by the death benefit)

- Obviously there is the income tax-free death benefit that goes to the beneficiaries

- ERISA protects assets within qualified plans, so there is protection from creditors. Although this is true of most permanent life insurance in general.

Some of the downsides of including life insurance in your qualified plan are that it has to abide by ERISA rules and you have to be a current participant. This just means it’s more complex. But this factor becomes much less of an issue when the business is small and there are very few participants (owner & spouse). All in all, it’s worth looking into if you are a small business owner and are considering different retirement strategies.

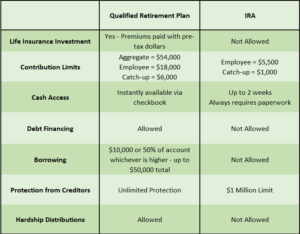

Okay, now let’s take a look at the various comparisons between a Qualified Retirement Plan and an IRA:

Contribution Limits

There are three specific contribution limits to be aware of when discussing the Qualified Retirement Plan or the IRA. First there is the annual aggregate contribution limit of $54,000 (2017). The aggregate limit of $54,000 is the total amount of both the employer and the employee contributions combined. In addition, there is a $270,000 (2017) limit on the amount of income that can be considered for qualified plan participation by any one employee.

So if the company is offering a 20% contribution to a qualified plan for all employees, those that make $270,000 and above all get the same amount of $52,000. If the company had offered 25%, they would all only get $54,000 because of the aggregate limit of $54,000.

The second limit is the employee contribution limit of $18,000 (2017). This limit is known as the maximum employee deferral limit (the tax-deferred limit). This third limit is the catch-up limit and in 2017 it stands at $6,000 if the participant is over 50.

There are only two limits to worry about for the traditional or Roth IRA’s – the maximum contribution of $5,500, and the catch-up limit of $1,000 for those over 50. So the maximum contribution is $6,500 for those over 50 for either an IRA or Roth IRA.

To put this in perspective, it would take roughly 20 years to save $250,000 with a traditional maxed out IRA that earns a consistent 7% annually (which does not typically happen). That amount of money would generate roughly $1750 a month if you continued to get 7% annually. All that to say, it’s not a lot of money – and it’s taxable income (unless it’s a Roth).

Cash Access (Speed / Ease)

Your cash is important to you, and the ease with which you can access that cash is of importance as well. With a qualified retirement plan, the cash inside can be accessed instantly because you can have a checkbook to the account. Get access to the money quickly and easily without any hassle.

In contrast, the traditional IRA can require up to 2 weeks to access the cash. In addition you will be required to fill out paperwork every time you want to access your own cash. This type of headache tends to keep participants from accessing their cash unless they have a serious need. Obviously this is the plan by plan administrators because they don’t want to encourage cash access.

Debt Financing

With a qualified plan, you can become a lender with your cash and not incur any adverse tax penalties. For those that like the idea of lending out their cash and becoming the banker for asset backed loans, the qualified plan offers the opportunity. Or even if you just want to purchase property with your cash, with a qualified plan you can do it. With a traditional IRA your options are limited.

With a traditional IRA the ability to use the cash as debt financing is not available without tax consequences. The IRS has something called a Unrelated Debt Financed Income (UDFI) tax. This tax is levied when an IRA purchases real estate and then makes a profit from it with money that has not been taxed.

Borrowing

Qualified plans allow for the participant to borrow $10,000 or 50% of the vested account balance, whichever is more. But there is a limit of $50,000 on all outstanding loans from an account. In other words, a vested account balance of $40,000, can get a loan for up to $20,000. The loan must be paid back within five years using substantially equal payments that include interest. If however, the loan is for the primary residence, the loan can be paid back in excess of five years.

IRA’s do not allow borrowing. In fact, if you choose to borrow money from your IRA, the entire account balance will instantly be treated as regular income and taxed accordingly. Also, if you choose to use your IRA as collateral for a purchase, the amount that is used will be treated as a distribution from the account and taxed accordingly.

Protection from Creditors

ERISA protects assets within qualified accounts from creditors in an unlimited amount in most states. This means that you can go through a bankruptcy and your qualified account will be safe from collection regardless of the amount of money in the account. The same is not true of the IRA.

The IRA is also protected during bankruptcy from creditors, but only up to 1 million dollars. Once you have exceeded that amount, your creditors can come after your retirement account. Likely not an issue for most, but we figured we’d mention it all the same.

Hardship Distributions

The IRS allows for hardship distributions for needs that are immediate and heavy. Each plan must specify the qualifications of such in a manner that is non-discriminatory and objective. All this means is that your qualified plan can allow for emergency distributions, which is always a good thing.

An early distribution is allowed from an IRA without the early distribution tax consequences in a couple situations. For higher eduction expenses and a first-time home purchase, the participant doesn’t incur the tax penalties. However, there are few other exceptions, so in general it is safe to say that the IRA is not an account that allows for typical hardship distributions.

Remember, you always have access to the cash in your account, but there will be tax penalties for unusual access.

Hopefully this article helps shed a little light on the advantages of a qualified retirement account. At insuranceandestates.com we definitely tend to highlight the benefits of permanent insurance and infinite banking with regard to retirement planning. But every situation is unique and for the right individual the qualified retirement plan may be a perfect fit.

For easy comparison I’ve created a chart of the Qualified Retirement Plan vs. IRA below