The Ultimate Asset® Framework vs. Dave Ramsey’s Approach

By Jason Kenyon, Esq., I&E CFO, Estate Planning Attorney & Insurance Strategist

Table of Contents

- Key Takeaway

- Quick Facts

- The Framework Face-Off

- The $231K Volatility Tax

- What Happens When Markets Crash

- The DALBAR Reality: Why Human Psychology Destroys Returns

- The Ultimate Asset Advantage During Crashes

- The Banking System Secret

- Volume Beats Rate: Mathematical Truth

- The Death Benefit Leverage Nuclear Weapon

- Stewardship Principles: Certainty vs. Speculation

- The Tax Bucket Reality

- Moving From Survival to Infinite Banking

- Frequently Asked Questions

- Conclusion: The Path to Financial Independence

🔗 Part of Our Dave Ramsey Analysis Series: This mathematical analysis builds on our comprehensive review of Dave Ramsey’s financial advice. For the complete picture including business model concerns and licensing questions, explore our full analysis series.

📋 KEY TAKEAWAY

Dave Ramsey’s advice helped millions escape debt, but his investment strategy delivered only 6.91% actual returns over 25 years with maximum stress. The Ultimate Asset provides 5% guaranteed returns plus Volume-Based Banking advantages, $1.3M+ immediate death benefit leverage, and tax-free growth. Banks hold $130B+ in The Ultimate Asset while conventional wisdom tells you to avoid it.

📊 QUICK FACTS: The Mathematical Reality

| Real S&P 500 performance 2000-2024: | 6.91% actual geometric return |

| Arithmetic average: | 8.47% “average” |

| Volatility (actual vs average) cost investors: | $231,572 on $100K invested |

| The Ultimate Asset IRR: | 5%+ tax-free |

| Death benefit leverage: | Up to 32X leverage in initial years |

Dave Ramsey built a media empire by getting into churches and selling simple sound bites to well-meaning families. His debt elimination advice helped many escape consumer debt, but his investment ‘wisdom’ has cost followers hundreds of thousands of dollars through mathematical ignorance and Wall Street mythology.

His “Baby Steps” provide a solid foundation for financial responsibility, and his emphasis on contentment over materialism offers valuable perspective. But when it comes to wealth building after debt freedom, biblical stewardship requires mathematical truth, suggesting a different path may serve families better.

While Ramsey’s media empire built substantial wealth through church partnerships and referral revenue streams, his followers often discover that simplified sound bites don’t translate to sophisticated wealth-building results in practice.

The Framework Face-Off

Dave’s Promise: “Invest 15% of your income in growth stock mutual funds, ride out the volatility, average 12% returns over time.”

Volume-Based Banking Reality: “Replace your banking function with The Ultimate Asset, deploy strategically from strength, build generational wealth with massive death benefit leverage.”

The fundamental question isn’t about investment preferences. It’s about who controls your banking function.

💡 IMPORTANT CLARIFICATION

This doesn’t replace your investment strategy:

- ✓ Keep your Roth IRA

- ✓ Keep your real estate investments

- ✓ Keep your business investments

- ✓ Keep your stock picks

Just make this ONE change: switch the BANKING FUNCTION in your life from traditional banks to

High Cash Value Whole Life.

Interestingly, Dave advocates becoming your own banker while simultaneously directing followers to traditional banking relationships and credit-dependent systems that benefit his endorsed partners rather than the families following his guidance. This contradiction becomes clearer when you examine the underlying business incentives:

The Accountability Gap: Why Traditional Advisors Face Different Consequences

Traditional financial advisors are directly accountable to client performance. Poor investment results typically lead to lost clients and reduced income, creating natural market accountability.

Dave Ramsey operates under a different business structure:

- Media revenue – Radio show, books, and courses generate income regardless of follower investment outcomes

- Referral partnerships – SmartVestor Pro fees and Zander insurance partnerships create ongoing revenue streams

- Upfront payments – FPU licensing and materials sold before long-term results can be measured

- Brand loyalty – Media platform creates emotional connection that transcends investment performance

The structural difference: While Dave Ramsey’s 12% return assumptions and 8% withdrawal rates would likely face client departures during market downturns, media-based financial personalities can maintain revenue streams even when their mathematical projections don’t align with market realities.

This creates fundamentally different incentive structures between advice-giving models.

Dave Ramsey’s Principles

How Volume-Based Banking Delivers on Every Single One

| Dave’s Core Principles | How High Cash Value Whole Life Implements Them |

|---|---|

| Emergency Fund | ✓ Access liquid cash value without penalties, credit checks, or waiting periods |

| Avoid Debt | ✓ Borrow from yourself instead of banks – eliminate external debt dependency |

| Wealth Building | ✓ Guaranteed growth plus dividends with zero market risk or volatility |

| Save Money | ✓ Forced savings mechanism with guaranteed compound growth |

| Be Self-Reliant | ✓ Become your own banker – control your financing without external approval |

| Leave a Legacy | ✓ Guaranteed death benefit passes tax-free to beneficiaries |

| Avoid Market Risk | ✓ Not tied to market performance – contractually guaranteed returns |

| Tax Efficiency | ✓ Tax-deferred growth, tax-free loans, tax-free death benefit |

| Pay Cash | ✓ Policy loans let you “pay cash” while your money keeps growing |

| Long-term Thinking | ✓ Built for multi-generational wealth accumulation and transfer |

| Avoid Get Rich Quick | ✓ Steady, predictable growth without speculation or gambling |

| Personal Responsibility | ✓ You control your money, financing decisions, and financial destiny |

The irony: Dave teaches these principles, then recommends strategies that work against them.

Meanwhile, the tool he opposes delivers on every single one. As we detailed in our comprehensive Dave Ramsey analysis, these principles work well in theory but his implementation recommendations often contradict them.

💡 KEY INSIGHT: The $231,572 Volatility Tax Dave Doesn’t Mention

Our analysis of why Dave doesn’t understand whole life insurance reveals how his anti-insurance stance may protect business partnerships rather than follower wealth. Let’s examine actual S&P 500 returns from 2000-2024, not theoretical examples. Here’s what happened to $100,000 invested in 2000:

Dave’s Promise vs. Reality:

| Dave’s 12% promise: | $1,700,006 |

| What investors actually got: | $531,808 |

| Dave’s promise vs. reality gap: | $1,168,198 |

The 25-Year Reality Check (ACTUAL S&P 500 Returns 2000-2024):

- 2000: -9.03% → $90,970

- 2001: -11.85% → $80,182

- 2002: -21.47% → $62,958

- 2003: +28.36% → $80,808

- 2004: +10.74% → $89,489

- 2005: +4.83% → $93,811

- 2006: +15.61% → $108,454

- 2007: +5.48% → $114,397

- 2008: -36.55% → $72,564 (devastating financial crisis)

- 2009: +25.94% → $91,380 (recovery year)

- 2010: +15.02% → $105,108

- 2011: +2.10% → $107,316

- 2012: +15.89% → $124,363

- 2013: +32.15% → $164,335 (bull market year)

- 2014: +13.52% → $186,559

- 2015: +1.38% → $189,134

- 2016: +11.77% → $211,395

- 2017: +21.61% → $257,076 (strong year)

- 2018: -4.25% → $246,153

- 2019: +31.21% → $323,001 (another strong year)

- 2020: +18.02% → $381,221

- 2021: +28.47% → $489,730 (pandemic recovery)

- 2022: -18.04% → $401,370 (reality check)

- 2023: +6.03% → $425,574

- 2024: +24.88% → $531,808 final value

The Mathematical Deception:

| Arithmetic Average: | 8.47% (add all returns, divide by years) |

| What 8.47% “should” deliver: | $763,380 |

| What investors actually received: | $531,808 |

| Volatility stole from investors: | $231,572 |

| Actual geometric return: | 6.91% annually |

Volatility destroys wealth through the difference between arithmetic and geometric means.

What Happens When Markets Crash: The Human Factor

Dave’s approach assumes robotic discipline that most humans don’t possess during financial crises.

The Crash Reality:

2000-2002 Bloodbath: Three straight losing years totaling -37.4%

- Dave’s theory: “Stay the course, don’t look at statements”

- Human reality: Mass panic selling, early 401(k) withdrawals, family stress

2008 Financial Crisis: Single year -36.55% wipeout

- Dave’s theory: “It’s just a paper loss”

- Human reality: Marriages stressed, retirements destroyed, portfolio liquidations

2020 COVID Crash: March panic selling epidemic

- Dave’s theory: “Dollar-cost average through it”

- Human reality: “I can’t take this anymore”—sold at the bottom

The brutal truth: Most followers of conventional advice never achieved that theoretical 8.47% average return because they panic-sold during crashes and bought back high during recoveries.

Dave’s 8% withdrawal rate recommendations compound these problems catastrophically. Sequence of returns risk means that retirees who begin withdrawing during market crashes face portfolio destruction:

The Math Dave Won’t Explain:

- Retire in 2000, withdraw 8% during the dot-com crash (-37.4% over three years)

- You’re forced to sell shares at rock-bottom prices to fund withdrawals

- Even when markets recover, you’ve permanently reduced your principal base

- Financial studies show 8% withdrawal rates lead to portfolio failure within 15 years

Yet Dave continues teaching withdrawal rates that virtually guarantee retirement failure, while building his own wealth through the guaranteed strategies he tells followers to avoid. These mathematical realities remain unaddressed despite repeated challenges from finance professionals.

The DALBAR Reality: Why Human Psychology Destroys Returns

The mathematical volatility damage is only half the story. The DALBAR Quantitative Analysis of Investor Behavior reveals the devastating impact of human psychology on actual returns over 20+ years of data:

Market Performance vs. Investor Reality (20-Year Analysis):

| S&P 500 Average (Not Geometric) Return: | 10.5% |

| Average Equity Investor Return: | 3.27% |

| Investor Behavior Gap: | 7.23% annually |

The Behavior Tax:

$100,000 invested over 20 years:

- Market return would deliver: $673,000

- Average investor actually received: $189,000

- Human psychology cost: $484,000

Why This Happens:

- Panic selling during crashes (buy high, sell low)

- Emotional decision-making during volatility

- Performance chasing and market timing attempts

- Fear-based portfolio abandonment

The DALBAR study proves that even if Dave Ramsey’s 12% projections were mathematically sound, human psychology prevents most investors from capturing market returns. The “stay the course” advice sounds logical until your portfolio drops 37% over three years.

The stunning reality: Even the DALBAR study is overstating market performance by using arithmetic averages! A whole life strategy actually beats what most investors achieve AND what markets actually deliver geometrically.

💡 THE REALITY CHECK

Most investors earn 3-5% actual returns that are typically taxable.

Meanwhile, whole life insurance delivers 4-5% guaranteed returns that require zero emotional discipline, no market timing, and no risk of panic-driven mistakes – all tax-free.

The Ultimate Asset Advantage During Crashes

While conventional investors were panic-selling at bottoms, Volume-Based Banking practitioners were deploying cash at fire-sale prices.

Your experience during market chaos with The Ultimate Asset:

- Portfolio growing steadily (guaranteed 5% regardless of market conditions)

- Sleeping peacefully (no market risk to foundation)

- Opportunity mindset (“Now I can deploy cash at massive discounts!”)

- Strategic thinking (not emotional panic)

- Position of strength (guaranteed foundation provides confidence)

Specific deployment opportunities from the real data:

- 2002 Bottom: Deploy Ultimate Asset cash, ride 2003’s +28.36% recovery

- 2009 Recovery: Buy during fear, capture +25.94% rebound

- 2020 COVID: Deploy at March lows, surf subsequent recovery waves

Result: Guaranteed 5% foundation PLUS strategic deployment gains that often exceed conventional stress-filled approaches.

💡 KEY INSIGHT: The Banking System Secret

Here’s what challenges Dave Ramsey’s approach: Banks hold over $130 billion in Bank-Owned Life Insurance (BOLI)—The Ultimate Asset that conventional wisdom tells you to avoid.

Why do banks use The Ultimate Asset for their own reserves?

- Guaranteed returns without volatility

- Tax advantages

- Regulatory capital benefits

- Stable, predictable growth

The question that challenges conventional wisdom: If The Ultimate Asset is such a poor financial vehicle, why do the most sophisticated financial institutions in the world hold $130+ billion of it?

This raises uncomfortable questions about whose interests are truly being served when simplified advice generates ongoing revenue streams through insurance partnerships and investment referrals, while institutions quietly build wealth using the very strategies discouraged to individual families.

This institutional usage contradicts Dave’s advice, as we explored in our truth about whole life insurance returns. Perhaps we should follow what they do, not what conventional advice tells us to do.

Volume Beats Rate: The Mathematical Truth of Volume-Based Banking

Conventional Thinking: “Get the highest return per dollar”

Volume-Based Banking Reality: “Control massive volume at guaranteed rates”

Better to earn 5% on $50,000 than 10% on $5,000.

The Volume-Based Banking Strategy That Changes Everything

| Approach | Annual Capacity | Limitations | Control |

|---|---|---|---|

| Dave’s 15% Limitation | $22,500 for $150K earner | Contribution limits, tax penalties | None—money trapped until retirement |

| Volume-Based Banking | $40,000+ annually (no limits) | None—flexible premiums | Complete—90% available as loans |

The Math Explosion:

By year 10, you could have $400K+ cash value in The Ultimate Asset. Deploy $200K during a market crash while your policy continues earning on the full $400K. Total growth comes from both guaranteed foundation AND deployment gains.

Meanwhile, the conventional follower who panic-sold during the crash is sitting in cash, afraid to re-enter the market.

The Death Benefit Leverage Nuclear Weapon

This is where the comparison highlights the difference between temporary and permanent protection strategies.

Dave’s Buy Term and Invest the Difference (BTID) Strategy:

- Temporary term life coverage (typically 20-30 years)

- $150K earner invests $22,500 annually in volatile markets

- Term premiums increase dramatically over time

- Coverage eventually becomes unaffordable or expires

The Ultimate Asset Permanent Protection:

- Day 1 death benefit: $1,303,895 (32X leverage on $40K premium)

- Permanent wealth protection that never expires

- Death benefit typically grows over time

- Banking control plus protection in one vehicle

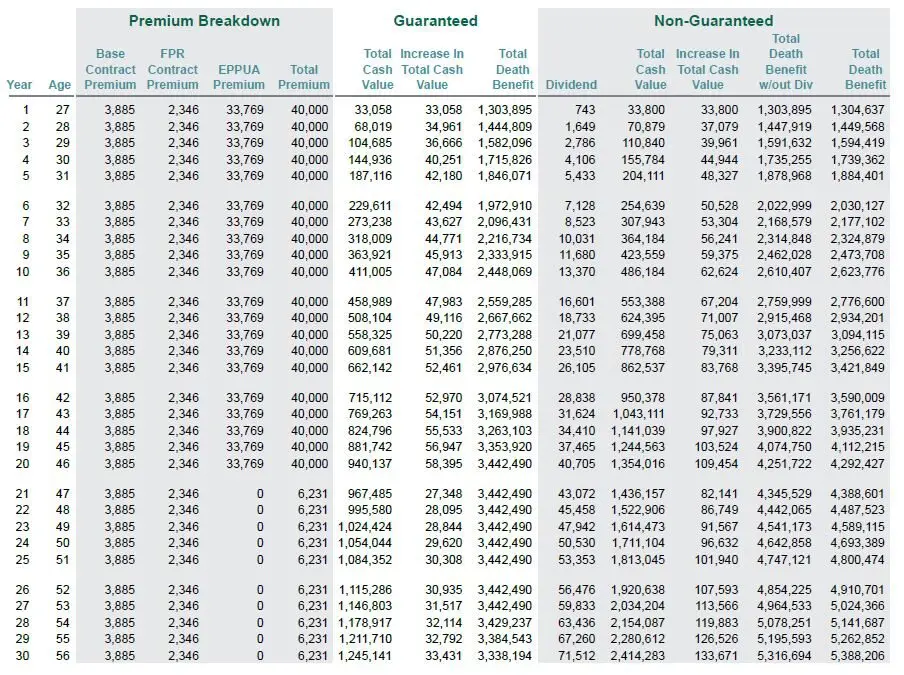

Real Client Example (26-year-old):

| Strategy | Premium/Investment | Coverage Type | Death Benefit |

|---|---|---|---|

| Dave’s BTID approach | $40,000 split between term + investing | Temporary (expires) | Term coverage amount |

| Volume-Based Banking | $40,000 premium | Permanent (never expires) | $1,303,895 |

The Key Difference:

Dave’s approach provides temporary protection while hoping volatile markets cooperate. The Ultimate Asset provides permanent protection while building guaranteed banking capital you control immediately.

Stewardship Principles: Certainty vs. Speculation

Two Financial Philosophies: As Proverbs 27:23 instructs: ‘Be sure you know the condition of your flocks, give careful attention to your herds.’ True biblical stewardship requires certainty and knowledge, not speculation and hope.

Market Speculation Approach:

- Hoping volatile markets cooperate for decades

- Anxiety-inducing strategies creating family stress

- Dependent on market performance and emotional discipline

- Fear-based decisions during market turmoil

Volume-Based Banking Approach:

- Guaranteed growth providing stability and peace of mind

- Confidence-promoting strategies that enhance family harmony

- Patient stewardship building generational wealth

- Strategic deployment from positions of strength

- Contractual certainty while serving others during crises

The Prudent Steward Model: Wise stewardship doesn’t come from speculating on unpredictable markets. It comes through patient discipline, guaranteed multiplication, and strategic positioning rather than forcing outcomes through market timing.

The Tax Bucket Reality Conventional Advice Ignores

| Bucket Type | Examples | Tax Treatment | Preference |

|---|---|---|---|

| Tax-Deferred | 401(k), IRA | Pay taxes later at unknown rates | Least preferred |

| Taxable | Savings, stocks, real estate | Pay taxes annually | Middle preference |

| Tax-Free | The Ultimate Asset (properly structured) | No taxes ever | Most preferred |

100% of people choose the tax-free bucket as their preference when shown these options.

Yet conventional advice promotes putting most money in the least preferred bucket (tax-deferred 401(k)s) while ignoring the most preferred option (tax-free Ultimate Asset strategies).

Moving From Survival to Infinite Banking

Dave gets you out of debt. That’s valuable and necessary. His debt elimination principles provide solid foundation for financial responsibility. However, his business model appears designed around recurring revenue from product referrals rather than measurable client outcomes, a structure that continues profiting regardless of follower success or mathematical accuracy of the underlying advice.

So then what? Conventional investment approaches keep you in financial survival mode:

- Hoping markets cooperate for 30+ years

- Praying you don’t panic-sell during crashes

- Building wealth slowly with maximum stress

- Temporary protection that expires when you need it most

- Dependent on market performance for retirement

Volume-Based Banking with The Ultimate Asset moves you to infinite banking mode:

- Guaranteed foundation regardless of market conditions

- Strategic deployment opportunities during others’ panic

- Permanent death benefit protection from day one

- Tax-free growth and access

- Building generational wealth with peace of mind

From financial survival to financial independence. From hoping markets work to knowing your foundation is secure.

The Credit Score Contradiction: How “Cut Up Your Cards” Hurts Families

Dave’s oversimplified approach extends beyond investments to credit management, where his absolutist ‘cut up credit cards and never use debt’ philosophy creates financial outcasts in a credit-scored economy where strategic credit use determines access to opportunities.

The Reality Dave Ignores:

- Credit scores affect insurance rates, rental approvals, job opportunities

- “No credit history” equals “bad credit” to modern institutions

- Cash-only living costs more through higher deposits and insurance premiums

- Emergency situations often require credit access that cash can’t solve

While Dave preaches credit avoidance, sophisticated wealth builders use debt strategically to build assets and maintain financial flexibility. His advice handicaps families in a system that rewards responsible credit management rather than complete avoidance.

💡 KEY INSIGHT: The Volume-Based Banking Implementation Reality

For a 26-year-old with $40,000 available:

| Strategy | Annual Investment | Death Benefit | Timeline | Stress Level |

|---|---|---|---|---|

| Conventional Path | $40,000 into volatile accounts | Temporary term coverage | 35+ years to maybe reach $2-3M | High—market dependent |

| Volume-Based Banking | $40,000 into The Ultimate Asset | $1.3M immediate, permanent | Wealth protection starts day one | Low—guaranteed foundation |

The question: Would you rather hope for wealth over 35 stressful years with temporary protection, or guarantee permanent wealth protection while building additional banking capital strategically?

The Infinite Banking System in Action

Year 5 Example with $200K cash value in The Ultimate Asset:

- Deploy $150K for real estate down payment via policy loan

- Rental income pays back the loan over 5-7 years

- Cash value continues growing on the full $200K during payback

- You now own: The property + larger cash value base + death benefit protection

- Repeat the process with even more capital available

This creates true infinite banking—your own financial ecosystem that grows regardless of external market conditions.

Frequently Asked Questions

How does 5% guaranteed compare to market returns?

Tax-free 5% often equals 7-8% taxable returns. Plus you get strategic deployment opportunities during crashes, massive death benefit leverage, and complete peace of mind—advantages no market strategy provides.

Why do banks use The Ultimate Asset if it’s not optimal?

Banks hold $130+ billion in Bank-Owned Life Insurance because it provides guaranteed returns, tax advantages, and stability. They understand what individual investors miss about financial control and predictable growth.

How quickly can I access my money with Volume-Based Banking?

Policy loans are available within 30 days, with no credit checks or qualification requirements. You can access up to 90% of cash value while the full amount continues earning returns.

What about opportunity cost with The Ultimate Asset?

You’re not giving up opportunities—you’re multiplying them. The guaranteed foundation provides capital for strategic deployment during market downturns when others are forced to sell.

Is Volume-Based Banking only for wealthy people?

The strategy works with as little as $500/month in premiums, but it’s most powerful for higher-income individuals who can maximize the volume advantage and death benefit leverage.

What are the risks of The Ultimate Asset strategy?

The primary risk is over-borrowing relative to cash value growth. However, insurance companies limit borrowing to prevent problems, and proper management eliminates most risks. Unlike market investments, you can’t lose principal to volatility.

Conclusion: The Path to True Financial Independence

This isn’t about criticizing Dave Ramsey’s valuable debt elimination principles or his heart for helping families. His emphasis on contentment and avoiding consumer debt provides an essential financial foundation. But when it comes to generational wealth building after debt freedom, the mathematical evidence points toward a different approach, one that provides:

- Peace of mind instead of market anxiety

- Strategic advantage to deploy during others’ panic

- Generational stewardship with guaranteed multiplication

- Infinite banking capabilities rather than dependence on external institutions

The choice isn’t between having money or not having money. It’s between two different approaches to building wealth:

- Conventional approach: Hoping volatile markets cooperate, living with anxiety, crossing fingers

- Volume-Based Infinite Banking approach: Trusting proven principles, building with certainty, deploying from strength

📚 Continue Your Dave Ramsey Education

Our comprehensive investigation examines Dave Ramsey’s financial advice from multiple angles:

Core Analysis & Mathematical Proof

Expert Insurance Analysis

Ready to explore The Ultimate Asset with Volume-Based Banking advantages?

The wealthy don’t follow conventional advice, they create their own financial ecosystems using strategies like infinite banking. Perhaps it’s time to discover if The Ultimate Asset aligns with your calling to build generational wealth and true financial independence.

Discover if The Ultimate Asset Strategy is Right for You

Before committing to this Volume-Based Banking approach, get a personalized analysis from our independent advisory team. We’ll help you understand if The Ultimate Asset truly aligns with your financial goals and wealth building objectives.

- ✓ Receive a detailed breakdown of how The Ultimate Asset would work in your specific situation

- ✓ Compare Volume-Based Banking to conventional investment strategies and Dave Ramsey’s approach

- ✓ Understand the potential tax advantages and death benefit leverage benefits

- ✓ Get a clear explanation of all features and implementation requirements

Schedule your complimentary 30-minute Ultimate Asset analysis today and take the first step toward becoming your own banker.

No obligation. No sales pressure. Just expert guidance to help you determine if The Ultimate Asset and Volume-Based Banking is the right fit for your long-term financial strategy.

2 comments

Eric Coppala

You pose some great points in response to Ramsey’s approach to insurance. I agree with much of what he preaches but you cause me to rethink. I would add this, you figure in the continuing need for life insurance where Ramsey does not. Once a person is out of debt, house paid for, kids independent and portfolio built up, there’s no need for life insurance. One is self insured at that point so the problem of increasing premiums is moot. Otherwise, you present some strong arguments for non term life insurance.

Insurance&Estates

You’ve touched on the huge flaw in Ramsey’s “self-insurance” theory, but there’s an even bigger problem most people miss:

Self-insurance isn’t just difficult to achieve – it’s often a myth even for those who think they’ve made it.

Here’s why:

1. Asset Stress & Liquidity Crisis

When you’re “self-insured,” your family faces a brutal choice at death:

Sell assets in a down market to cover expenses?

Liquidate real estate at fire-sale prices?

Force heirs to cash out retirement accounts and trigger massive taxes?

Your $2M portfolio might only net $1.2M after taxes, market timing, and forced liquidation costs.

2. The Spending Dilemma

If you’re truly self-insured, you can’t actually SPEND your wealth in retirement:

That $2M nest egg? It’s earmarked as your “death benefit”

Want to travel? Too bad – that’s your kids’ inheritance

Long-term care needed? Now you’re draining the “life insurance” fund

You’ve trapped yourself. You built wealth but can’t enjoy it because it has to stay intact for your family.

3. Sequence of Returns Risk

This is the one that destroys even the best-laid plans:

You retire at 65 with $2M “self-insured”

Market crashes 40% in year 1 (hello 2008, 2020, 2022…)

Now you’re at $1.2M

But you’re taking distributions, so you’re selling low

You die at 75 with $400K left instead of $2M+

Your family gets a fraction of what you planned. And there’s nothing they can do about it.

Here’s what permanent life insurance does:

✓ Guaranteed death benefit – $2M is $2M, regardless of market crashes

✓ Frees up assets – Spend your wealth in retirement; insurance covers the legacy

✓ Eliminates sequence risk – Death benefit isn’t tied to market performance

✓ Tax-free payout – Full amount to heirs, no liquidation costs or capital gains

✓ Liquidity when needed – Cash value accessible while alive without market risk

Wealthy people use permanent life insurance not because they need it, but because they’re smart enough to know that “self-insurance” means:

You can’t spend your money

Your heirs inherit whatever’s left after markets, taxes, and timing

One bad decade destroys the plan

Real self-insurance looks like this:

$500K whole life policy with $400K cash value

Spend your retirement accounts guilt-free

Market crashes? Who cares – death benefit is guaranteed

Need long-term care? Borrow from policy, death benefit still pays out

Die with $50K in the bank? Family still gets $500K tax-free

Ramsey’s “self-insurance” assumes perfect health, perfect markets, perfect timing, and that you’ll never actually USE your wealth. That’s not a financial plan. That’s gambling with your family’s security.