Regardless of how much money you have saved, the key to a successful and rewarding retirement is income – particularly incoming cash flow that arrives on a regular basis for the remainder of your lifetime, no matter how long that may be.

That is because when you have this system in place, you can worry much less about stock market or economic conditions and instead concentrate on enjoying retirement, doing things you enjoy with people you love and care about.

One way to create an ongoing stream of income – either for a set period of time, or even for the rest of your life – is with an annuity. But even though these financial vehicles can provide you with a long list of benefits, all annuity contracts are not exactly the same.

In addition, even though they can offer guarantees, there are still some annuity risks that you should know about before you move forward with purchasing one for your portfolio. So, it is important to know what you can anticipate with different types of annuities and the different annuity companies in the marketplace, and whether or not any of these are right for you.

Advantages of Annuities

Predictable Payout

Certainly, one big advantage of annuities is the reliable, ongoing income they can pay out. This can make your retirement more predictable, and in turn, allow you to spend more freely on your living expenses, knowing that money will continue to flow in – even during volatile stock market and economic conditions.

Tax Deferred Growth

Another benefit of annuities is tax deferred growth. When there are no taxes to pay on the gains every year, the value of the account can grow and compound – especially over time.

No Cap

Further, because there are no maximum annual contribution limits with annuities, you can still obtain the same type of growth that you get from an IRA or retirement plan, but without the cap on what you can regularly contribute.

Emergency Funds

Annuities may also include other nice benefits, too, such as penalty-free access to funds if you incur various healthcare and/or long-term care needs – which can be particularly beneficial if you do not have insurance that covers these types of situations.

Customizable

Further, with so many different types of annuities available in the marketplace today, you have the ability to “customize” one to more closely fit your particular short- and long-term objectives.

Disadvantages of Annuities

Surrender Charges

Along with the annuity benefits, there are also some potential risks to consider. One of the primary annuity risks is the surrender charge that you can incur if you cancel the annuity – or even if you withdraw more than the penalty-free amount – before the surrender period has ended.

Early Withdrawal Penalty

In addition, you may incur a 10% IRS “early withdrawal penalty” if you access funds before you have turned age 59 ½. This penalty is in addition to any of the taxes that you may have to pay. So, it is critical that you know how much you will actually net out and be able to spend on your living expenses or other financial needs.

Charges/Fees

Another risk of annuities includes the charges and fees that you may incur. However, these are usually associated with variable annuities. These fees can impact your overall return on the annuity.

Yet, even with the various drawbacks and annuities risk, the downside(s) could be reduced – or even eliminated – by understanding that these are longer-term financial commitments. And with that in mind, you can compensate for your other financial needs in other ways.

Annuity Pros and Cons

| Annuity Advantages | Annuity Disadvantages |

|---|---|

| Reliable income stream - possibly even for the remainder of your lifetime, regardless of how long | Surrender charges (at least until the surrender period expires) |

| Tax deferred growth | Fees (primarily with variable annuities) |

| No annual maximum contribution limits | Low return (primarily with fixed annuities) |

| Ability to customize to your needs | Complex / confusing to understand |

| Death benefit | IRS "early withdrawal penalty" if under age 59 ½ |

| Penalty-free access to funds for specific needs / health issues | |

| Protection of principal (with fixed and fixed indexed annuities) |

What You Need to Know About Annuities

Due to the advantages of annuities, many retirees – as well as those who are preparing for retirement – include one or more annuity contracts in their plan. Depending on the type of annuity, there are several ways to benefit, such as:

- Reliable income

- Principal protection

- Tax-advantaged growth

- Funds for critical / chronic illness and/ or long-term care needs

- Legacy for loved ones

Owning an annuity can be a long-term commitment, though, so it is critical that you have a good understanding of how annuities work, and where they may – or may not – fit in with your financial and retirement objectives.

With that in mind, there are five things that you need to know before you lock into an annuity contract.

5 Things You Need to Know Before Purchasing an Annuity

- Immediate or deferred annuity – When does the income payout begin?

- Fixed, fixed indexed, or variable annuity – How is the return calculated?

- Income payout options – How often and how long will the annuity make payments?

- Additional annuity benefits – What other features are available (and how much will they cost)?

- Financial strength and stability of the annuity company – Will you actually receive the benefits you’re hoping for?

Immediate or Deferred Annuity – When does the income payout begin?

Annuities can be “categorized” in several ways. One is whether the annuity is immediate or deferred.

Immediate

Immediate annuities are usually funded with just one lump sum. This could come from personal savings and investments, or it could be money from an IRA (individual Retirement Account) or employer-sponsored retirement plan (like a 401k) which may be rolled over to this type of annuity.

Once this contribution has been made, a stream of income will start paying out from the annuity – either right away or at some point within the next 12 months. The income can then continue for a pre-set period of time, or even for the rest of your lifetime, no matter how long that may be.

These financial vehicles are oftentimes referred to as Single Premium Immediate Annuities, or SPIAs, and they are often used by retirees who are looking for a way to generate reliable income after they’ve left the working world.

Depending on the actual annuity, there may be a joint income option available. This could be used for a couple (or any two individuals) who want to make sure that an income stream will continue until the death of the second individual. In some cases, the amount of the income payments may be reduced after the passing of the first person.

Because many businesses have done away with the traditional defined benefit pension plan, immediate annuities can offer an alternative for receiving guaranteed lifetime income in retirement.

Deferred

Alternatively, deferred annuities don’t pay out income until a time in the future – and some deferred annuity owners may never convert the account into an income stream. These annuities essentially have two “phases” – accumulation and income.

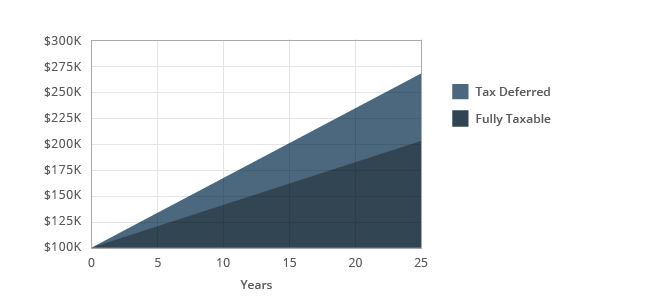

While in the accumulation phase, the money that is in a deferred annuity grows tax deferred. This means that there is no tax due on the gain until it is withdrawn in the future. Because of this, tax deferred accounts can often exceed growth on a fully taxable account (with all other factors being equal).

This is because a return is being generated on the original contribution, as well as on previous gains, and on money that would have otherwise been paid out in taxes.

Comparison of Tax Deferred versus Fully Taxable Growth

You can usually either make one single lump sum contribution into a deferred annuity, or instead make multiple contributions over time.

Deferred annuities can be particularly beneficial if you have “maxed out” your annual contribution(s) to an IRA and/or employer-sponsored retirement account. This is because deferred annuities offer an additional avenue of tax-advantaged growth.

Also, unlike IRAs and qualified retirement plans, there is typically no maximum annual contribution limit with an annuity.

Surrender Charge

It is important to note that while you are usually allowed to access some of a deferred annuity’s account value before you annuitize (i.e., convert the annuity to an income stream), during the early years, you could incur a surrender charge if you withdraw more than a certain amount (such as 10% of the contract’s value) in a given year.

The amount of a deferred annuity’s surrender charge will usually decrease over time, until it eventually disappears. However, if you make withdrawals before you are age 59 ½, you could be charged with a 10% “early withdrawal” penalty from the IRS. This is in addition to any taxes that you may owe.

So, knowing that a deferred annuity contract is usually a longer-term commitment can help you to avoid these charges. It can also help you to determine how much premium to contribute, while at the same time leaving some liquid funds in place outside of the annuity for possible emergencies.

Immediate versus Deferred Annuities

| Immediate Annuities | Deferred Annuities | |

|---|---|---|

| Contribution(s) | Typically, one lump sum (May be rolled over from an IRA or employer-sponsored retirement account) | Lump sum or multiple contributions over time |

| Accumulation Period | No accumulation period | Funds in the annuity grow tax-deferred during the accumulation period |

| Flexibility | Once purchased, the income cannot be converted back to a lump sum of cash | Can make full or partial withdrawals (a surrender charge may be incurred in the initial years) |

| Fees | Usually just a one-time agent or broker commission (if any) | Surrender / early withdrawal charge; rider charge (if applicable); added variable annuity fees can include mortality and expense charges; administrative fees; investment management charges |

| Typical Purchaser | Retirees who are seeking an immediate income stream | Pre-retirees who are seeking tax-advantaged growth and income in the future |

| Income Payout | Begins right away (or within 12 months of making a contribution) | Begins at a time in the future |

Fixed, Fixed Indexed, or Variable Annuity – How is the return calculated on the annuity?

Annuities are also categorized in terms of how they generate a return. In this case, there are different types of annuities to choose from, including:

- Fixed annuities

- Fixed indexed (or index) annuities

- Variable annuities

Fixed Annuities

A fixed annuity generally offers a set rate of return – no matter what happens in the stock market. Like other types of “safe” money alternatives, the return on fixed annuities may be somewhat low. But in return for that, your principal will be protected – which alleviates the risk of loss. Plus, without having any losses to make up for, the value of a fixed annuity can slowly but surely climb.

Income that is paid out from fixed annuities is also guaranteed. So, you can be assured that you will receive a certain amount of income on a regular basis over time – even if the stock market incurs a significant fall.

FIA

A variation of the regular fixed annuity is the fixed index annuity, or FIA. Fixed index annuities base their return on the performance of one or more underlying market indexes, such as the S&P 500 and the DJIA (Dow Jones Industrial Average).

Within a given time period – such as a contract year – if the performance of the index(es) is good, then the annuity is credited with a positive return, oftentimes up to a certain limit, or “cap.”

However, if the index performs poorly and incurs a loss, the annuity is not credited with a negative return. Rather, fixed index annuities usually have a guaranteed minimum “floor” that often ranges from 0% to 2%. So, not only is the principal protected, but it could even be credited with a gain if the index loses value.

Like regular fixed annuities, a fixed index annuity can pay out a guaranteed income stream for a pre-set time period, or for the remainder of your (and possibly a second income recipient’s) lifetime.

There may be other benefits that are attached to a fixed index annuity, too, such as penalty-free access to funds in certain circumstances. These could include being diagnosed with a chronic, critical, or terminal illness, or requiring long-term care services.

In fact, many fixed, fixed index, and variable annuities in the marketplace today offer features other than just tax deferred growth and an income stream. This myriad of options can make it easier to “customize” a particular annuity for your specific needs and goals.

Variable Annuities

Variable annuities also offer the opportunity to attain a high return. This is based on the performance of underlying equities like mutual funds. In many cases, there is no limit on the upside return potential with a variable annuity.

But just the opposite is also true in that losses could occur if the underlying investments perform poorly. This can make variable annuities quite risky – especially for those who are approaching or in retirement and wish to keep principal safe.

There are some other drawbacks associated with variable annuities, too. For instance, this type of annuity is often riddled with many charges and fees, such as:

- Mortality & Expense (M&E) fees. This charge goes to cover the insurance portion of the annuity.

- Administrative fees.

- Annual contract fees.

- Rider charges. In some cases, additional features may come with no charge, while others will cost an additional amount of premium.

- Investment management fees (on the underlying investments that are being tracked).

As with other types of annuities, variable products will also typically include a surrender charge if you withdraw “too much” money from the contract in the early years.

In addition, variable annuities are considered securities. Therefore, they are regulated by the Securities and Exchange Commission (SEC). Because of that, you must receive a prospectus from a financial advisor who is offering you a variable annuity before you actually make a purchase.

Annuity Income Payout Options – How often and how long will the annuity make payments?

One of the primary reasons that people purchase annuities is for the ongoing income stream they can pay out. Although different annuities may offer differing options, the most common payout alternatives include:

Period Certain

With the period certain payout, income from the annuity will be paid for a specific time frame, like 10 years. However, if the income recipient passes away within that time period, a beneficiary will receive the remaining payments.

Life Only

The life only option will continue to pay out income for the rest of the income recipient’s (i.e., the annuitant’s) lifetime – regardless of how long that may be. This can provide an effective hedge against outliving income in retirement.

Life with Period Certain

The life with period certain income option will make payments for the annuitant’s life. But, if he or she dies within a pre-set time, such as 10 or 20 years, a beneficiary will receive income from the annuity for the remainder of the time period.

Systematic Withdrawals

With the systematic withdrawal method, you can select the size and the timing of your payments from the annuity, as well as the number of total payments that you’ll receive. The amount and the number of payments will depend on how much money you have the account. Note that if you choose the systematic withdrawal option, though, you do not have protection against outliving the income from the annuity.

Joint and Survivor

With the joint and survivor payment alternative, income from the annuity will continue to be paid out until the death of a second individual. Many couples choose this option to ensure that neither spouse or partner loses the income stream during their lifetime. Depending on the particular annuity, the dollar amount of the payout may either stay the same or it could be reduced upon the death of the first recipient.

Lump Sum

In some cases, an annuity holder may not want to receive a series of income payments. So, there is usually an option to simply withdraw a lump sum from the annuity. In this case, though, it is important to be mindful of the taxes you will owe.

For instance, income and/or withdrawals from different types of annuities will be taxed differently. How much of your annuity income or withdrawals are taxed will depend in large part on whether the annuity is qualified or non-qualified.

Qualified vs Non-Qualified

Qualified annuities are funded with pre-tax dollars, meaning that you can deduct the contribution from your earnings on your federal income tax return in the year(s) that they are made. The funds in the annuity grow on a tax-deferred basis, so no tax is due on the gain inside the annuity until the time of withdrawal.

At that time, 100% of your income or withdrawals from the qualified annuity will be taxed at your then-current income tax rate. This is because none of these funds – the contributions nor the gains – have yet been subject to taxation.

Because qualified annuities are funded with IRA and/or retirement plan funds, these annuities will mandate (per IRS rules) that you start taking required minimum distributions at a certain age. In 2023, this age is 73 (but over time, the beginning age for required minimum distributions, or RMDs, will rise to 75).

On the other hand, non-qualified annuities are funded with after-tax dollars. These funds have already been taxed. However, the gains that take place in the account are still tax deferred. So, in this instance, each income payment that is received will consist of part taxable gain, and another part tax free return of contribution.

The percentage of the non-taxable contribution is referred to as the exclusion ratio. This ratio will “expire” when all of the original contributions have been received. After that, all of the payments from the annuity going forward will be 100% taxable.

Qualified vs Non-Qualified Annuities

| Qualified Annuity | Non-Qualified Annuity | |

|---|---|---|

| Contributions | Pre-tax | After tax |

| Growth in the account | Tax-deferred | Tax-deferred |

| Taxation of withdrawals | Usually 100% taxable | Gain is taxable, and return of principal is non-taxable |

| Maximum contribution | Yes | No (but can depend on the offering insurance company's limitations, if any) |

| Required distributions | Yes (at age 73, in 2023) | No |

Additional Annuity Benefits – What other features are available and how much will they cost?

Before you purchase an annuity, it is important to know whether or not there are any additional benefits attached to it. Some of these features may be automatically included with the annuity, and others may be added as optional riders (which may also require you to make a higher amount of contribution).

Some of the more common annuity features include a(n):

- Death benefit

- Penalty-free withdrawals if you contract a particular chronic, critical, or terminal illness

- Funds for long-term care needs

Some annuities might also offer the opportunity to add an income rider. There are several different variations of annuity income riders. These include the:

Guaranteed Minimum Withdrawal Benefit (GMWB) rider.

This option guarantees a specific withdrawal each year as a percentage of your initial contribution into the annuity. In this case, even if the funds in the annuity drop in value, the rider will ensure that you can withdraw at least the amount that you contributed to the annuity.

Guaranteed Minimum Income Benefit (GMIB) rider.

The GMIB rider guarantees a growth rate to the annuity’s benefit / income base during its accumulation phase. This guarantee is in place regardless of how the underlying market is performing. The base can then be converted into an income stream.

Guaranteed Minimum Accumulation Benefit (GMAB) rider.

With the GMAB rider, the annuity’s asset base is guaranteed not to fall below a stated level (which is oftentimes the amount of your contribution) after a pre-set time period.

With this rider, the amount of contribution that you make (or made) into the annuity will not be reduced – even if the underlying market performs poorly. In addition, at a time in the future, your entire principal balance will be returned to you, as long as the then-current value of the annuity is less than the amount that you contributed into it.

Guaranteed Lifetime Withdrawal Benefit (GMWB) rider.

The guaranteed lifetime withdrawal benefit rider offers guaranteed growth on the annuity’s income base, as well as a set withdrawal limit. Here, you could grow the annuity’s income base and withdrawal rate with payments that can last for the rest of your life, while also having access to the actual annuity value.

Before you add any features to an annuity, it is essential that you first have a good understanding of how they will work, what they will (and will not) do, and how much additional contribution – if any – is required.

Financial Strength and Stability of the Annuity Company – Will you actually receive the benefits that you’re hoping for?

In addition to researching the specific annuity that you are interested in purchasing, it is also essential that you know whether or not the offering annuity company is strong and stable financially, and that it has a good reputation for paying out claims to its policy holders.

The guarantees that are offered by annuities (as well as other types of insurance products) are only as good as the financial strength of the insurance carrier that offers them. One of the best ways to research the financial stability of insurance carriers is to check their ratings.

There are five independent agencies that rate the financial strength of insurers. These are:

- A.M. Best

- Fitch Ratings

- Kroll Bond Rating Agency (KBRA)

- Standard & Poor’s

- Moody’s Investor Services

While each of these agencies has a somewhat different rating system in place, you can still get an idea of whether or not an insurance company is financially stable, based on its letter grade from one or more of the ratings companies.

It is also helpful to check information about the insurer through the Better Business Bureau. Here you can find details about customer disputes, as well as customer reviews. Also, the BBB assigns letter grades from A+ to F, similar to a “report card,” to companies that are affiliated with the organization.

Other Items to Consider Before Buying an Annuity

In addition to the annuity type, the features it includes, and the strength of the underlying insurance carrier, there are some other items to consider before you commit to purchasing an annuity. These include your:

- Risk tolerance

- Time frame until retirement

- Other retirement income sources

Risk Tolerance

A primary consideration to keep in mind when thinking about an annuity is your risk tolerance. For instance, does the potential for market losses make you feel queasy, or are you willing to take on more risk in return for a potentially higher return?

When it comes to annuities, variable products can provide you with the opportunity for a market-linked return, based on how the underlying investment(s) perform. In some instances, the upward return potential is unlimited. However, there is also the possibility for losses – including loss to your original principal – if the investments that are being tracked perform poorly.

There is less risk with fixed and fixed indexed annuities, as compared to variable products. In this case, while the returns on these financial vehicles may be more in line with other “safe” money options, there are also no losses incurred – even if the stock market tumbles. Plus, without any previous losses to make up for, your positive return can continue to grow.

Time Frame Until Retirement

You should also factor in your time frame until retirement. If you are already retired – or you soon will be – then an immediate annuity can provide you with income right away (or within a short period of time).

However, if retirement is still several years away, then you might want to consider going with a deferred annuity so that you can take advantage of the tax deferred growth. Today (in early 2023), as interest rates rise from their previous historical lows, many annuity carriers are offering multi-year high interest rates on fixed annuities.

This can be a significant benefit for those who are nearing retirement and are looking for fixed income that is guaranteed for life as versus relying on unpredictable (and likely volatile) stock market returns.

Your Other Retirement Income Sources

It is also important to take any other income sources that you may have into consideration. These may include one or more of the following:

- Employer-sponsored defined benefit pension

- Social Security

- Rental property earnings

- Reverse mortgage

- Interest and/or dividends from savings and investments

- Other annuities

Based on the timing of these other income sources – as well as whether or not they will be taxed – you should coordinate all of your income generators so that you maximize the amount of net income you’ll have available to spend.

Is an Annuity Right for You?

Even with all of the benefits that annuities can provide, these financial vehicles may not necessarily be right for everyone across the board. So, it is important that your decision to move forward with an annuity is based on your particular goals and needs, and not someone else’s.

Just like any other financial tool, annuities can have both advantages and drawbacks. With that in mind, be sure that you go through the annuity pros and cons before you make a long-term commitment to one.

How to Find the Best Annuity for Your Retirement Needs

With so many annuities to choose from, how do you know which one – if any – is right for you and your unique objectives?

The best way to narrow down whether or not an annuity is a good fit for your retirement plan is to work with an income planning specialist. That’s where Insurance and Estates comes in!

At Insurance and Estates, our goal is to educate consumers on how to grow and protect assets – both now and in the future so that you can enjoy retirement to the fullest – and leave something behind for those you love.

You’ve worked hard to build up your retirement portfolio. So, the last thing you want is for it to be diminished by stock market fluctuations, taxes, and a whole host of other economic and financial predators.

The experts at Insurance and Estates can show you how to position assets so that they are moving you towards your objectives, but without putting them in harm’s way. So, if you would like to set up a time to chat with an Insurance and Estates specialist, we invite you to call us directly at (877) 787-7558 or request an annuity quote through our secure online portal at Annuity Quotes.